Yes! You can use AI to fill out 2023 Form IL-1040-X, Amended Individual Income Tax Return (Illinois Department of Revenue)

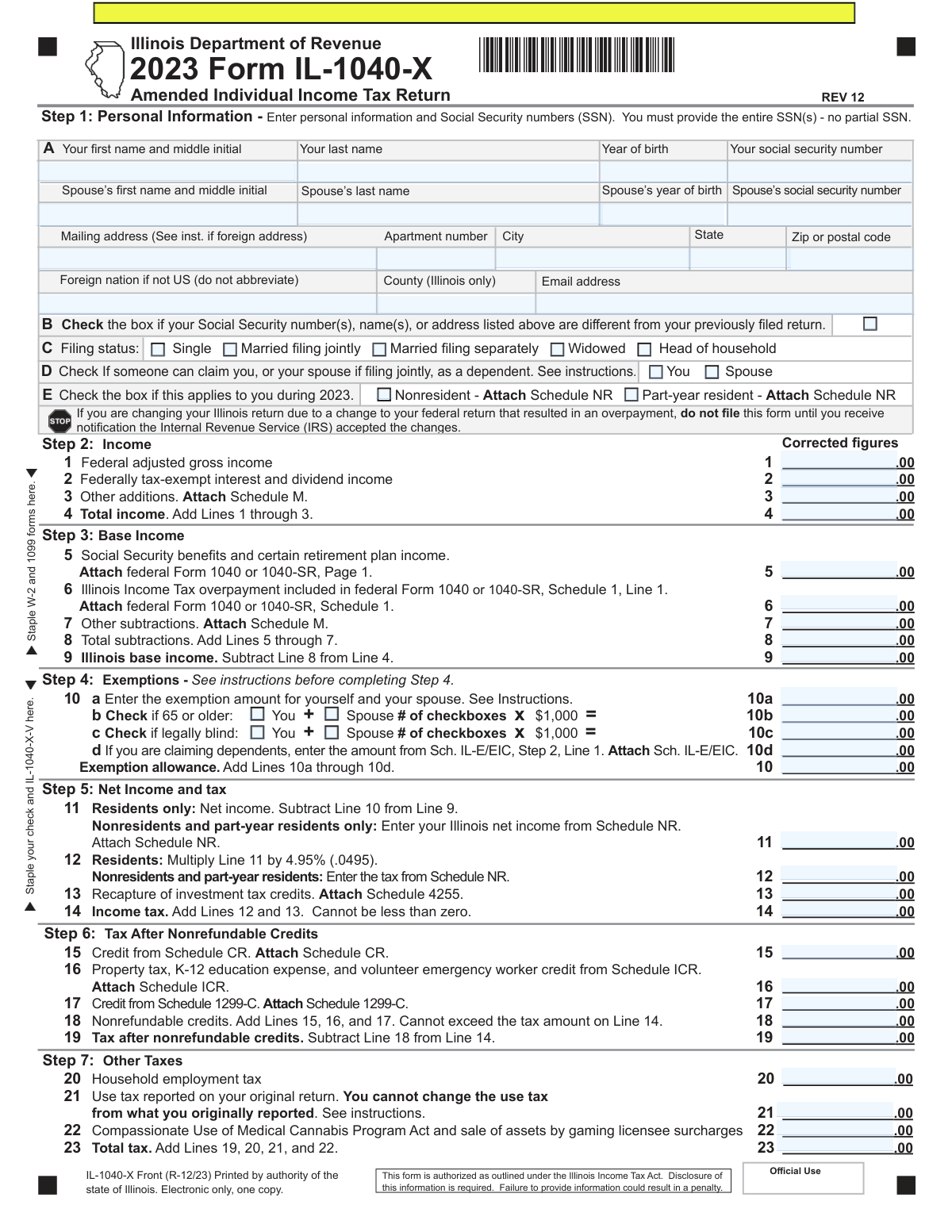

Form IL-1040-X (2023) is the official Illinois amended return used to report corrected income, subtractions, exemptions, credits, payments, and to calculate an adjusted refund or amount owed after you’ve already filed your original Illinois individual income tax return. It’s important because it is the state’s required method to fix errors, reflect accepted federal changes (such as an IRS adjustment), or report other state-level changes, and it determines whether you receive an additional refund or must pay additional tax. The form also requires explanations and supporting documentation (for example, Schedule M, Schedule NR, IL-WIT, and copies of federal finalization or federal amended forms when applicable). Today, this form can be filled out quickly and accurately using AI-powered services like Instafill.ai, which can also convert non-fillable PDF versions into interactive fillable forms.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out IL-1040-X (2023) using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | 2023 Form IL-1040-X, Amended Individual Income Tax Return (Illinois Department of Revenue) |

| Number of pages: | 2 |

| Language: | English |

| Categories: | individual tax forms, income forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out IL-1040-X (2023) Online for Free in 2026

Are you looking to fill out a IL-1040-X (2023) form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your IL-1040-X (2023) form in just 37 seconds or less.

Follow these steps to fill out your IL-1040-X (2023) form online using Instafill.ai:

- 1 Go to Instafill.ai and upload the 2023 Illinois Form IL-1040-X (or select it from the form library).

- 2 Let the AI extract your personal information (names, SSNs, address, filing status, residency status) and confirm or edit Step 1 details.

- 3 Provide the reason for the amendment (federal change accepted, NOL accepted, or state change), enter original filing date information, and add the required explanation; upload supporting documents (e.g., federal finalization, Form 1040X/1045 if filed).

- 4 Enter corrected income and subtraction amounts (Steps 2–5), including any Schedule M and Schedule NR figures, and have the AI compute totals (total income, total subtractions, base income, exemptions, net income, and tax).

- 5 Add credits and other taxes (Schedules CR, ICR, 1299-C, household employment tax, use tax as originally reported, and any surcharges) and verify the calculated total tax.

- 6 Enter payments and refundable credits (withholding via IL-WIT, estimated payments, pass-through withholding/credits, IL E/EIC amounts, and amounts paid with the original return) and review the computed overpayment/underpayment and refund or amount owed.

- 7 Choose refund method (direct deposit with routing/account details or paper check), e-sign where supported or generate a signature-ready packet, then download/print the final return with attachments for mailing to the Illinois Department of Revenue.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable IL-1040-X (2023) Form?

Speed

Complete your IL-1040-X (2023) in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 IL-1040-X (2023) form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form IL-1040-X (2023)

Form IL-1040-X is the Illinois Amended Individual Income Tax Return for tax year 2023. Use it to correct or update information you reported on your original Illinois Form IL-1040 (or a prior IL-1040-X).

File IL-1040-X if you need to change your Illinois income, exemptions, credits, payments/withholding, or refund/amount due for 2023. It’s also used when your Illinois return changes because your federal return changed or the state made an adjustment.

Yes, if your Illinois change is due to a federal change that resulted in an overpayment, do not file IL-1040-X until you receive notification that the IRS accepted the federal changes. The form instructs you to attach proof of federal finalization.

You must enter full Social Security number(s) (no partial SSNs), names, year(s) of birth, and your current mailing address. You also select a filing status and indicate if you were a nonresident or part-year resident (which requires Schedule NR).

Check that box in Step 1 if any of those items changed since the return you’re amending. This helps Illinois match your amended return to your prior filing.

Enter the corrected figures for federal adjusted gross income, additions, and subtractions, then compute totals as directed (e.g., Line 4 is Lines 1–3; Line 9 is Line 4 minus Line 8). If you use “Other additions” or “Other subtractions,” you generally must attach Schedule M.

Common attachments include Schedule M (additions/subtractions), Schedule NR (nonresident/part-year), Schedule IL-E/EIC (dependents/EIC), Schedule IL-WIT (withholding), and any credit schedules such as CR, ICR, 1299-C, or 4255 if applicable. If the change is due to a federal amendment, attach the federal Form 1040-X/1045 (if filed) and a copy of your federal finalization.

You enter the exemption amount for yourself/spouse (Line 10a), then add any additional amounts for being 65 or older (Line 10b), legally blind (Line 10c), and dependents from Schedule IL-E/EIC (Line 10d). Add Lines 10a–10d to get your total exemption allowance on Line 10.

You must check the Nonresident or Part-year resident box in Step 1 and attach Schedule NR. Your net income and tax are taken from Schedule NR instead of using the resident calculations on Lines 11–12.

No. The form states you cannot change the use tax from what you originally reported, so Line 21 should match the use tax on your original return.

Enter Illinois withholding on Line 25 and attach Schedule IL-WIT, then list estimated payments (Line 26) and any pass-through withholding/credits (Lines 27–28) with the required K-1 schedules. Line 30 is the total amount you paid with the original return plus any additional tax paid after filing, and Line 31 totals Lines 25–30.

On Line 36, enter the refund amount you want and select either direct deposit or paper check. If you choose direct deposit, you must provide the routing number, account number, and indicate checking or savings.

Check the box that matches the reason for the change and provide the relevant acceptance date (for federal change or NOL) if applicable. You must also explain the reason(s) in detail in the explanation section and attach supporting documents (including federal finalization when required).

Sign and date in Step 12, and include a daytime phone number. If this is a joint return, both you and your spouse must sign.

Yes—AI tools like Instafill.ai can help auto-fill form fields accurately and save time by pulling values from your tax documents and prior returns. Typically, you upload the IL-1040-X PDF and your supporting documents (e.g., W-2s/1099s, schedules, prior IL-1040), then review and approve the populated fields before printing/signing and mailing as instructed.

If the PDF is flat/non-fillable, Instafill.ai can convert it into an interactive fillable form so you can type into the fields. After conversion, you can auto-fill, review, and export the completed form for signature and submission.

Compliance IL-1040-X (2023)

Validation Checks by Instafill.ai

1

Validates taxpayer and spouse SSNs are complete 9-digit values and not masked

Checks that the taxpayer SSN is exactly 9 digits (allowing optional hyphens) and contains no letters, asterisks, or partial/masked values. If filing jointly, the spouse SSN must also be present and meet the same format rules. This is required because the form explicitly states the entire SSN(s) must be provided and SSNs are the primary identifier for matching the amended return to the original filing. If validation fails, block submission and prompt for a corrected SSN entry.

2

Ensures filing status selection is exactly one option and consistent with spouse fields

Validates that exactly one filing status checkbox is selected (Single, Married filing jointly, Married filing separately, Widowed, or Head of household). If a married status is selected, spouse name, spouse year of birth, and spouse SSN must be provided; if Single/Head of household is selected, spouse identity fields should be blank. This prevents ambiguous filing status and downstream calculation/eligibility errors. If validation fails, require the user to correct the filing status or complete/clear spouse fields accordingly.

3

Validates year-of-birth fields are plausible and support age-based exemption checkboxes

Checks that taxpayer and spouse year of birth are 4-digit years within a reasonable range (e.g., not in the future and not unrealistically old). If the “65 or older” checkbox is selected for the taxpayer/spouse, the year of birth must indicate age 65+ during tax year 2023; if not 65+, the checkbox should not be selected. This ensures the additional exemption amount is only claimed when eligible. If validation fails, flag the mismatch and require correction of either the year of birth or the age checkbox selection.

4

Validates residency status selection and required Schedule NR attachment dependency

Ensures that the Nonresident and Part-year resident checkboxes are not both selected, and that if either is selected, Schedule NR is indicated/attached and Line 11/Line 12 follow the nonresident instructions. For residents (neither box checked), Line 11 must be computed as Line 9 minus Line 10 and Line 12 must be computed as Line 11 × 4.95%. This is important because residency drives the tax computation method and required schedules. If validation fails, prevent submission until residency selection and related lines/attachments are corrected.

5

Validates required personal information completeness for mailing address (domestic vs foreign)

Checks that mailing address, city, state, and ZIP/postal code are present for U.S. addresses, and that if a foreign nation is provided, it is not abbreviated and the address fields follow foreign-address rules (e.g., state may be blank, postal code may be alphanumeric). This ensures the Department can mail notices/refunds and reduces returned mail. If validation fails, require completion of missing address components or correction of foreign nation formatting.

6

Validates phone number fields are numeric and correctly segmented (area code + 7-digit number)

Checks that daytime phone number area code is exactly 3 digits and the main part is exactly 7 digits; applies the same rule to firm phone and third-party designee phone when provided. This prevents invalid contact numbers that impede issue resolution and identity verification. If validation fails, prompt the filer to correct the phone number format before submission.

7

Validates date fields use MM/DD/YYYY and are logically valid calendar dates

Checks that signature dates, paid preparer signature date, federal change accepted date (if applicable), NOL accepted date (if applicable), and original filing date are valid dates in MM/DD/YYYY (or month/day/year components where split). Also validates that month is 1–12 and day is valid for the month (including leap-year rules). Accurate dates are critical for statute-of-limitations and processing timelines. If validation fails, reject the date entry and require a corrected date.

8

Ensures amended-return reason selection is made and required supporting dates/attachments are present

Validates that at least one reason checkbox is selected (Federal change accepted, NOL accepted, or State change). If Federal change accepted is selected, the federal acceptance date must be provided and a copy of federal finalization must be indicated/attached; if NOL accepted is selected, the NOL acceptance date must be provided. This is important because amended returns require a documented basis and supporting documentation. If validation fails, block submission until the reason, dates, and required attachments are provided.

9

Validates federal amended form indicator consistency with attachments (Form 1040X/1045)

Checks that exactly one of “Yes” or “No” is selected for whether a federal Form 1040X or 1045 was filed. If “Yes” is selected, the system should require an attachment indicator for the federal 1040X/1045 copy; if “No,” the attachment should not be required. This prevents missing documentation that can delay or invalidate the amendment. If validation fails, require the user to correct the selection and/or provide the attachment.

10

Validates arithmetic for income and subtraction totals (Lines 4, 8, 9)

Recomputes Line 4 as Line 1 + Line 2 + Line 3, Line 8 as Line 5 + Line 6 + Line 7, and Line 9 as Line 4 − Line 8, using the corrected figures. This ensures the base income is internally consistent and prevents downstream tax miscalculation. If the entered totals do not match computed totals (within rounding rules), flag the discrepancy and require correction or auto-calculate the totals.

11

Validates exemption allowance calculations and dependent schedule dependency (Line 10)

Checks that Line 10 equals the sum of Lines 10a–10d, and that Lines 10b and 10c equal $1,000 multiplied by the number of checked boxes (You/Spouse) for 65+ and legally blind, respectively. If Line 10d (dependents) is greater than zero, require Schedule IL-E/EIC attachment indicator and ensure filing status supports dependent claims where applicable. This prevents overstatement of exemptions and ensures required schedules are included. If validation fails, require recalculation and/or missing schedule attachment.

12

Validates resident vs nonresident net income and tax computation rules (Lines 11–14)

For residents, verifies Line 11 = Line 9 − Line 10 and Line 12 = Line 11 × 0.0495; for nonresidents/part-year residents, verifies that Line 11 and Line 12 are sourced from Schedule NR and that Schedule NR is attached. Also enforces that Line 14 (Income tax) = Line 12 + Line 13 and cannot be less than zero. This ensures the correct tax base and rate are applied and prevents negative tax amounts. If validation fails, require correction of the computation method or missing schedule.

13

Validates nonrefundable credits do not exceed tax and totals are consistent (Lines 18–19)

Checks that Line 18 equals Line 15 + Line 16 + Line 17 and that Line 18 is not greater than Line 14, as required by the form. Verifies Line 19 = Line 14 − Line 18 and is not negative. This prevents claiming nonrefundable credits beyond allowable limits and ensures correct tax after credits. If validation fails, cap credits or require corrected entries before submission.

14

Validates total tax rollups and immutability rule for use tax (Lines 21, 23, 24)

Verifies Line 23 = Line 19 + Line 20 + Line 21 + Line 22 and Line 24 equals Line 23. Additionally enforces the rule that Line 21 (use tax) cannot be changed from what was originally reported; if the system has access to the original return value, it must match exactly, otherwise require an explicit confirmation and/or block changes. This is important to comply with form instructions and prevent unauthorized adjustments. If validation fails, require correction of totals and/or revert Line 21 to the original value.

15

Validates payments/refundable credits totals and overpayment/underpayment logic (Lines 31–38)

Checks that Line 31 equals the sum of Lines 25–30, and then enforces mutual exclusivity and correctness of Line 32 vs Line 33 based on whether Line 31 is greater than Line 24. Validates Line 35 = Line 32 − Line 34 when applicable, Line 37 = Line 35 − Line 36, and Line 38 follows the form’s conditional rules using Lines 32, 33, and 34. This prevents contradictory outcomes (e.g., both overpayment and underpayment) and ensures the refund/amount due is computed correctly. If validation fails, require recalculation or auto-compute dependent lines.

16

Validates refund method selection and direct deposit banking information

Ensures exactly one refund method is selected (direct deposit or paper check) when Line 36 (refund requested) is greater than zero. If direct deposit is selected, routing number must be 9 digits and pass the ABA checksum, account number must be present and within acceptable length/character rules, and exactly one of Checking or Savings must be selected. This reduces rejected deposits and misdirected refunds. If validation fails, require corrected banking details or switch to paper check.

Common Mistakes in Completing IL-1040-X (2023)

People sometimes enter only the last four digits of the SSN, transpose digits, or use a nickname that doesn’t match Social Security records. This can cause the Illinois Department of Revenue to reject or delay processing because the return can’t be reliably matched to the taxpayer account. Always enter the full SSN(s) and use the exact legal name as shown on Social Security cards; double-check spouse information if filing jointly. AI-powered tools like Instafill.ai can help by validating SSN length/format and reducing typos during data entry.

Taxpayers often update their address or correct a name/SSN but don’t mark the checkbox indicating the information differs from the previously filed return. This can trigger correspondence, slow processing, or cause the amendment to be misapplied to the wrong account/address. If anything in Step 1 changed since the original IL-1040/IL-1040-X, check the box and ensure the new information is complete and consistent. Instafill.ai can flag inconsistencies between prior and current entries and prompt you to mark the correct checkbox.

Because this is an amended return, filers sometimes assume the filing status carries over automatically and forget to select one, or they choose a status that doesn’t match the original return or current eligibility. An incorrect filing status can change exemptions, credits, and tax calculations, leading to an incorrect refund/balance due and potential notices. Confirm the correct 2023 filing status and ensure it aligns with your situation and the original filing unless you are specifically amending that item. Instafill.ai can help prevent this by prompting for required selections and validating status logic.

A common error is checking “Nonresident” or “Part-year resident” but not attaching Schedule NR, or completing Schedule NR but forgetting to check the box. This can result in incomplete computation of Illinois net income/tax and delays while the Department requests missing schedules. If you were nonresident or part-year resident in 2023, check the correct box and attach Schedule NR; if you were a full-year resident, do not use Schedule NR lines. Instafill.ai can remind you of required attachments based on residency selections.

The form repeatedly requires attachments (e.g., federal Form 1040/1040-SR Page 1 for Social Security/retirement income, Schedule 1 for IL overpayment included in federal income, and a copy of federal 1040X/1045 and federal finalization when applicable). People often submit the IL-1040-X alone, assuming the state will “pull” federal data, which can lead to processing holds or denial of the change. Carefully follow each “Attach…” instruction for the lines you used and include the federal finalization documentation when the amendment is due to federal changes. Instafill.ai can generate an attachment checklist based on which lines/schedules you complete.

Filers sometimes copy numbers from the original IL-1040 instead of entering the corrected figures, or they enter federal amounts on Illinois-specific lines without applying Illinois rules. This leads to incorrect base income (Line 9), net income (Line 11), and tax (Line 12/14), which can create an incorrect refund or balance due. Use the corrected federal AGI and only include additions/subtractions supported by Illinois rules and the appropriate schedules (e.g., Schedule M). Instafill.ai can help by mapping values from source documents and formatting them into the correct “corrected figures” fields.

Exemptions are frequently miscalculated because filers forget the additional amounts for age 65+ or legal blindness, or they enter dependent exemptions without completing Schedule IL-E/EIC Step 2 Line 1. Errors here flow into Line 10 and reduce/increase net income incorrectly, affecting tax and refund. Read the instructions for the correct exemption amounts, check the appropriate age/blindness boxes, and attach Schedule IL-E/EIC if claiming dependents. Instafill.ai can reduce these mistakes by calculating totals from checkbox selections and prompting for required schedules.

Line 21 explicitly states you cannot change the use tax from what you originally reported, but people often try to “fix” it on the amended return. This can cause the Department to adjust the return back, issue notices, or delay processing while reconciling the discrepancy. Enter the use tax exactly as reported on the original return and follow the instructions if you believe it was wrong. Instafill.ai can flag this rule and prevent edits that conflict with the form’s constraints.

Taxpayers often enter withholding from W-2s/1099s directly on Line 25 but forget to attach Schedule IL-WIT, or they omit pass-through withholding/credits without attaching K-1-P/K-1-T. Missing or mismatched documentation can lead to disallowed credits/withholding and a reduced refund or increased amount due. Summarize withholding on Schedule IL-WIT and attach it, and include the correct K-1 forms for pass-through items. Instafill.ai can help by extracting withholding data from W-2/1099/K-1 documents and ensuring the required schedules are included.

Common issues include entering an invalid routing number, truncating the account number, choosing the wrong account type (checking vs savings), or checking direct deposit and paper check inconsistently. These mistakes can cause the refund to be rejected by the bank and reissued as a paper check, significantly delaying receipt. Verify the 9-digit routing number, the full account number, and select only one refund method with the correct account type. Instafill.ai can validate routing number format and help ensure only compatible refund selections are made.

Filers often forget to check the correct reason box (federal change accepted, NOL accepted, or state change), omit the acceptance date, or leave the original filing date blank. They also provide a vague explanation in the “Explain, in detail” field, which can trigger follow-up requests and slow processing. Provide the relevant dates (month/day/year), attach the required federal finalization, and write a clear explanation referencing what changed (income, subtraction, credit) and which lines/schedules were affected. Instafill.ai can prompt for required dates and help structure a complete explanation.

A frequent rejection cause is forgetting to sign and date the return, or submitting a joint return with only one spouse’s signature. People also sometimes enter dates in the wrong format (the form specifies mm/dd/yyyy) or misplace digits in the split phone number fields (area code vs main number). Ensure both spouses sign and date if filing jointly, and follow the required date and phone formats exactly. Instafill.ai can enforce required fields and formatting rules before you print and mail the form.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out IL-1040-X (2023) with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 2023-form-il-1040-x-amended-individual-income-tax-return-illinois-department-of-revenue forms, ensuring each field is accurate.