Yes! You can use AI to fill out Momentum Wealth Retirement Income Option Application (WIS060E)

The Momentum Wealth Retirement Income Option (WIS060E) is an application form for setting up or transferring into a living annuity that provides regular retirement income while allowing the underlying capital to remain invested. It captures investor identity and contact details, tax residency and politically-exposed person declarations, transfer and investment instructions (including optional phasing-in and a Guaranteed Annuity Portfolio), income payment and tax deduction choices, beneficiary nominations, and adviser appointment/fee authorisations. It is important because the selections you make (income level, investment mix, tax method, and beneficiaries) directly affect the sustainability of your retirement income, compliance with South African regulations, and how benefits are paid on death. Today, this form can be filled out quickly and accurately using AI-powered services like Instafill.ai, which can also convert non-fillable PDF versions into interactive fillable forms.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out WIS060E using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Momentum Wealth Retirement Income Option Application (WIS060E) |

| Number of pages: | 11 |

| Language: | English |

| Categories: | retirement forms, investment forms, income forms, Momentum Wealth forms, wealth management forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out WIS060E Online for Free in 2026

Are you looking to fill out a WIS060E form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your WIS060E form in just 37 seconds or less.

Follow these steps to fill out your WIS060E form online using Instafill.ai:

- 1 Go to Instafill.ai and upload the WIS060E “Retirement Income Option” PDF (or select it from the form library).

