Form SS-8 (Rev. December 2023), Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding Completed Form Examples and Samples

Explore detailed examples and samples of a filled IRS Form SS-8 (Rev. December 2023). Understand how to complete the Determination of Worker Status form with our practical guides, helping both workers and firms clarify employment status for federal tax purposes.

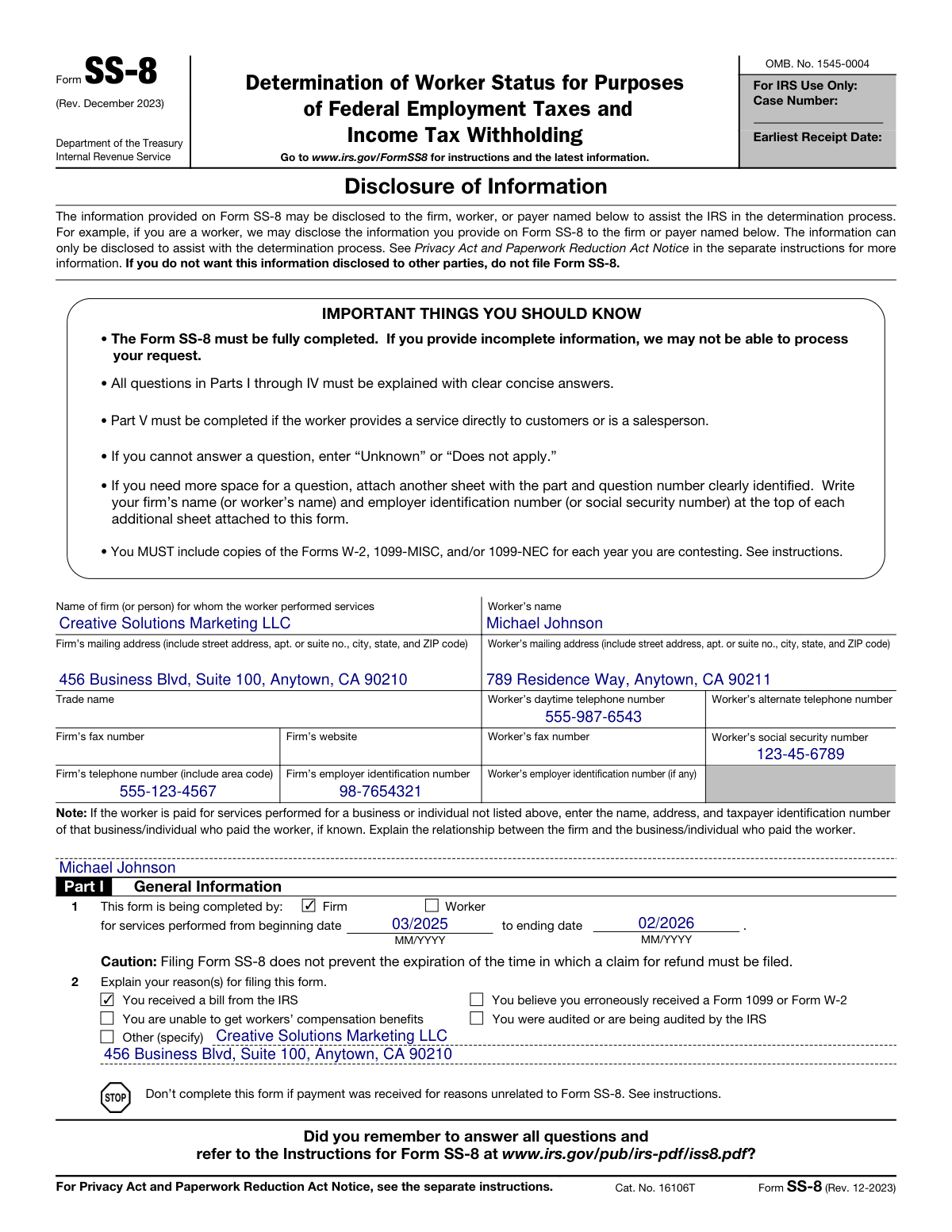

Form SS-8 Example – Misclassified Graphic Designer

How this form was filled:

This is an example of a Form SS-8 filed by a worker, a graphic designer, who believes they were misclassified as an independent contractor. The form details how the marketing firm exercised significant behavioral and financial control, such as dictating work hours, requiring the use of firm-provided equipment and software, and integrating the worker into the company team, all strong indicators of an employer-employee relationship.

Information used to fill out the document:

- Form Filer: Worker

- Worker Name: Michael Johnson

- Worker SSN: 123-45-6789

- Worker Address: 789 Residence Way, Anytown, CA 90211

- Worker Phone: 555-987-6543

- Worker Email: [email protected]

- Firm Name: Creative Solutions Marketing LLC

- Firm EIN: 98-7654321

- Firm Address: 456 Business Blvd, Suite 100, Anytown, CA 90210

- Firm Contact: Jane Smith, Owner

- Firm Phone: 555-123-4567

- Type of Service: Graphic Design

- Service Start Date: 03/01/2025

- Service End Date: 02/28/2026

- Reason for Filing: Worker received Form 1099-NEC but believes he was an employee and should have received a W-2.

- Behavioral Control Details: Required to work at the firm's office from 9 AM to 5 PM, Monday-Friday. Required daily check-ins and use of specific project management software. Firm provided all instructions on how work was to be performed.

- Financial Control Details: The firm provided a high-end computer and all necessary software licenses (Adobe Creative Suite). The worker was not permitted to use his own equipment. The firm handled all client billing and payments.

- Relationship Details: Worker was presented to clients as a 'member of our design team.' Required to attend weekly staff meetings. A non-compete clause in the contract prevented work for other marketing firms.

What this filled form sample shows:

- Clearly demonstrates how a worker initiates the filing of Form SS-8.

- Provides specific examples for describing behavioral control, such as set hours and mandatory meetings.

- Illustrates how to detail financial control, including who provides essential tools and bears business expenses.

- Shows how to explain the relationship between the parties, like being integrated into the business operations.

- Uses current dates and a common scenario (creative professional) to be a relevant and practical sample.

Form specifications and details:

| Form: | SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding |

| Revision Date: | December 2023 |

| Use Case: | Worker-filed determination request for a graphic designer who believes they were misclassified as an independent contractor. |

Created: January 29, 2026 06:45 PM