Yes! You can use AI to fill out Form W-2, Wage and Tax Statement (2025)

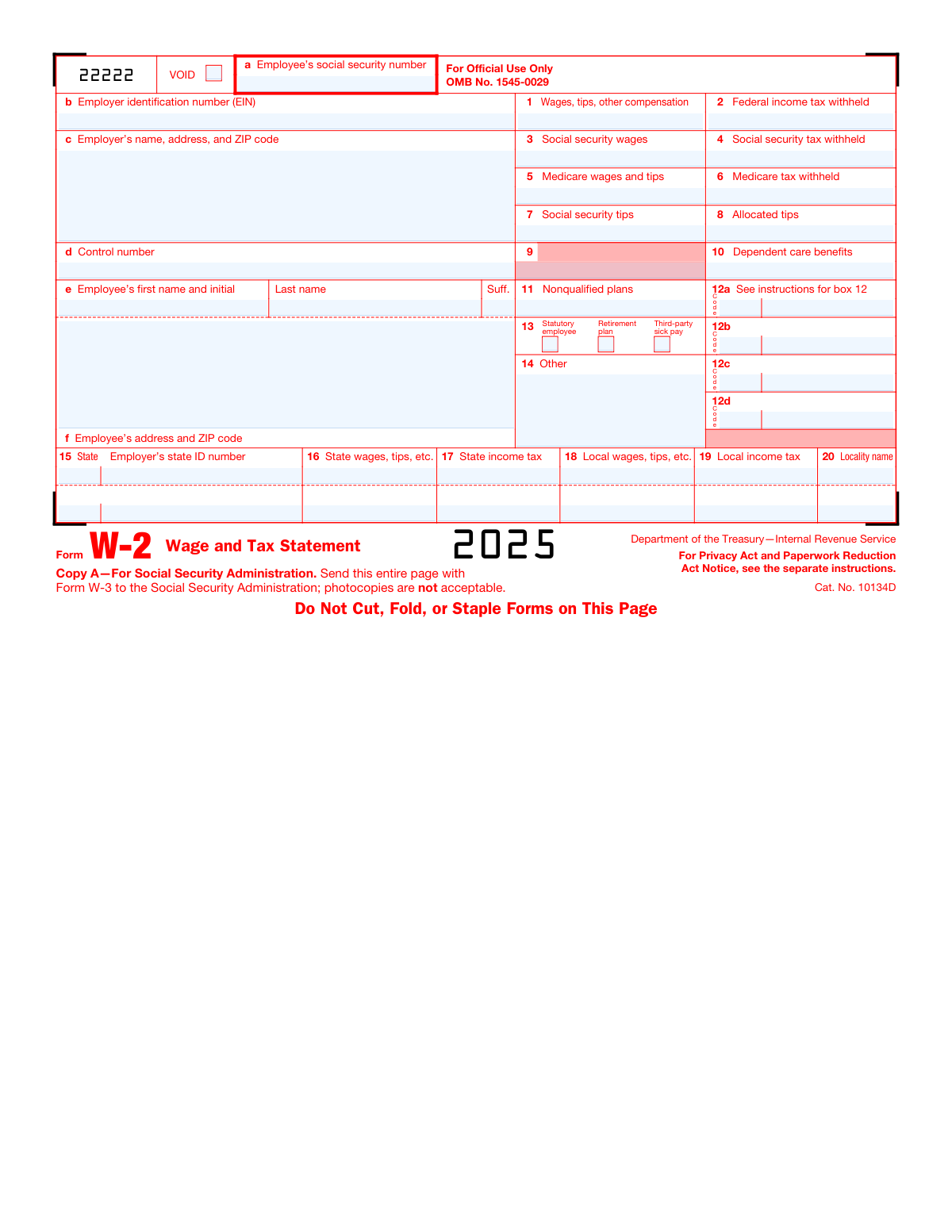

Form W-2 is an IRS information return prepared by employers to summarize each employee’s yearly compensation and payroll tax withholdings. It includes key figures such as wages, federal income tax withheld, Social Security and Medicare wages/taxes, and various benefit and deferral codes (box 12). The form is important because employees rely on it to accurately file tax returns and claim refunds/credits, and the SSA/IRS use it to verify earnings and tax reporting. Employers must provide employee copies and file Copy A (typically scannable) with the SSA by the annual deadline.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out W-2 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form W-2, Wage and Tax Statement (2025) |

| Number of pages: | 11 |

| Language: | English |

| Categories: | tax forms, state tax forms, PA state forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out W-2 Online for Free in 2026

Are you looking to fill out a W-2 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your W-2 form in just 37 seconds or less.

Follow these steps to fill out your W-2 form online using Instafill.ai:

- 1 Select the correct tax year (2025) and choose the appropriate W-2 copy/output for your purpose (employee copies vs. employer/SSA filing).

- 2 Enter employer details: EIN, employer legal name, and complete address/ZIP; add a control number if your payroll system uses one.

- 3 Enter employee details: full name (including suffix if applicable), address/ZIP, and Social Security number (SSN).

- 4 Input wage and withholding amounts for boxes 1–11 (wages/tips, federal withholding, Social Security/Medicare wages and taxes, tips, dependent care benefits, and nonqualified plans) based on payroll records.

- 5 Complete box 12 items by selecting the correct codes (e.g., D, W, DD) and entering the corresponding amounts; repeat for 12a–12d as needed.

- 6 Check applicable box 13 checkboxes (Statutory employee, Retirement plan, Third-party sick pay) and complete box 14 “Other” entries if required by your payroll/benefits reporting.

- 7 Add state and local information in boxes 15–20 (state, employer state ID, state wages/tax, local wages/tax, locality name), then review totals and generate/print the correct copies or e-file through SSA as required.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable W-2 Form?

Speed

Complete your W-2 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 W-2 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form W-2

Form W-2 reports an employee’s annual wages and the taxes withheld from their pay. Employees use it to prepare federal, state, and local income tax returns, and the SSA uses it to update earnings records.

Employers complete Form W-2 for each employee they paid during the year. Employees generally do not “file” the W-2 itself; they receive copies to use when filing their tax returns.

Copy A is filed with the Social Security Administration (SSA) along with Form W-3 (unless e-filing). Copy B is for the employee’s federal tax return, Copy 1 and Copy 2 are for state/city/local returns, Copy C is for the employee’s records, and Copy D is for the employer’s records.

No. The IRS.gov printed Copy A is not scannable, and the SSA may penalize filings that can’t be scanned; you must use official scannable forms or file electronically.

Employers can e-file using the SSA’s Employer W-2 Filing Instructions & Information site (www.SSA.gov/employer). The SSA’s W-2 Online service lets employers create, save, print, and submit W-2s electronically (up to 50 at a time).

No. When you e-file through SSA’s W-2 Online service, an electronic Form W-3 is created for you, so you don’t submit a separate paper W-3.

Employers must provide Copies B, C, and 2 to employees by February 2, 2026. Employers must also file Copy A (and Form W-3 if filing on paper) with the SSA by February 2, 2026.

If you file 10 or more information returns, you must file electronically (per the form’s instructions referencing Reg. 301.6011-2). Even if not required, e-filing can be faster and easier.

You must provide the employee’s Social Security number, the employer’s EIN, the employer’s name/address/ZIP, an optional control number, and the employee’s name and address/ZIP.

Box 1 shows taxable wages to report on the wages line of the employee’s tax return. Box 2 shows federal income tax withheld to report on the federal withholding line of the return.

Boxes 3 and 5 reflect wages subject to Social Security and Medicare rules, which can differ from taxable wages in Box 1 due to pre-tax deductions or wage base limits. Boxes 4 and 6 show the Social Security and Medicare taxes withheld on those wages.

Notify your employer and ask them to correct the record and file Form W-2c with the SSA. If your name/SSN don’t match your Social Security card, contact the SSA to update your card/record.

Box 12 uses letter codes to report specific items such as retirement deferrals, HSA contributions, or health coverage cost. Some codes are informational (for example, code DD is not taxable), while others may be needed to complete your tax return.

It indicates you were covered by an employer retirement plan during the year. This can affect whether and how much you can deduct for traditional IRA contributions (see Pub. 590-A).

Order official IRS information returns (including scannable Copy A) through the IRS Online Ordering page at www.irs.gov/orderforms under Employer and Information returns. The IRS will mail the scannable forms to you.

Compliance W-2

Validation Checks by Instafill.ai

1

Employee SSN format and validity (Box a)

Validate that the employee Social Security number is present (unless explicitly allowed to be masked on employee copies) and matches the required 9-digit SSN format (either "#########" or "###-##-####"). Reject known invalid patterns (e.g., all zeros in any group, 000-##-####, ###-00-####, ###-##-0000) and non-numeric characters beyond hyphens. This is critical because SSA/IRS matching relies on a valid SSN; if validation fails, the submission should be blocked and the user prompted to correct the SSN.

2

Employer EIN format and validity (Box b)

Ensure the Employer Identification Number is provided and is exactly 9 digits, optionally formatted as "##-#######". Disallow all-zero values and non-numeric characters beyond a single hyphen. EIN accuracy is required for IRS/SSA identification of the filer; if invalid, the form should fail validation and require correction before acceptance.

3

Employer name and complete mailing address completeness (Box c)

Check that employer legal name is present and that address includes street (or PO Box), city, state, and ZIP code. Validate that ZIP is either 5 digits or ZIP+4 ("#####" or "#####-####") and that state is a valid USPS two-letter code. Missing or malformed address data can cause delivery issues and filing mismatches; if validation fails, require completion/correction of the missing components.

4

Employee name fields completeness and character rules (Box e)

Verify that employee first name and last name are present, and that middle initial/suffix (if provided) conforms to expected patterns (e.g., single letter for initial; suffix like Jr, Sr, II, III). Disallow numerals and unsupported special characters that commonly indicate OCR/entry errors. Correct name data is essential for SSA wage crediting; if invalid, the system should stop submission and request corrected name fields.

5

Employee mailing address completeness and ZIP validation (Box f)

Require employee address line plus city, state, and ZIP, and validate ZIP format (5-digit or ZIP+4) and state code. Optionally flag obviously invalid addresses (e.g., missing city/state, ZIP not matching allowed patterns). Accurate employee address is needed for distribution and recordkeeping; if validation fails, prevent finalization until corrected.

6

Tax year consistency check (Form year = 2025)

Confirm the W-2 tax year is explicitly set to 2025 and that the submission is not mixing data intended for another year (e.g., user-selected year differs from the form year). This prevents misreporting wages/withholding to the wrong tax year, which can trigger IRS/SSA discrepancies. If the year is inconsistent, block submission and require the user to select/confirm the correct tax year.

7

Monetary fields numeric format and non-negative constraints (Boxes 1–12, 14, 16–19)

Validate that all money boxes contain valid currency numbers (digits with optional decimal point, max two decimal places) and are not negative unless a specific box is explicitly allowed to be negative by business rules (commonly they are not on W-2). Also enforce reasonable upper bounds to catch data-entry errors (e.g., accidental extra zeros) and disallow commas or currency symbols if your system requires normalized numeric input. If formatting or sign rules fail, reject the submission and highlight the offending box(es).

8

Withholding cannot exceed corresponding wage bases (Boxes 2, 4, 6 vs. Boxes 1, 3, 5)

Check that federal income tax withheld (Box 2) is not greater than wages (Box 1) by an implausible margin and that Social Security/Medicare tax withheld (Boxes 4 and 6) are not inconsistent with their wage bases (Boxes 3 and 5). While Box 2 can exceed Box 1 in rare edge cases, large mismatches should be flagged for review; Boxes 4/6 should be tightly consistent with statutory rates and caps. If the mismatch exceeds configured tolerances, fail validation or require an override with justification.

9

Social Security tax calculation and wage base cap validation (Boxes 3 and 4)

Validate that Social Security tax withheld (Box 4) approximately equals 6.2% of Social Security wages (Box 3), subject to rounding rules, and that Box 3 does not exceed the Social Security wage base for 2025 (system-configured cap). This ensures compliance and catches common entry errors (e.g., swapped boxes, missing decimals). If the computed tax and reported tax differ beyond tolerance or wages exceed the cap without explanation, block submission or require correction/override.

10

Medicare tax calculation and Additional Medicare Tax reasonableness (Boxes 5 and 6)

Validate that Medicare tax withheld (Box 6) is at least 1.45% of Medicare wages (Box 5), with allowance for Additional Medicare Tax (0.9%) on wages above $200,000 and rounding tolerances. If Box 6 is less than the base 1.45% calculation (beyond tolerance), it indicates underwithholding or data entry error. On failure, require correction or an explicit exception workflow.

11

Tips and allocated tips logical consistency (Boxes 1, 7, 8)

Ensure Social Security tips (Box 7) and allocated tips (Box 8) are non-negative and that allocated tips (Box 8) are not included in Boxes 1, 3, 5, or 7 per the form instructions. Also flag cases where Box 7 is present but Box 3 is zero, or where Box 8 is present but Box 1/5 appear inconsistent, as these often indicate misplacement of tip amounts. If inconsistencies are detected, fail validation and prompt the user to verify tip reporting.

12

Dependent care benefits limit and inclusion rule check (Box 10 vs. Box 1)

Validate that dependent care benefits (Box 10) do not exceed typical statutory limits (commonly $5,000, or $2,500 for married filing separately) unless the system supports an override with explanation. Also ensure that any amount over the plan limit is included in Box 1 as required by instructions, which can be checked by comparing Box 1 against expected taxable wages if your system has that data. If Box 10 exceeds limits without proper inclusion/override, block submission or require correction.

13

Box 12 code/value pair validation (12a–12d)

For each Box 12 entry, require a valid IRS Box 12 code (e.g., D, E, G, W, DD, etc.) and a corresponding numeric amount where applicable, enforcing that codes are single/two-letter as defined and not duplicated when your business rules disallow duplicates. Validate code-specific constraints (e.g., DD is informational and should be non-negative; elective deferral codes should be within annual limits unless catch-up rules apply). If an invalid code is used or the amount is missing/invalid, reject the submission and identify the specific Box 12 line.

14

Box 13 checkbox dependency checks (Statutory employee / Retirement plan / Third-party sick pay)

Validate that Box 13 selections are consistent with other reported amounts and codes (e.g., if "Retirement plan" is checked, elective deferral codes in Box 12 are plausible; if "Third-party sick pay" is checked, wage/tax patterns should not be empty). While not all combinations are invalid, certain selections with zero wages/withholding can indicate an incomplete form. If dependencies fail, require user confirmation or correction before acceptance.

15

State and local tax section completeness when any state/local amount is present (Boxes 15–20)

If any of Boxes 16–20 contain amounts, require Box 15 state abbreviation and employer’s state ID number (where applicable), and require locality name (Box 20) when local wages/tax (Boxes 18–19) are present. Validate state code format and ensure state/local wage and tax fields are numeric and non-negative. If partial state/local data is provided, fail validation and prompt completion of the missing identifiers to avoid unusable state/local reporting.

Common Mistakes in Completing W-2

People often download a W-2 PDF from IRS.gov and assume any printed “Copy A” can be mailed to the SSA. The form text explicitly warns that the online printed Copy A is not scannable, and SSA may reject it or penalties may apply for filing forms that can’t be scanned. To avoid this, either e-file through SSA’s W-2 Online/approved software or order official scannable red-ink Copy A forms from the IRS and submit those.

Because employers keep copies for records, they sometimes photocopy Copy A or detach/trim the page to fit envelopes. The form states “photocopies are not acceptable” and “Send this entire page with Form W-3,” so SSA processing can fail if the submission isn’t the original scannable page in full. Use the official scannable Copy A (or e-file) and mail the full page unaltered.

Many filers treat the W-2 like a normal document and staple it to W-3, fold it for mailing, or cut margins for neatness. The form warns “Do Not Cut, Fold, or Staple Forms on This Page,” because scanning equipment relies on intact alignment and clean paper. Mail flat in a suitable envelope and use paper clips (if allowed) rather than staples, and never trim margins.

The multiple copies (A, B, C, 1, 2, D) look similar, so people accidentally give employees Copy A or send Copy B to SSA. This causes compliance issues: SSA/IRS may not receive the required copy, and employees may not have the correct copy for federal/state filing. Always match the copy label to its purpose: Copy A to SSA, Copy B for employee’s federal return, Copy 1/2 for state/local, Copy C for employee records, Copy D for employer records.

SSNs are frequently mistyped, transposed, or entered with placeholders, especially when payroll data is copied from onboarding forms. A wrong SSN can prevent wages from being credited to the employee’s SSA earnings record and can trigger SSA/IRS mismatch notices and the need for a Form W-2c correction. Verify the SSN against the employee’s Social Security card (and keep name/SSN consistent with SSA records) before issuing and filing.

The employee name line is structured (first name and initial, last name, suffix), but filers often cram the full name into one area, omit suffixes (Jr., Sr., III), or use nicknames. Even if the SSN is correct, a name mismatch can still cause SSA validation problems and require corrections. Use the employee’s legal name as shown on the Social Security card and place each part in the correct segment (including suffix when applicable).

Small employers sometimes enter an owner’s SSN instead of the Employer Identification Number, reuse an old EIN after entity changes, or mistype digits. An incorrect EIN can misattribute wage reports, delay processing, and lead to IRS notices or penalties. Confirm the EIN from the IRS assignment letter/official records and enter it exactly as issued.

Employers often use a DBA/trade name on one copy and a legal entity name on another, or they enter an outdated address/ZIP. Inconsistent or incorrect employer identification details can cause correspondence to go to the wrong place and complicate matching with IRS/SSA records. Use the legal employer name tied to the EIN and a current, complete mailing address with the correct ZIP code on all copies.

A common misunderstanding is assuming boxes 1, 3, and 5 should always match, or copying the same number into all wage boxes. In reality, pre-tax deductions (like certain retirement or cafeteria plan items) can make these boxes differ, and incorrect entries can lead to employee tax return errors and payroll tax reconciliation problems. Use payroll system totals that follow IRS definitions for each box and reconcile withheld taxes (2/4/6) to the corresponding wage bases.

Box 12 requires specific letter codes (e.g., D, W, DD) and separate entries (12a–12d), but filers often put descriptions instead of codes, use the wrong code, or lump multiple benefits into one line. This can mislead employees and cause incorrect tax reporting (for example, HSA contributions under code W or retirement deferrals under code D). Follow the Box 12 code list in the instructions, use one code per line with the correct amount, and don’t substitute free-text labels for codes.

Box 13 checkboxes are frequently guessed at or left blank because they seem optional, but they affect employee tax rules (for example, IRA deduction limits when “Retirement plan” is checked). Mischecking can cause employees to claim deductions they’re not eligible for or miss required reporting. Confirm each checkbox based on payroll/benefits facts for the year and apply the IRS definitions rather than assumptions.

When employees work in multiple states/localities, filers often omit the employer’s state ID number, use the wrong state abbreviation, or report state/local wages that don’t align with withholding. Errors here can lead to state notices, employee filing problems, and amended state returns. Use the correct state employer ID, ensure wages/taxes match the state/local payroll registers, and list the proper locality name when local tax applies.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out W-2 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-w-2-wage-and-tax-statement-2025 forms, ensuring each field is accurate.