Yes! You can use AI to fill out California Form 568 (2023), Limited Liability Company Return of Income

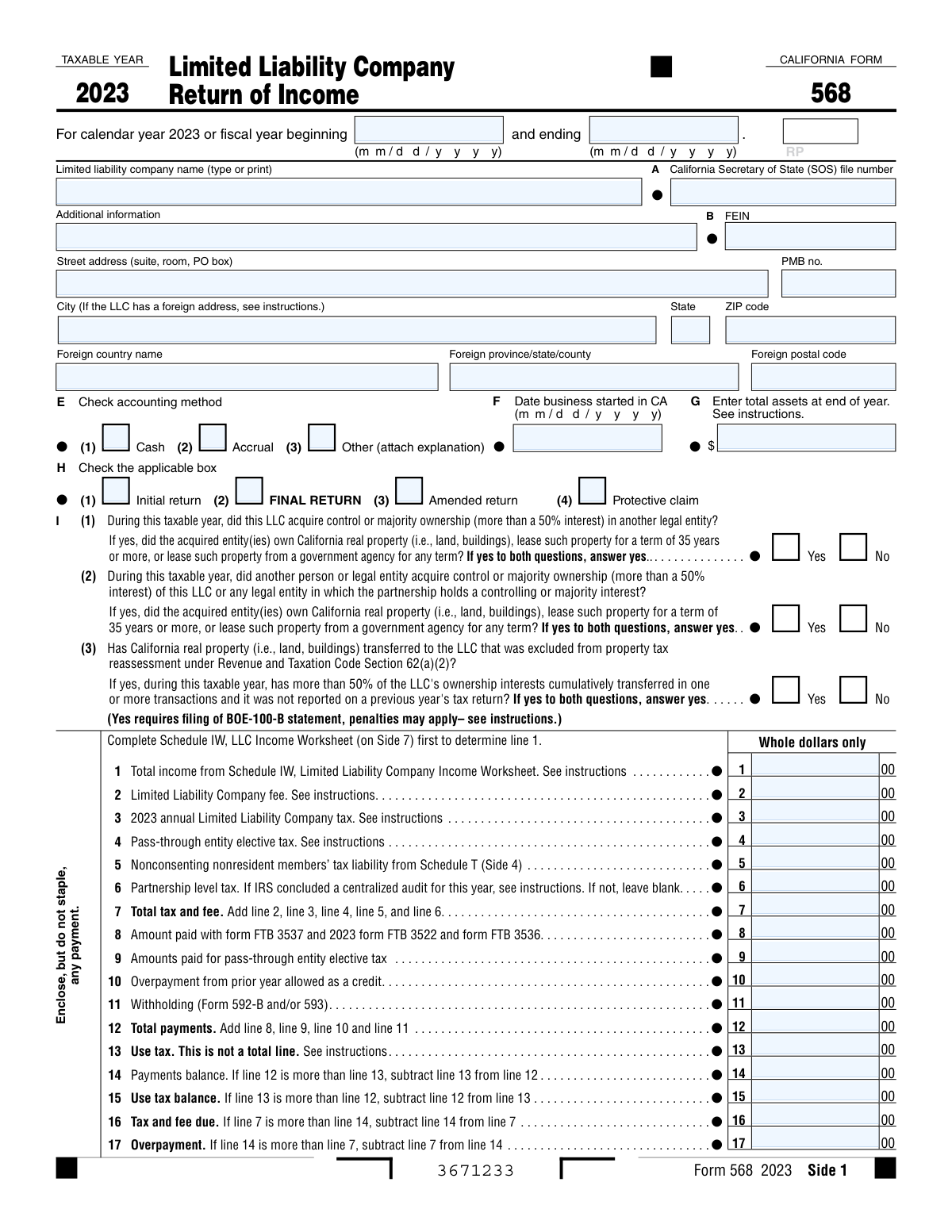

California Form 568 is the primary state income tax return for limited liability companies that are doing business in California, registered with the California Secretary of State, or otherwise subject to California LLC tax rules. It reports the LLC’s income and deductions (including California adjustments), calculates the annual $800 LLC tax (when applicable) and the LLC fee based on total California income, and reconciles payments, withholding, and any balance due or refund. The form also includes key compliance questions (e.g., real property transfer/ownership changes, nonresident members, disregarded entity status) and requires supporting schedules such as Schedule IW, Schedule B, Schedule K, and others when applicable. Filing accurately is important to avoid penalties and to properly report member allocations and any required nonresident withholding/tax.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out CA Form 568 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | California Form 568 (2023), Limited Liability Company Return of Income |

| Number of pages: | 7 |

| Filled form examples: | Form CA Form 568 Examples |

| Language: | English |

| Categories: | California tax forms, LLC tax forms, California FTB forms, income forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out CA Form 568 Online for Free in 2026

Are you looking to fill out a CA FORM 568 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your CA FORM 568 form in just 37 seconds or less.

Follow these steps to fill out your CA FORM 568 form online using Instafill.ai:

- 1 Confirm filing basics: select the taxable year period, identify whether the return is initial/final/amended/protective, and gather the LLC’s CA SOS file number, FEIN, address, accounting method, start date in CA, and year-end total assets.

- 2 Complete Schedule IW first to compute Total California income (Schedule IW line 17) and carry it to Form 568 Side 1, line 1; use California-source/attributable amounts and apply any required California adjustments.

- 3 Fill out income and deductions schedules as needed (e.g., Schedule A cost of goods sold, Schedule B income and deductions, and Schedule K items) and ensure totals reconcile to the amounts used in Schedule IW and on the main return.

- 4 Calculate taxes and fees on Side 1: LLC fee, annual LLC tax, pass-through entity elective tax (if applicable), nonconsenting nonresident members’ tax from Schedule T, and any partnership-level tax if applicable; compute total tax/fee and apply payments/credits/withholding.

- 5 Answer the entity and compliance questions on Sides 1–3 (real property/ownership change questions, apportionment via Schedule R, nonresident members and Forms 592 series, disregarded entity status, reportable transactions, audits, related-party questions) and attach required statements/forms (e.g., Form 8886, BOE-100-B when triggered).

- 6 Complete balance sheet and reconciliation sections if required (Schedule L, Schedule M-1, and Schedule M-2) and any additional schedules such as Schedule EO or Schedule O when applicable.

- 7 Review, sign, and finalize: compute amount due/refund (Side 2), enter preparer information if used, provide required signatures/consents (including SMLLC consent if applicable), and submit the return with any payment enclosed (do not staple) and all required attachments.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable CA Form 568 Form?

Speed

Complete your CA Form 568 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 CA Form 568 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form CA Form 568

Form 568 is the California Limited Liability Company (LLC) Return of Income. It’s used to report the LLC’s income, deductions, and other required information, and to calculate the annual LLC tax, LLC fee, and any other entity-level taxes due to the Franchise Tax Board (FTB).

Generally, LLCs doing business in California, registered with the California Secretary of State, or earning California-source income must file Form 568. Single-member LLCs that are disregarded for tax purposes may still have a Form 568 filing requirement and may need to complete Schedule IW even if other schedules aren’t required.

You’ll need the LLC’s legal name, California SOS file number, FEIN, business address, taxable year dates, accounting method, date business started in California, and total assets at year end. You also must enter a principal business activity code and describe the business activity and product/service.

These questions ask whether there were ownership/control changes involving the LLC or other entities and whether California real property was involved. If you answer “Yes” as instructed, the form notes that a BOE-100-B statement may be required and penalties may apply.

Check “Initial return” if this is the first Form 568 for the LLC, “Final return” if the LLC is ending/terminating, “Amended return” to correct a previously filed Form 568, and “Protective claim” if you’re preserving a refund claim pending an outcome (as described in the instructions). Only select the box that matches the return you are filing.

Line 1 comes from Schedule IW (Side 7), which totals California income from specified sources and activities. You must complete Schedule IW first and then enter Schedule IW, line 17 on Form 568, Side 1, line 1.

These lines include amounts paid with FTB 3537 and the 2023 FTB 3522 and FTB 3536, pass-through entity elective tax payments, prior-year overpayment credits, and withholding reported on Forms 592-B and/or 593. Add them to compute total payments on line 12.

Line 13 is for California use tax and is specifically noted as “not a total line.” It is compared to your payments to determine a payments balance (line 14) or a use tax balance (line 15), which then affects the total amount due calculation.

If total tax and fee (line 7) is more than your payments balance (line 14), you generally owe the difference on line 16. If line 14 is more than line 7, you have an overpayment on line 17, which you can apply to next year (line 18) and/or request as a refund (line 19).

