Fill out special assessment forms

with AI.

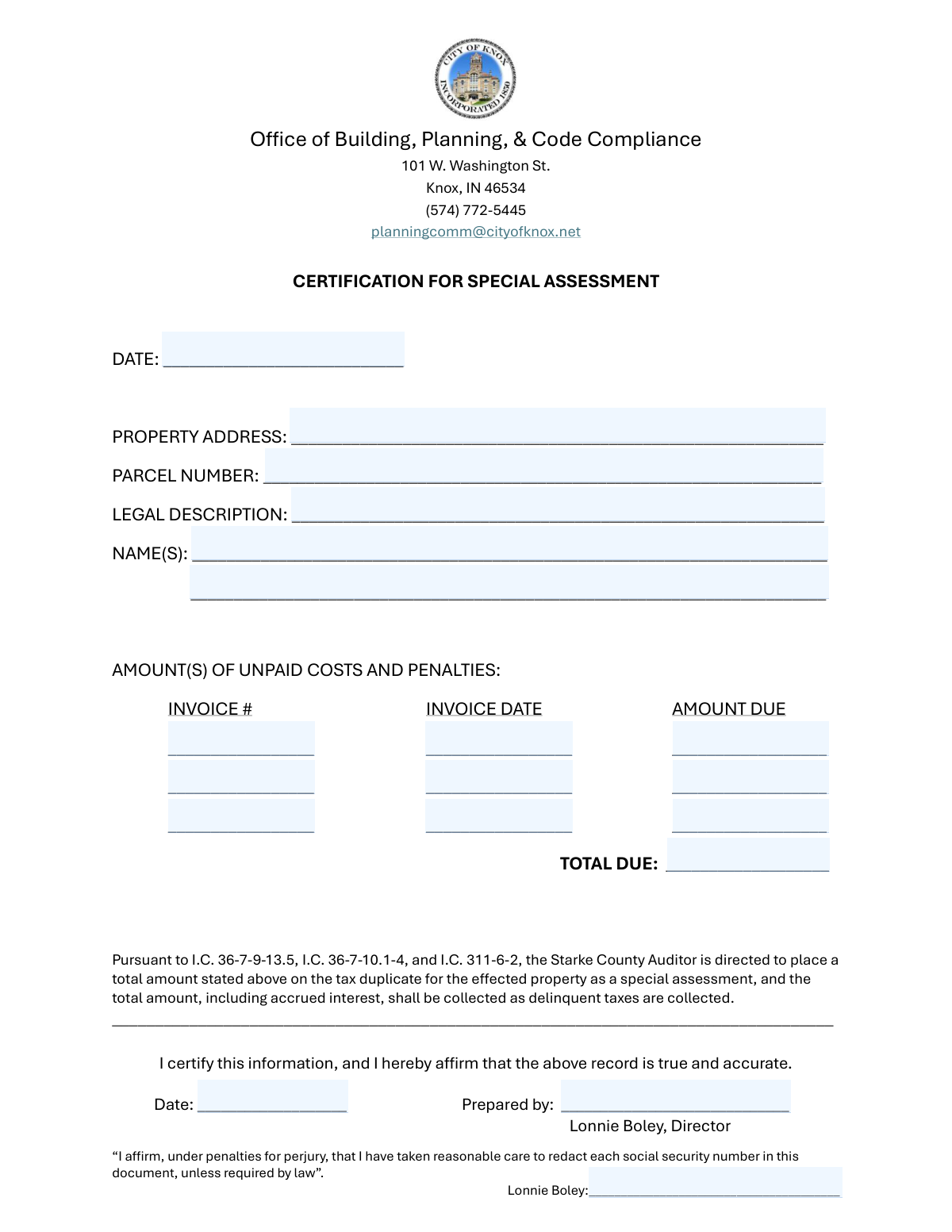

Special assessment forms are official government documents used to formally record and recover unpaid costs, fines, or penalties tied to specific properties. These forms create a legally recognized paper trail that allows local municipalities to place outstanding amounts — such as code enforcement fees or unremediated violation costs — onto a property's tax record, where they can be collected alongside delinquent taxes. Because they carry legal and financial consequences for property owners, accuracy in documenting property identifiers, dollar amounts, and applicable legal authority is essential.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About special assessment forms

These forms are typically used by local government offices — such as building, planning, and code compliance departments — when a property owner has failed to pay costs associated with code violations, abatement work, or other municipal actions. A common example is the Certification for Special Assessment issued by the City of Knox, Indiana, which documents unpaid costs tied to a specific parcel and initiates the process of adding those amounts to the county tax duplicate under Indiana state law. Property owners, municipal clerks, and compliance officers may all encounter these documents during enforcement proceedings.

Because these forms require precise property information and must be properly signed and certified, errors can cause delays or legal complications. Tools like Instafill.ai use AI to fill these forms accurately in under 30 seconds, and can even convert non-fillable PDF versions into interactive forms — making the process faster and more reliable for everyone involved.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds