Yes! You can use AI to fill out Form W-8IMY (Rev. October 2021), Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting

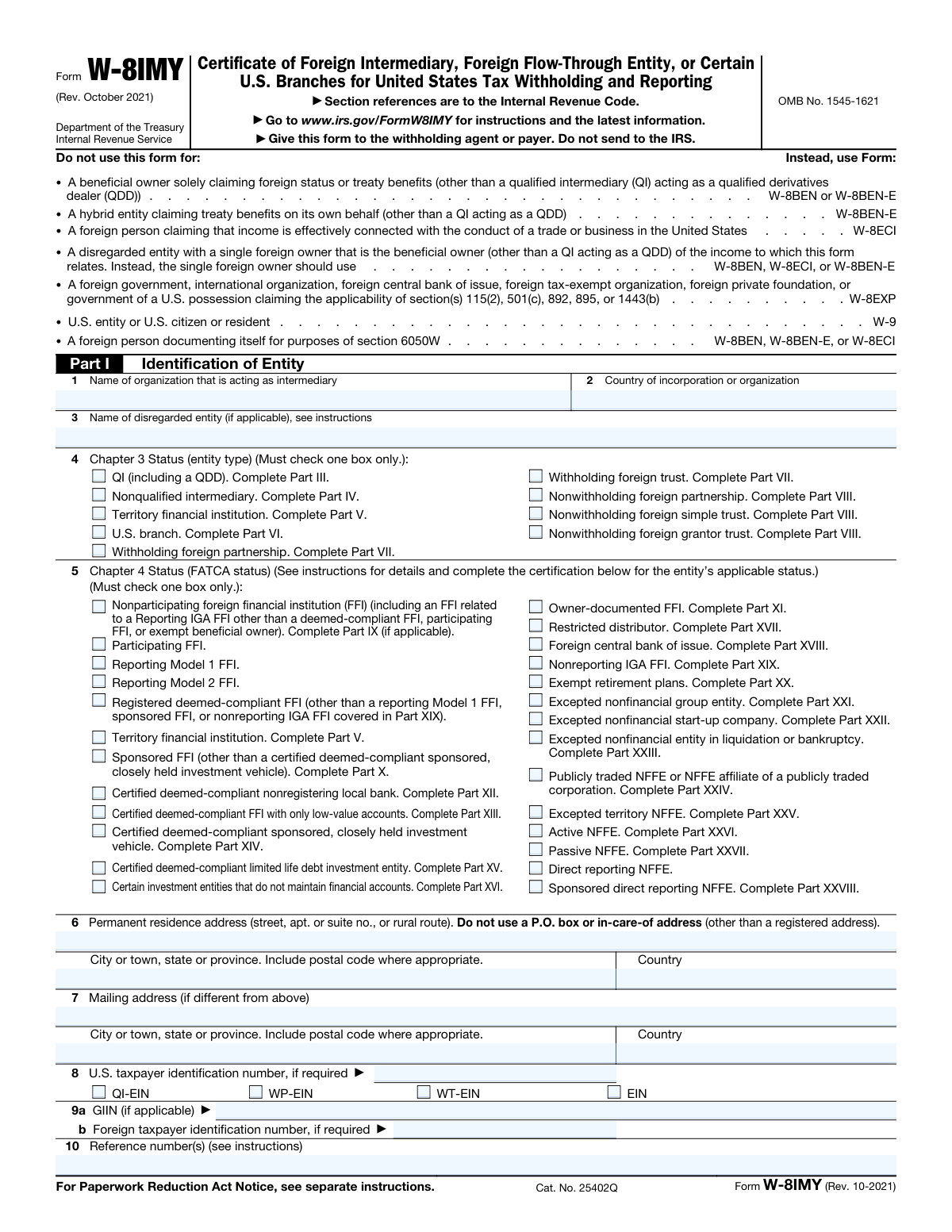

Form W-8IMY is an IRS withholding certificate used when an entity is receiving U.S.-source income as an intermediary (such as a qualified intermediary or nonqualified intermediary), a flow-through entity (such as certain foreign partnerships or trusts), or a qualifying U.S. branch of a foreign entity. It establishes the entity’s Chapter 3 status (for NRA withholding) and, where applicable, its Chapter 4 (FATCA) status, and it often accompanies a withholding statement and underlying payee documentation. Withholding agents rely on this form to determine how to withhold and report payments and whether additional documentation is required. The form is given to the withholding agent or payer (not filed with the IRS) and must be updated if certifications become incorrect.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out W-8IMY using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form W-8IMY (Rev. October 2021), Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting |

| Number of pages: | 8 |

| Language: | English |

| Categories: | tax forms, state tax forms, PA state forms, tax withholding forms, entity tax forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out W-8IMY Online for Free in 2026

Are you looking to fill out a W-8IMY form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your W-8IMY form in just 37 seconds or less.