If the LLC is a multiple-member LLC, the form states you must attach a California Schedule K-1 (568) for each member up to the maximum number of members during the year (Side 2, line K). This supports the allocation of income, deductions, and credits to members.

Schedule T calculates the tax liability for nonconsenting nonresident members and the amount withheld and paid on their behalf (reported on Form 592-B). If applicable, you total the tax due on Schedule T and enter it on Form 568 (the form references entering the total on Side 1).

You must indicate whether the LLC has foreign nonresident members and/or domestic nonresident members, and whether the required withholding forms (Forms 592, 592-A, 592-B, 592-F, and 592-PTE) were filed. If you answer “Yes” to having such members, be prepared to support withholding and reporting compliance.

Complete Schedule A if the LLC has cost of goods sold to report, and then carry Schedule A, line 8 to Schedule B, line 2. You must also indicate how closing inventory was valued and answer questions about LIFO adoption (attach federal Form 970 if applicable), IRC Section 263A applicability, and changes in inventory methods.

Schedule L reports the LLC’s balance sheets at the beginning and end of the year. Schedule M-1 reconciles book income to income per return under California law, and Schedule M-2 analyzes changes in members’ capital accounts using California amounts.

An authorized member or manager must sign and date the return, and the paid preparer completes their section if applicable. You can answer “Yes” or “No” to authorize the FTB to discuss the return with the preparer shown on the form.

Compliance CA Form 568

Validation Checks by Instafill.ai

1

Taxable Year Period Format and Valid Range

Validate that the taxable year beginning and ending dates are present and in MM/DD/YYYY format, and that the period corresponds to either calendar year 2023 or a valid fiscal year. The ending date must be after the beginning date and the period length should be consistent with a normal tax year (generally 12 months, unless short-year return rules apply). If invalid, reject the submission or require correction because the taxable year drives due dates, fee/tax computations, and schedule applicability.

2

Entity Identification Completeness (LLC Name, CA SOS File Number, FEIN)

Ensure the LLC legal name, California Secretary of State (SOS) file number, and FEIN are provided and not placeholder text. Validate the SOS file number and FEIN follow expected character rules (e.g., FEIN is 9 digits, typically formatted as XX-XXXXXXX or XXXXXXXXX). If missing or malformed, the return cannot be reliably matched to the taxpayer account and should be flagged for correction before processing.

3

Address Field Integrity (Domestic vs Foreign Address Rules)

Validate that street address, city, state, and ZIP code are complete for U.S. addresses, and that foreign country/province/postal code fields are used instead when a foreign address is indicated. Enforce ZIP code format (5 digits or 9-digit ZIP+4) and state as a valid two-letter code when domestic. If the address is inconsistent (e.g., foreign country filled with a U.S. state), fail validation because notices, refunds, and compliance correspondence may be misrouted.

4

Accounting Method Selection (Exactly One and 'Other' Explanation Required)

Check that exactly one accounting method box is selected: Cash, Accrual, or Other. If 'Other' is selected, require an attached explanation or a populated explanation field. If multiple or none are selected, the return should be rejected/held because accounting method affects income recognition and audit interpretation.

5

Business Start Date in California Format and Logical Consistency

Validate that the 'Date business started in CA' is in MM/DD/YYYY format and is not after the taxable year end date. If the return is marked as an initial return, the start date should generally be on or before the taxable year end and plausibly within or before the first CA filing period. If inconsistent, flag for review because it can affect filing obligations, minimum tax applicability, and first-year status questions.

6

Return Type Checkbox Consistency (Initial/Final/Amended/Protective Claim)

Ensure exactly one return type is selected among Initial, Final, Amended, or Protective claim. Apply logical rules: a Final return should not also be marked Initial; an Amended return should generally have prior-year reference/indicators in the system; and Protective claim should align with instructions and attachments. If conflicting selections occur, fail validation because processing paths, penalties, and account updates differ by return type.

7

Principal Business Activity Code Required and Valid

Verify the principal business activity code is present and matches an allowed code format (typically numeric, often 6 digits aligned to NAICS/FTB instructions). Also require that the business activity description and product/service fields are not blank when the form indicates they must be completed. If missing/invalid, reject or route to error correction because the code is required for classification, analytics, and certain compliance filters.

8

Maximum Number of Members Must Be a Positive Integer and Align With Filing Requirements

Validate that the maximum number of members is provided as a whole number (no decimals/letters) and is at least 1. If the number is greater than 1, enforce that the submission includes/indicates California Schedule K-1 (568) for each member as required by the form instructions. If the count is missing or inconsistent with attached schedules, fail validation because member reporting is central to pass-through compliance.

