Yes! You can use AI to fill out Form 941-X (Rev. April 2023), Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund

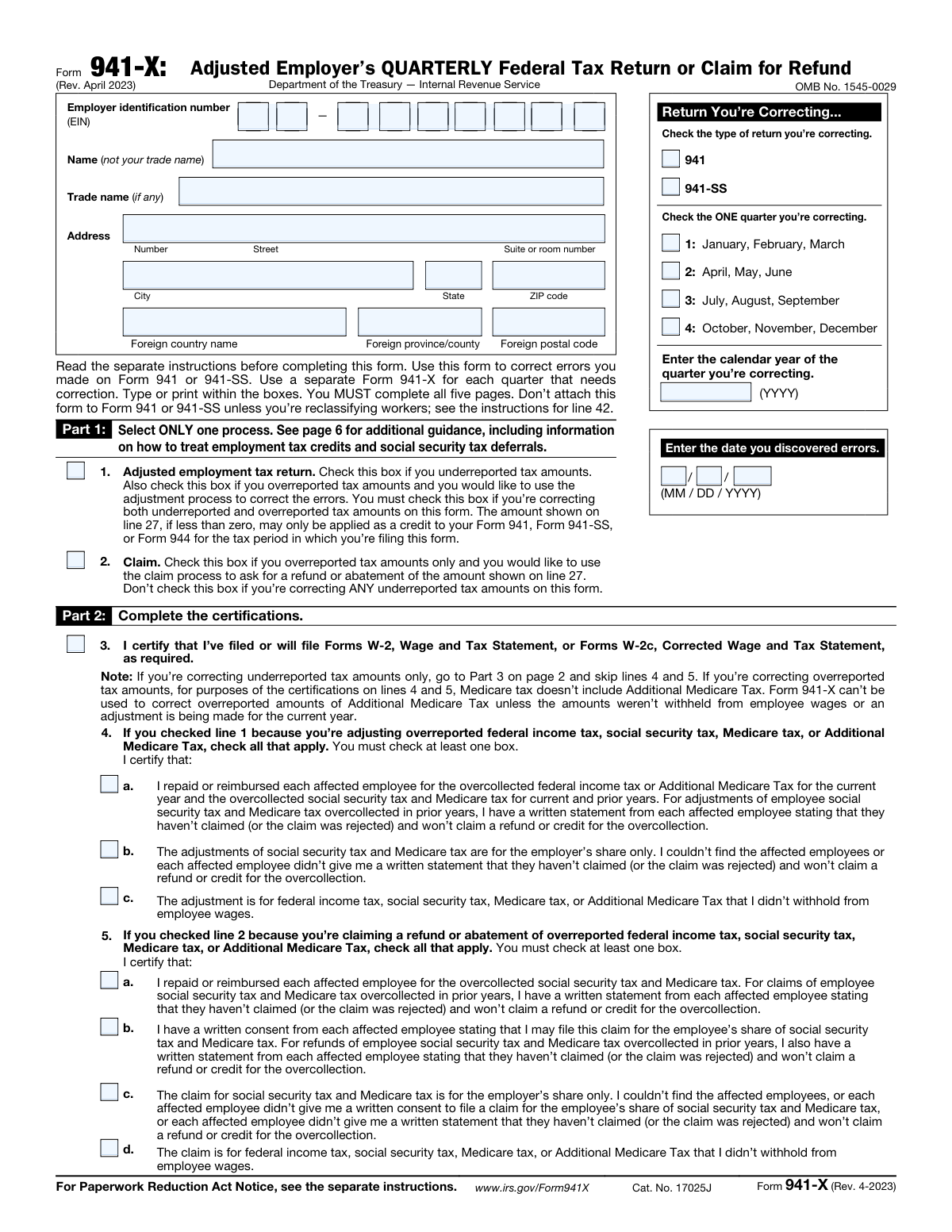

Form 941-X is the IRS’s official amended quarterly employment tax return used to fix mistakes made on Form 941 or Form 941-SS for a particular calendar quarter. It allows an employer to correct wages, withholding, Social Security and Medicare taxes, and certain credits/deferrals by reporting the corrected amounts, the originally reported amounts, and the difference. The form also requires certifications (including W-2/W-2c-related statements) and a detailed explanation of how corrections were determined. Filing the correct process (adjustment vs. claim) is important because it determines whether the result is applied as a credit to a current period return or requested as a refund/abatement.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 941-X using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 941-X (Rev. April 2023), Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund |

| Number of pages: | 6 |

| Language: | English |

| Categories: | employer forms, tax forms, federal forms, VA claim forms, federal tax forms, employer tax forms, quarterly tax forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 941-X Online for Free in 2026

Are you looking to fill out a FORM 941-X form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 941-X form in just 37 seconds or less.

Follow these steps to fill out your FORM 941-X form online using Instafill.ai:

- 1 Enter employer information (EIN, legal name, trade name if any, and address) and select the return type being corrected (941 or 941-SS).

- 2 Identify the exact quarter and calendar year being corrected and enter the date the errors were discovered.

- 3 Choose the correction process in Part 1: check either “Adjusted employment tax return” (line 1) or “Claim” (line 2) based on whether you underreported, overreported, or both.

- 4 Complete Part 2 certifications: confirm W-2/W-2c filing and check the required certification boxes for adjustments or refund claims (including repayment/consent statements where applicable).

- 5 In Part 3, enter corrections line-by-line using Columns 1–4 (corrected amount, originally reported amount, difference, and tax correction), including any applicable credits/deferrals, and compute the total on line 27 (balance due, credit, or refund).

- 6 In Part 4, provide a detailed written explanation of each correction (and indicate if corrections include both under- and overreported amounts or involve reclassified workers).

- 7 Sign and date Part 5 (and complete paid preparer information if applicable), then submit the form and pay any amount due by the filing time or request the credit/refund as indicated by your selected process.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 941-X Form?

Speed

Complete your Form 941-X in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 941-X form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 941-X

Form 941-X is used to correct errors you made on a previously filed Form 941 or Form 941-SS for a specific quarter. It can be filed either as an adjusted return or as a claim for refund/abatement, depending on the type of error.

Employers who already filed Form 941 or Form 941-SS and later discover mistakes in wages, withholding, Social Security/Medicare taxes, credits, or deferrals for a quarter generally need to file Form 941-X to correct them.

Yes. You must use a separate Form 941-X for each quarter that needs correction, and you must check the single quarter and year you’re correcting on the form.

Usually no. The form states you shouldn’t attach Form 941-X to Form 941 or 941-SS unless you’re reclassifying workers (see line 42 and the instructions for line 42).

Line 1 (Adjusted return) is used when you have underreported amounts, or when you want to handle overreported amounts through the adjustment process (generally resulting in a credit applied to a future return). Line 2 (Claim) is used only when you overreported amounts and want a refund or abatement.

No. Part 1 says to select ONLY one process on a single Form 941-X. If you need both processes (for example, to pay underreported amounts and also request a refund for overreported amounts), the guidance indicates you may need to file two separate Forms 941-X.

If you’re correcting both types, you generally must use the adjustment process (line 1) if you’re putting them on one form. Depending on timing (such as being within 90 days of the refund limitations period), you may be required to file two forms—one for adjustments (line 1) and one for a claim (line 2).

The form’s guidance says that if you’re correcting overreported amounts and you file within 90 days of the expiration of the period of limitations on credit/refund, you must use the claim process (line 2). If you file more than 90 days before it expires, you may be able to choose either adjustment (line 1) or claim (line 2), depending on what you want (credit vs. refund).

You’ll need your EIN, legal name (not trade name), trade name (if any), and address. You must also indicate whether you’re correcting Form 941 or 941-SS, select the quarter (1–4), enter the calendar year, and provide the date you discovered the errors.