Follow these steps to fill out your W-8IMY form online using Instafill.ai:

- 1 Confirm W-8IMY is the correct form for your role (intermediary, flow-through entity, or certain U.S. branch) and identify whether you must also provide a withholding statement and underlying payee documentation.

- 2 Complete Part I (Identification of Entity): enter the entity’s legal name, country of incorporation/organization, any disregarded entity name (if applicable), permanent and mailing addresses, and required tax identifiers (U.S. TIN if required, GIIN if applicable, foreign TIN, and any QI-EIN/WP-EIN/WT-EIN/EIN as relevant).

- 3 Select your Chapter 3 status in line 4 (check exactly one) and then complete the corresponding certification part (e.g., Part III for QI/QDD, Part IV for nonqualified intermediary, Part V for territory financial institution, Part VI for certain U.S. branches, Part VII for WP/WT, or Part VIII for nonwithholding partnership/trust).

- 4 Select your Chapter 4 (FATCA) status in line 5 (check exactly one) and complete the applicable FATCA certification section(s) (e.g., Sponsored FFI, Owner-Documented FFI, Nonreporting IGA FFI, Active/Passive NFFE, etc.), including any required sponsor/trustee details and GIINs.

- 5 If applicable, complete Part II for a disregarded entity or branch receiving payment (including the branch/disregarded entity FATCA status, address, and GIIN) when the payment is received through a branch in a different country or a disregarded entity with a GIIN.

- 6 Review all checked boxes and statements for consistency with your withholding statement, reference numbers (line 10), and any attached documentation, ensuring the form aligns with how payments should be allocated and reported.

- 7 Sign and date Part XXIX (Certification) as an authorized official, then deliver the completed form (and any required withholding statement/attachments) to the withholding agent or payer and track renewal/updates if any information changes.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable W-8IMY Form?

Speed

Complete your W-8IMY in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 W-8IMY form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form W-8IMY

Form W-8IMY is used to certify that an entity is acting as a foreign intermediary, foreign flow-through entity, or certain U.S. branches for U.S. tax withholding and reporting purposes. It helps the withholding agent determine the correct withholding and reporting under chapters 3 and 4 (FATCA) and certain partnership withholding rules.

Entities that receive U.S.-source payments as an intermediary (such as a qualified intermediary or nonqualified intermediary), a flow-through entity (such as certain foreign partnerships or trusts), or certain U.S. branches should complete it. The entity completes it and provides it to the withholding agent or payer.

Beneficial owners claiming foreign status or treaty benefits generally use Form W-8BEN or W-8BEN-E, and U.S. persons use Form W-9. If the income is effectively connected with a U.S. trade or business, use Form W-8ECI; certain exempt organizations/governments use Form W-8EXP.

No. The form should be given to the withholding agent or payer, and it should not be sent to the IRS.

You generally must provide the entity’s legal name, country of incorporation/organization, chapter 3 status (entity type), chapter 4 (FATCA) status, and permanent residence address. You may also need to provide U.S. TIN (if required), GIIN (if applicable), and a foreign TIN (if required).

Chapter 3 status (line 4) identifies your role/type for withholding (for example, QI, nonqualified intermediary, withholding foreign partnership). Chapter 4 status (line 5) identifies your FATCA classification (for example, participating FFI, reporting Model 1 FFI, active NFFE, passive NFFE).

Select the single option that matches how your entity is acting for the payments covered by the form (for example, QI vs. nonqualified intermediary vs. nonwithholding foreign partnership). The form instructs you to complete the corresponding Part (e.g., QI completes Part III; nonqualified intermediary completes Part IV).

Choose the single FATCA status that applies to your entity based on whether it is an FFI or NFFE and any applicable deemed-compliant or IGA category. After selecting the status, complete the related certification part (for example, Sponsored FFI in Part X, Owner-documented FFI in Part XI, Active NFFE in Part XXVI).

Complete Part II only if the payment is received by a disregarded entity with a GIIN or by an FFI branch located in a country different from the FFI’s country of residence. Do not complete Part II for QDD branches (per the form’s instructions).

A GIIN (Global Intermediary Identification Number) is a FATCA registration number for certain financial institutions and related entities. You provide it on line 9a (or line 13 for a branch/disregarded entity) when your FATCA status requires or includes a GIIN.

Line 8 is completed only if a U.S. taxpayer identification number is required for your situation. Whether it is required depends on your status and the withholding agent’s documentation requirements for the payment type.

A withholding statement is documentation that allocates payments to underlying payees/owners and provides the supporting withholding certificates or other documentation. Many statuses on the form (such as nonqualified intermediaries and nonwithholding foreign partnerships/trusts) require providing a withholding statement with this form.

Line 10 is used to help the withholding agent match this form to specific accounts, payees, or payment streams. You can enter account numbers or other internal reference identifiers as described in the instructions.

An authorized official must sign and date the form under penalties of perjury, confirming the information is true and complete. The signer also agrees to provide an updated form within 30 days if any certification becomes incorrect.

Processing time is determined by the withholding agent or payer, not the IRS, since the form is not filed with the IRS. Submit it to the withholding agent as early as possible (typically before payments are made) to avoid incorrect withholding or payment delays.

Compliance W-8IMY

Validation Checks by Instafill.ai

1

Part I Line 1 Intermediary/Entity Name Required and Non-Placeholder

Validate that line 1 (name of organization acting as intermediary) is present, not blank, and not a placeholder value (e.g., “N/A,” “same,” or asterisks). This is essential because the withholding agent must be able to identify the legal entity making the certifications. If missing or invalid, the submission should be rejected and routed for correction before it can be relied upon.

2

Part I Line 2 Country of Incorporation/Organization Must Be a Valid Country

Ensure line 2 contains a valid country name or ISO-recognized jurisdiction and is not a U.S. state/territory unless the entity is actually organized there (which may indicate the wrong form is being used). Country is required to determine foreign status and FATCA/Chapter 4 treatment. If the country is missing or invalid, flag the form as incomplete and prevent downstream tax classification.

3

Chapter 3 Status (Line 4) Exactly One Selection and Corresponding Part Completion

Verify that exactly one Chapter 3 status checkbox is selected on line 4 (e.g., QI, NQI, U.S. branch, WP/WT, nonwithholding partnership/trust). Also validate that the corresponding certification part is completed (e.g., QI requires Part III; NQI requires Part IV; U.S. branch requires Part VI). If multiple or none are selected, or the required part is not completed, the form should fail validation because the withholding agent cannot determine the correct withholding and reporting regime.

4

Chapter 4 FATCA Status (Line 5) Exactly One Selection and Required Part Completion

Confirm that exactly one FATCA status checkbox is selected on line 5 and that any required associated part is completed (e.g., Sponsored FFI requires Part X with sponsoring entity name; Owner-documented FFI requires Part XI certifications). FATCA status drives GIIN requirements and withholding under chapter 4. If the selection is missing/ambiguous or the required part is incomplete, the form should be rejected or treated as undocumented for FATCA purposes.

5

Permanent Residence Address (Line 6) Completeness and No P.O. Box

Validate that line 6 includes street address, city, and country, and that it does not contain a P.O. box or “in care of” address except where explicitly allowed as a registered address. A valid permanent residence address is a core documentary requirement for foreign status and reasonableness checks. If a P.O. box is provided or key components are missing, the form should be flagged for cure and may be treated as invalid documentation.

6

Mailing Address (Line 7) Conditional Completeness and Difference Logic

If line 7 is provided, ensure it is complete (street/city/country) and is meaningfully different from line 6; if it is identical, the system should either auto-clear it or flag as redundant based on business rules. This prevents inconsistent address records and reduces downstream mailing/notice failures. If line 7 is partially filled or inconsistent, fail validation and request correction.

7

U.S. TIN (Line 8) Format and Conditional Requirement Based on Status

Check that a U.S. TIN, if provided, matches acceptable formats (EIN: 9 digits, often written as XX-XXXXXXX; ITIN/SSN: 9 digits with valid grouping if hyphens are used). Additionally, enforce conditional requirements where a U.S. TIN is required by instructions/business context (e.g., certain U.S. branch or treaty-related scenarios as implemented by the withholding agent). If the TIN is malformed or required but missing, the form should be rejected or treated as not valid for withholding rate determination.

8

GIIN (Line 9a) Format Validation and Required When Applicable

Validate GIIN format (19 characters, typically alphanumeric with periods in standard GIIN structure) and ensure it is present when the selected FATCA status requires registration (e.g., Participating FFI, Reporting Model 2 FFI, Registered deemed-compliant FFI, Sponsored FFI where applicable). GIIN is critical for FATCA classification and to avoid chapter 4 withholding. If GIIN is required but missing/invalid, the form should be flagged and the entity may be treated as nonparticipating/undocumented per policy.

9

Foreign TIN (Line 9b) Presence When Required and Basic Character Rules

Ensure the foreign taxpayer identification number is provided when required by the form instructions or withholding agent policy, and validate it against basic character rules (no illegal characters, reasonable length, not all zeros). Foreign TIN supports identity verification and treaty/FATCA reasonableness checks. If required but missing or clearly invalid, the submission should fail validation and be returned for correction.

10

QI-EIN / WP-EIN / WT-EIN / EIN Fields Conditional Requirement and EIN Format

If the entity selects QI, WP, or WT status, validate that the corresponding EIN field (QI-EIN, WP-EIN, or WT-EIN) is present and formatted as a valid EIN (9 digits, hyphen optional). These identifiers are used to confirm agreement status and proper withholding responsibilities. If the relevant EIN is missing or malformed, the form should be rejected because the claimed status cannot be operationalized.

11

Part II Completion Trigger and Internal Consistency (Disregarded Entity/Branch)

Validate that Part II is completed only when applicable: a disregarded entity with a GIIN or a branch of an FFI in a country other than the FFI’s country of residence, and not for QDD branches. If Part II is completed, require line 11 status, line 12 address, and line 13 GIIN (if any) to be consistent and complete. If Part II is filled when not applicable or missing required subfields when applicable, flag for correction to prevent misclassification of the payee/branch.

12

Sponsored FFI / Sponsored Direct Reporting NFFE Sponsoring Entity Name Required

When Sponsored FFI is selected (Part X) or Sponsored Direct Reporting NFFE is selected (Part XXVIII), require the sponsoring entity name (line 23a or line 41) and ensure it is not blank or a placeholder. Sponsorship is central to FATCA compliance and determines who performs due diligence and reporting. If the sponsor name is missing, the claimed status should be treated as invalid and the form should fail validation.

13

Nonreporting IGA FFI (Part XIX) IGA Model and Jurisdiction Must Be Provided

If Nonreporting IGA FFI is selected, validate that the applicable IGA jurisdiction (country) is provided and that exactly one model is indicated (Model 1 or Model 2). If trustee documented trust or sponsored entity is indicated, require trustee/sponsor name and trustee type (U.S. or Foreign) selection. Missing IGA details makes the status unverifiable; the form should be rejected or treated as undocumented for FATCA.

14

Publicly Traded NFFE / Affiliate (Part XXIV) Market and Entity Name Requirements

If Part XXIV is used, require completion of the securities market name (and, for affiliate status, the publicly traded parent/entity name and market). This information substantiates the “publicly traded” exception and supports reasonableness checks. If the market or required entity name is missing, the status claim should fail and the form should be returned for completion.

15

Signature, Printed Name, and Date (Part XXIX) Presence and Date Format

Require an authorized official’s signature, printed name, and a date in MM-DD-YYYY format, and validate that the date is a real calendar date (e.g., not 13-40-2025). The penalties-of-perjury certification is what makes the form legally valid for reliance. If any of these elements are missing or the date is invalid, the form must be rejected as not properly executed.

16

Reference Number(s) (Line 10) Character/Length Validation and Optionality Rules

If line 10 reference numbers are provided, validate allowed characters (letters, numbers, hyphen/underscore as configured) and enforce a maximum length and count to prevent truncation or injection into downstream systems. Reference numbers are often used to link accounts/withholding statements and must be reliably stored. If the value exceeds limits or contains disallowed characters, the system should reject or sanitize and request resubmission per policy.

Common Mistakes in Completing W-8IMY

People often select W-8IMY because they are “foreign,” even when they are actually the beneficial owner (W-8BEN/W-8BEN-E), claiming effectively connected income (W-8ECI), a U.S. person/entity (W-9), or an exempt organization/government (W-8EXP). This leads to rejection by the withholding agent and default (often higher) withholding because the documentation does not match the payee’s role. Confirm whether you are an intermediary/flow-through entity/U.S. branch versus the beneficial owner, and use the form explicitly listed in the “Do not use this form for” section when applicable.

Line 4 requires exactly one Chapter 3 status, but filers frequently check more than one (e.g., both QI and nonqualified intermediary) or pick a status that doesn’t match their legal/contractual role. The consequence is that the withholding agent cannot apply the correct withholding and reporting rules and will request a corrected form or apply conservative withholding. Choose the single status that matches your agreement/structure (QI, NQI, WP/WT, nonwithholding partnership/trust, U.S. branch, etc.) and then complete only the corresponding part referenced on the form.

Line 5 also requires exactly one FATCA status, but many filers either select multiple statuses or select a status that conflicts with their GIIN/registration reality (e.g., “Participating FFI” without a GIIN, or “Nonreporting IGA FFI” without identifying the IGA category). This can cause FATCA withholding (up to 30% on withholdable payments) or repeated documentation follow-ups. Determine whether you are an FFI or NFFE first, then select the single FATCA status that matches your registration/IGA classification and complete the related certification part.

A very common error is checking a status on Line 4 or Line 5 but not completing the required part (e.g., selecting QI but not completing Part III, selecting Sponsored FFI but not completing Part X, selecting Owner-documented FFI but not completing Part XI). Withholding agents typically treat the form as invalid because the certifications supporting the status are missing. After you check a status, immediately go to the referenced part and complete all required checkboxes, names (e.g., sponsor), and statements.

Line 6 explicitly says not to use a P.O. box or in-care-of address (except certain registered addresses), but filers often use mailing addresses, bank addresses, or c/o service providers. This can create residency ambiguity and trigger requests for additional documentation or rejection of the form. Use the entity’s actual permanent residence/business address (street address) and reserve P.O. boxes for the mailing address on Line 7 if needed.

Filers frequently enter a trade name instead of the legal name on Line 1, omit the disregarded entity name on Line 3 when applicable, or list the wrong country of incorporation/organization on Line 2 (especially for entities managed elsewhere). These inconsistencies can cause the withholding agent’s KYC/tax documentation checks to fail and delay payments. Use the exact legal name as shown on formation documents, list the disregarded entity only when required, and ensure the country on Line 2 matches the entity’s place of incorporation/organization (not where it operates).

Many filers leave Lines 8 and/or 9b blank without confirming whether a TIN is required for their claim, or they enter the wrong type of number (e.g., using a local registration number that is not a tax identification number). Missing/incorrect TINs can invalidate the form for certain payments, prevent treaty/FATCA validations, and lead to backup/FATCA withholding or follow-up requests. Confirm which TIN is required for your status and payment type, and enter the correct format (U.S. TIN when required; foreign TIN when required; and the appropriate QI/WP/WT EIN if applicable).

Filers often provide a GIIN when their selected FATCA status does not support it, provide a GIIN that doesn’t match the entity name/country, or forget to provide a GIIN for a status that generally requires registration. This can cause the withholding agent to treat the entity as undocumented or nonparticipating, resulting in FATCA withholding and reporting issues. Only provide a GIIN if applicable to your selected status, and ensure it matches the registered entity/branch details; if documenting a branch/disregarded entity in Part II, use the correct GIIN for that branch/entity.

Part II is only for a disregarded entity with a GIIN or an FFI branch in a different country than the FFI’s country of residence, and it should not be completed for QDD branches. People either fill it out “just in case” (creating contradictions) or skip it when payments are actually being received by a documented branch/disregarded entity. This can lead to misapplied FATCA status and incorrect withholding. Complete Part II only when the payment recipient is the branch/disregarded entity described, and ensure the Chapter 4 status, address, and GIIN there align with the payment flow.

Many statuses on W-8IMY require a withholding statement and underlying payee documentation (e.g., NQI transmitting documentation, nonwithholding partnerships/trusts, certain U.S. branches, QIs for pooled reporting, etc.). Without the statement, the withholding agent cannot allocate payments to the correct recipients or rate pools and may withhold at the maximum rate or reject the package. Review the part you are certifying under and provide the required withholding statement, allocation information, and any associated Forms W-8/W-9 for underlying owners/partners/beneficiaries.

Common issues include missing signature, unsigned electronic submissions where a wet signature is required by the payer, signing by someone without proper authority, or using the wrong date format (the form specifies MM-DD-YYYY). An invalid certification makes the entire form unusable, often triggering default withholding until corrected. Ensure an authorized official signs, print the signer’s name, and date the form in MM-DD-YYYY; also confirm the withholding agent’s signature policy (wet vs. acceptable e-signature).

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out W-8IMY with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-w-8imy-rev-october-2021-certificate-of-foreig forms, ensuring each field is accurate.