9

Yes/No Question Responses Must Be Explicit and Complete

For all binary questions (e.g., real property transfer questions, investment partnership, apportionment, nonresident members, audit status), ensure exactly one of Yes/No is selected and that no question is left blank where required. Where a question has dependent sub-questions (e.g., property ownership follow-ups), require the dependent answer only when the parent is Yes. If unanswered or both selected, fail validation because downstream filing obligations (e.g., BOE-100-B, Schedule R, Schedule EO, Form 8886) depend on these responses.

10

Dependent Attachment Requirements Triggered by Answers

Enforce attachment rules based on responses: if Schedule R is 'Yes', require Schedule R; if member/partner in another LLC/partnership is 'Yes', require Schedule EO Part I; if owns disregarded entity is 'Yes', require Schedule EO Part II; if reportable transaction is 'Yes', require federal Form 8886; if LIFO adopted is checked, require federal Form 970; if inventory method changes are 'Yes', require explanation. If required attachments are missing, fail validation because the return is incomplete and may be materially incorrect.

11

Whole-Dollar Amount Enforcement on All 'Whole dollars only' Lines

Validate that all monetary fields designated 'Whole dollars only' contain integers with no cents, commas handled consistently, and no non-numeric characters (except a leading minus where explicitly allowed). For fields that show a printed '.00' area, ensure cents are not entered or are ignored per rules. If cents or invalid characters are present, fail validation to prevent calculation errors and mismatches with FTB processing expectations.

12

Tax and Payment Arithmetic Cross-Checks (Side 1/2 Totals)

Recalculate and verify: line 7 equals the sum of lines 2–6; line 12 equals lines 8–11; line 14/15 reflect the comparison of line 12 vs line 13; line 16 equals line 7 minus line 14 when applicable; line 17 equals line 14 minus line 7 when applicable; line 19 equals line 17 minus line 18; and line 21 follows the stated formula. If any computed total does not match the provided value, fail validation or auto-correct with an audit trail because incorrect arithmetic changes the amount due/refund and can trigger erroneous notices.

13

Mutual Exclusivity of Amount Due vs Overpayment Outcomes

Validate that the return does not simultaneously indicate both a tax/fee due (e.g., line 16 or line 21 positive) and an overpayment/refund (line 17/19 positive) in a contradictory way. Ensure that when line 17 (overpayment) is greater than zero, line 16 should be zero (or not positive) and line 18+19 allocation must not exceed line 17. If inconsistent, fail validation because it indicates a fundamental payment-balance error.

14

Schedule IW Line 17 Non-Negative Rule and Tie-Out to Form 568 Side 1 Line 1

Enforce that Schedule IW line 17 is not negative (if computed negative, it must be reported as -0- per instructions) and that it exactly matches Form 568 Side 1 line 1. Also validate that line 17 equals the sum of the specified components (lines 7, 8c, 9c, 10–16) using California-source amounts. If the tie-out fails, reject or flag because the LLC fee and other computations depend on the correct total California income.

15

Schedule A / Schedule B Cost of Goods Sold Tie-Out and Inventory Method Completeness

If Schedule A is used, validate that Schedule A line 8 (COGS) equals line 6 minus line 7 and that it matches Schedule B line 2. Require a closing inventory valuation method selection (at least one method checked) and enforce that if 'Other' is selected, a method description is provided. If COGS is present without required inventory method details or tie-outs, fail validation because gross profit and taxable income would be unreliable.

16

Signature, Date, and Contact Information Validations (Taxpayer and Paid Preparer)

Require an authorized member/manager signature and signature date; validate the date format and that it is not before the taxable year end by an implausible margin (or after submission date if captured). If a paid preparer section is completed, require preparer signature, PTIN, firm name/address, and phone number in valid formats; also require a Yes/No selection for the 'May the FTB discuss' authorization. If missing, fail validation because unsigned returns are not valid filings and incomplete preparer data can violate regulatory requirements.

Common Mistakes in Completing CA Form 568

Filers often check “No” because they think the questions only apply to direct real estate sales, but the form is asking about control/majority ownership changes and certain long-term leases involving California real property. A wrong answer can trigger missed BOE-100-B filing requirements and potential penalties for unreported change-in-ownership events. To avoid this, review any >50% ownership/control changes during the year (including indirect/entity-level changes) and confirm whether any involved CA real property or qualifying leases before selecting Yes/No.

A very common error is entering worldwide or federal total amounts on Schedule IW lines 1–17, even though the worksheet requires California amounts (or properly assigned/apportioned amounts). This can overstate or understate “Total California income,” which drives the LLC fee and can lead to notices, penalties, or an incorrect payment. To avoid it, use Schedule R when the business is within and outside CA, and only include receipts/income derived from or attributable to California as the instructions require.

People frequently enter net profit figures (after expenses) on Schedule IW because they assume it mirrors an income statement, but the LLC fee is based on total income/gross receipts concepts as defined in the instructions. This mistake usually happens when filers pull a single “net income” number from books or the federal return and place it on line 17. The consequence is an incorrect LLC fee calculation and potential underpayment penalties; avoid it by following each line’s definition (gross receipts, rents, interest, dividends, gains) and entering gains “not losses” where specified.

Several lines explicitly require gains only (e.g., Schedule B line 8; Schedule IW lines 6, 13, 14) and losses only on separate lines (e.g., Schedule B line 9, 11). Filers often net gains and losses together and enter a single net number, which can distort total income and the LLC fee base. To avoid this, report gains and losses on their designated lines and follow the instruction that Schedule IW line 17 cannot be negative (enter -0- if applicable).

The form instructs filers to complete Schedule IW first to determine Side 1, line 1, but many skip it and enter Schedule B totals or a federal figure instead. This leads to mismatched totals across the return and incorrect fee/tax computations. To avoid this, finish Schedule IW through line 17, confirm it reflects California amounts, and then transfer that exact line 17 figure to Side 1, line 1.

Because many accounting reports show cents, filers often enter amounts with decimals or round inconsistently across schedules. This can cause small but frequent math mismatches that trigger processing errors or notices, especially when totals don’t tie out. To avoid it, round all entries to whole dollars consistently (typically standard rounding) and ensure the same rounded figures are used wherever the amount is referenced again.

Single-member LLCs that are disregarded for tax purposes often answer U(1) incorrectly or fail to complete the additional required sides/schedules referenced in U(2). This happens when filers confuse federal classification, California filing requirements, and whether the entity is treated as a partnership vs. disregarded entity. The consequence can be missing schedules, incorrect fee computation, and delayed processing; avoid it by confirming the LLC’s tax classification for the year and following the form’s instruction to complete the specified pages/schedules when U(1) is “Yes.”

Line J explicitly says “Do not leave blank,” but filers often skip it or enter a narrative description without the code. Missing or invalid codes can cause processing delays and follow-up correspondence from the FTB. To avoid this, use the correct business activity code (typically aligned with the federal Form 1065 principal business code) and also complete the activity and product/service descriptions.

Filers frequently misplace payments among lines 8 (FTB 3537/3522/3536), 9 (PTE elective tax payments), 10 (prior-year credit), and 11 (withholding), or they count the same payment in more than one line. This leads to incorrect balances due/refunds and can create notices when FTB records don’t match the return. To avoid it, reconcile each payment to the specific voucher/form and year, separate PTE elective tax payments from other estimates, and keep documentation (confirmations, canceled checks, EFT receipts).

Many yes/no questions require additional attachments (e.g., Schedule EO when “Yes” to being a member/partner in another entity; federal Form 8886 for reportable transactions; trust schedules and federal IDs when “Yes” to trust interest; Form 970 if LIFO adopted; FTB 3885L for depreciation). Filers often check “Yes” but forget the attachment, or they attach the wrong document (federal-only without CA adjustments). This can delay processing and lead to disallowed items or penalties; avoid it by using a checklist tied to each “Yes” response and confirming the attachment matches California requirements.

Filers often enter an incorrect maximum number of members, forget to include a Schedule K-1 (568) for each member in a multi-member LLC, or omit/incorrectly report nonresident member details needed for withholding and Schedule T. This happens when membership changes during the year or when filers rely on internal cap tables that don’t match tax ownership. The consequence can be incomplete filings, withholding issues, and member-level reporting problems; avoid it by reconciling membership records for the entire year (including transfers) and ensuring every member receives a correct CA Schedule K-1 and any required nonresident withholding forms are filed.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out CA Form 568 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills california-form-568-2023-limited-liability-company forms, ensuring each field is accurate.