Fill out property tax forms

with AI.

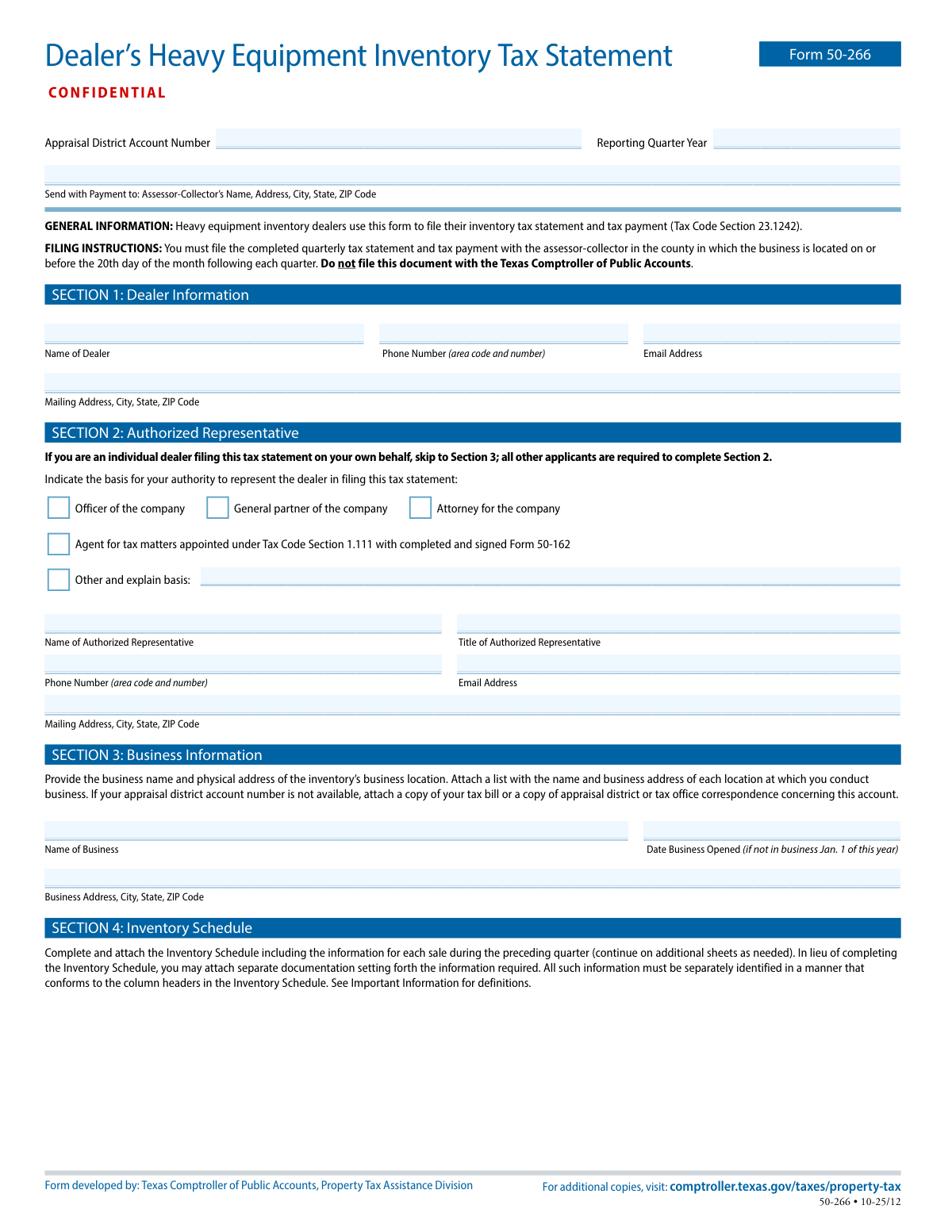

Property tax forms are official documents used to report, calculate, and remit property taxes owed to local taxing authorities. In Texas, these forms are particularly important for businesses and individuals who hold taxable property — including real estate, vehicles, and specialized inventory — because Texas relies heavily on property taxes to fund local government services and schools. Filing accurately and on time is essential, as late or incorrect submissions can result in statutory penalties and compliance issues.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About property tax forms

This category covers forms used by property owners, businesses, and dealers operating in Texas to meet their property tax obligations. A notable example is Form 50-266, the Dealer's Heavy Equipment Inventory Tax Statement, which is required for dealers who sell, lease, or rent heavy equipment. These dealers must file quarterly statements with their county tax assessor-collector, reporting each transaction and calculating the unit property tax due — a process that demands careful attention to detail and strict deadlines.

For anyone who needs to complete these forms, tools like Instafill.ai use AI to fill them out in under 30 seconds, helping ensure the information is entered accurately without the usual hassle of navigating complex tax documents manually.

Forms in This Category

| Form Name | Pages | |

|---|---|---|

| 1. | Dealer’s Heavy Equipment Inventory Tax Statement (Form 50-266) | 4 |

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds