Form 4852, Substitute for Form W-2 or 1099-R Completed Form Examples and Samples

Explore a detailed example of Form 4852, a substitute for a missing W-2. This guide demonstrates filling out the form with estimated wages, federal tax withheld, and essential employee and employer information. Ideal for tax season preparation.

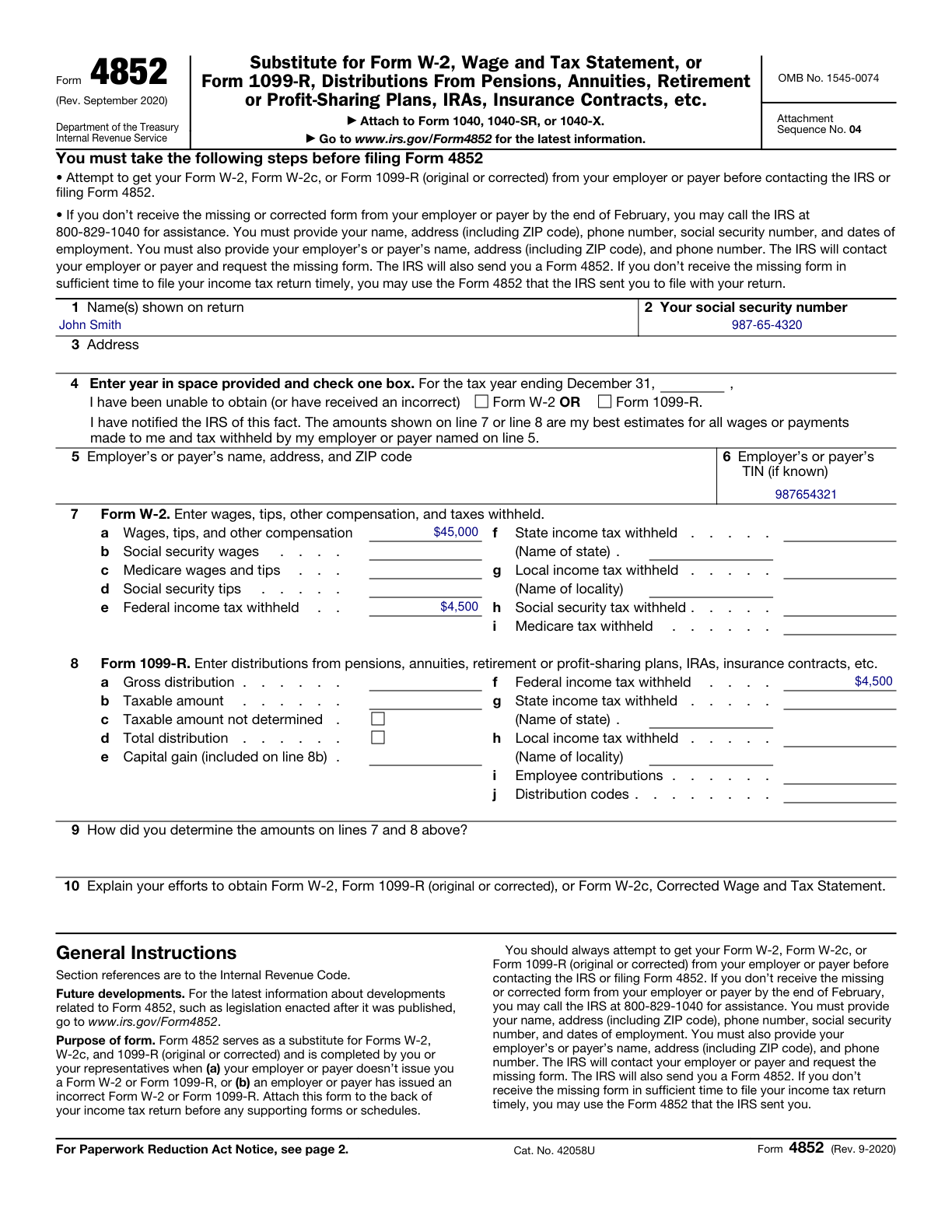

Form 4852 Example – Replacement for Missing W-2

How this form was filled:

This example demonstrates how to complete Form 4852 when a W-2 is missing. It includes estimated wages, federal income tax withheld, and other necessary details. The employee’s details and employer’s information are filled in with estimated amounts, including a signature and date.

Information used to fill out the document:

- Employee Name: John Smith

- Employee Social Security Number: 987-65-4320

- Tax Year: 2024

- Employer's Name: ABC Industries, Inc.

- Employer's Address: 456 Corporate Drive, Business City, USA

- Employer's Identification Number (EIN): 98-7654321

- Estimated Wages: $45,000

- Estimated Federal Income Tax Withheld: $4,500

- Signature: John Smith

- Date: 02/15/2025

What this filled form sample shows:

- Steps to create a substitute for a missing W-2

- Estimated amounts for wages and tax withheld

- Detailed employer information section

- Mandatory signature and date fields completed

Form specifications and details:

| Use Case: | Substitute for a missing or incorrect W-2 |

| Form Number: | 4852 |

| Filing Year: | 2025 |