Yes! You can use AI to fill out Form SS-8 (Rev. December 2023), Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding

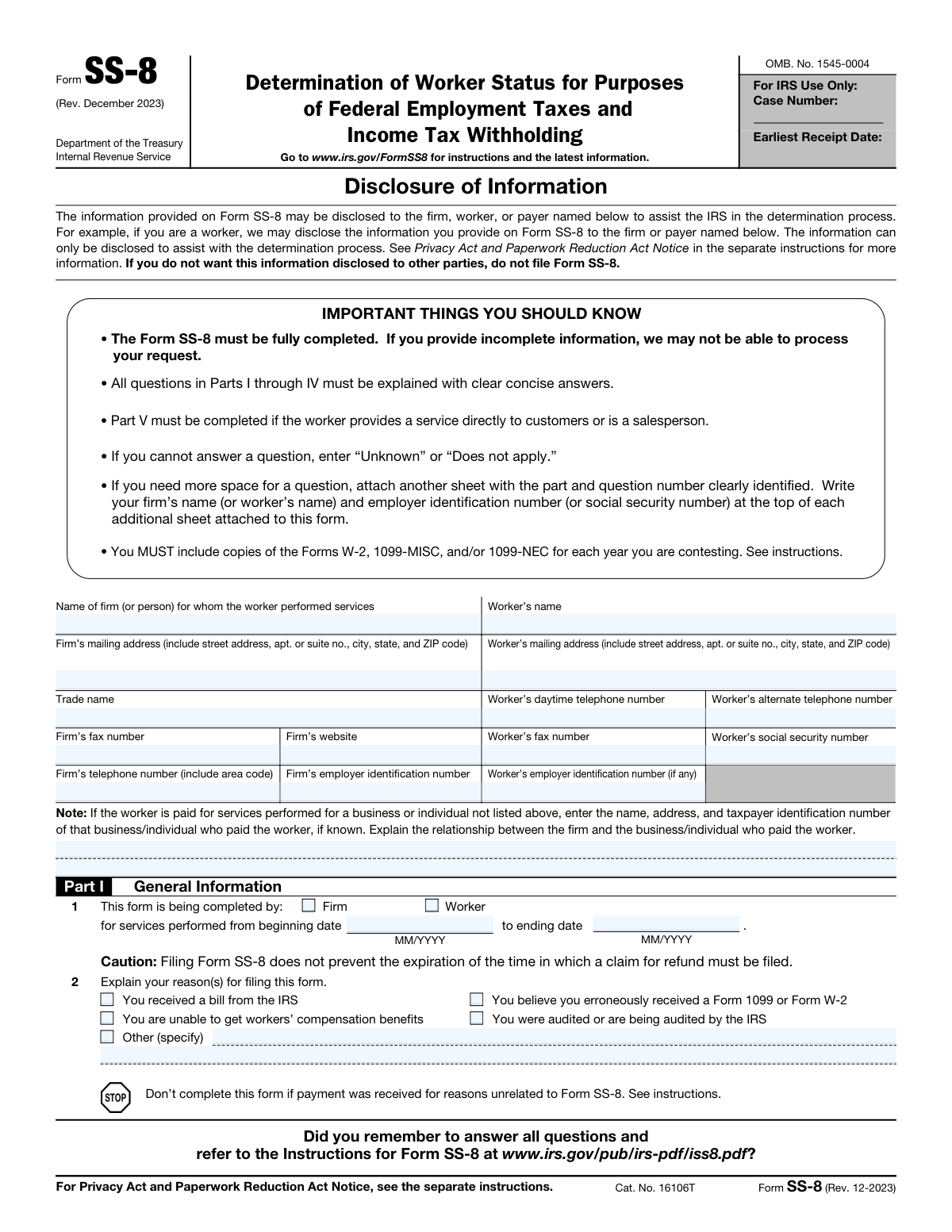

Form SS-8 is an Internal Revenue Service request form used by a worker or a firm to ask the IRS to determine a worker’s federal tax status (employee vs. independent contractor). The form collects detailed facts about behavioral control, financial control, and the relationship between the parties so the IRS can apply common-law rules. It is important because worker classification affects payroll tax obligations, withholding, eligibility for certain benefits, and whether income is reported on Form W-2 or Form 1099. The form must be fully completed and supported with documentation (such as contracts and Forms W-2/1099) for the IRS to process the request.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out SS-8 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form SS-8 (Rev. December 2023), Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding |

| Number of pages: | 5 |

| Filled form examples: | Form SS-8 Examples |

| Language: | English |

| Categories: | employment forms, employment tax forms, federal forms, federal employment forms, Work and Income forms, income forms, income tax forms, federal tax forms, tax withholding forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out SS-8 Online for Free in 2026

Are you looking to fill out a SS-8 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your SS-8 form in just 37 seconds or less.

