Fill out individual tax forms

with AI.

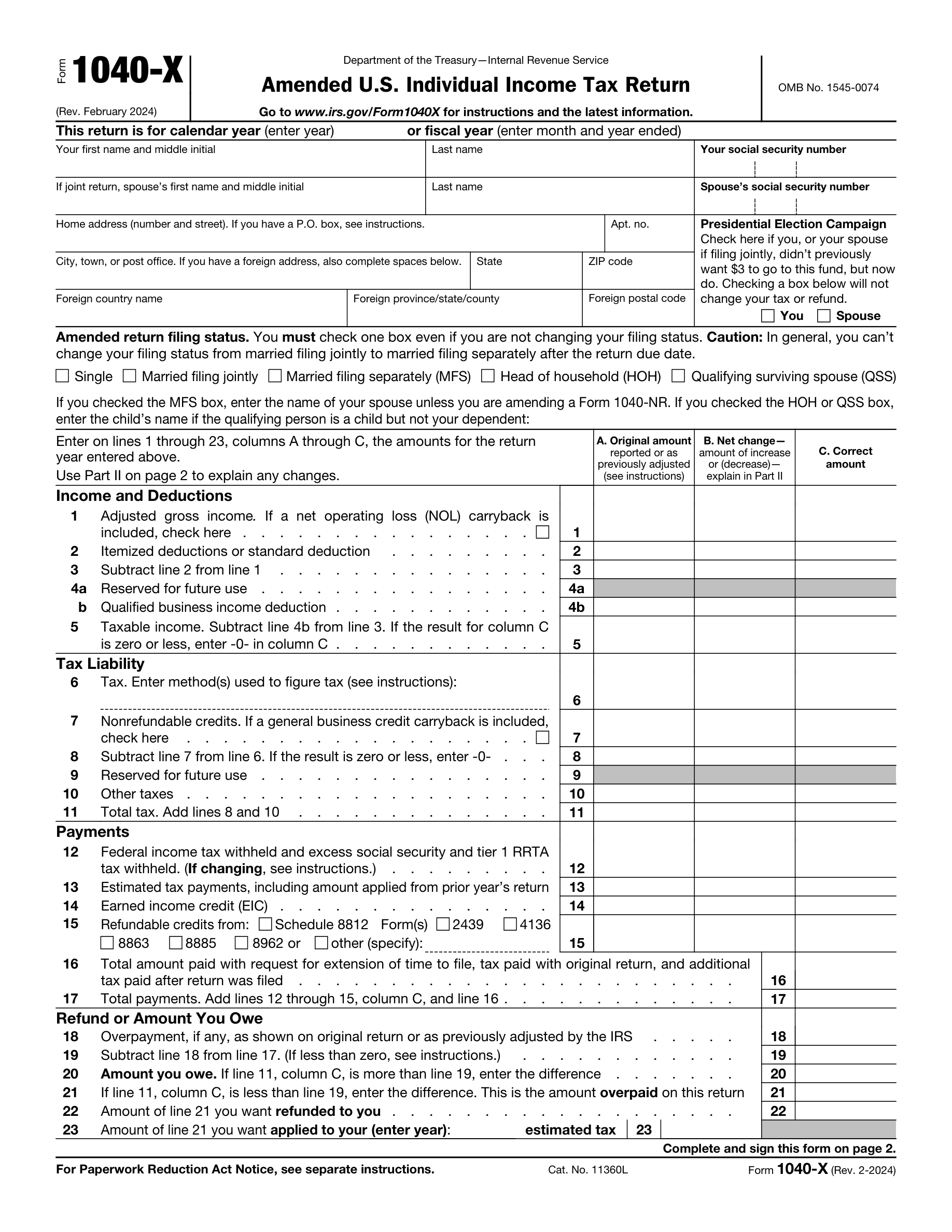

Individual tax forms are the backbone of the U.S. tax filing system, covering everything from your annual income tax return to quarterly estimated payments and amended filings. Whether you're submitting a standard Form 1040, correcting a prior year's return with Form 1040-X, or making estimated tax payments throughout the year using Form 1040-ES, these documents determine how much you owe — or how much you get back — from the IRS or your state tax authority. Getting them right matters, both for compliance and for making sure you're not leaving money on the table.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About individual tax forms

Most working adults will encounter at least a few of these forms over their lifetime. Freelancers, gig workers, and self-employed individuals often need to file quarterly estimated taxes to avoid underpayment penalties. People who missed the tax deadline may need to request an extension using Form 4868. And anyone who made an error on a previously filed return — whether it's a missed deduction, a reporting mistake, or a change triggered by an IRS adjustment — will need to file an amended return at the federal or state level. State-specific forms, like Arizona's Form 285-I or Illinois's IL-1040-X, add another layer of complexity for those with multi-state obligations.

For anyone who finds tax paperwork time-consuming or confusing, tools like Instafill.ai use AI to fill out these forms accurately in under 30 seconds, handling the details securely so you can focus on reviewing rather than manually entering data.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds