Fill out income forms

with AI

Income forms cover a broad range of documents used to report, verify, and calculate earnings across nearly every financial situation — from filing your annual federal tax return to disclosing income in a family law proceeding or applying for a student loan repayment plan. This category includes IRS staples like Form 1040 (the standard individual income tax return

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About income forms

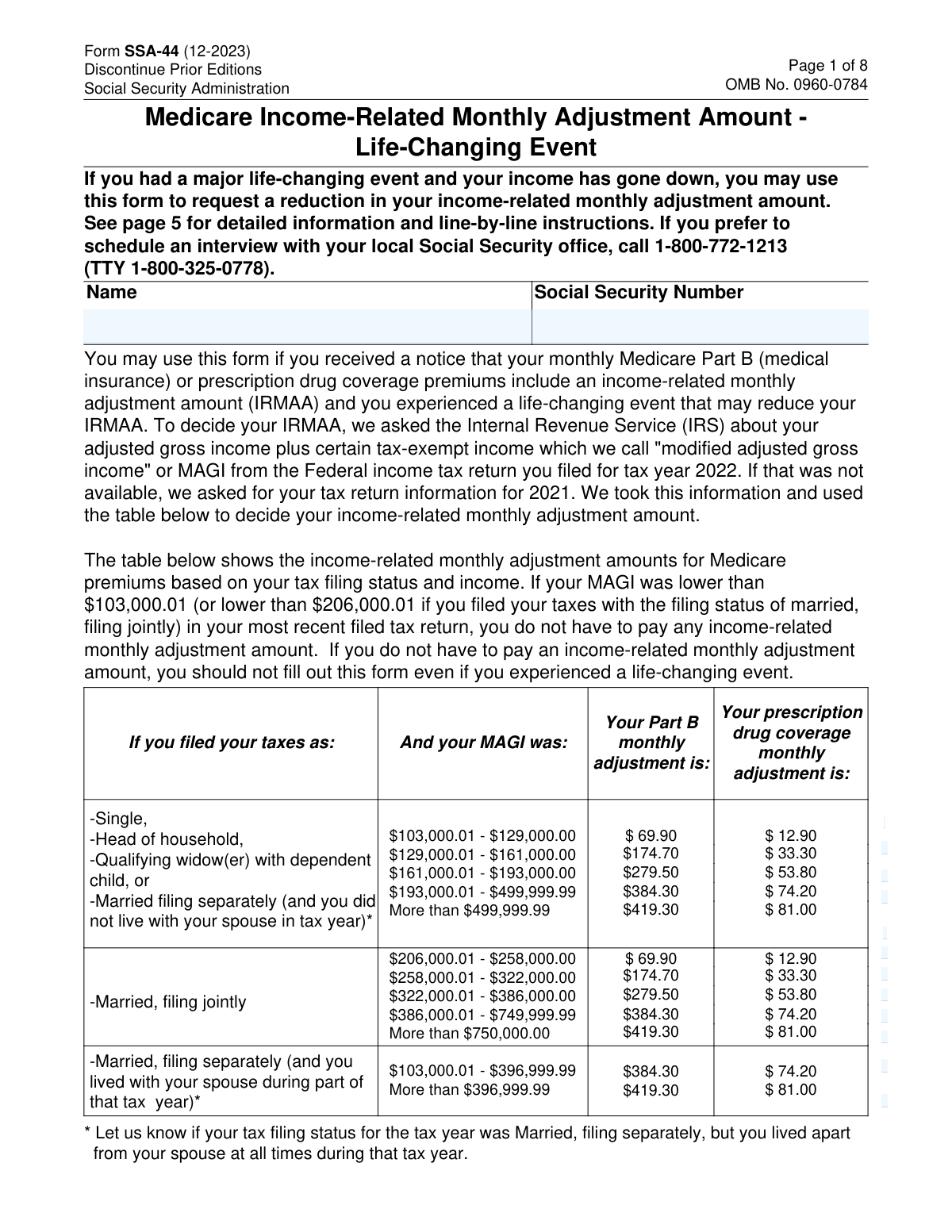

These forms are used by a wide range of people: individual taxpayers filing or correcting their returns, small business owners and self-employed workers reporting pass-through income, fiduciaries managing estates and trusts, nonresident aliens with U.S.-source income, and individuals navigating life events like bankruptcy, divorce, or Medicare adjustments. Organizations — including nonprofits and S corporations — also rely on income-related forms to stay compliant with federal and state tax obligations.

With 41 forms in this category spanning federal, state, and specialized contexts, knowing which form applies to your situation is half the battle. Tools like Instafill.ai use AI to help you fill out these forms accurately in under 30 seconds, making it easier to stay on top of deadlines and avoid costly errors — whether you're handling a straightforward 1040 or a more complex partnership return.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds