Yes! You can use AI to fill out Form 8962, Premium Tax Credit (PTC)

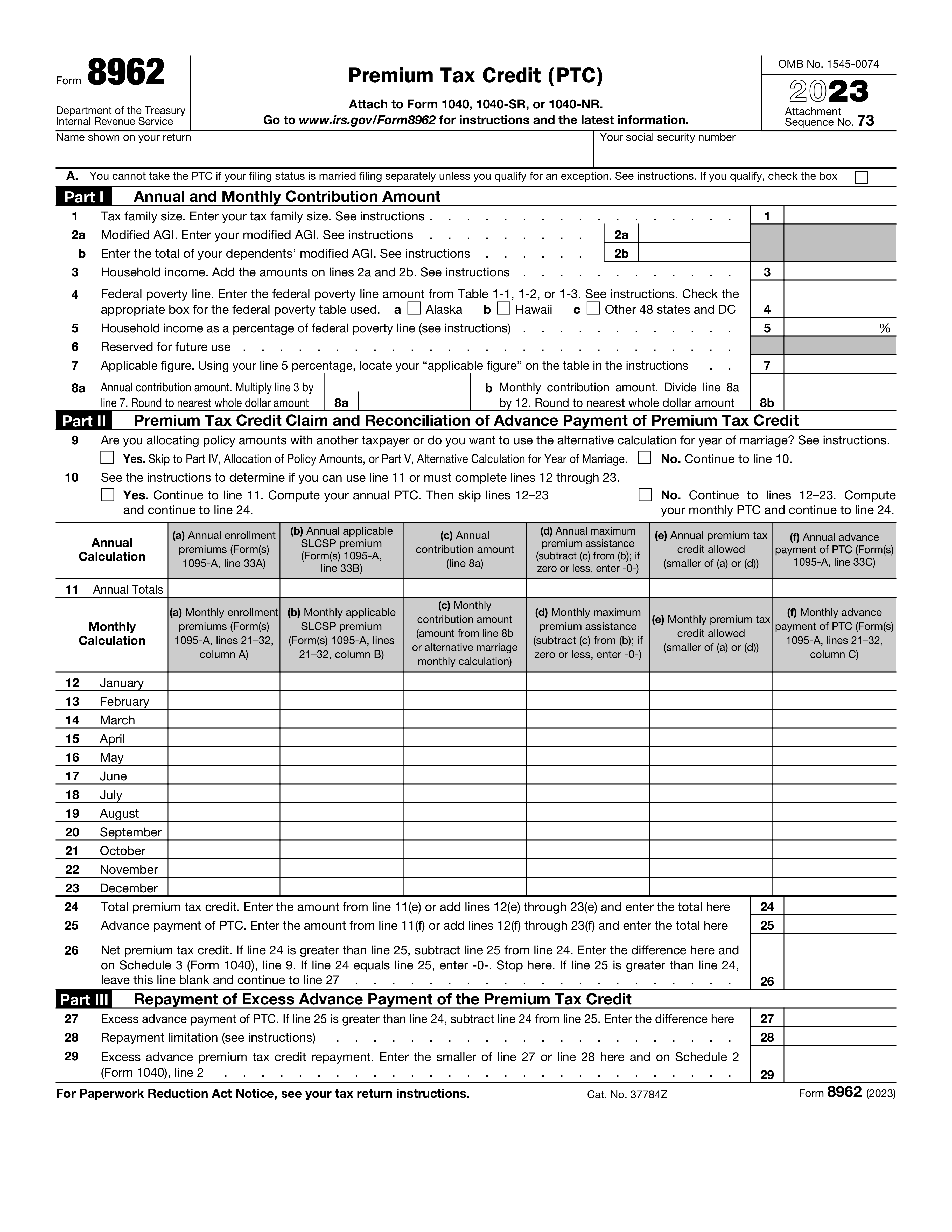

Form 8962, Premium Tax Credit (PTC), is a tax form used by individuals who have purchased health insurance through the Health Insurance Marketplace and wish to claim the Premium Tax Credit. This form helps reconcile the advance payments of the PTC made to your insurance company with the actual credit you qualify for based on your income. It's important for ensuring you receive the correct amount of tax credit and for avoiding discrepancies in your tax filings.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 8962 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 8962, Premium Tax Credit (PTC) |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 141 |

| Number of pages: | 2 |

| Version: | 2023 |

| Form page: | https://www.irs.gov/forms-pubs/about-form-8962 |

| Language: | English |

| Categories: | insurance forms, tax forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 8962 Online for Free in 2026

Are you looking to fill out a FORM 8962 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 8962 form in just 37 seconds or less.

Follow these steps to fill out your FORM 8962 form online using Instafill.ai:

- 1 Visit instafill.ai and select Form 8962.

- 2 Enter your tax family size.

- 3 Input your modified AGI.

- 4 Calculate household income.

- 5 Determine federal poverty line.

- 6 Sign and date the form electronically.

- 7 Check for accuracy and submit.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 8962 Form?

Speed

Complete your Form 8962 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 8962 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 8962

Form 8962 is used to calculate and claim the Premium Tax Credit (PTC), which is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace. It is also used to reconcile the amount of premium tax credit you received in advance with the actual premium tax credit you are eligible for based on your final income for the year.

To be eligible to claim the Premium Tax Credit (PTC), you must meet certain criteria, including having a household income that falls within a specific range, not being eligible for other types of minimum essential coverage (such as Medicare, Medicaid, or affordable employer-sponsored coverage), and purchasing health insurance through the Health Insurance Marketplace. Additionally, you must not be claimed as a dependent by another taxpayer.

Generally, married individuals who file their tax returns separately are not eligible to claim the Premium Tax Credit (PTC). However, there are exceptions for victims of domestic abuse and spousal abandonment, provided certain conditions are met. In such cases, the individual must indicate their eligibility for the exception on Form 8962.

Your tax family size for Form 8962 includes yourself, your spouse (if filing jointly), and any individuals you claim as dependents on your tax return. This includes children and relatives who meet the IRS criteria for being a dependent. It's important to accurately report your tax family size as it affects your eligibility for the Premium Tax Credit and the amount of credit you can claim.

Modified Adjusted Gross Income (modified AGI) is your Adjusted Gross Income (AGI) plus any tax-exempt interest income, foreign earned income, and certain other deductions and exclusions. For Form 8962, you calculate your modified AGI by starting with your AGI from your tax return and then adding back any of these items that apply to you. Your modified AGI is used to determine your eligibility for the Premium Tax Credit and the amount of credit you can claim.

The federal poverty line amount for Form 8962 can be found in the instructions for Form 8962 provided by the IRS. These instructions include tables that list the federal poverty guidelines based on your household size and the state you live in. You will need to refer to the guidelines for the year for which you are filing the form, as they are updated annually.

Household income as a percentage of the federal poverty line is a calculation used to determine eligibility for the Premium Tax Credit (PTC) and the amount of the credit. It is calculated by dividing your household income by the federal poverty line amount for your household size and state, then multiplying by 100 to get a percentage. This percentage helps determine your eligibility for the PTC and the amount of advance payments of the premium tax credit you can receive.

To calculate the annual and monthly contribution amounts for the Premium Tax Credit, you first need to determine your household income as a percentage of the federal poverty line. Then, using the applicable percentage table provided in the Form 8962 instructions, find the percentage that corresponds to your income level. Multiply your household income by this percentage to find your annual contribution amount. To find the monthly contribution amount, divide the annual contribution amount by 12.

The difference between annual and monthly calculation for the Premium Tax Credit (PTC) lies in the timeframe they cover. The annual calculation determines your total expected contribution towards your health insurance premiums for the year, based on your estimated household income. The monthly calculation breaks this down into a monthly amount, which is used to determine the amount of advance payments of the PTC you can receive each month to help pay for your health insurance premiums. At the end of the year, when you file your tax return, you will reconcile the advance payments with the actual PTC you are eligible for based on your actual income.

To reconcile advance payments of the Premium Tax Credit (PTC), you must complete Form 8962 when you file your annual tax return. On this form, you will compare the amount of advance payments you received throughout the year with the actual amount of PTC you are eligible for based on your final household income and family size. If the advance payments exceed the actual PTC, you may need to repay the excess, subject to certain repayment caps. If the actual PTC is more than the advance payments, you may receive the difference as a credit on your tax return.

If you received excess advance payment of the Premium Tax Credit (PTC), you may need to repay some or all of the excess amount when you file your federal income tax return. The amount you need to repay depends on your income and filing status. You should complete Form 8962 to reconcile the advance payments with the actual PTC you're eligible for based on your final income for the year.

To allocate policy amounts with another taxpayer, you must complete Part IV of Form 8962. This section is used when you need to allocate the policy amounts (such as premiums and advance payments of the PTC) between two taxpayers who are enrolled in the same health insurance policy. Both taxpayers must agree on the allocation percentages and each must complete their own Form 8962 using these percentages.

The alternative calculation for the year of marriage is an option available to married taxpayers who got married during the tax year. This calculation can help reduce the amount of excess advance payments of the PTC that you may need to repay. It allows you to calculate your PTC and reconcile advance payments as if you were married for the entire year, potentially lowering your repayment amount.

To complete Part IV, Allocation of Policy Amounts, on Form 8962, you need to enter the allocation percentages agreed upon by both taxpayers sharing a health insurance policy. These percentages are used to divide the policy's premiums and advance payments of the PTC between the two taxpayers. Each taxpayer must then use these percentages to complete their own Form 8962, ensuring that the total allocation percentages add up to 100%.

To complete Part V, Alternative Calculation for Year of Marriage, on Form 8962, you need information about your marital status, the date of your marriage, and your household income and family size before and after your marriage. This information is used to calculate your Premium Tax Credit (PTC) and reconcile any advance payments of the PTC using the alternative calculation method, which can help reduce the amount of excess advance payments you may need to repay.

The instructions for Form 8962 can be found on the official website of the Internal Revenue Service (IRS). They provide detailed guidance on how to fill out the form correctly, including definitions, examples, and specific instructions for each line of the form.

Form 8962 should be attached to your federal tax return. If you are filing a paper return, staple Form 8962 to the front of your Form 1040, 1040-SR, or 1040-NR. If you are filing electronically, the tax software you use will include Form 8962 as part of your electronic submission.

The applicable figure in Form 8962 is used to determine the amount of the premium tax credit (PTC) you are eligible for. It helps in calculating the maximum amount of PTC based on your household income as a percentage of the federal poverty line. This figure is crucial for accurately determining your PTC and any advance payments you may have received.

You need to complete lines 12 through 23 of Form 8962 if you or anyone in your tax family enrolled in a qualified health plan through the Marketplace and received advance payments of the premium tax credit (APTC) for one or more months of the year. These lines are used to calculate the PTC on a monthly basis, which is necessary if your income, family size, or enrollment in a qualified health plan changed during the year.

The repayment limitation for excess advance payment of the premium tax credit (PTC) is the maximum amount you are required to repay if you received more advance payments of the PTC than you were eligible for based on your actual income for the year. The limitation amount varies depending on your filing status and income level, and it is designed to protect taxpayers with lower incomes from having to repay large amounts. The specific limitation amounts are adjusted annually and can be found in the instructions for Form 8962.

Compliance Form 8962

Validation Checks by Instafill.ai

1

Verifies that the filing status is not married filing separately unless an exception is claimed and the appropriate box is checked.

Ensures that the taxpayer's filing status is correctly identified, particularly focusing on the restriction against married filing separately status unless an exception is explicitly claimed. Confirms that the appropriate box is checked to indicate the exception, thereby validating the eligibility for the Premium Tax Credit. This check is crucial for maintaining compliance with IRS regulations regarding the Premium Tax Credit. It also prevents potential errors or audits related to incorrect filing status.

2

Confirms that the tax family size is accurately entered on line 1 of Part I.

Verifies that the number of individuals included in the tax family size is accurately reported on line 1 of Part I. This validation ensures that the calculation of the Premium Tax Credit is based on the correct number of dependents and family members. It checks for discrepancies that could affect the credit amount, ensuring accuracy in the tax filing process. This step is essential for determining the correct amount of Premium Tax Credit the taxpayer is eligible for.

3

Ensures that the modified Adjusted Gross Income (AGI) is correctly entered on line 2a, and if applicable, dependents' modified AGI on line 2b.

Confirms that the modified Adjusted Gross Income (AGI) for the taxpayer is accurately reported on line 2a. If applicable, it also verifies that the modified AGI for dependents is correctly entered on line 2b. This validation ensures that the income figures used for calculating the Premium Tax Credit are accurate and reflect the taxpayer's financial situation. It plays a critical role in determining the eligibility and amount of the credit, preventing errors that could lead to incorrect credit calculations.

4

Validates that the household income is correctly calculated by adding lines 2a and 2b and entered on line 3.

Ensures that the total household income is accurately calculated by summing the amounts from lines 2a and 2b and correctly entered on line 3. This validation is crucial for the accurate computation of the Premium Tax Credit, as household income is a key factor in determining the credit amount. It checks for mathematical errors or omissions that could affect the credit calculation. This step is vital for ensuring that the taxpayer receives the correct amount of Premium Tax Credit based on their household income.

5

Checks that the federal poverty line amount is accurately entered on line 4, considering the appropriate table for Alaska, Hawaii, or other 48 states and DC.

Verifies that the federal poverty line amount is accurately entered on line 4, taking into account the specific tables for Alaska, Hawaii, or the other 48 states and DC. This validation ensures that the correct federal poverty line amount is used in the calculation of the Premium Tax Credit, which is essential for determining the taxpayer's eligibility and the credit amount. It checks for the correct application of the federal poverty guidelines based on the taxpayer's state of residence. This step is crucial for maintaining the accuracy and fairness of the Premium Tax Credit calculation.

6

Verifies that the household income as a percentage of the federal poverty line is correctly calculated and entered on line 5.

Ensures that the calculation of the household income as a percentage of the federal poverty line is accurately performed and correctly entered on line 5 of Form 8962. This validation is crucial for determining eligibility and the amount of the Premium Tax Credit. It involves verifying the mathematical accuracy of the percentage calculation based on the taxpayer's household income and the federal poverty guidelines. The AI software cross-references the entered data with the federal poverty line percentages to confirm correctness.

7

Ensures that the applicable figure from the instructions is correctly found using the percentage from line 5 and entered on line 7.

Confirms that the applicable figure, as determined by the percentage from line 5, is accurately identified from the instructions and correctly entered on line 7. This step is essential for the accurate calculation of the Premium Tax Credit. The AI software verifies that the correct figure is selected based on the taxpayer's income percentage of the federal poverty line. It ensures that the figure entered on line 7 aligns with the instructions provided for Form 8962.

8

Confirms that the annual contribution amount is accurately calculated by multiplying line 3 by line 7 and entered on line 8a, and the monthly contribution amount is correctly calculated by dividing line 8a by 12 and entered on line 8b.

Validates the accuracy of the annual and monthly contribution amounts by ensuring that line 3 is correctly multiplied by line 7 to determine the annual contribution amount on line 8a. Additionally, it confirms that the monthly contribution amount on line 8b is accurately calculated by dividing the annual contribution amount by 12. The AI software performs these calculations to verify the mathematical correctness of the entries. It ensures that the taxpayer's contributions towards the premium are accurately reflected based on their income and the applicable figure.

9

Validates that the question on line 9 regarding allocation of policy amounts or use of the alternative calculation for the year of marriage is answered correctly, and the appropriate instructions are followed.

Ensures that the response to the question on line 9 about the allocation of policy amounts or the use of the alternative calculation for the year of marriage is accurate and in compliance with the instructions. The AI software checks that the taxpayer has correctly indicated whether they are allocating policy amounts or using the alternative calculation. It verifies that the chosen method aligns with the taxpayer's marital status and the specific circumstances of the year of marriage. This validation is critical for the correct application of the Premium Tax Credit.

10

Checks that either the annual or monthly calculation sections are correctly completed to determine the premium tax credit, based on the taxpayer's situation.

Confirms that the appropriate section for calculating the Premium Tax Credit, whether annual or monthly, is correctly completed based on the taxpayer's specific situation. The AI software evaluates the taxpayer's entries to ensure that the calculations align with their eligibility and the method chosen for determining the credit. It verifies that all necessary fields are accurately filled out and that the calculations reflect the taxpayer's actual premium payments and income. This ensures that the Premium Tax Credit is accurately determined and applied.

11

Ensures that the total premium tax credit is accurately entered on line 24 and the total advance payment of PTC on line 25.

The AI software verifies that the total premium tax credit is accurately entered on line 24, ensuring that the taxpayer's eligibility and calculations are correctly reflected. It also confirms that the total advance payment of PTC on line 25 is accurately reported, matching the amounts received throughout the tax year. This step is crucial for determining the correct amount of premium tax credit the taxpayer is entitled to. Additionally, it ensures that any discrepancies between the advance payments and the actual credit are identified and addressed.

12

Verifies that the net premium tax credit is correctly calculated on line 26, and if applicable, the excess advance payment of PTC on line 27 and the repayment limitation on line 28 are accurately calculated, with the smaller of line 27 or line 28 entered on line 29.

The AI software checks the accuracy of the net premium tax credit calculation on line 26, ensuring it reflects the correct amount after considering advance payments. It also verifies the calculation of the excess advance payment of PTC on line 27, if applicable, and the repayment limitation on line 28, ensuring these figures are accurately determined. The software then confirms that the smaller of the two amounts (line 27 or line 28) is correctly entered on line 29, which is essential for determining any repayment obligations. This validation ensures that the taxpayer is not overpaying or underpaying their premium tax credit obligations.

13

Confirms that Part IV is correctly completed with the necessary details for up to four policy amount allocations, if applicable.

The AI software ensures that Part IV of Form 8962 is accurately completed, including the necessary details for up to four policy amount allocations, if applicable. It verifies that each allocation is correctly calculated and entered, reflecting the taxpayer's share of the premium tax credit. This step is crucial for taxpayers who are allocating the premium tax credit among multiple policies or family members. The software also checks for consistency and completeness in the information provided, ensuring that all required fields are filled out correctly.

14

Validates that Part V is accurately completed with the required information, if electing the alternative calculation for the year of marriage.

The AI software validates that Part V of Form 8962 is accurately completed, especially if the taxpayer is electing the alternative calculation for the year of marriage. It ensures that all required information is provided, including the details necessary for the alternative calculation. This validation is important for married taxpayers who may benefit from this election, as it can affect the amount of premium tax credit they are eligible for. The software also checks for any updates or changes in the IRS guidelines that may impact the completion of Part V.

15

Ensures that Form 8962 is attached to the appropriate tax return form (Form 1040, 1040-SR, or 1040-NR) and that the latest instructions from www.irs.gov/Form8962 have been consulted for any updates or additional guidance.

The AI software confirms that Form 8962 is correctly attached to the appropriate tax return form, whether it be Form 1040, 1040-SR, or 1040-NR, ensuring compliance with IRS filing requirements. It also verifies that the latest instructions from www.irs.gov/Form8962 have been consulted, ensuring that the taxpayer is aware of any updates or additional guidance that may affect their premium tax credit calculation. This step is crucial for maintaining the accuracy and completeness of the tax return. Additionally, the software checks for any discrepancies or errors that may arise from not following the latest IRS instructions, helping to avoid potential penalties or delays in processing.

Common Mistakes in Completing Form 8962

Selecting the wrong filing status can lead to incorrect premium tax credit calculations. It's crucial to choose the status that accurately reflects your marital and dependency situation as of the last day of the tax year. To avoid this mistake, review the IRS guidelines on filing statuses and consult with a tax professional if your situation is complex. Ensuring the correct filing status is selected will help in accurately determining your eligibility and the amount of premium tax credit.

Miscalculating the tax family size can significantly affect the premium tax credit amount. The tax family size includes the taxpayer, spouse, and dependents who are required to file a tax return. To prevent errors, carefully review the IRS rules on who qualifies as a dependent and ensure all eligible family members are included. Accurate calculation of the tax family size is essential for determining the correct premium tax credit and avoiding potential issues with the IRS.

Entering an incorrect modified adjusted gross income (AGI) can lead to errors in the premium tax credit calculation. Modified AGI includes certain deductions and exclusions, and it's important to accurately calculate this figure based on IRS guidelines. To avoid mistakes, double-check all income sources and adjustments before entering the modified AGI on Form 8962. Accurate reporting of modified AGI ensures the correct calculation of the premium tax credit and compliance with tax laws.

Errors in calculating household income can result in incorrect premium tax credit amounts. Household income includes the modified AGI of the taxpayer, spouse, and dependents. It's essential to accurately sum up all sources of income and apply the correct adjustments. To minimize errors, use the IRS worksheets provided in the Form 8962 instructions and verify all calculations. Proper calculation of household income is crucial for accurately determining the premium tax credit and ensuring tax compliance.

Using the wrong federal poverty line (FPL) amount can lead to incorrect premium tax credit calculations. The FPL amount varies based on the tax family size and the state of residence. To avoid this mistake, ensure you are using the correct FPL guidelines for the applicable tax year and state. Accurate use of the FPL amount is necessary for determining eligibility for the premium tax credit and calculating the correct credit amount.

A frequent error involves miscalculating the household income percentage, which is crucial for determining eligibility for the Premium Tax Credit (PTC). This mistake can lead to either an overestimation or underestimation of the credit. To avoid this, taxpayers should carefully review the instructions provided by the IRS for calculating household income as a percentage of the federal poverty line. Utilizing the correct figures and applying them accurately ensures the correct determination of the PTC. Consulting with a tax professional or using IRS-approved software can also help in accurately calculating this percentage.

Errors in calculating the annual contribution amount can significantly affect the Premium Tax Credit calculation. This often results from not accurately reporting the expected contribution amount or misunderstanding the guidelines. Taxpayers should ensure they use the correct figures from their health insurance marketplace statement and apply the appropriate formulas as outlined in the IRS instructions. Double-checking calculations and seeking assistance from tax professionals can prevent these errors and ensure the correct PTC is claimed.

Incorrectly calculating the monthly contribution amounts is another common mistake that can distort the Premium Tax Credit. This error typically arises from not accurately dividing the annual contribution by 12 or failing to account for changes in coverage throughout the year. Taxpayers should meticulously review their health insurance statements and ensure that any changes in coverage are accurately reflected in their calculations. Utilizing spreadsheets or tax software that automatically calculates monthly contributions can help in avoiding these errors.

Misallocating policy amounts among family members can lead to errors in the Premium Tax Credit calculation. This mistake often occurs when taxpayers do not accurately assign the correct portion of the policy premium to each family member. To prevent this, it is essential to carefully review the allocation instructions provided by the IRS and ensure that each family member's share of the premium is accurately calculated. Consulting with a tax professional can also provide clarity and accuracy in this complex area.

Taxpayers often make errors when applying the alternative calculation for marriage, which is designed to address situations where married couples experience changes in their marital status during the tax year. This mistake can result from not properly applying the alternative calculation method or misunderstanding its applicability. Taxpayers should thoroughly review the IRS guidelines on the alternative calculation for marriage and ensure they meet the criteria for its use. Seeking advice from a tax professional can also help in correctly applying this calculation and avoiding errors in the PTC claim.

A frequent error involves inaccurately entering the total premium tax credit on Form 8962. This mistake can stem from misunderstanding the instructions or incorrectly calculating the credit based on household income and the cost of the second-lowest-cost Silver plan (SLCSP). To avoid this, carefully review the instructions for calculating the premium tax credit and ensure that all income and coverage information is accurately reported. Double-check calculations or use tax software that automatically computes the credit based on entered data.

Mistakes often occur when entering the amount of advance payments of the premium tax credit received. This can happen if the amounts reported on Form 1095-A are not accurately transferred to Form 8962. To prevent this error, verify the amounts from Form 1095-A, Part III, Column C, and ensure they are correctly entered on Form 8962, Part II, Column B. It's also advisable to reconcile any discrepancies before filing the tax return.

Miscalculating the net premium tax credit is a common error that can lead to incorrect tax liabilities or refunds. This mistake often results from errors in subtracting the advance payments of the premium tax credit from the total premium tax credit. To avoid this, ensure that the subtraction is accurately performed and that the result is correctly entered on the appropriate line of Form 8962. Utilizing tax preparation software can help minimize calculation errors.

Incorrectly calculating the excess advance payment of the premium tax credit is a mistake that can significantly affect the taxpayer's liability. This error typically arises from not accurately determining the difference between the advance payments received and the actual premium tax credit allowed. To prevent this, carefully follow the instructions for calculating excess advance payments on Form 8962, Part II, and ensure all figures are accurately reported. Consulting with a tax professional may also help in accurately determining this amount.

Errors in calculating the repayment limitation for excess advance payments of the premium tax credit can lead to incorrect repayment amounts. This mistake often occurs due to misunderstanding the income-based repayment limitation rules or incorrectly applying them. To avoid this, thoroughly review the instructions related to repayment limitations on Form 8962, Part II, and ensure that the calculation is based on the correct household income percentage of the federal poverty line. Accurate income reporting and understanding of the repayment limitation rules are crucial to prevent this error.

A frequent oversight is not accurately allocating the policy amounts among family members when calculating the premium tax credit. This can lead to incorrect credit amounts and potential issues with the IRS. To avoid this, carefully review the allocation instructions provided by the IRS and ensure that the amounts are divided correctly based on the coverage period and the individuals covered. Utilizing tax software or consulting with a tax professional can also help ensure accuracy in this complex area.

Taxpayers often fail to properly complete the alternative calculation for marriage when it applies, which can result in an incorrect premium tax credit. This mistake typically occurs when taxpayers do not understand the specific requirements for using the alternative calculation. To prevent this, it is crucial to thoroughly read the IRS instructions related to the alternative calculation for marriage and determine if it applies to your situation. Seeking assistance from a tax professional can also provide clarity and ensure that the calculation is done correctly.

Neglecting to attach Form 8962 to the tax return is a common error that can delay processing and potentially lead to penalties. This form is essential for claiming the premium tax credit and must be included with your tax return. To avoid this mistake, double-check your tax return before submission to ensure that all required forms, including Form 8962, are attached. Creating a checklist of documents needed for your tax return can also help prevent this oversight.

Failing to consult the latest IRS instructions for Form 8962 can lead to errors in claiming the premium tax credit. Tax laws and form instructions can change annually, making it important to refer to the most current guidelines. To avoid this mistake, always download the latest version of Form 8962 and its instructions from the IRS website before preparing your tax return. Additionally, staying informed about any tax law changes that may affect your eligibility for the premium tax credit is advisable.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 8962 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 8962 forms, ensuring each field is accurate.