Fill out partnership tax forms

with AI.

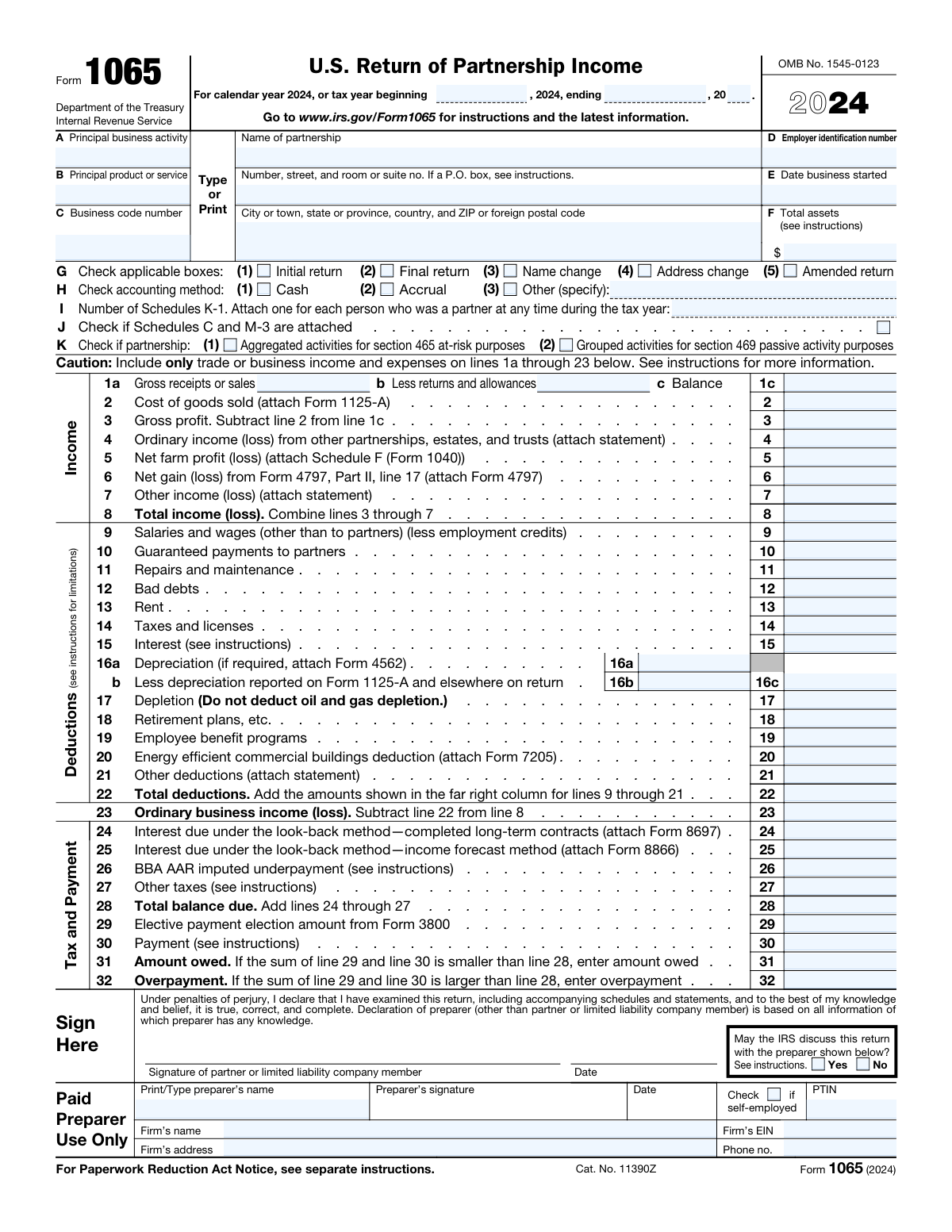

Partnership tax forms are the federal and state filings that business partnerships use to report income, deductions, credits, and other financial activity to the IRS and relevant tax authorities. Unlike corporations or sole proprietors, partnerships are pass-through entities — meaning the business itself doesn't pay income tax directly. Instead, the partnership reports its financial results, and each partner receives their share of income or loss to report on their own return. Getting these filings right matters because errors or late submissions can trigger IRS penalties and create downstream problems for every partner's individual tax situation.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About partnership tax forms

These forms are typically needed by general partnerships, limited partnerships, limited liability partnerships (LLPs), and multi-member LLCs taxed as partnerships. The cornerstone of this category is Form 1065, the U.S. Return of Partnership Income, which most partnerships are required to file annually. Completing it accurately requires pulling together income statements, expense records, partner ownership percentages, and other details that flow through to each partner's Schedule K-1.

For small business owners, accountants, and tax preparers who handle these filings every year, tools like Instafill.ai use AI to fill partnership tax forms in under 30 seconds, handling the data accurately and securely — a practical time-saver during a busy filing season.

Forms in This Category

| Form Name | Pages | |

|---|---|---|

| 1. | Form 1065, U.S. Return of Partnership Income | 6 |

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds