California Form 568 (2023), Limited Liability Company Return of Income Completed Form Examples and Samples

Find clear, filled-out examples of California Form 568 (2023), the Limited Liability Company Return of Income. Our samples for single-member and multi-member LLCs demonstrate how to correctly calculate the annual tax and LLC fee, report income, and complete the form. Use our detailed 2023 CA Form 568 samples to help you file accurately.

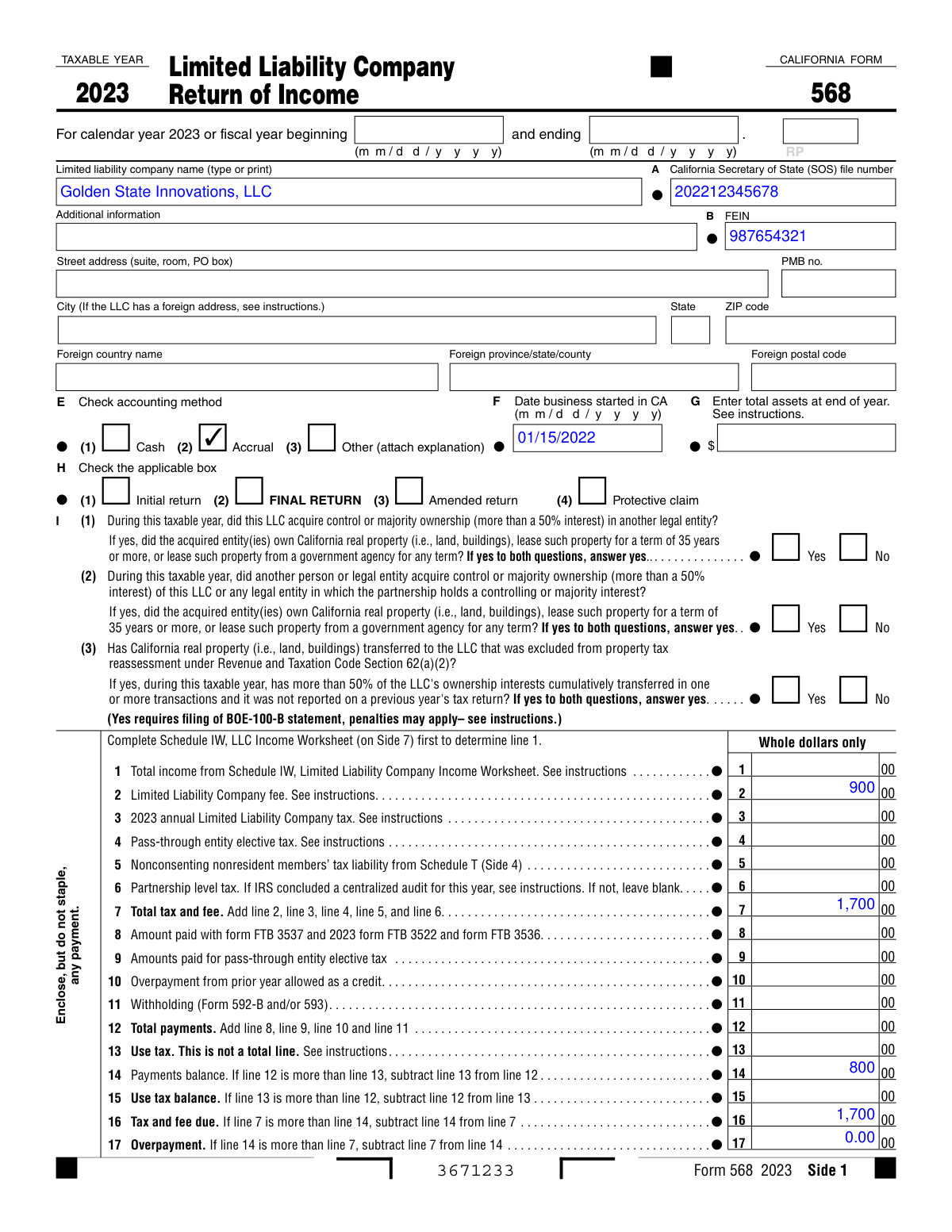

California Form 568 (2023) Example – Multi-Member LLC

How this form was filled:

This is an example of a completed California Form 568 for the 2023 tax year, filed by a multi-member LLC. It shows how total California income is used to calculate the LLC fee, in addition to the standard $800 annual tax. The business in this sample is a consulting firm with gross income of $475,000.

Information used to fill out the document:

- LLC Name: Golden State Innovations, LLC

- FEIN: 98-7654321

- California SOS File Number: 202212345678

- Principal Business Address: 456 Tech Way, San Jose, CA 95113

- Date Business Started in California: 01/15/2022

- Accounting Method: Accrual

- Principal Business Activity (PBA) Code: 541600 (Management, Scientific, and Technical Consulting Services)

- Total California Income (from Schedule B, Line 1): $475,000

- Ordinary Business Income (from Form 568, Line 1): $225,000

- Annual LLC Tax: $800.00

- LLC Fee (based on $475,000 income): $900.00

- Total Tax and Fee: $1,700.00

- Estimated Tax Payments Made: $800.00

- Amount Owed with Return: $900.00

- Number of Members: 2

- Signer: Jane Smith

- Title: Managing Member

- Date Signed: 03/12/2024

What this filled form sample shows:

- Correctly completed entity information including FEIN and California SOS file number.

- Accurate calculation of the LLC fee based on total California income ($475,000 falls into the $250,000 - $499,999 bracket, resulting in a $900 fee).

- Inclusion of the non-negotiable $800 annual LLC tax.

- Demonstrates reporting for a multi-member LLC treated as a partnership for tax purposes.

- Shows the final calculation of amount owed after accounting for estimated payments.

Form specifications and details:

| Form Name: | California Form 568, Limited Liability Company Return of Income |

| Tax Year: | 2023 |

| Filing Jurisdiction: | California Franchise Tax Board (FTB) |

| Use Case: | Multi-member LLC taxed as a partnership |

Created: February 03, 2026 05:03 AM