Column 1 is the total corrected amount, Column 2 is what you originally reported (or previously corrected), and Column 3 is the difference (Column 1 minus Column 2, using a minus sign if negative). Column 4 is used for the tax correction calculations on certain lines.

Leave it blank. The form instructions in Part 3 state that if any line doesn’t apply, you should leave it blank rather than entering zeros.

Part 2 requires you to certify that you have filed or will file Forms W-2 or Forms W-2c as required. If your corrections change employee wage/tax amounts, you generally need to issue corrected wage statements (W-2c) and file them as required.

If you’re adjusting or claiming overreported amounts, you must check at least one certification box on line 4 (for adjustments) or line 5 (for claims). These certifications address whether you repaid/reimbursed employees, obtained written statements/consents, are correcting employer-share only, or are correcting amounts you didn’t withhold from employees.

Some lines show a full rate (for example, 0.124 for Social Security and 0.029 for Medicare) and note that if you’re correcting the employer share only, you use half the rate (0.062 for Social Security and 0.0145 for Medicare). Use the employer-only rate only when your correction applies solely to the employer portion, as described in the instructions.

If line 27 is more than zero, that’s the amount you owe and you should pay it by the time you file Form 941-X. If line 27 is less than zero, it’s either applied as a credit (if you checked line 1) or refunded/abated (if you checked line 2), following the instructions on line 27.

You must provide a detailed explanation of how you determined your corrections on line 43. You also check line 41 if a correction line includes both underreported and overreported amounts, and check line 42 if the corrections involve reclassified workers, then explain those situations on line 43.

Compliance Form 941-X

Validation Checks by Instafill.ai

1

Validates Employer Identification Number (EIN) format and presence

Checks that the EIN is provided and matches the IRS-required 9-digit format (commonly displayed as NN-NNNNNNN). This is critical because the EIN uniquely identifies the employer’s account and determines where the adjustment/claim is posted. If the EIN is missing or malformed, the submission should be rejected and routed back for correction because downstream matching and posting will fail.

2

Ensures employer legal name is present and not replaced by trade name

Verifies that the 'Name (not your trade name)' field is completed and is not blank or identical to the trade name when a separate legal name is required. The legal name is used for IRS account matching and correspondence, while the trade name is optional and informational. If the legal name is missing or appears to be a trade/DBA only, the form should be flagged for correction to prevent misidentification and processing delays.

3

Validates address completeness and domestic vs. foreign address consistency

Checks that the address includes required components (street/number, city, state, ZIP) for U.S. addresses, or foreign country plus foreign postal code/province when a foreign address is used. It also validates that U.S. state/ZIP are not provided alongside a foreign country in a conflicting way. If address fields are incomplete or inconsistent, the submission should fail validation because IRS notices/refunds may be undeliverable.

4

Validates 'Return you’re correcting' selection (941 vs 941-SS) is exactly one

Ensures the filer selects exactly one return type: Form 941 or Form 941-SS. This matters because the underlying tax rules, lines, and IRS processing streams differ between the two return types. If neither or both are selected, the form should be rejected because the correction cannot be applied to the correct original return.

5

Validates correcting quarter selection and calendar year format

Checks that exactly one quarter (1–4) is selected and that the correcting calendar year is a 4-digit year (YYYY). It should also validate that the quarter/year combination is plausible (e.g., not a future quarter/year relative to filing context, if known). If quarter or year is missing/invalid, the submission should fail because the IRS cannot associate the correction with the correct tax period.

6

Validates 'Date you discovered errors' format and logical relationship to corrected period

Ensures the discovered date is present and in MM/DD/YYYY format, and represents a real calendar date. Additionally, it should be logically on or after the end of the quarter being corrected (or at least not unreasonably before the quarter begins). If the date is invalid or illogical, the form should be flagged because it can affect timeliness/limitations analysis and audit trail integrity.

7

Enforces Part 1 process selection: exactly one of line 1 (Adjusted return) or line 2 (Claim)

Validates that the filer checks only one process box in Part 1. This is essential because the adjustment process and claim process have different legal and payment/refund handling, especially for negative line 27 amounts. If both or neither are checked, the submission should be rejected because the system cannot determine whether to apply a credit or issue a refund/abatement.

