Fill out inventory tax forms

with AI.

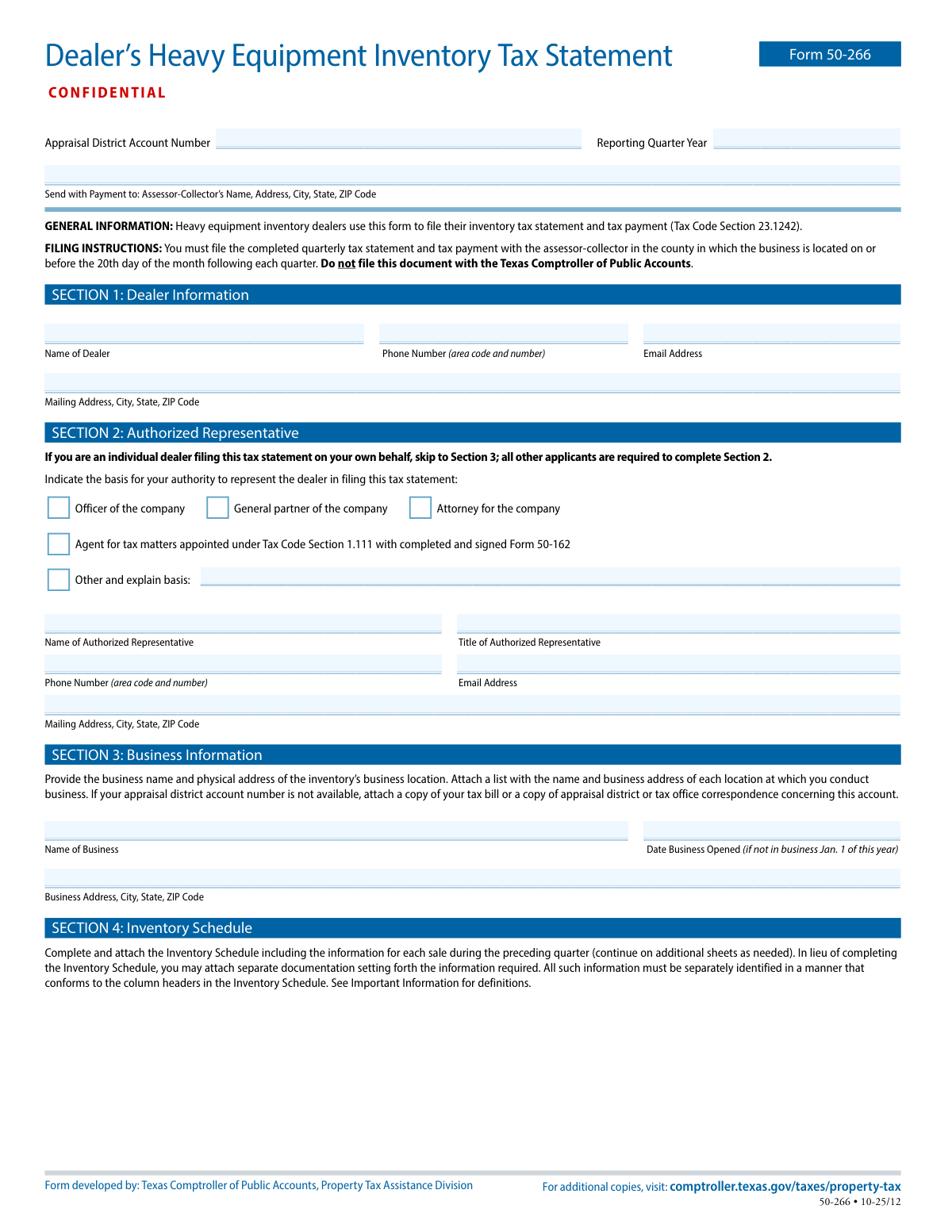

Inventory tax forms are used to report and pay property taxes on goods held for sale, lease, or rental — a requirement that applies to specific industries where high-value inventory changes hands regularly. In Texas, dealers who hold heavy equipment inventory are subject to a unique tax structure that requires quarterly reporting of each item sold, leased, or rented, along with the corresponding unit property tax calculated using a locally determined tax factor. These obligations exist at the county level, meaning payments and filings go directly to the county tax assessor-collector rather than a state agency.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About inventory tax forms

The primary users of these forms are heavy equipment dealers — businesses that buy, sell, lease, or rent machinery such as construction equipment, forklifts, or agricultural equipment. Form 50-266, the Dealer's Heavy Equipment Inventory Tax Statement, is a key example: it must be filed quarterly by the 20th day of the month following each quarter, and late or inaccurate submissions can trigger statutory penalties and complicate audit compliance. Keeping up with these deadlines is critical for dealers managing large, fluctuating inventories.

Because these forms involve precise figures and strict deadlines, accuracy matters as much as timeliness. Tools like Instafill.ai use AI to fill out forms like these in under 30 seconds, helping dealers and their staff avoid errors and move through paperwork efficiently without sacrificing data security.

Forms in This Category

| Form Name | Pages | |

|---|---|---|

| 1. | Dealer’s Heavy Equipment Inventory Tax Statement (Form 50-266) | 4 |

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds