Fill out tax forms

with AI.

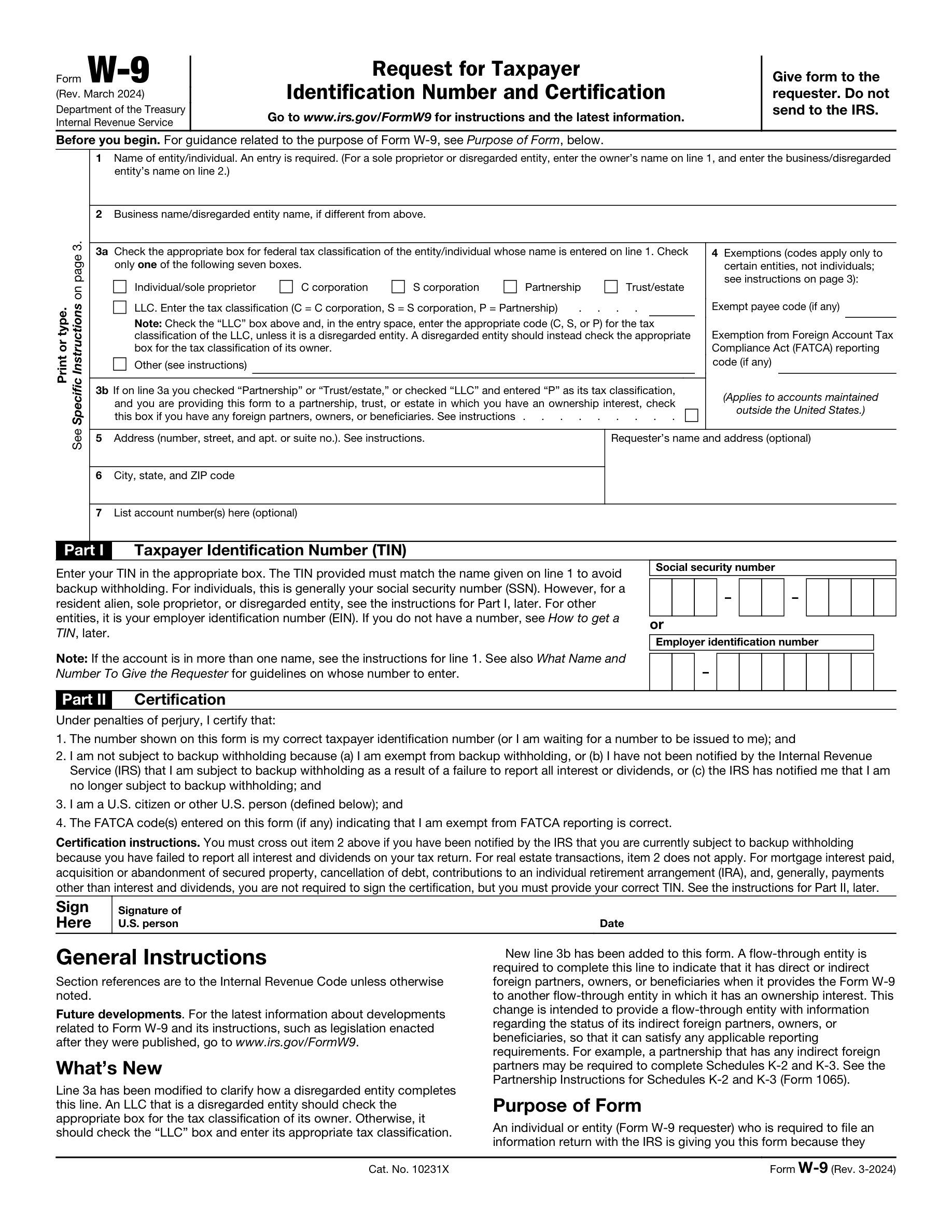

Tax forms cover a broad range of documents used to report income, claim credits, pay taxes, and stay compliant with federal, state, and local tax authorities. Whether you're filing a personal income tax return, reporting payroll taxes as an employer, managing the finances of an estate or trust, or appealing a property tax assessment, there's a specific form designed for each situation. This category includes 60 forms spanning everything from foundational documents like Form 1040 and Form W-2 to more specialized filings such as Form 1041 for estates and trusts, Form 941 for quarterly payroll reporting, and state-specific returns for California, Arizona, and Texas.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About tax forms

These forms are used by a wide range of people and organizations — individual employees, self-employed workers and freelancers, small business owners, S corporations, partnerships, nonprofits, and foreign nationals earning U.S.-sourced income. Situations that commonly trigger a tax form include starting a new job, receiving gambling winnings, taking an early retirement distribution, correcting a prior-year return, or requesting an extension. Property owners and dealers in Texas, for example, may need state-specific forms to handle local tax obligations, while nonresident aliens have their own dedicated filing requirements under the IRS.

Filling out tax forms correctly matters — errors can lead to penalties, delayed refunds, or compliance issues. Tools like Instafill.ai use AI to help complete these forms accurately in under 30 seconds, making it a practical option for anyone who wants to get through the paperwork quickly and securely.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds