Yes! You can use AI to fill out Judicial Council of California Form FL-150, Income and Expense Declaration

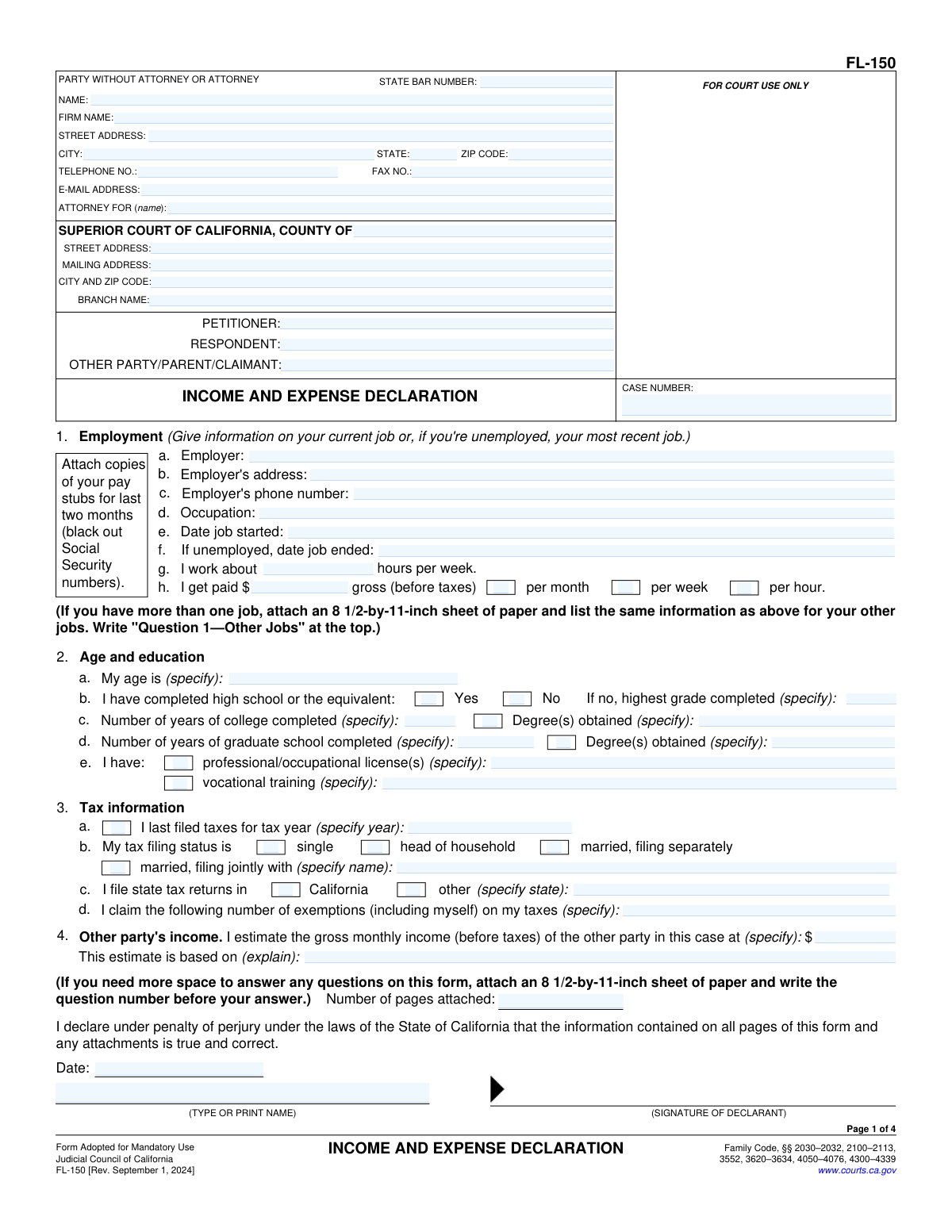

Form FL-150 (Income and Expense Declaration) is a mandatory California family law financial disclosure form used in matters such as child support, spousal/partner support, and attorney’s fees. It summarizes employment details, income from all sources, deductions, assets, household members’ contributions, and monthly living expenses, and may include child-support-specific information. The form is important because courts rely on it to determine ability to pay, set or modify support, and assess need-based requests; incomplete or inaccurate disclosures can affect court orders and credibility. The declarant signs under penalty of perjury and must attach supporting documents such as recent pay stubs and proof of other income.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out FL-150 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Judicial Council of California Form FL-150, Income and Expense Declaration |

| Number of pages: | 4 |

| Language: | English |

| Categories: | court forms, Judicial Council forms, California judicial forms, income forms, income and expense forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out FL-150 Online for Free in 2026

Are you looking to fill out a FL-150 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FL-150 form in just 37 seconds or less.

Follow these steps to fill out your FL-150 form online using Instafill.ai:

- 1 Enter case and party information at the top (court county/branch, case number, petitioner/respondent/other party, and attorney or self-represented contact details).

- 2 Complete Employment and background sections (current/most recent job details, pay frequency and gross pay, hours worked, age and education, and basic tax filing information).

- 3 Report income for last month and average monthly income across all categories (wages, overtime, bonuses, public assistance, support received, retirement, disability, unemployment, workers’ comp, and other income), and attach required proof (last two months’ pay stubs and documentation of other income).

- 4 Add investment and self-employment information (dividends/interest, rental/trust income, business income), and upload the required schedules such as a profit-and-loss statement or Schedule C (with Social Security numbers redacted).

- 5 List deductions and assets (union dues, required retirement payments, insurance premiums, support paid, job-related expenses with an explanation attachment, and totals for cash/accounts, marketable securities, and other property).

- 6 Complete household and expense sections (people living with you and their contributions, monthly living expenses, installment debts, and—if requesting attorney fees—attorney fee amounts paid/owed and hourly rate with attorney confirmation if applicable).

- 7 If child support is involved, complete the child-support information page (children/time-share, health insurance availability and cost, additional child expenses, special hardships, and other relevant information), then sign and date the declaration under penalty of perjury and generate a final PDF for filing/service.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable FL-150 Form?

Speed

Complete your FL-150 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 FL-150 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form FL-150

FL-150 tells the court your income, expenses, assets, and certain deductions so the judge can make decisions about child support, spousal/partner support, and sometimes attorney’s fees in a family law case.

Typically, each party in a family law case (petitioner and respondent, and sometimes another parent/claimant) must complete it when support, financial issues, or attorney’s fees are being requested or reviewed.

You must complete pages 1–3. Page 4 (Child Support Information) is completed only if your case involves child support.

Attach copies of your pay stubs for the last two months and proof of any other income, and black out your Social Security number. Bring a copy of your most recent federal tax return to the hearing (also with the Social Security number blacked out).

List your most recent job and provide the date the job ended. If you have no recent job, provide the best available information and explain your current situation in the space provided or on an attachment.

Complete Question 1 for your main job and attach an 8 1/2-by-11-inch sheet labeled “Question 1—Other Jobs” with the same details for each additional job.

“Last month” is what you actually received in the most recent month. “Average monthly” is calculated by totaling what you received in each category over the last 12 months and dividing by 12.

You must report self-employment income after business expenses and identify the business type and ownership. Attach a profit and loss statement for the last two years or a Schedule C from your last federal tax return (with your Social Security number blacked out).

Yes. Question 8 asks whether you received one-time money in the last 12 months and requires the source and amount.

Deductions include items like required union dues, required retirement payments (not Social Security/FICA/401(k)/IRA), health insurance premiums, and certain court-ordered support you pay. For job-related expenses not reimbursed by your employer, attach an explanation labeled “Question 10g.”

List totals for cash/accounts, easily sold assets (like stocks/bonds), and all other real and personal property. For property, estimate fair market value minus the debts you owe on it.

List everyone who lives with you, their age, relationship to you, their gross monthly income, and whether they pay some household expenses. This helps the court understand your household financial situation.

Use the “Estimated” or “Actual” columns based on what you can document and what best reflects your typical monthly spending. If you are asking for support, the “Proposed needs” column can show what you believe you need going forward.

These are recurring debt payments not already listed elsewhere (like credit cards, loans, or other monthly obligations). You must itemize what the debt is for, the monthly amount, the balance, and the date of the last payment.

That section is required if either party is requesting attorney’s fees. It asks what you’ve paid, the source of the funds, what you still owe, and your attorney’s hourly rate, and it includes a confirmation signature for the attorney.

Compliance FL-150

Validation Checks by Instafill.ai

Common Mistakes in Completing FL-150

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out FL-150 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills judicial-council-of-california-form-fl-150-income forms, ensuring each field is accurate.