Yes! You can use AI to fill out Form 1040-X (Rev. February 2024), Amended U.S. Individual Income Tax Return

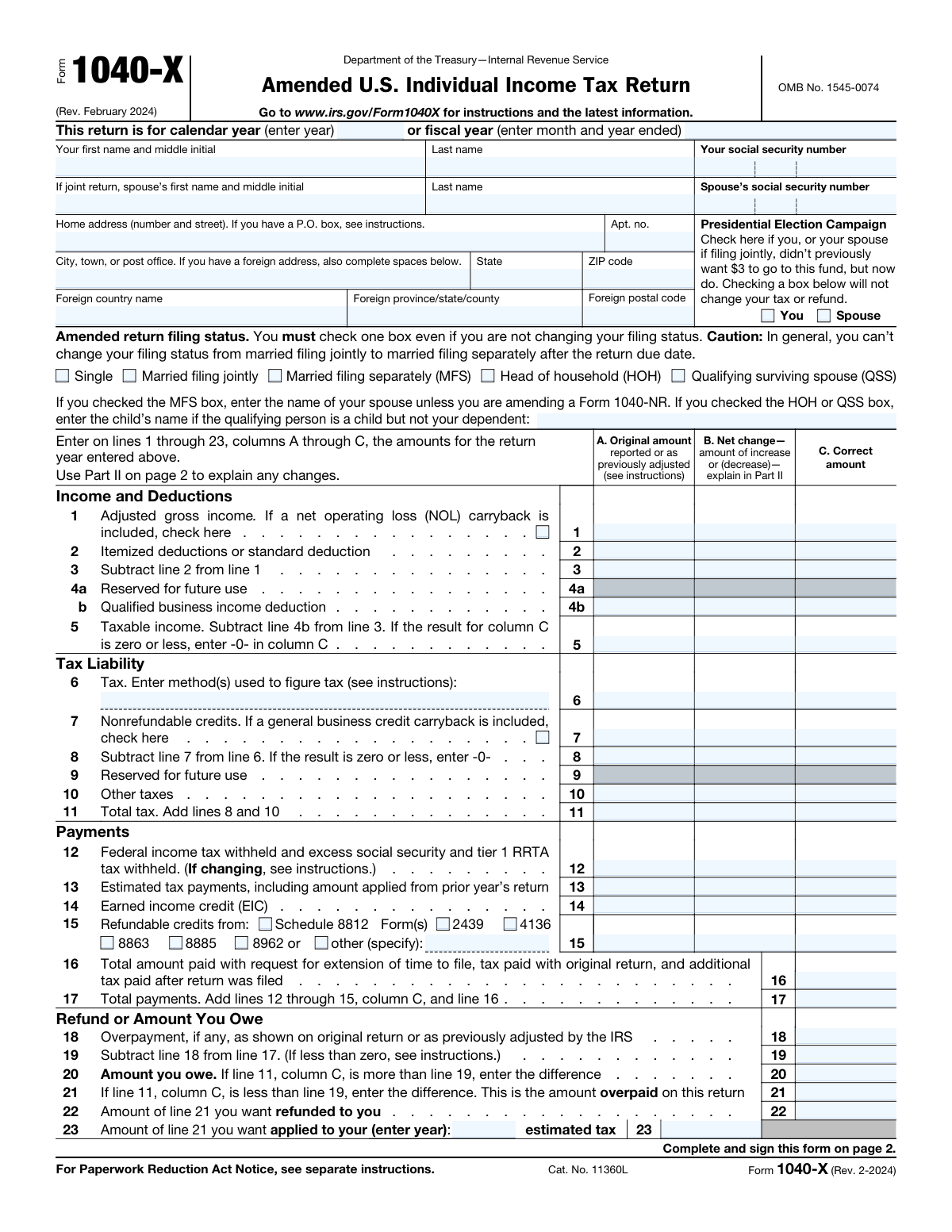

Form 1040-X is the official IRS form individuals use to change or correct information reported on an already-filed Form 1040-series return for a specific tax year. It compares the original amounts (Column A) to the net changes (Column B) and the corrected amounts (Column C), and it calculates any additional tax owed or refund due. The form also requires a clear explanation of the changes in Part II and may require attaching updated schedules or supporting documents. Filing Form 1040-X is important to ensure your tax record is accurate and to properly claim refunds, credits, or adjustments you were entitled to (or to resolve underreported tax).

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out 1040-X using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 1040-X (Rev. February 2024), Amended U.S. Individual Income Tax Return |

| Number of pages: | 2 |

| Language: | English |

| Categories: | individual tax forms, income forms, income tax forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out 1040-X Online for Free in 2026

Are you looking to fill out a 1040-X form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your 1040-X form in just 37 seconds or less.

Follow these steps to fill out your 1040-X form online using Instafill.ai:

- 1 Select the tax year being amended (calendar or fiscal year) and gather your original return, any IRS adjustment notices, and documents supporting the changes (W-2/1099s, receipts, schedules).

- 2 Enter taxpayer and (if applicable) spouse identification details, address, and choose the amended return filing status; complete the Presidential Election Campaign checkboxes if you want to change that election.

- 3 Complete Lines 1–23 using Columns A (original/previously adjusted amounts), B (net increase or decrease), and C (correct amounts) for income, deductions, taxable income, tax, credits, other taxes, withholding, payments, and totals.

- 4 Calculate the outcome in the Refund or Amount You Owe section (Lines 18–23), indicating whether you owe additional tax or are due an overpayment and whether you want a refund or to apply it to estimated tax for a future year.

- 5 If dependents are changing, complete Part I (Dependents), including the corrected number of dependents and listing all dependents claimed on the amended return with SSNs, relationship, and credit eligibility boxes.

- 6 Write a clear narrative in Part II (Explanation of Changes) describing exactly what you changed and why, and attach any new or revised forms/schedules and supporting documentation required by the instructions.

- 7 Sign and date the return (both spouses if filing jointly), include Identity Protection PIN(s) if issued, provide contact information, and submit the amended return using your online filing service or by mailing it to the IRS address listed in the Form 1040-X instructions.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable 1040-X Form?

Speed

Complete your 1040-X in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 1040-X form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form 1040-X

Form 1040-X is used to amend (correct) a previously filed U.S. individual income tax return. You file it to change items like income, deductions, credits, filing status (in limited cases), or dependents for a specific tax year.

File Form 1040-X if you already filed a Form 1040-series return for a year and later need to correct or update information. Common reasons include receiving a late tax form (like a W-2 or 1099), claiming a missed credit, or fixing dependent information.

Enter the calendar year you are amending (for example, 2023) or the fiscal year end date if you filed a fiscal-year return. Each Form 1040-X covers only one tax year.

Yes. The form states you must check one filing status box even if your filing status is not changing, so the IRS can process the amended return correctly.

Usually no, if the return due date has already passed. The form cautions that in general you can’t change from Married Filing Jointly to Married Filing Separately after the due date.

Column A is the original amount reported (or as previously adjusted), Column B is the net change (increase or decrease), and Column C is the corrected amount. Column C should equal Column A plus/minus Column B for each line.

Use Part II, “Explanation of Changes,” on page 2. Provide a clear description of what you changed, why you changed it, and reference any lines, forms, or schedules that were updated.

Attach any supporting documents and any new or changed forms and schedules related to your changes (for example, updated schedules or forms for credits). The form specifically instructs you to attach supporting documents and new/changed forms and schedules.

Complete Part I (Dependents) to change dependent information, including the number of dependents. You must list ALL dependents claimed on the amended return in the dependents table, even if only one dependent changed.

The form indicates you should see the instructions and check the box for more than four dependents. Follow the instructions for how to provide the additional dependent information.

Update the Payments section (lines 12–17) using the corrected amounts in Column C. If you are changing federal income tax withheld (line 12), the form notes to see the instructions for special guidance.

Compare your corrected total tax (line 11, Column C) to your corrected payments and credits (line 19). If line 11, Column C is more than line 19, you owe the difference (line 20); if it’s less, you have an overpayment (line 21) and can choose refund (line 22) or apply it to estimated tax (line 23).