Follow these steps to fill out your SS-8 form online using Instafill.ai:

- 1 Gather required information and documents: firm and worker identifying details (names, addresses, EIN/SSN), the service period, written/oral agreements, and copies of Forms W-2 and/or 1099-MISC/1099-NEC for each year contested plus any supporting contracts/invoices.

- 2 Enter party information at the top of the form (firm and worker contact details and taxpayer identification numbers) and note any third-party payer information if someone other than the firm paid the worker.

- 3 Complete Part I (General Information): who is filing, dates of service, reasons for filing, business description, job title/duties, prior/subsequent services, and details of any written or oral agreement; attach explanations and additional sheets as needed.

- 4 Complete Part II (Behavioral Control): describe training/instructions, who assigns work and how, who controls methods, reporting requirements, work schedule, work locations, meetings, and whether the worker can hire/pay helpers or substitutes.

- 5 Complete Part III (Financial Control): list who provides tools/supplies, any leases, unreimbursed expenses and reimbursements, pay method, advances, who customers pay, workers’ compensation coverage, and who sets pay rates/prices and financial risk/loss factors.

- 6 Complete Part IV (Relationship): describe benefits, termination rights/penalties, work for others and noncompete terms, advertising, customer introductions, whose name services are performed under, and whether the relationship continues or how it ended.

- 7 If applicable, complete Part V (Service Providers/Salespersons), then review for completeness, attach all required supporting documents, sign and date the declaration under penalties of perjury, and submit the package as directed in the IRS instructions.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable SS-8 Form?

Speed

Complete your SS-8 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 SS-8 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form SS-8

Form SS-8 is used to ask the IRS to determine whether a worker should be treated as an employee or an independent contractor for federal employment taxes and income tax withholding.

Either the worker or the firm (payer) can complete and file Form SS-8. The form asks you to check whether it is being completed by the firm or the worker.

You may file when there is a dispute or uncertainty about worker classification, such as receiving a Form 1099 or W-2 you believe is incorrect, being audited, or other classification-related issues. The form asks you to explain your reason(s) for filing in Part I.

No. The form specifically cautions that filing Form SS-8 does not prevent the expiration of the time period in which a claim for refund must be filed.

You must provide identifying and contact information for both parties, including names, mailing addresses, and taxpayer identification numbers (EIN for the firm and SSN for the worker, plus any worker EIN if applicable).

You must include copies of Forms W-2, 1099-MISC, and/or 1099-NEC for each year you are contesting. You should also attach supporting documentation such as contracts, invoices, memos, closing agreements, or IRS rulings, if available.

If no income reporting forms were furnished, the form asks you to enter the amount of income earned for the year(s) at issue. You should also attach any other documentation that supports the payments and work arrangement.

You must explain why both forms were issued or received (for example, both W-2 and 1099-NEC, or both W-2 and 1099-MISC). Include any documents that help clarify what happened.

If you cannot answer a question, you should write “Unknown” or “Does not apply.” The IRS notes the form must be fully completed, and incomplete information may prevent processing.

Attach an additional sheet and clearly label it with the part and question number. Put the firm’s name (or worker’s name) and the EIN (or SSN) at the top of each additional sheet.

Parts I through IV must be answered and explained with clear, concise answers. Part V is required if the worker provides services directly to customers or is a salesperson.

The form asks who directs the work (training, assignments, methods, meetings, reports) and who bears financial responsibility (tools/equipment, expenses and reimbursements, pay type, financial risk/loss). Provide specific names/titles where applicable and attach examples (like reports) if requested.

The form instructs you to list the name, address, and taxpayer identification number of the business/individual who paid the worker, if known. You must also explain the relationship between that payer and the firm.

Answer “Yes” to Part I, line 7 and provide the previous owner’s name and taxpayer identification number, the type of change, a description, and the date of the change. This helps the IRS understand which entity controlled and paid for the work.

Yes, the form states the information may be disclosed to the firm, worker, or payer named to assist the IRS in the determination process. If you do not want the information disclosed to other parties, you should not file Form SS-8.

Compliance SS-8

Validation Checks by Instafill.ai

1

Firm identity fields present and non-empty

Validates that the firm (or person) name and the firm mailing address are provided and not left blank. These fields are essential for the IRS to identify the entity whose relationship to the worker is being evaluated and to route correspondence correctly. If missing, the submission should be rejected or flagged as incomplete because the IRS determination cannot be reliably associated to a specific firm.

2

Worker identity fields present and non-empty

Checks that the worker’s name and worker mailing address are completed. This ensures the request can be tied to the correct individual and that the IRS can contact the worker regarding the determination. If absent, the form should fail completeness validation and require correction before processing.

3

Taxpayer Identification Number (TIN) format validation (SSN/EIN)

Validates that the worker SSN is exactly 9 digits (optionally formatted as XXX-XX-XXXX) and that any EIN provided (firm EIN and/or worker EIN) is 9 digits (optionally formatted as XX-XXXXXXX). Correct TIN formatting is critical for matching IRS records and avoiding misidentification. If the format is invalid or the field contains non-numeric characters beyond allowed separators, the submission should be blocked or routed to exception handling.

4

Phone and fax number format validation

Ensures firm and worker telephone numbers (and fax numbers, if provided) contain a valid US phone pattern (10 digits with optional punctuation and optional leading country code +1). This reduces failed contact attempts and improves case processing efficiency. If a number is present but invalid, the system should flag the field and require correction or allow submission only with a warning depending on business rules.

5

Website and email-like field hygiene (firm website)

Validates that the firm website, if provided, resembles a valid URL (e.g., includes a valid domain and no illegal characters) and is not mistakenly populated with unrelated text (like a phone number). While not required, a clean website value can support verification and contact. If invalid, the system should either strip/normalize (e.g., add https://) or flag for correction.

6

Service period date format and range validation (Part I, Line 1)

Checks that the beginning and ending service dates are provided in MM/YYYY format and represent valid months (01–12). Also validates that the ending date is the same as or later than the beginning date. If the dates are missing, malformed, or logically inconsistent, the submission should fail because the determination period is unclear.

7

Prior owner change date format validation (Part I, Line 7)

If the user answers 'Yes' to the business sale/merger/acquisition/reorganization question, validates that the 'Date of change' is present and in MM/DD/YY format with a real calendar date. This date is important to understand which entity employed/paid the worker during the contested period. If missing or invalid, the form should be flagged as incomplete for the Line 7 conditional section.

8

Mutually exclusive selection enforcement (single-choice questions)

Validates that questions explicitly requiring a single selection have exactly one option chosen (e.g., 'This form is being completed by: Firm/Worker' and 'Which do you believe the worker is: Employee/Independent contractor'). This prevents contradictory inputs that undermine the determination narrative. If multiple or no options are selected, the submission should be rejected and the user prompted to correct the selection.

9

Conditional explanation required when 'Other (specify)' is selected

Checks that any time an 'Other (specify)' option is selected (e.g., reason for filing, how job was obtained, change type, assignment method, meeting type, pay type, etc.), the accompanying free-text 'specify' field is populated with a meaningful description. This is necessary because 'Other' without details provides no actionable information. If missing, the system should fail validation for that question and request the missing specification.

10

Required narrative responses present for key descriptive prompts

Validates that required open-ended prompts are answered with non-trivial text (not blank, not only 'N/A' unless allowed, and not whitespace), including items like reason(s) for filing, firm’s business description, worker’s duties, and explanations where requested. The IRS instructions emphasize clear concise answers in Parts I–IV, and missing narratives can prevent processing. If these fields are empty, the submission should be marked incomplete and returned for completion.

11

Yes/No dependency validation for follow-up fields

Ensures that when a Yes/No question is answered 'Yes', the required follow-up fields are completed (e.g., if 'Yes' to written agreement, attach/capture terms; if 'Yes' to meetings, provide type; if 'Yes' to penalties, provide penalty; if 'Yes' to substitutes, provide approval details; if 'Yes' to reimbursement, explain who reimburses). This maintains logical completeness and prevents dangling answers. If follow-ups are missing, the system should block submission or flag the specific missing dependent fields.

12

Location percentage allocation validation (Part II, Line 7)

Validates that any provided percentages for service locations are numeric values between 0 and 100 and that the total across locations equals 100% when more than one location is listed. This check ensures the distribution of work locations is interpretable and consistent. If totals exceed/under 100% (beyond a small rounding tolerance) or contain invalid numbers, the submission should be flagged for correction.

13

Numeric field validation for counts, amounts, and percentages

Checks that numeric fields such as total number of similar workers (Part I, Line 3), income amount when no forms were furnished (Part I, Line 5b), route/territory payment amount (Part V, Line 7), and all percentage fields (e.g., insurance time percentages, solicitation time percentage) are valid numbers in acceptable ranges. This prevents parsing errors and nonsensical values (negative counts, percentages over 100). If invalid, the system should reject the entry and identify the specific field and expected range/format.

14

Part V completion requirement based on customer-facing service/sales indicators

Validates that Part V is completed when the worker provides services directly to customers or is a salesperson, as stated in the form instructions. The system should infer this requirement from relevant answers (e.g., sales-related primary services, customer pays worker, selling locations, or explicit sales role) or require an explicit indicator. If Part V is required but missing, the submission should be flagged as incomplete and not forwarded for determination.

15

Attachment requirement validation for contested years (W-2/1099)

Ensures the submission includes copies of Forms W-2, 1099-MISC, and/or 1099-NEC for each year being contested, or captures a clear explanation when forms were not furnished (with income amounts provided on Line 5b). Attachments are explicitly required and are critical evidence for the IRS review. If attachments are missing without a valid exception path, the system should prevent final submission or route to an exception queue with a clear deficiency notice.

16

Signature, printed name, and signature date presence and date validity

Validates that the signer’s printed name, signature, and signature date are present, and that the date is a valid calendar date (and not in the future, if policy requires). The perjury statement requires an executed signature to make the submission legally complete. If any of these are missing or invalid, the form should be rejected as unsigned/incomplete and not treated as a valid request.

Common Mistakes in Completing SS-8

People often skip questions they can’t answer or think are irrelevant, but Form SS-8 explicitly instructs filers to enter “Unknown” or “Does not apply.” Blank answers can make the submission “incomplete,” which may delay or prevent IRS processing of the request. To avoid this, review every line in Parts I–IV (and Part V if applicable) and enter a valid response even when details are unavailable.

Filers frequently miss the instruction that Part V is mandatory if the worker provided services directly to customers or is a salesperson. Skipping Part V leaves out key facts the IRS uses to evaluate control, territory, leads, and sales terms, which can slow the determination or lead to follow-up requests. If the worker had any customer-facing route/territory, lead generation, or sales activity, complete Part V fully and attach supporting documents where requested.

A common error is answering with general statements like “the worker had flexibility” or “the firm controlled everything” without identifying who did what. The form repeatedly asks for “names and titles of specific individuals” and concrete descriptions (training, assignments, complaint handling), and vague answers reduce the usefulness of the submission. Provide specific people (e.g., “Jane Smith, Operations Manager”), specific instructions given, and real examples (emails, schedules, policies) to support each answer.

Filers often enter dates in the wrong format (e.g., MM/DD/YYYY instead of MM/YYYY on line 1) or provide inconsistent timelines across the form. Another frequent issue is answering “No” to services outside the period while later describing work that clearly occurred before/after, which creates credibility and consistency problems. Use the exact format requested, double-check that the service period matches attachments (contracts, invoices, W-2/1099 years), and complete line 10 with dates and differences if any work occurred outside the main period.

Many submissions omit the required copies of income reporting forms, especially when the filer assumes the IRS already has them. The form states you MUST include copies for each year contested, and missing forms can delay processing or trigger requests for additional information. Gather and attach the W-2/1099s for every year at issue, and ensure the years match the service dates and the income amounts discussed in Part I, line 5b.

It’s common to place the worker’s SSN in the firm EIN field, omit the firm EIN, or provide mismatched names/addresses compared to the tax forms. These identifier errors can cause processing delays, misrouting, or difficulty matching the case to IRS records. Carefully enter the firm’s legal name and EIN exactly as shown on official documents, enter the worker’s name and SSN accurately, and verify mailing addresses and phone numbers for both parties.

When a worker is paid by an entity different from the firm receiving the services (or when there was a sale/merger/reorganization), filers often skip the required explanation. This creates confusion about who controlled the work, who paid wages, and which taxpayer identification number applies, which are central to worker classification. If any third party paid the worker or multiple EINs were involved, provide the payer’s name/address/TIN if known, describe the relationship, and complete line 7 with the change type and date.

Filers sometimes check “Employee” or “Independent contractor” on Part I, line 9 but then describe facts that conflict (e.g., firm sets schedule, requires meetings, provides tools, prohibits outside work). Contradictions can weaken the submission and lead to follow-up questions because the IRS relies on consistent facts across behavioral, financial, and relationship sections. Before finalizing, cross-check your narrative against Parts II–IV and ensure your explanation aligns with the specific facts you provide.

People often mention contracts, invoices, training materials, or policies but don’t attach them, or they attach extra pages without identifying the part/question number. Missing or poorly organized documentation makes it harder for the IRS to verify claims and can slow the determination process. Attach relevant documents (signed agreements, invoices, meeting requirements, reimbursement policies, ads) and, for any additional sheets, clearly label the part and question number and include the firm/worker name and EIN/SSN at the top.

A frequent mistake is answering “Yes/No” to expenses, reimbursements, equipment, or financial risk without providing the requested details (frequency, amounts, lease terms, examples). The IRS uses these specifics to evaluate financial control, and missing details can lead to an inconclusive record or additional information requests. List who provided what equipment, describe unreimbursed expenses, state reimbursement frequency/amounts, and explain how the worker could realize profit or loss with concrete examples.

Some filers complete the entire form but overlook the signature and date section, especially when assembling attachments. An unsigned form is typically treated as incomplete and may not be processed, causing significant delays. Before mailing, confirm the printed name, signature, and date are present and match the person completing the form (firm or worker).

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out SS-8 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-ss-8-rev-december-2023-determination-of-worke forms, ensuring each field is accurate.