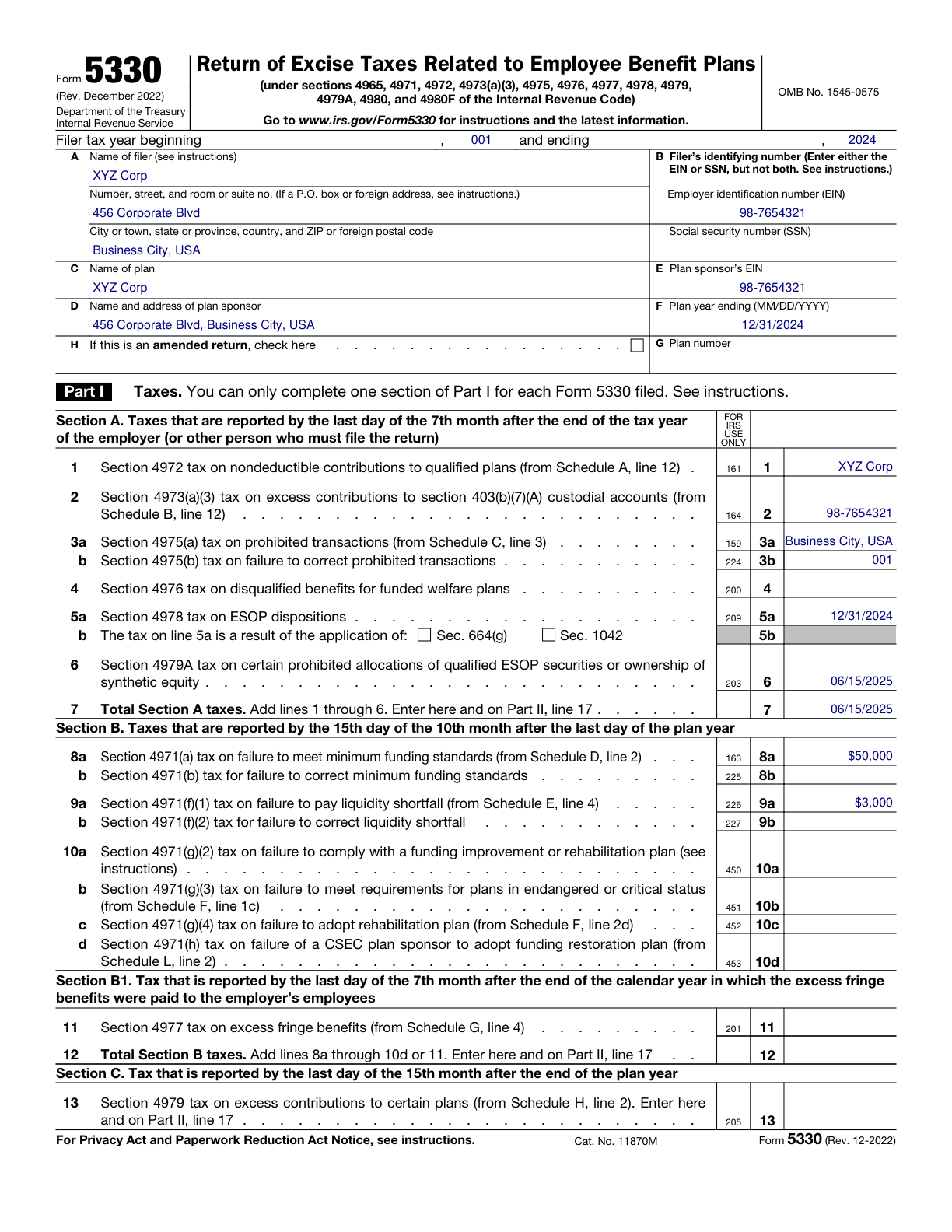

Form 5330, Return of Excise Taxes Completed Form Examples and Samples

Explore a detailed example of Form 5330, demonstrating how to complete it for reporting excise taxes on late contributions to a retirement plan. This guide provides step-by-step instructions and highlights key sections for accurate submission.

Form 5330 Example – Retirement Plan Compliance

How this form was filled:

The form is filled out to report excise taxes for a late contribution to a retirement plan. It includes plan sponsor details, plan information, and tax payment information. The form is signed and dated for official submission.

Information used to fill out the document:

- Sponsor Name: XYZ Corp

- Sponsor Address: 456 Corporate Blvd, Business City, USA

- EIN: 98-7654321

- Plan Number: 001

- Plan Year Ending: 12/31/2024

- Date of Late Contribution: 06/15/2025

- Amount of Late Contribution: $50,000

- Tax Payment Due: $3,000

- Signature: Jane Smith

- Date: 07/10/2025

What this filled form sample shows:

- Accurate completion of plan sponsor information and plan identification fields

- Correct reporting of late contribution date and amount

- Proper calculation and recording of tax payment due

- Valid signature and submission date

Form specifications and details:

| Use Case: | Reporting excise taxes for late contributions to a retirement plan |

| Applicable Year: | 2025 |

| Plan Type: | Qualified Retirement Plan |