Yes. If you have an overpayment on line 21, you can request a refund on line 22 and/or apply part or all of it to a future year’s estimated tax on line 23 (enter the year on line 23).

Yes. The signature section states that if it is a joint return, both spouses must sign and date the form.

An IP PIN is a number the IRS may issue to help prevent identity theft. If the IRS sent you (or your spouse) an IP PIN, enter it in the designated IP PIN field in the signature area on page 2.

Compliance 1040-X

Validation Checks by Instafill.ai

1

Validates return year/fiscal year entry is present and correctly formatted

Checks that the filer entered either a 4-digit calendar year (YYYY) or a fiscal year end month and year in the format required by the form instructions. This is critical because all amounts and dependency information must correspond to the specific tax period being amended. If the year is missing, non-numeric, or ambiguous (e.g., two-digit year), the submission should be rejected or routed for correction.

2

Ensures taxpayer name and SSN are complete and SSN is in a valid format

Verifies that the taxpayer’s first name, last name, and Social Security number are provided, and that the SSN matches a valid 9-digit pattern (with or without hyphens) and is not all zeros or otherwise invalid. Correct identity data is essential for matching the amended return to the original filing and preventing misapplication of payments/refunds. If the SSN fails format checks or required name fields are blank, the form should fail validation and require resubmission.

3

Validates spouse information requirements based on filing status (joint vs non-joint)

If the amended filing status is Married Filing Jointly or Qualifying Surviving Spouse where spouse data is expected, checks that spouse name and spouse SSN are present and properly formatted. If the filing status is not joint, ensures spouse SSN is not erroneously required and that any spouse fields are consistent with the selected status. If spouse data is missing when required (or present when it should not be), the submission should be flagged for correction.

4

Validates mailing address completeness and domestic vs foreign address consistency

Checks that a complete address is provided: street address (or valid P.O. box per instructions), city, state, and ZIP for U.S. addresses, or foreign country plus foreign postal code/province fields for foreign addresses. Ensures the filer does not mix domestic and foreign formats (e.g., U.S. state with a foreign country name). If address fields are incomplete or inconsistent, the return may be undeliverable and should be rejected or held for follow-up.

5

Validates Presidential Election Campaign checkbox logic

Ensures that the campaign fund selection is represented as explicit boolean choices for “You” and “Spouse” and that the spouse option is only allowed when filing jointly. This prevents invalid combinations and ensures the election is recorded correctly without affecting tax calculations. If the spouse box is checked on a non-joint return or the values are not interpretable, the submission should be flagged.

6

Requires exactly one amended filing status selection and enforces status-specific required fields

Checks that exactly one filing status box is selected (Single, MFJ, MFS, HOH, QSS) and that any required supplemental text is provided. Specifically, if MFS is selected, the spouse name must be entered (unless amending Form 1040-NR as noted), and if HOH or QSS is selected, the qualifying child’s name must be entered when the qualifying person is a child but not the filer’s dependent. If multiple statuses are selected or required supporting names are missing, validation fails.

7

Enforces MFS change restriction warning (MFJ to MFS after due date) as a business-rule flag

Implements a consistency check that flags attempts to change filing status from Married Filing Jointly to Married Filing Separately when the amendment is submitted after the original return due date (including extensions, if tracked by the system). The form cautions that this change is generally not allowed, so the system should require additional justification or route to manual review. If the rule is violated and no override workflow exists, the submission should be blocked or marked for exception handling.

8

Validates numeric fields on lines 1–23 are properly formatted and column structure is complete

Checks that all monetary entries are valid numbers (allowing negatives where appropriate), use consistent decimal rules (typically whole dollars if required by the system), and are placed in the correct columns A (original), B (net change), and C (correct). This prevents calculation errors and misinterpretation of increases/decreases. If non-numeric characters, misplaced values, or missing required column entries are detected, the form should fail validation.