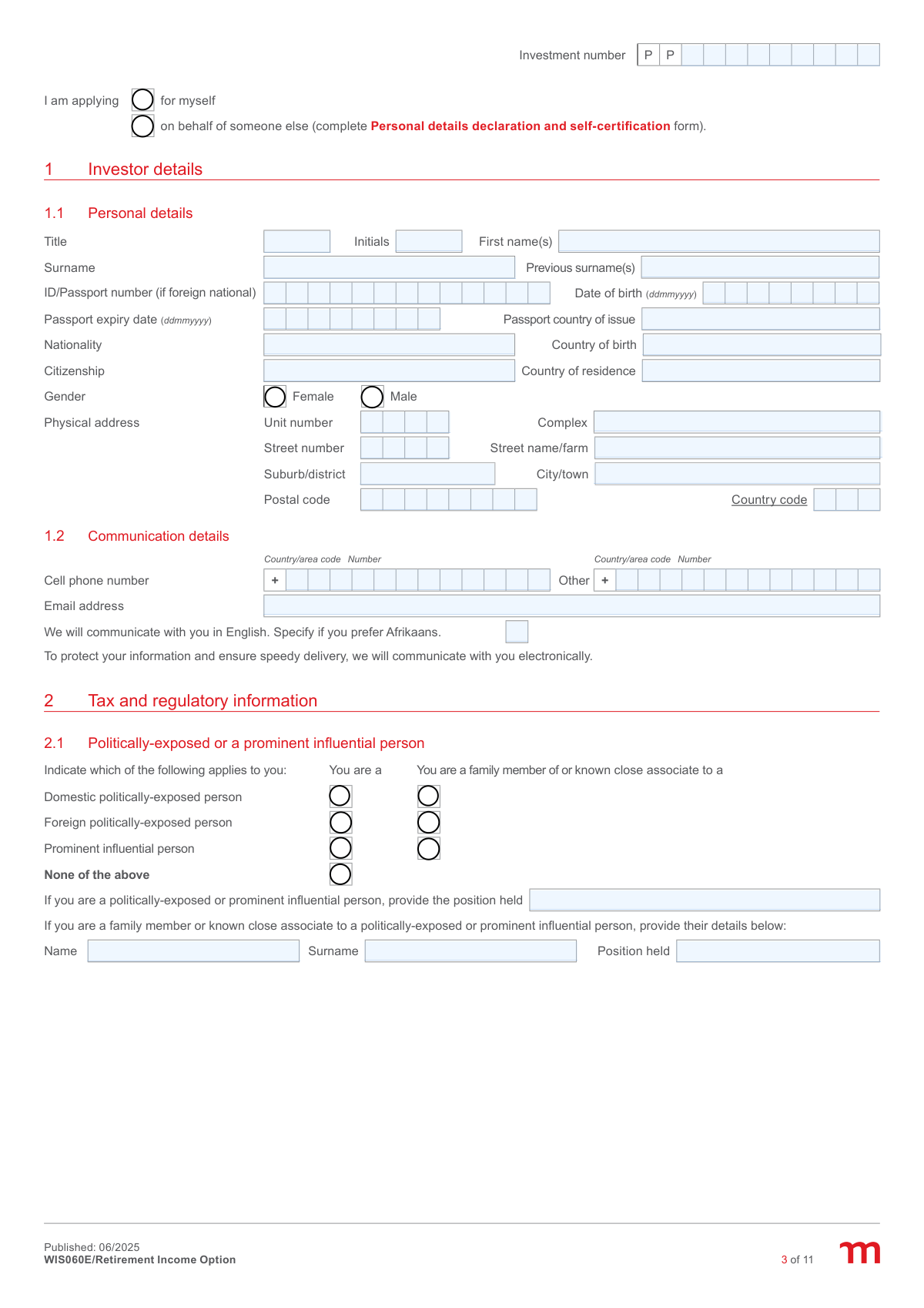

- 2 Let the AI detect fields, then enter/confirm investor details (application type, personal details, ID/passport, addresses, and communication preferences).

- 3 Complete regulatory and tax sections (politically-exposed/prominent influential person status, employment sector, South African and foreign tax residency/TIN details).

- 4 Add investment and transfer details (cash and/or unit/share portfolio transfers, transferring fund/FSP information, expected values, and required supporting documents).

- 5 Provide investment instructions (fee account and withdrawal account choices, lump-sum allocation percentages, and any phase-in schedule and target funds).

- 6 Set income and payment instructions (income percentage or amount, payment frequency, tax deduction option/preferred rate or SARS directive details, income payment day, and South African bank account details).

- 7 Review beneficiaries, Guaranteed Annuity Portfolio (if selected), fees and adviser appointment details, then e-sign/date the investor and adviser declarations and download/share the completed package.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable WIS060E Form?

Speed

Complete your WIS060E in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 WIS060E form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form WIS060E

This form is an application for Momentum Wealth’s Retirement Income Option, which is a living annuity. It sets up your retirement investment and instructs Momentum on your income payments, tax method, investment components, fees, and beneficiaries.

You can apply for yourself, or on behalf of someone else. If you apply on behalf of someone else, you must also complete the Personal details declaration and self-certification form as required on the application.

Momentum may request proof of payment for each transfer from the approved retirement fund/FSP before finalising the application. If they can’t verify your bank details, they may also request official proof of the bank account (not older than three months), and for unit/share transfers a valuation statement not older than 30 days.

Momentum will finalise your application once the payment reflects in their bank account and all requirements have been met. If anything is missing or cannot be processed, they will inform you or your financial adviser.

Legislation limits your before-tax annual income to a minimum of 2.5% and a maximum of 17.5% of the value of your living annuity. Your chosen income level is not guaranteed for life and may become unsustainable depending on investment returns and longevity.

Choose a payment day between the 5th and the 25th of the month to help ensure timely processing and correct tax-year accounting. If the day falls on a weekend or public holiday, Momentum will process the payment on the nearest business day before your chosen day (and if you don’t choose a day, they use the 25th).

No—your income can only be paid into a South African bank account in your name. Momentum does not pay to a credit card or a bond account.

A cash transfer is when retirement funds are transferred as cash, and you provide the expected value and the transferring fund/FSP details. A unit/share portfolio transfer moves existing units/shares and requires additional documents such as a recent valuation statement (≤30 days old) and the relevant transfer forms (e.g., Unit transfer to Momentum form or Personal Share Portfolio form).

A fee account is an investment component you choose where ongoing fees are deducted; if it runs low, fees may be deducted from other components. A withdrawal account is a rand-denominated unit trust from which units can be sold to pay your income.

Phasing in means you initially invest in a money market fund and then gradually move (phase out) into other selected funds over 2 to 24 phases on a daily, weekly, or monthly schedule. You must specify the money market fund, number of phases, frequency, start date (or first available trade date), and the target funds with allocation percentages.

You can choose how Momentum calculates PAYE on your annuity income: non-annualised (remaining income for the tax year), annualised (as if for a full year), a preferred higher tax rate, or a lower rate supported by a SARS tax directive. If you don’t choose, option 6.2.1 applies by default; if you want a lower rate, you must attach the SARS directive.

The Guaranteed Annuity Portfolio is an optional component that pays a guaranteed income for as long as you live. If you include it, Momentum requires a signed fee and benefit proposal, and you complete section 7 only if you want the income to continue for your life partner as a second annuitant.

Only the investment owner can nominate beneficiaries, and you must allocate benefit percentages across beneficiaries that total 100%. If you need more than six beneficiaries, copy the beneficiary section, sign it, and attach it; if you don’t nominate (or a beneficiary predeceases you), the balance is paid to your estate.

You may not change any part of the form or the terms of the agreement. If you correct information you completed, you must sign next to the correction.

Yes—AI tools can help reduce errors and save time by auto-filling fields from your information; services like Instafill.ai use AI to accurately populate form fields. If your PDF is flat/non-fillable, Instafill.ai can convert it into an interactive fillable form and then guide you to complete and export it for submission.

Compliance WIS060E

Validation Checks by Instafill.ai

1

Application type selection is mutually exclusive and drives required attachments

Validate that exactly one of the two application type options is selected: applying for self OR applying on behalf of someone else. If 'on behalf of someone else' is selected, require the Personal details declaration and self-certification form to be completed/attached and ensure the signatory capacity reflects acting for another person. If both or neither are selected, the submission should be rejected and returned for correction because downstream KYC and authority-to-act checks cannot be completed.

2

Investor identity number format and SA ID vs passport consistency

Validate that the ID/Passport field is populated and matches an acceptable format (e.g., South African ID number length/structure or a passport number pattern for foreign nationals). If a passport number is provided, require passport country of issue and passport expiry date; if a South African ID is provided, passport fields should be blank unless explicitly applicable. If the identity format is invalid or required supporting passport fields are missing, fail validation because identity verification and regulatory reporting cannot proceed.

3

Date fields are valid ddmmyyyy and logically consistent (DOB, passport expiry, directive dates, signatures)

Validate that all dates captured in ddmmyyyy are real calendar dates (including leap years) and not in the future where inappropriate (e.g., date of birth must be in the past). Passport expiry must be after the submission/signature date, and SARS directive validity 'from' must be on/before 'to'. If any date is malformed or inconsistent, block processing because it can cause failed KYC checks, invalid tax directive application, or unenforceable declarations.

4

Mandatory personal details completeness (name, gender, residence, contact)

Ensure required investor fields are completed: title, initials, first name(s), surname, date of birth, gender (exactly one), country of residence, and at least one reliable contact method (cell phone and/or email as per business rules). Also validate that the electronic communication consent aligns with the presence of an email address (if electronic communication is required, email must be present and valid). If incomplete, fail validation to prevent inability to contact the client and to meet onboarding/KYC requirements.

5

Email address format validation and deliverability safeguards

Validate email address syntax (single @, valid domain, no spaces, reasonable length) and optionally block known invalid patterns (e.g., 'test@test', missing TLD). This is important because the form states communication will be electronic for speed and security, and invalid emails lead to missed disclosures and statements. If invalid, require correction before acceptance or require an alternative verified communication method per policy.

6

Phone number format validation with country/area code pairing

Validate that phone numbers contain only allowed characters (digits, optional leading + in the country/area code field) and meet minimum/maximum length rules for the selected country/area code. Ensure the country/area code is present when a phone number is provided and that the local number is not duplicated in the code field. If invalid, fail validation because contactability and OTP/verification processes may fail.

7

Physical address completeness and postal code format by country

Validate that the physical address has sufficient detail to be usable: street number and street name/farm, suburb/district, city/town, postal code, and country code. Apply country-specific postal code rules (e.g., South Africa typically 4 digits) and ensure the country code is a valid SARS alphabetical country code where required. If incomplete or malformed, fail validation because address is required for regulatory/KYC and tax residency determinations.

8

Politically-exposed/prominent influential person (PEP/PIP) selection consistency and required details

Validate that the PEP/PIP section has a coherent selection: either 'None of the above' OR one/more applicable PEP/PIP categories, but not both. If the investor is a PEP/PIP, require 'position held (self)'; if the investor is a family member/close associate, require the related person's name, surname, and position held. If these dependencies are not met, fail validation because FICA risk rating and enhanced due diligence cannot be completed.

9

Nature of business/employment sector selection and 'Other' specification requirement

Validate that at least one employment sector option is selected, and if 'Other' is selected then the 'Other (specify)' text field is populated with a meaningful description (not blank or placeholder text). This is important for AML risk profiling and product suitability workflows. If missing, fail validation and request completion to avoid incomplete regulatory profiling.

10

Tax residency logic: SA residency, SARS tax number, and foreign TIN/No-TIN reason rules

Validate that the tax residency questions are answered consistently: if the investor is a tax resident in South Africa, require a SARS tax number in an acceptable format/length. If primary tax residence is not South Africa or foreign tax numbers apply, require at least one foreign tax residence row with country code and either a TIN or exactly one valid 'No TIN reason' (A/B/C) per row. If inconsistent or incomplete, fail validation because CRS/FATCA-style reporting and SARS submissions may be incorrect.

11

Transfer type selection and required transfer details/attachments

Validate that at least one transfer type is selected (cash transfer and/or unit/share portfolio transfer) and that the corresponding sections are completed. For cash transfers, require expected value and number of transferring funds/FSPs plus registered names; for unit/share transfers, require FSP name, reference number, expected value, and confirmation that a recent valuation statement (<=30 days) and the correct transfer forms are attached. If missing, fail validation because the application cannot be finalised without transfer source details and proof requirements.

12

Investment allocation percentages sum to 100% and are within valid bounds

Validate that all lump sum allocation percentage fields are numeric, between 0 and 100, and that the total allocation across selected investment components equals exactly 100.00% (allowing only a small rounding tolerance if the system supports decimals). Also ensure that any component marked as fee account/withdrawal account is actually one of the selected components and is rand-denominated where required. If totals do not reconcile, fail validation because trades and fee/withdrawal deductions cannot be executed correctly.

13

Phase-in instruction rules (number of phases, frequency, dates, and allocation totals)

If 'Request to phase in' is used, validate that the number of phases is between 2 and 24, exactly one frequency is selected (daily/weekly/monthly), and either a valid first phase-out date is provided or 'first available trade date' is selected (not both). Ensure the phase-in target allocation percentages sum to 100% and that the money market fund used for phase-in is specified with a valid allocation. If invalid, fail validation because the phasing schedule and trades would be ambiguous or impossible to execute.

14

Income selection constraints: percentage vs amount, frequency required, and regulatory min/max

Validate that the investor selects exactly one income basis: either a yearly income percentage OR a specific yearly gross amount, and that an income payment frequency is selected. Enforce the legislative limits stated on the form: the before-tax income must be between 2.5% and 17.5% of the product value (for amount-based selection, the system should compute the implied percentage using the transfer value once known and flag if outside limits). If the selection is missing or outside limits, fail validation because the annuity cannot be administered within regulatory requirements.

15

Income tax option selection and dependent fields (preferred rate and SARS directive)

Validate that exactly one tax deduction option is selected (6.2.1–6.2.4). If preferred tax rate is selected, require a numeric percentage and ensure it is higher than the calculated SARS table rate (system-calculated) and that end-date logic is consistent (either end of tax year, a valid specific end date, or no end date). If SARS directive option is selected, require directive number, directive tax rate percentage, and validity dates, and require the directive document to be attached; otherwise fail validation because applying an incorrect tax method can create compliance and client tax shortfall issues.

16

Income payment day and bank account eligibility (SA account, account type, and format)

Validate that the income payment day is either blank (default to 25) or a day between 5 and 25 inclusive, and that it is a two-digit day value. Validate bank details are present and eligible: South African bank account only, account number format/length is plausible, and exactly one account type is selected (cheque/current OR savings), and reject known disallowed account types (credit card/bond) as per the form. If invalid, fail validation because payments may be rejected by banking systems and the product rules prohibit non-qualifying accounts.

17

Beneficiary nomination integrity: required fields per beneficiary and total allocation equals 100%

For each beneficiary row with any data entered, require minimum identity details (name and surname, date of birth, relationship, country of residence, and benefit allocation percentage) and validate passport fields only when a passport number is used. Ensure benefit allocation percentages across all beneficiaries sum to exactly 100.00% (with defined rounding tolerance) and that no individual allocation is negative or exceeds 100. If the nomination is incomplete or totals do not equal 100%, fail validation because death benefit distribution instructions would be ambiguous or invalid.

Common Mistakes in Completing WIS060E

Applicants often overlook the “Investment number – part 1” field or type the full number instead of the first character/prefix exactly as shown. This can cause the application to be linked to the wrong record or delayed while Momentum requests clarification. Always copy the first character exactly (including any letter prefix) from the statement/proposal and double-check against the source document. AI-powered form filling tools like Instafill.ai can reduce this error by extracting the correct prefix and validating it against expected formats.

People frequently tick “on behalf of someone else” without realising it triggers an additional requirement (the Personal details declaration and self-certification form), or they tick “for myself” when acting under authority for another person. This can invalidate parts of the submission or force a resubmission due to missing supporting documentation. Confirm who the legal investor/applicant is and only select the option that matches; if applying on behalf of someone else, attach the required declaration form. Instafill.ai can prompt for the extra form when “on behalf” is selected and prevent submission until all required attachments are present.

This form repeatedly requires dates in ddmmyyyy, but applicants commonly enter dd/mm/yyyy, yyyy-mm-dd, or omit leading zeros (e.g., 5/1/1970). Incorrect date formats can cause system capture failures, compliance issues, and delays (especially for passport expiry and SARS directive validity dates). Enter dates as eight digits with no separators (e.g., 05012070) and ensure the date is logically valid (passport expiry in the future, directive dates within validity). Instafill.ai can automatically format dates correctly and flag impossible or inconsistent date entries.

Applicants often use nicknames, omit middle names, or forget to include previous surnames (e.g., maiden name) even though the form asks for legal names exactly as on identity documents. Mismatches can trigger FICA/KYC verification failures and require certified documents or corrections, slowing down onboarding. Copy names exactly from the ID/passport and only use “Previous surname(s)” for former legal surnames; leave it blank if none. Instafill.ai can help by standardising name fields and checking consistency across the form.

A common issue is missing key address components (street number, suburb, postal code) or entering a PO Box where a physical address is required. Incomplete addresses can lead to compliance follow-ups and delays in processing, especially where address verification is needed. Provide a full physical address with unit/complex details where applicable, and ensure the postal code matches the city/town and suburb. Instafill.ai can validate address completeness and formatting before submission.

Applicants frequently put the full number (including +27) into the local number field, omit the country/area code, or provide a number that doesn’t match the country of residence. This can prevent Momentum from contacting the investor for outstanding requirements, causing avoidable delays. Enter the international prefix in the country/area code box (e.g., +27) and the remaining digits in the number field, and confirm the email address is typed correctly. Instafill.ai can format phone numbers to E.164-style logic and catch common email typos.

People often tick “None of the above” while also indicating they are a family member/associate, or they select a PEP category but leave the required “position held” details blank. Because this is a regulatory requirement under FICA, inconsistencies can trigger compliance escalation and stop the application from being finalised. Select exactly what applies and, if any PEP/PIP option is selected, provide the position held (and the related person’s details where required). Instafill.ai can enforce conditional logic so required PEP details must be completed when relevant.

Applicants commonly answer “Yes” to SA tax residency but omit the SARS tax number, or they indicate a foreign tax residence but fail to provide the country code and TIN (or select an invalid ‘No TIN’ reason). This can lead to CRS/FATCA-style reporting issues and delays while Momentum requests corrected tax declarations. If SA tax resident, provide the SARS tax number; if not, complete the foreign tax residence table with the correct SARS alphabetical country code and TIN, and only use a ‘No TIN’ reason when genuinely applicable. Instafill.ai can validate country codes, require a SARS number when SA residency is selected, and prevent contradictory selections.

Applicants often tick a transfer type but don’t complete the corresponding section, or they forget the required supporting documents (e.g., valuation statement not older than 30 days for unit/share transfers, Unit transfer to Momentum form per transfer, Personal Share Portfolio form). Missing or outdated documents are a top cause of processing delays and repeated follow-ups. Confirm whether the transfer is cash, unit/share, or both, complete each relevant subsection, and attach the correct, current documentation for every transferring fund/FSP. Instafill.ai can generate a checklist based on selected transfer type(s) and flag missing attachments before submission.

In the investment instruction section, applicants frequently allocate percentages that don’t add up to 100%, leave the fee account unspecified, or mark “use as part of the withdrawal account” without ensuring a suitable rand-denominated unit trust is selected. This can result in default fund allocation, unintended sell-down behaviour for income payments, and back-and-forth queries to correct allocations. Recalculate allocations so the lump sum allocation totals 100% across chosen components, explicitly choose a fee account (money market fund if intended), and clearly indicate which component is the withdrawal account. Instafill.ai can automatically sum-check allocations and warn when totals are not 100% or when required account designations are missing.

Applicants sometimes enter both a yearly income percentage and a specific yearly income amount, choose a percentage outside the legal 2.5%–17.5% range, or select an income payment day outside the recommended 5th–25th window. These mistakes can cause the instruction to be rejected, require rework, or lead to late payments and tax-year timing complications. Choose either percentage or amount (not both), ensure the percentage is within 2.5%–17.5%, select a payment frequency, and pick an income day between 05 and 25 (two digits). Instafill.ai can enforce the min/max income rules, prevent dual-entry conflicts, and format the income day correctly.

A frequent issue is providing bank details that are not a South African bank account in the investor’s name, or selecting the wrong account type (cheque vs savings). The form explicitly states payments cannot be made to a credit card or bond account, and unverifiable details may require proof of account not older than three months, delaying first payment. Use a SA bank account held in the investor’s name, enter the account number carefully, and tick the correct account type; be ready to provide recent proof of account if requested. Instafill.ai can help by validating account number length/format patterns and ensuring required bank fields are completed consistently.

Applicants often forget to complete key beneficiary fields (DOB/ID, relationship, contact details) or allocate percentages that don’t total 100%, which can create uncertainty and administrative delays. Another common mistake is having someone other than the investment owner sign—this makes the beneficiary nomination invalid per the form’s rules. Ensure each beneficiary entry is complete and the total allocation equals exactly 100%; if adding extra beneficiaries, attach a signed copy of the beneficiary section. Instafill.ai can total-check beneficiary percentages and flag missing required beneficiary data before the form is submitted.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out WIS060E with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills momentum-wealth-retirement-income-option-application-wis060e forms, ensuring each field is accurate.