8

Validates Part 2 certification requirements based on selected process

Checks that line 3 certification is acknowledged, and that if line 1 is selected and overreported taxes are being adjusted, at least one checkbox on line 4 (a/b/c) is selected; if line 2 is selected, at least one checkbox on line 5 (a/b/c/d) is selected. These certifications are required to support employee repayment/consent rules and protect against improper refunds. If the required certification boxes are not selected, the submission should fail validation because the claim/adjustment is not legally complete.

9

Validates numeric field formatting for all monetary and wage/tip entries

Ensures all line entries in Columns 1–4 are numeric, allow decimals to cents where applicable, and allow negative values only where the form permits (Column 3 differences and resulting Column 4 corrections). It should also reject non-numeric characters (other than a leading minus sign) and enforce reasonable maximum lengths. If formatting fails, the submission should be rejected because calculations and IRS posting will be unreliable.

10

Validates Column arithmetic: Column 3 equals Column 1 minus Column 2 for each completed line

For each line with values in Columns 1 and 2, verifies that Column 3 exactly equals Column 1 minus Column 2, including correct sign handling for decreases. This is critical because Column 3 is the basis for tax correction computations and totals. If any line’s arithmetic is incorrect, the submission should be flagged or rejected because totals (lines 23 and 27) will be wrong.

11

Validates tax correction calculations in Column 4 for rate-based lines

Checks that Column 4 equals Column 3 multiplied by the printed rate for lines 8, 9, 10, 11, 12, and 13, with appropriate rounding rules (typically to cents). It should also validate that the employer-share-only alternative rates (0.062, 0.0145) are not used unless the filer’s context indicates employer-share-only corrections (e.g., supported by certification/statement logic). If the computed tax correction does not match, the submission should fail because the IRS will treat the return as mathematically incorrect.

12

Validates line 23 and line 27 totals equal the sum of referenced lines in Column 4

Ensures line 23 equals the sum of Column 4 amounts from lines 7 through 22, and line 27 equals the sum of Column 4 amounts from lines 23 through 26c. This matters because line 27 determines balance due vs. credit/refund and drives payment/refund workflows. If totals do not reconcile, the submission should be rejected or routed to error correction to prevent incorrect billing or refunds.

13

Enforces time-window eligibility for COVID-era and other period-limited lines

Validates that lines restricted to specific quarters/periods are only used when the correcting quarter/year falls within the allowed window (e.g., lines 9–10 for leave taken before 4/1/2021; ERC lines 18a/26a/30/31a for quarters after 3/31/2020 and before 1/1/2022; line 33a only for Q2 2020; line 33b only for Q3/Q4 2020; lines 35–40 only for quarters after 3/31/2021). This prevents invalid credit/deferral claims outside statutory periods. If a restricted line is populated for an ineligible quarter, the submission should fail validation and require correction.

14

Requires explanation in Part 4 when indicated and when corrections exist

Checks that line 43 contains a detailed explanation whenever any corrections are entered in Part 3, and specifically requires explanation when line 41 (both underreported and overreported on a line) or line 42 (reclassified workers) is checked. The explanation is necessary for IRS review and substantiation of the adjustments/claims. If line 43 is blank when required, the submission should be rejected as incomplete.

15

Validates signature block completeness and date format (taxpayer and preparer as applicable)

Ensures the form is signed and dated (MM/DD/YYYY) by an authorized person, with printed name, title, and best daytime phone present. If a paid preparer section is completed, it should validate preparer signature, PTIN format, firm information, and preparer phone/ZIP completeness. If signatures/dates are missing or invalid, the submission should fail because an unsigned 941-X is not a valid return/claim.

Common Mistakes in Completing Form 941-X

People often check line 2 (Claim) because they want money back, even when they also have any underreported amounts, which makes the selection invalid. This can delay processing, trigger IRS correspondence, or require filing a corrected 941-X again. Before checking a box, confirm whether you have underreported amounts, overreported amounts only, and whether you’re within 90 days of the refund statute expiration; when in doubt, follow the decision table on page 5–6 and file two 941-X forms if required.

A very common error is trying to fix multiple quarters on one 941-X or mixing corrections across quarters in the same set of numbers. This causes mismatches with IRS quarter-specific records and can lead to rejected adjustments or long delays. Use one Form 941-X per quarter, and double-check that the “Correcting quarter” and “Correcting calendar year” match the original Form 941/941-SS you’re correcting.

Filers frequently select the wrong quarter (1–4), enter the wrong year format, or leave the discovery date blank or in the wrong format. This can affect statute-of-limitations determinations and may cause the IRS to question timeliness or route the form incorrectly. Enter the year as YYYY, the discovery date as MM/DD/YYYY, and ensure the quarter/year align with the payroll period that produced the original error.

Many employers put the DBA/trade name in the “Name (not your trade name)” field or transpose digits in the EIN. The IRS may not be able to match the filing to the correct account, which can delay credits/refunds and generate notices. Use the exact legal entity name associated with the EIN (as shown on IRS notices/CP letters) and verify the EIN digit-by-digit before submitting.

Form 941-X explicitly requires all five pages, yet filers often submit only the pages with numbers or forget to sign and date Part 5. An unsigned or incomplete submission is typically treated as invalid and will be returned or suspended, delaying any adjustment or refund. Include every page (even if some lines are blank), complete the signer’s printed name/title/phone, and ensure the signature and date are present.

When correcting overreported amounts, filers often skip lines 4/5, fail to check at least one sub-box (a–c or a–d), or certify reimbursement/consent they don’t actually have. This can invalidate the claim, create audit risk, and lead to IRS requests for employee statements/consents. Follow the note under line 3: if you have any overreported amounts, complete the applicable certification section and keep the required employee statements/consents in your records.

A frequent mistake is entering the “difference” in Column 1, copying the corrected totals into Column 2, or forgetting to use a minus sign for negative differences. This leads to incorrect tax corrections in Column 4 and an incorrect total on line 27, potentially creating an erroneous balance due or refund. Column 1 must be the corrected total, Column 2 the originally reported (or previously corrected) amount, and Column 3 the difference (with a minus sign when negative).

Filers sometimes multiply by 0.062/0.0145 (employer share only) when they are actually correcting both employer and employee shares, or they use the full combined rate when they intended employer-only corrections. This miscalculates Column 4 and can cause underpayment, overpayment, or IRS recalculations and notices. Confirm whether your correction is for both shares or employer share only, then use the exact rate shown on the line (and the employer-only rate only when the instructions allow it).

Because the form includes multiple pandemic-era credit lines with strict date windows, filers often enter amounts on lines that don’t apply to the quarter being corrected (for example, ERC lines outside eligible quarters). This can result in disallowed credits, processing delays, and potential penalties if it creates an underpayment. Before entering any credit amounts, verify the quarter’s eligibility and use only the lines explicitly permitted for that time period (as noted on each line).

Line 16 requires Form 8974, but filers often claim the credit without attaching it or attach the wrong quarter’s form. Missing attachments commonly lead to the credit being denied or the IRS requesting additional documentation, delaying resolution. If you enter an amount on a line that requires an attachment, include the correct supporting form and ensure it matches the same quarter/year as the 941-X.

Many submissions include vague explanations like “payroll error” or omit the narrative entirely, even though line 43 requires a detailed method for how corrections were determined. Weak explanations increase the chance of IRS follow-up, slow processing, and can undermine the credibility of the correction. Clearly describe what was wrong, what records you used, how you computed each affected line, and check line 41 for mixed under/over corrections and line 42 for reclassified worker issues, then explain those specifically.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 941-X with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-941-x-rev-april-2023-adjusted-employers-quart forms, ensuring each field is accurate.