Fill out IRS business forms

with AI.

IRS business forms are official documents that businesses, corporations, partnerships, and other entities use to communicate with the Internal Revenue Service — whether that's reporting income, making elections, updating records, or fulfilling compliance obligations. These forms play a critical role in keeping a business in good standing with the IRS, and failing to file them accurately or on time can lead to missed notices, penalties, or complications with tax records tied to an Employer Identification Number (EIN).

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About IRS business forms

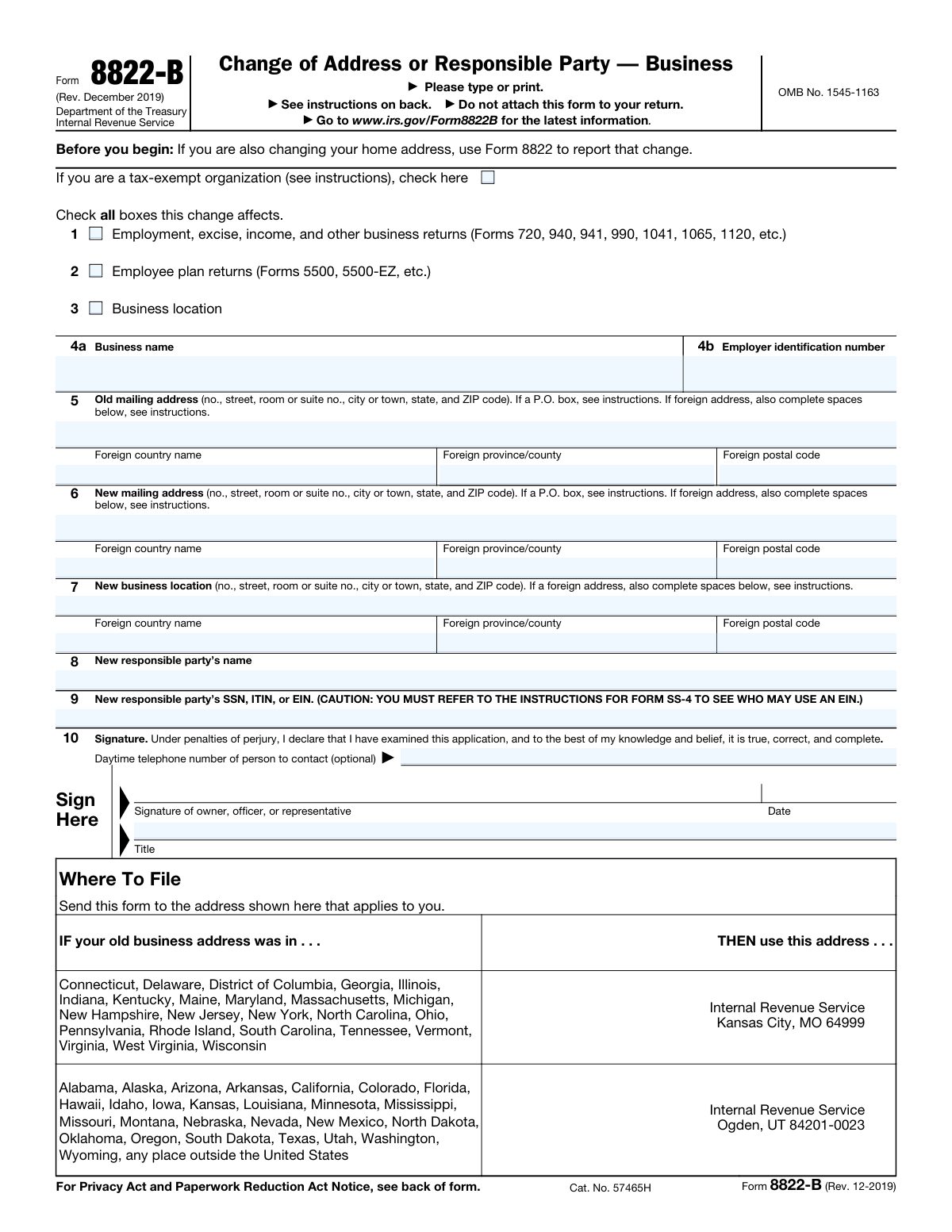

Business owners, accountants, attorneys, and corporate officers regularly encounter the need to file these forms across a wide range of situations. For example, Form 8822-B is required whenever a business changes its mailing address, physical location, or the individual designated as its responsible party — a change that must generally be reported to the IRS within 60 days. Whether you're a sole proprietor, LLC, nonprofit, or large corporation, staying current with IRS recordkeeping requirements is an ongoing part of running a business.

Filling out IRS business forms correctly matters, as errors can cause delays or trigger follow-up from the IRS. Tools like Instafill.ai use AI to help users complete these forms accurately in under 30 seconds, making it a practical option for business owners and tax professionals who need to get paperwork done efficiently and securely.

Forms in This Category

| Form Name | Pages | |

|---|---|---|

| 1. | Form 8822-B (Rev. December 2019), Change of Address or Responsible Party — Business | 1 |

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds