Yes! You can use AI to fill out Form 1040-C, U.S. Departing Alien Income Tax Return

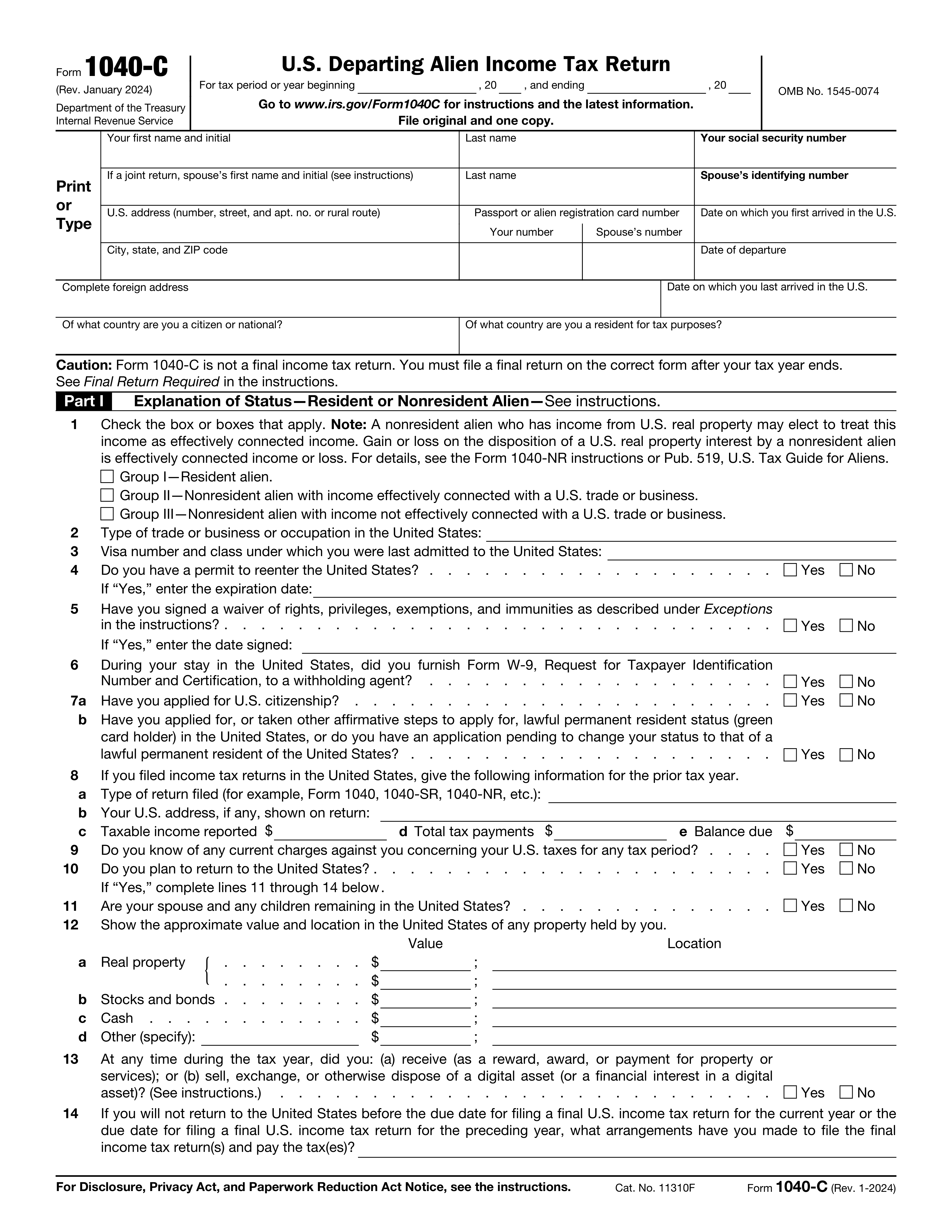

Form 1040-C, U.S. Departing Alien Income Tax Return, is used by nonresident aliens who are leaving the United States to report their income and calculate their tax obligations. This form is important to ensure that departing aliens fulfill their tax responsibilities before leaving the country.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 1040-C using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 1040-C, U.S. Departing Alien Income Tax Return |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 307 |

| Number of pages: | 4 |

| Version: | 2024 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i1040c.pdf |

| Language: | English |

| Categories: | tax forms, income forms, income tax forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 1040-C Online for Free in 2026

Are you looking to fill out a FORM 1040-C form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 1040-C form in just 37 seconds or less.

Follow these steps to fill out your FORM 1040-C form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 1040-C.

- 2 Enter your personal information and tax details.

- 3 Provide information about your income and deductions.

- 4 Sign and date the form electronically.

- 5 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 1040-C Form?

Speed

Complete your Form 1040-C in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 1040-C form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 1040-C

Form 1040-C is used by departing aliens to report their U.S. source income and calculate their U.S. income tax liability before leaving the country.

Form 1040-C must be filed by individuals who are departing from the United States and have U.S. source income during the tax year.

Form 1040-C requires information such as the taxpayer's name, social security number, address, passport or alien registration card number, and details about their U.S. source income and deductions.

A resident alien is an individual who meets the green card test or the substantial presence test, while a nonresident alien is an individual who does not meet either of these tests.

Effectively connected income is income that is derived from a U.S. trade or business. This includes income from renting out real property located in the United States, income from the sale of U.S. real property, and income from personal services performed in the United States.

Income that is not effectively connected with a U.S. trade or business is income that is derived from sources outside the United States. This includes income from foreign employment, income from the sale of foreign real property, and income from foreign dividends, interest, and royalties.

Form 1040-C must be filed before the alien departs from the United States. If the alien is unable to file the return before leaving the country, they may request an extension of time to file by submitting Form 2350, Application by a Taxpayer Outside the United States for Extension of Time To File U.S. Income Tax Return and for Waiver of Penalties.

Form 1040-C can be filed electronically using the IRS Free File program or by mailing a paper copy of the form to the IRS address listed on the form instructions. It is recommended that aliens file as early as possible to allow sufficient time for processing and to avoid potential delays or issues.

The deadline for filing Form 1040-C is the same as the deadline for filing a final income tax return for the tax year. Generally, the deadline is April 15, but this date may change if it falls on a weekend or holiday.

Failure to file Form 1040-C may result in penalties and interest, and the IRS may take other collection actions to enforce the tax liability. It is important for departing aliens to file this form to ensure they meet their U.S. tax obligations before leaving the country.

Yes, a departing alien may claim deductions on Form 1040-C, but only if the deductions are connected to U.S. trade or business income and not deducted elsewhere. It is important for departing aliens to carefully review the instructions for Form 1040-C to ensure they are correctly reporting their income and deductions.

The waiver of rights, privileges, exemptions, and immunities question on Form 1040-C is related to the Voluntary Withdrawal Agreement (VWA) program. This program allows certain individuals to waive their right to contest a U.S. tax liability in order to expedite their departure from the United States. By signing the waiver, the departing alien agrees to pay any assessed tax and interest, and waives their right to contest the tax liability in court.

The Form W-9 question on Form 1040-C is related to the requirement for departing aliens to provide their taxpayer identification number (TIN) to any person who is required to withhold income tax on their payments to the alien. This information is used to ensure that the correct amount of tax is withheld and reported to the IRS. Departing aliens should provide their TIN as soon as possible to avoid delays in the processing of their tax return.

Compliance Form 1040-C

Validation Checks by Instafill.ai

1

Documentation Availability

Ensures that all necessary documentation, including income statements, tax forms, and identification, is available before form completion. This check is crucial to prevent delays and ensure that the information provided on the U.S. Departing Alien Income Tax Return is accurate and complete. It also helps in verifying the identity of the taxpayer and the authenticity of the income reported.

2

Filing Before Departure

Confirms that Form 1040-C is filed before the alien's departure from the United States. This validation is important to comply with the Internal Revenue Service (IRS) regulations, which require that certain departing aliens report their income and pay any taxes due before leaving the country. It also ensures that the taxpayer does not face any legal issues or penalties for non-compliance.

3

Correct Instructions Usage

Verifies the correct use of Instructions for Form 1040-NR for nonresident aliens or Instructions for Forms 1040 for resident aliens to complete Form 1040-C. This check is essential for the accurate completion of the form, as it guides the taxpayer through the process and helps avoid common mistakes. It also ensures that the taxpayer takes advantage of all applicable tax benefits and deductions.

4

Form 8854 Filing

Checks for the filing of Form 8854 for former U.S. citizens or long-term residents who expatriated in 2024. This validation is significant for those who have renounced their U.S. citizenship or ended their long-term residency, as it is a requirement by the IRS to certify compliance with all tax obligations. It also helps in avoiding potential penalties associated with the expatriation process.

5

Form 843 Filing

Validates that Form 843 is filed if social security or Medicare taxes were withheld in error. This check is important to ensure that taxpayers can claim a refund for any taxes incorrectly withheld from their income. It also confirms that the taxpayer's rights are protected and that they are not overpaying taxes due to administrative errors.

6

ITIN Renewal Processing

The system ensures that an Individual Taxpayer Identification Number (ITIN) renewal has been processed if the ITIN has not been included on a U.S. federal tax return in the last three consecutive years. This validation is crucial as an expired ITIN may lead to processing delays and possible disallowance of certain tax benefits until the number is renewed and updated in the tax records.

7

Social Security Number for Child Tax Credit

The system confirms that a valid Social Security Number (SSN) is provided when claiming the child tax credit on the tax return. This check is essential because the IRS requires an SSN for each qualifying child listed on the return to ensure eligibility for the credit and to prevent fraudulent claims.

8

Form 1040-C Not a Final Return

The system verifies that Form 1040-C, filed by departing aliens to report income received or expected to be received for the entire year, is not treated as a final return. It ensures that the taxpayer understands the obligation to file a final income tax return after the tax year ends, if required, to settle any outstanding tax liabilities.

9

Tax Credit from Form 1040-C

The system ensures that any tax paid with Form 1040-C is properly accounted for as a credit against the tax liability on the final income tax return. This validation prevents double taxation and ensures that the taxpayer receives credit for any payments made at the time of departure from the United States.

10

Filing Form 1040-C or Form 2063 for Certificate of Compliance

The system confirms that either Form 1040-C or Form 2063 is filed with the local IRS office by the departing alien to obtain a certificate of compliance, also known as a 'sailing permit'. This check is important to ensure that the taxpayer has settled all U.S. tax obligations before leaving the country, as required by law.

11

Payment of Tax Due on Form 1040-C

The system ensures that all tax liabilities indicated as due on the U.S. Departing Alien Income Tax Return (Form 1040-C) are settled by the taxpayer. It verifies that any outstanding taxes for previous years are also paid in full. The validation process includes cross-referencing the amounts entered with the taxpayer's payment history to confirm that no outstanding balance remains. This check is crucial to prevent any discrepancies and ensure compliance with tax obligations before departure.

12

Scheduling Appointment with Local IRS Office

The system checks that the taxpayer has scheduled an appointment with the local IRS office at least two weeks prior to their planned departure date. This validation is important to ensure that there is sufficient time for the IRS to review the Form 1040-C and address any potential issues. The system may also remind the taxpayer of this requirement and provide information on how to schedule the appointment if necessary.

13

Inclusion of All Income

The system ensures that all income received, as well as income that is reasonably expected to be received during the entire year of departure, is accurately reported on Form 1040-C. This includes wages, dividends, interest, and any other forms of income. The validation process helps to prevent underreporting of income and potential penalties. It also assists in calculating the correct amount of tax due for the partial year of residency.

14

Filing Status for Resident and Nonresident Aliens

The system confirms that nonresident aliens adhere to the regulation that prohibits them from filing a joint return. Conversely, it verifies that resident aliens may file a joint return on Form 1040-C if specific conditions are met. This validation check is essential to ensure that the filing status complies with the tax rules applicable to departing aliens. The system may also provide guidance on the conditions under which a joint return is permissible for resident aliens.

15

Payment of Tax and Refund Claims

The system verifies that all tax shown as due on Form 1040-C is paid at the time of filing. Additionally, it ensures that any refund claims are processed using the appropriate forms, such as Form 1040 or Form 1040-NR, at the end of the tax year. This validation check is important to confirm that the taxpayer's account is accurately settled and that any overpayment is refunded in accordance with tax laws.

Common Mistakes in Completing Form 1040-C

Failure to file Form 1040-C (Statement for Withholding on Account of Estimated Tax) before departing from the United States can result in significant complications. This form is crucial for ensuring that the appropriate amount of U.S. income tax has been withheld from your earnings. To avoid this mistake, make sure to file Form 1040-C well before your planned departure date. If you are unsure about the process or have any questions, consult a tax professional for guidance.

It is essential to report all income received and reasonably expected to be received during the entire year of departure on your U.S. Departing Alien Income Tax Return. Neglecting to do so can lead to penalties and potential legal issues. To avoid this mistake, carefully review your income sources and document all earnings. Be sure to include wages, salaries, tips, and any other forms of compensation, as well as income from interest, dividends, and capital gains. If you are unsure about what constitutes taxable income, consult a tax professional for guidance.

Filing as a nonresident alien without obtaining the correct instructions (Form 1040-NR, U.S. Nonresident Alien Income Tax Return) can result in incorrect filings and potential penalties. Nonresident aliens have unique tax requirements, and it is essential to use the appropriate forms and instructions to ensure compliance. To avoid this mistake, make sure to obtain the correct forms and instructions from the IRS website or consult a tax professional for guidance.

Filing as a resident alien without obtaining the correct instructions (Forms 1040, U.S. Individual Income Tax Return) can lead to incorrect filings and potential penalties. Resident aliens have different tax requirements than nonresident aliens, and it is essential to use the appropriate forms and instructions to ensure compliance. To avoid this mistake, make sure to obtain the correct forms and instructions from the IRS website or consult a tax professional for guidance.

Failing to provide a valid Social Security number when claiming the Child Tax Credit can result in the denial of the credit or potential penalties. It is essential to ensure that you provide accurate and valid Social Security numbers for all eligible children. To avoid this mistake, double-check that you have the correct Social Security numbers for your children before filing your tax return. If you encounter any issues or have questions, consult a tax professional for guidance.

Nonresident aliens cannot file a joint tax return with a U.S. spouse or Reforegn Spouse. Each nonresident alien must file their own tax return using Form 1040-NR or Form 1040-NR-EZ. Filing a joint return as a nonresident alien may result in penalties and incorrect tax calculations. To avoid this mistake, ensure each nonresident alien files their individual tax return using the appropriate form.

Nonresident aliens are required to appear in person at a designated IRS office to file their tax return and obtain a certificate of compliance (Form 1040-C) before leaving the United States. Failing to schedule an appointment with the local IRS office at least 2 weeks before planned departure may result in missed deadlines and potential penalties. To avoid this mistake, nonresident aliens should plan ahead and schedule their appointment well in advance of their departure date.

Nonresident aliens are required to bring all necessary documents to their appointment with the IRS, including their passport, original tax returns, receipts, and proof of income. Failing to bring all required documents may result in delays or denial of the certificate of compliance. To avoid this mistake, nonresident aliens should carefully review the list of required documents and gather them before their appointment to ensure a smooth and efficient process.

Nonresident aliens are required to pay all tax shown as due on Form 1040-C at the time of filing. Failing to pay the full amount due may result in penalties and interest charges. To avoid this mistake, nonresident aliens should carefully review their tax calculations and ensure they have sufficient funds to pay the full amount due at the time of filing.

Nonresident aliens are required to file a final income tax return (Form 1040-NR or Form 1040-NR-EZ) for the tax year in which they leave the United States. Failing to file a final return may result in missed opportunities for claiming refunds or credits. To avoid this mistake, nonresident aliens should file their final income tax return as soon as possible after leaving the United States to ensure they have met all their tax obligations.

Form 8854, the Statement of Specified Foreign Financial Assets, is a crucial document for individuals who have expatriated from the United States. This form is mandatory for reporting specified foreign financial assets and determining the expatriation tax liability. Neglecting to file Form 8854 can lead to penalties and potential legal complications. To avoid this mistake, ensure that you meet the filing requirements and submit the form along with your annual income tax return. It is essential to consult a tax professional for guidance on the specific rules and deadlines for filing Form 8854 as an expatriate.

Social security and Medicare taxes are mandatory deductions for individuals working in the United States. However, in some cases, these taxes may be withheld in error, leading to unnecessary financial burdens. To rectify this situation, individuals must file Form 843, the Claim for Refund of Excise, Estate, Gift, or Certain Other Taxes. Failing to request a refund can result in the loss of potential tax savings. To avoid this mistake, carefully review your tax withholdings and consult a tax professional if you suspect any errors. They can help you determine if filing Form 843 is necessary and guide you through the process.

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS) for certain nonresident and resident aliens, their spouses, and dependents who cannot obtain a Social Security Number. ITINs must be renewed every few years to maintain their validity. Failing to renew an ITIN when required can result in the inability to file a tax return or receive a refund. To avoid this mistake, ensure that you renew your ITIN if you have not used it on a tax return in the last three consecutive years. Consult the IRS website or a tax professional for guidance on the renewal process and deadlines.

Form 1040-C, the Application for Credit for Foreign Tax Paid, and Form 2063, the U.S. Income Tax Return for Residents of Puerto Rico, are specific tax forms with unique purposes. However, they should not be used as a substitute for filing a final income tax return after the tax year ends for individuals who are required to file a U.S. income tax return. Filing the incorrect form can lead to penalties, missed tax credits, and potential legal complications. To avoid this mistake, ensure that you file the appropriate form for your tax situation and consult a tax professional for guidance if you are unsure.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 1040-C with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 1040-c forms, ensuring each field is accurate.