Fill out employer forms

with AI.

Employer forms represent the backbone of business administration, covering everything from federal tax obligations and health insurance reporting to workplace safety compliance. These documents are essential for maintaining a legal and transparent relationship between a company, its employees, and various government agencies. For instance, forms such as the IRS Form 941 for quarterly tax returns or the SS-4 for obtaining an Employer Identification Number (EIN) are foundational to business operations, financial accountability, and regulatory compliance.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About employer forms

Typically, business owners, HR managers, and payroll specialists need these forms during key milestones, such as hiring new staff, managing workers' compensation claims, or reporting annual unemployment taxes. In specific jurisdictions, employers may also need specialized workers compensation forms, such as WCB Alberta forms, to document workplace exposure and ensure workers receive the benefits they are entitled to. Accurate completion of these forms is vital to avoid audits, legal disputes, or financial penalties that can arise from simple clerical errors or missed deadlines.

Managing a high volume of paperwork can be time-consuming for growing businesses and established enterprises alike. Tools like Instafill.ai use AI to fill these forms in under 30 seconds, handling sensitive data accurately and securely to save you valuable administrative time and reduce the burden of manual data entry.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds

How to Choose the Right Form

Managing employer obligations requires precise documentation. Whether you are setting up a new business, reporting quarterly taxes, or handling a workplace injury, selecting the correct form ensures compliance with federal and state regulations. Use the categories below to find the right document for your current need.

Federal Tax and Payroll Compliance

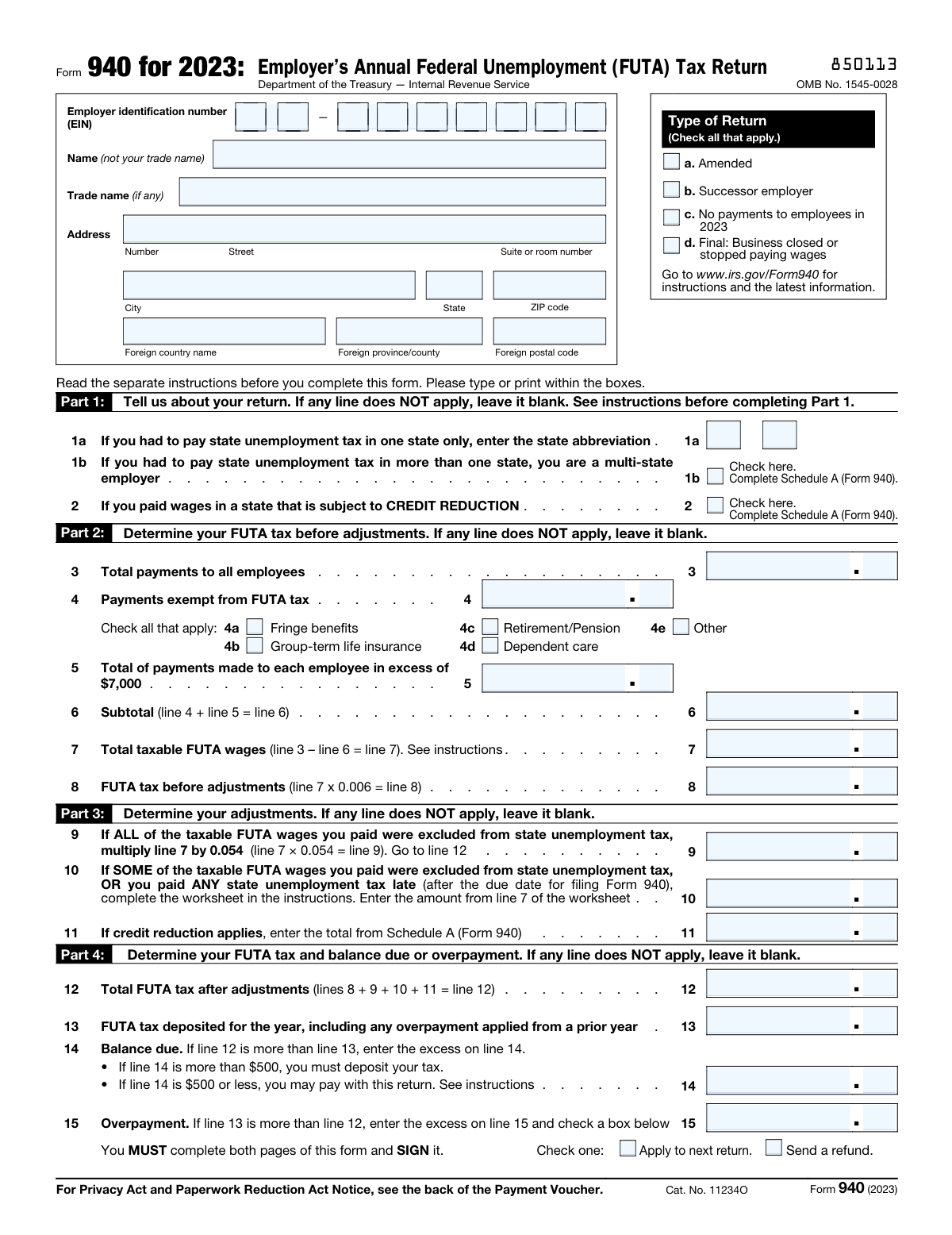

Most employers will frequently interact with IRS payroll forms. Use Form 941 (Employer’s Quarterly Federal Tax Return) to report income taxes and FICA taxes withheld from employee paychecks. If you realize you made an error on a previous submission, use Form 941-X to make corrections. For annual reporting of unemployment taxes, you will need Form 940.

If you are a new business owner or forming a new entity, your first step is often filing Form SS-4 to obtain an Employer Identification Number (EIN). For businesses with tipped employees, Form 8027 is required to report tip income and allocated tips.

Workers' Compensation and Injury Reporting

When an employee is injured on the job, reporting requirements vary by jurisdiction. In Texas, use DWC Form-001 (Employer’s First Report of Injury or Illness) to notify your insurance carrier. If you have already made voluntary payments to an injured worker and need to seek reimbursement from your carrier, file Form DWC002. For Canadian employers in Alberta, Form C139 (Employer’s Information Questionnaire) is used by WCB Alberta to verify employment details and assess workplace exposure.

Employee Benefits and Retirement

To manage health insurance reporting under the ACA, use Form 1095-C to document the coverage offered to employees. If your company utilizes TIAA retirement plans, you may need Form F10462 (Easy Transfer Form) to move funds into an employer-sponsored plan or Form F10794 for cash withdrawals or rollovers from private employer plans.

Hiring and State Registration

For new hires, the E-Verify Memorandum of Understanding is a critical agreement for verifying employment eligibility. If you are operating in California, you must register your business or update your account using Form DE 1 (Commercial Employer Account Registration).

Form Comparison

| Form | Primary Purpose | Filing Frequency | Target Authority |

|---|---|---|---|

| Form 940, Employer’s Annual FUTA Tax Return | Reports annual federal unemployment tax liability for the business. | Annually by January 31st. | Internal Revenue Service (IRS) |

| Form 941, Employer’s Quarterly Federal Tax Return | Reports withheld income, Social Security, and Medicare taxes from wages. | Quarterly (every three months). | Internal Revenue Service (IRS) |

| Form 1095-C, Employer-Provided Health Insurance Offer and Coverage | Reports health insurance coverage details offered to full-time employees. | Annually. | Internal Revenue Service (IRS) |

| Form SS-4, Application for Employer Identification Number | Used to apply for a federal tax ID number for entities. | Once, upon business formation or structural change. | Internal Revenue Service (IRS) |

| Form 8027, Employer’s Annual Information Return | Reports receipts and tip income for large food/beverage establishments. | Annually. | Internal Revenue Service (IRS) |

| Form 8994, Employer Credit for Paid Family and Medical Leave | Claims tax credits for providing qualifying paid leave to employees. | Annually with income tax return. | Internal Revenue Service (IRS) |

| Form DE 1, Commercial Employer Account Registration | Registers a new business for state payroll taxes in California. | Once, within 15 days of paying wages. | California Employment Development Department (EDD) |

| C139 – Employer’s Information Questionnaire (WCB Alberta) | Provides employment and noise exposure details for injury claims. | As needed during a WCB claim investigation. | Workers' Compensation Board (WCB) Alberta |

| DWC Form-001, Employer’s first report of injury or illness | Reports work-related injuries or illnesses to the insurance carrier. | Within 8 days of incident or notice. | Texas Workers' Compensation Carrier |

| Form F10462, Moving Funds to an Employer-Sponsored Retirement Plan at TIAA | Authorizes the transfer or rollover of retirement funds to TIAA. | As needed to consolidate retirement assets. | TIAA (Financial Institution) |

| The E-Verify Memorandum of Understanding for Employers | Binding agreement to participate in electronic employment eligibility verification. | Once, during initial program enrollment. | Department of Homeland Security (DHS) |

| Form 941-X, Adjusted Employer’s QUARTERLY Federal Tax Return | Corrects errors or claims refunds for previously filed quarterly returns. | As needed to fix specific quarterly mistakes. | Internal Revenue Service (IRS) |

Tips for employer forms

Ensure you are using the correct form for the specific jurisdiction, such as IRS Form 941 for federal taxes versus Form DE 1 for California state registration. Mixing these up can lead to significant processing delays and potential compliance issues with different tax authorities.

For forms like the DWC001S or WCB Alberta C139, timing is critical to the claims process. Filing these reports as soon as an incident occurs ensures that your employees receive benefits quickly and helps you maintain accurate safety records for insurance and regulatory purposes.

Many employer forms, such as the WCB C139 questionnaire, require specific attachments like noise level readings or payroll records. Having these documents digitized and ready to reference will prevent you from having to pause and search for data in the middle of a filing.

A common mistake is entering an incorrect EIN or legal business name on tax forms like the SS-4 or 941. Always verify these details against your official IRS records to ensure your filings are correctly attributed to your business account and to avoid rejected forms.

AI-powered tools like Instafill.ai can complete complex employer forms in under 30 seconds with high accuracy. This is a major time-saver for HR professionals and business owners dealing with multiple forms, and the platform ensures your sensitive data stays secure throughout the entire process.

When using forms like TIAA F10462 to move retirement funds, confirm the specific plan numbers and institution addresses beforehand. Providing precise account information ensures a smooth rollover process and prevents funds from being delayed due to administrative errors.

If you discover an error on a previously filed tax return, use a specific adjustment form like Form 941-X rather than filing a new original return. This allows you to clearly explain the difference between the original and corrected amounts, which simplifies the reconciliation process for tax authorities.

Frequently Asked Questions

Employer forms are a broad category of documents used by businesses to comply with federal, state, or provincial regulations regarding taxes, hiring, and workplace safety. They include everything from IRS tax returns and employment eligibility verifications to workers' compensation reports and retirement benefit plan transfers.

Most employers who pay wages to employees must file Form 941 quarterly to report income tax, Social Security, and Medicare taxes. If you need to report annual unemployment taxes, you would use Form 940, while Form SS-4 is required to establish your business's tax identity with the IRS.

Timelines vary by jurisdiction, but in many regions like Texas or Alberta, employers must file a first report of injury, such as DWC Form-001 or WCB forms, within a few days of the incident. These forms are essential for initiating the workers' compensation claims process and ensuring the employee receives necessary benefits.

If you discover an error on a submitted Form 941, you should use Form 941-X, the Adjusted Employer’s Quarterly Federal Tax Return. This form allows you to correct wages, withholdings, and credits, and helps you determine if you are entitled to a refund or if additional tax is owed.

Yes, AI tools like Instafill.ai can process and fill out employer forms in under 30 seconds. The system accurately extracts data from your source documents and places it into the correct fields on the PDF, reducing the risk of manual entry errors.

Using traditional manual methods, complex tax or workers' compensation forms can take 15 to 30 minutes to complete. However, with AI-powered platforms, you can generate a ready-to-print or ready-to-file version of these forms in less than half a minute.

The E-Verify MOU is a formal agreement between an employer and the Department of Homeland Security that outlines the rules for using the E-Verify system. By signing this, an employer commits to electronically verifying the employment eligibility of all new hires to ensure they are legally authorized to work in the United States.

The C139 Employer’s Information Questionnaire is used by WCB Alberta to investigate workplace exposure, particularly regarding noise-induced hearing loss claims. It helps the board verify employment history and safety protocols to determine if a worker’s condition is related to their time at your company.

New employers in California must use Form DE 1, the Commercial Employer Account Registration, to register with the Employment Development Department (EDD). This form establishes your state tax account, which is necessary for reporting payroll taxes and complying with state labor regulations.

Form 1095-C is specifically for Applicable Large Employers to report the health insurance coverage they offered to their full-time employees. It helps the IRS determine if the employer is meeting the requirements of the Affordable Care Act and if the employee is eligible for certain tax credits.

Submission locations depend on the specific form; IRS forms are typically mailed to a regional service center or filed electronically. State-specific forms like the DE 1 or Texas DWC forms are sent to their respective state agencies, while retirement forms are submitted directly to the financial institution, such as TIAA.

Glossary

- EIN (Employer Identification Number)

- A unique nine-digit number assigned by the IRS to identify a business entity for tax and reporting purposes, similar to a Social Security number for individuals.

- Tax Withholding

- The process where an employer deducts a specific amount from an employee's pay to cover federal, state, and local income taxes.

- FICA (Federal Insurance Contributions Act)

- A federal law that requires employers to withhold and pay taxes to fund Social Security and Medicare programs.

- FUTA (Federal Unemployment Tax Act)

- A federal tax paid exclusively by employers that funds state unemployment insurance agencies and provides benefits to workers who have lost their jobs.

- WCB (Workers’ Compensation Board)

- A government agency, such as WCB Alberta, that manages disability insurance programs to provide benefits to workers injured on the job and protect employers from lawsuits.

- E-Verify

- A web-based system through which employers confirm the eligibility of their employees to work legally in the United States by matching records from the DHS and Social Security Administration.

- Rollover

- The transfer of retirement assets from one employer-sponsored plan or financial institution to another, typically performed to avoid immediate tax liabilities.

- MOU (Memorandum of Understanding)

- A formal agreement between an employer and a government agency, such as the Department of Homeland Security, outlining the rules and responsibilities for participating in programs like E-Verify.

- CW-1 Status

- A nonimmigrant classification that allows employers in the Commonwealth of the Northern Mariana Islands to hire foreign workers who are otherwise ineligible for other nonimmigrant visa categories.