9

Cross-checks column arithmetic: Column C equals Column A plus Column B for lines 1–23

For each applicable line, verifies that the corrected amount in column C equals the original amount in column A plus the net change in column B (accounting for decreases as negative values). This is a core integrity check for amended returns because the IRS expects the corrected figures to reconcile to the original plus changes. If any line does not reconcile, the submission should be rejected or flagged for correction with line-level error messages.

10

Validates taxable income floor rule on line 5, column C (must be -0- if zero or less)

Ensures that if the computed result for line 5, column C (taxable income) is zero or negative, the entry is recorded as 0 (or “-0-” per form convention) rather than a negative taxable income amount. This matters because downstream tax computations assume taxable income is not negative. If a negative value is entered, the system should auto-correct to zero (if allowed) or require the filer to correct it.

11

Validates total tax computation: line 11 equals line 8 plus line 10 (by column where applicable)

Checks that line 11 (Total tax) equals the sum of line 8 and line 10 using the corrected amounts (column C) and that intermediate lines (6–8) follow the stated subtraction rule (line 8 = line 6 − line 7, floored at zero). This ensures the tax liability section is internally consistent and prevents incorrect balances due. If totals do not match, the submission should be flagged and the filer prompted to correct the inconsistent lines.

12

Validates total payments computation: line 17 equals sum of lines 12–15 (column C) plus line 16

Verifies that line 17 is correctly calculated as the sum of corrected payments/credits on lines 12 through 15 (column C) plus line 16. This is essential because the refund/amount owed section depends directly on total payments. If the sum is incorrect or any required component is missing, the system should prevent submission until corrected.

13

Validates refund/amount owed logic across lines 18–23

Checks that line 19 equals line 17 minus line 18, and then enforces that either line 20 (amount you owe) or line 21 (overpayment) is populated based on whether line 11, column C is greater than or less than line 19, but not both. Also validates that line 22 (refund requested) plus line 23 (applied to estimated tax) equals line 21 and that the “enter year” for line 23 is a valid 4-digit year. If these relationships do not hold, the submission should be rejected due to inconsistent settlement instructions.

14

Validates dependent counts reconcile to dependent list and are non-negative integers

Ensures Part I dependent counts (original, net change, correct) are whole numbers (no decimals, no negatives) and that the corrected number of dependents aligns with the number of dependents actually listed in line 30. This prevents mismatches that can affect credits and eligibility determinations. If counts do not reconcile or the list is missing when dependents are claimed, the return should be flagged for correction.

15

Validates each dependent entry: name, SSN format/uniqueness, relationship, and credit checkbox consistency

For each dependent listed, checks that first and last name are present, SSN is a valid 9-digit value, and relationship to the taxpayer is provided. Also enforces that a dependent is not duplicated (same SSN repeated) and that at least one of the credit qualification checkboxes (Child tax credit or Credit for other dependents) is selected when a dependent is claimed for credits. If any dependent record is incomplete, has an invalid/duplicate SSN, or has inconsistent credit indicators, the submission should fail validation.

16

Requires Part II explanation of changes when any net change (Column B) is non-zero

Checks that Part II contains a meaningful explanation whenever any line in column B indicates an increase or decrease, and that supporting documents/new schedules are attached when referenced. This is important because Form 1040-X requires the filer to explain why amounts changed, enabling IRS processing and reducing correspondence delays. If column B contains changes but Part II is blank or too short to be actionable, the submission should be rejected or routed for manual review.

17

Validates signatures, dates, and Identity Protection PIN (IP PIN) format requirements

Ensures the taxpayer signature and date are present, and if filing jointly, the spouse signature and date are also present. If an IP PIN is provided, validates it matches the IRS-issued format (typically 6 digits) and is present when the system indicates the IRS issued one to the filer/spouse. If signatures/dates are missing or IP PIN format is invalid, the return should not be accepted for filing.

Common Mistakes in Completing 1040-X

People often forget that Form 1040-X must match the specific return year being amended and accidentally enter the current year or leave the year blank. This can cause the IRS to apply the amendment to the wrong account/year or delay processing while they request clarification. Always copy the exact tax year from the original Form 1040/1040-SR you are amending, and only use the fiscal-year fields if you truly filed a fiscal-year individual return.

The form requires one filing status box to be checked even if you are not changing status, and many filers skip it because they assume it’s unchanged. Missing or inconsistent filing status can trigger correspondence or processing delays. Check the same status used on the original return unless you are legally changing it, and remember the caution: changing from Married Filing Jointly to Married Filing Separately is generally not allowed after the due date.

When selecting Married Filing Separately, the spouse’s name is required (unless amending Form 1040-NR), and HOH/QSS may require the qualifying child’s name in certain situations. People often miss these conditional prompts because they’re embedded in the instructions under the status line. Leaving them blank can lead to IRS requests for missing information or denial of the filing status. Re-read the status instructions and complete the spouse/qualifying person name fields whenever the form asks for them.

A very common error is entering corrected amounts in Column B or re-entering the original amounts in Column C, which makes the math inconsistent. The IRS uses these columns to reconcile what changed, so incorrect column usage can cause recalculation, delays, or an incorrect balance due/refund. Column A should match the original return (or last IRS adjustment), Column B should be only the increase/decrease, and Column C should equal A plus/minus B for each line.

Filers often write a one-line note like “correcting income” without specifying what changed, which forms/schedules are affected, and why. Without a clear explanation, the IRS may not be able to verify the amendment and may send a letter requesting more detail, slowing processing. In Part II, describe the exact change (e.g., “added W-2 from Employer X,” “corrected 1099-INT,” “changed filing status”), reference the affected lines, and list all attached supporting forms/schedules.

Many people update numbers on lines 1–23 but don’t include the revised Schedule(s) or forms (e.g., Schedule 1, Schedule A, Schedule 8812, Form 8863) that support those changes. The IRS may disallow the change or pause processing until documentation is provided. Attach every form or schedule that changed, plus any required statements, and ensure the amounts on those attachments tie to the corrected figures in Column C.

When changing dependents, filers sometimes list only the new dependent(s) and omit dependents that remain unchanged, or they forget to update the counts in the Original/Net Change/Correct columns. This can cause credit eligibility issues (Child Tax Credit/Credit for Other Dependents), mismatched SSNs, and IRS verification letters. In Part I, update the counts and then list ALL dependents claimed on the amended return with correct names, SSNs, relationships, and the appropriate credit checkbox.

A frequent data-entry problem is transposing digits in a dependent’s SSN, using a nickname that doesn’t match SSA records, or checking the wrong box for Child Tax Credit vs. Credit for Other Dependents. These errors can lead to automatic credit denial or refund delays while the IRS validates identity and eligibility. Use the dependent’s Social Security card for the exact legal name and SSN, and confirm which credit applies based on age, residency, and eligibility rules in the instructions.

People often miscompute totals (e.g., line 17 payments) or misunderstand when to enter “-0-” (such as taxable income line 5 or line 8 when the result is zero or less). These mistakes can flip a refund into a balance due (or vice versa) and may trigger IRS corrections that delay finalization. Carefully follow each line instruction (add/subtract exactly as stated), ensure Column C totals are used where required, and enter “-0-” only when the form explicitly instructs it.

Filers sometimes change withholding on line 12 without following the instructions, omit estimated payments on line 13, or forget amounts applied from a prior-year return. Payment errors can cause the IRS to show an incorrect amount due, reduce a refund, or generate notices for underpayment. Reconcile line 12 to Forms W-2/1099 and prior IRS records, list all estimated payments accurately, and include any amount applied from the prior year exactly as originally designated.

A surprisingly common rejection/delay cause is forgetting to sign and date page 2, or missing the spouse’s signature on a joint amended return. If the IRS issued an IP PIN and it’s omitted or entered incorrectly, processing can be held for identity verification. Always sign and date in the “Sign Here” section (both spouses if joint), and enter the correct IP PIN(s) exactly as provided by the IRS.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out 1040-X with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-1040-x-rev-february-2024-amended-us-individua forms, ensuring each field is accurate.