Yes! You can use AI to fill out Form 540 2EZ, California Resident Tax Return

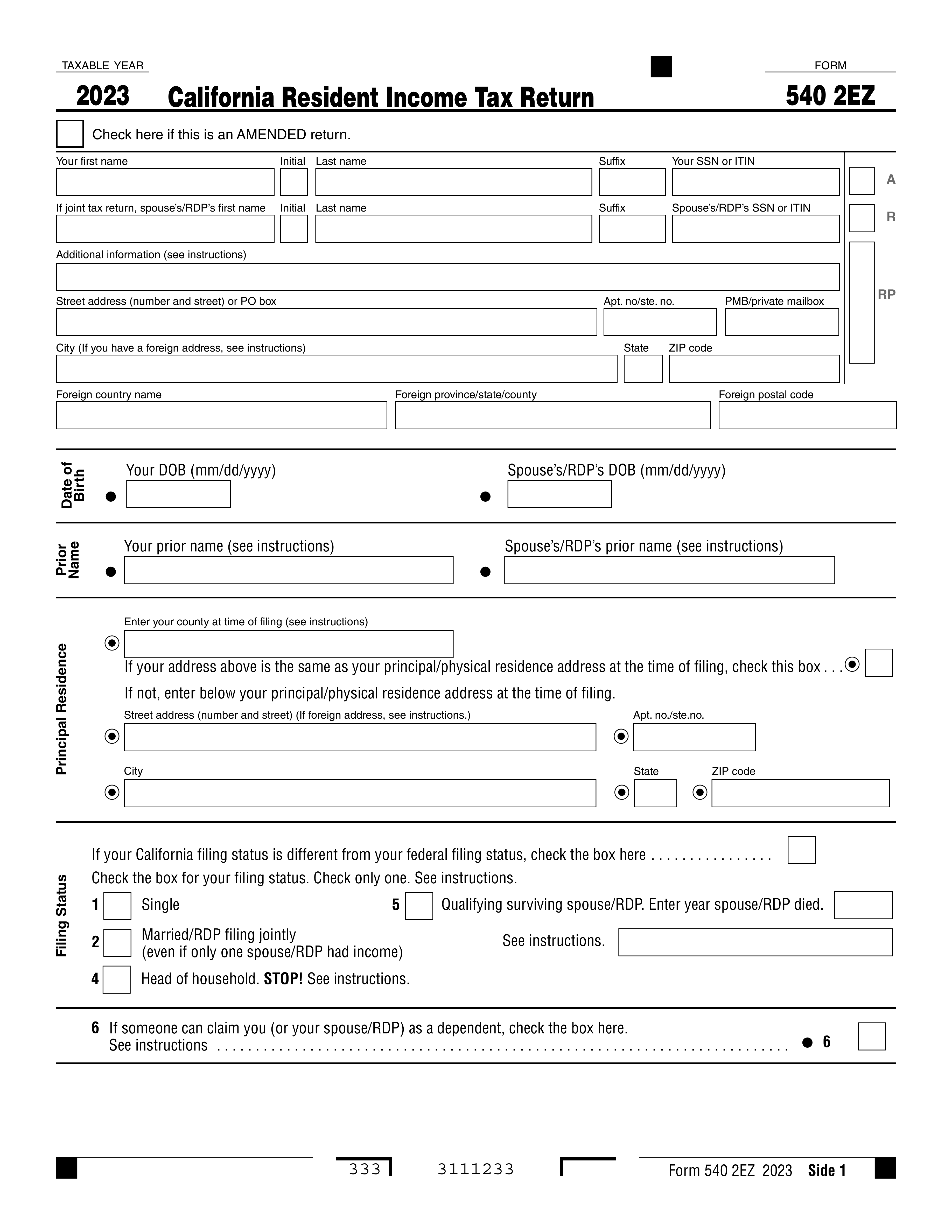

Form 540 2EZ, California Resident Income Tax Return, is used by California residents to report their income and calculate their tax liability. It simplifies the filing process for individuals with basic tax situations, ensuring compliance with state tax laws.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 540 2EZ using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 540 2EZ, California Resident Tax Return |

| Form issued by: | Franchise Tax Board |

| Number of fields: | 135 |

| Number of pages: | 5 |

| Version: | 2023 |

| Instructions: | https://ses.stf.com/old/CAST.TY23.Forms/CAST.TY23.Forms.Subforms/CAST.TY23.Forms.Subforms.Draft/CAST.TY23.Forms.Subforms.Draft.Individual/5402EZ-Ins.pdf |

| Language: | English |

| Categories: | California tax forms, tax forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 540 2EZ Online for Free in 2026

Are you looking to fill out a FORM 540 2EZ form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 540 2EZ form in just 37 seconds or less.

Follow these steps to fill out your FORM 540 2EZ form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 540 2EZ.

- 2 Enter your personal information and filing status.

- 3 Fill in income and deduction details.

- 4 Sign and date the form electronically.

- 5 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 540 2EZ Form?

Speed

Complete your Form 540 2EZ in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 540 2EZ form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 540 2EZ

The California Resident Income Tax Return (Form 540 2EZ) requires the following information:\n1. Personal information: full name, Social Security Number or Individual Taxpayer Identification Number (ITIN), and California driver's license or California identification card number (if applicable).\n2. Filing status: single, married/RDP filing jointly, head of household, or qualifying widow(er) or surviving spouse.\n3. Income: all sources of California taxable income, including wages, salaries, tips, and net self-employment income.\n4. Adjustments to income: student loan interest deduction, tuition and fees deduction, and other adjustments.\n5. Taxable income: total taxable income after adjustments.\n6. Tax computation: California taxable income, taxable income taxed at the disability rates, taxable income taxed at the alternative minimum tax rates, and taxable income taxed at the personal income tax rates.\n7. Credits: California Earned Income Tax Credit, Child and Dependent Care Expenses Credit, and other credits.\n8. Payments: estimated tax payments, withholding, and refunds.\n9. Signature: signature of the taxpayer and spouse (if filing jointly).

A California resident is required to file a California Resident Income Tax Return (Form 540 2EZ) if they meet any of the following conditions:\n1. Their total California taxable income is over the filing requirement.\n2. They have a filing requirement due to a dependent or a nonresident spouse.\n3. They are required to file because of a court order.\n4. They are a part-year resident or a nonresident alien with California-sourced income.\n5. They are required to file because of a change in tax status.\n6. They are required to file to claim a refund of withholding or estimated tax payments.\n7. They are required to file to claim certain credits or deductions.\n8. They are required to file to meet certain reporting requirements.\n9. They are required to file to meet certain other tax law provisions.

A principal residence is a place where an individual lives most of the time. It is the place where the individual maintains a permanent home and returns to after being away. A foreign address, on the other hand, refers to an address outside of the United States. For tax purposes, a California resident's principal residence is the place where they live most of the time and is usually where they maintain their family, social, and economic ties. A foreign address, on the other hand, is an address outside of the United States and is not considered a California residence for tax purposes. California residents with a foreign address may still be required to file a California Resident Income Tax Return (Form 540 2EZ) if they have California-sourced income.

The California Resident Income Tax Return (Form 540 2EZ) offers the following filing status options:\n1. Single: a taxpayer who is not married or who is legally separated or widowed.\n2. Married/RDP filing jointly: a taxpayer who is married or registered domestic partner (RDP) and files a joint return with their spouse or RDP.\n3. Head of household: a taxpayer who maintains a home and pays more than half the cost of maintaining it, and who has a qualifying person living with them.\n4. Qualifying widow(er) or surviving spouse: a taxpayer who was married at the time of their spouse's death and who has not remarried.\n5. Married filing separately: a taxpayer who is married but files a separate return from their spouse or RDP.

A joint tax return is a tax return filed by a married couple or registered domestic partners (RDPs) who choose to combine their income and deductions for tax purposes. Each spouse or RDP reports their individual income, deductions, and credits on the joint return. The total income, deductions, and credits are then calculated to determine the total tax liability. A separate tax return, on the other hand, is a tax return filed by each spouse or RDP individually. Each spouse or RDP reports their own income, deductions, and credits on their own return. The total tax liability for each spouse or RDP is then calculated separately. Married couples and RDPs may choose to file a joint return if it results in a lower tax liability, or they may choose to file separate returns for various reasons, such as to claim separate deductions or to avoid potential tax liabilities.

The California Use Tax is a state tax on the storage, use, or other consumption in California of tangible personal property or services that are subject to the California Sales and Use Tax but have not been taxed at the time of purchase. Use tax is generally due when you bring taxable items into California for personal use, or when you purchase taxable items from an out-of-state retailer that does not collect California sales tax. The use tax is due on the earlier of the date of consumption or the date of purchase, and it is reported and paid with your California Resident Income Tax Return.

The California Resident Income Tax Return (Form 540 2EZ) allows taxpayers to make voluntary contributions to various state funds. These funds include the California Competes Tax Credit Allocation Committee, the California Clean Energy and Pollution Reduction Fund, and the California Wildlife Conservation Board. Taxpayers may choose to contribute to one or more of these funds by checking the appropriate box on line 47 of the Form 540 2EZ and entering the amount of the contribution in the space provided. These contributions are not tax deductible for state or federal income tax purposes.

The Individual Shared Responsibility Penalty (ISRP) is a penalty imposed on individuals who do not maintain minimum essential health coverage (MEC) for themselves and their dependents for a month or more during the calendar year. The penalty is calculated as a percentage of the total household income for the year, up to the maximum amount set by law. For taxable years beginning in 2021, the maximum penalty is $2,880 per adult and $1,440 per child, or 2.5% of the total household income, whichever is greater. Taxpayers who are exempt from the requirement to maintain MEC or who qualify for a hardship exemption are not subject to the penalty.

You can make a payment for your California Resident Income Tax Return (Form 540 2EZ) by electronic funds transfer (EFT) or by check. To make a payment by EFT, you can use the California EFT system or the Financial Institution Payment (FIP) system. To make a payment by check, you should make the check payable to the 'State of California' and include it with your completed Form 540 2EZ when you file. If you are unable to pay the full amount due with your return, you may be able to set up a payment plan with the California Franchise Tax Board. Contact the FTB for more information.

A refund is a payment made by the California Franchise Tax Board to a taxpayer who has overpaid their California Resident Income Tax. A no amount due status means that the taxpayer has paid the exact amount of tax owed for the tax year. In other words, a refund is a payment of excess tax paid, while no amount due indicates that the taxpayer has paid the correct amount of tax due for the year.

To authorize direct deposit of your refund for the California Resident Income Tax Return (Form 540 2EZ), you need to provide your banking information on the form. This includes your routing number and account number. Make sure to enter this information accurately to ensure that your refund is deposited into the correct account. Once you have filled out the form with all required information, you can submit it electronically or by mail to the Franchise Tax Board. If your refund is electronically filed and approved, you can expect to receive your refund within 10 business days.

The voter registration information option on the California Resident Income Tax Return (Form 540 2EZ) allows taxpayers to update their voter registration information. Taxpayers can use this option to register to vote, update their current registration information, or cancel their registration. This information is forwarded to the California Secretary of State for processing. It is important to note that providing this information is voluntary, and taxpayers are not required to fill out this section of the form.

The Health Care Coverage Info. option on the California Resident Income Tax Return (Form 540 2EZ) allows taxpayers to report their health care coverage information for themselves, their spouse, and their dependents. This information is used to determine eligibility for the California Earned Income Tax Credit (CalEITC) and the Young Child Tax Credit (YCTC). Taxpayers are required to provide this information to the Franchise Tax Board to receive these credits. It is important to provide accurate and complete information to ensure that you receive all the credits you are eligible for.

The Suicide Prevention Voluntary Tax Contribution Fund and Mental Health Crisis Prevention Voluntary Tax Contribution Fund are optional contributions that taxpayers can make on the California Resident Income Tax Return (Form 540 2EZ). These funds support mental health and suicide prevention programs in California. Taxpayers can make a contribution by checking the box on line 47 or 48 of the form, depending on which fund they would like to contribute to. Contributions are voluntary, and taxpayers are not required to make a contribution to receive their tax refund.

Falsifying information on the California Resident Income Tax Return (Form 540 2EZ) is a serious offense that can result in penalties and even criminal charges. The Franchise Tax Board takes fraud very seriously and has various methods to detect and investigate tax fraud. Penalties for falsifying information can include fines, interest on unpaid taxes, and even criminal prosecution. It is important to provide accurate and complete information on your tax return to avoid any potential penalties or legal consequences.

A paid preparer is an individual or a business that helps prepare and file your California Resident Income Tax Return (Form 540 2EZ) for a fee. The preparer will ask for your personal information, income details, and other necessary data to complete the form. They will also ensure that the form is accurately filled out and filed with the California Franchise Tax Board. It's important to note that you are responsible for the accuracy of the information on the return, even if it was prepared by someone else.

The Third Party Designee option on the California Resident Income Tax Return (Form 540 2EZ) allows you to designate an individual or a business to receive certain information from the California Franchise Tax Board regarding your tax account. This can include things like notices, refunds, or copies of your tax return. Designating a third party designee can be helpful if you want someone else to handle your tax matters or if you want to keep your tax information separate from your personal mail. To designate a third party designee, you will need to complete Form 5884, Third Party Designee, and submit it along with your tax return.

Compliance Form 540 2EZ

Validation Checks by Instafill.ai

1

Ensures the taxpayer qualifies to use Form 540 2EZ

The AI ensures that the taxpayer is eligible to file using Form 540 2EZ by meticulously reviewing the 'Qualifying to Use Form 540 2EZ' section. It checks against the specific criteria such as residency status, income thresholds, and allowable tax credits. The AI cross-references the taxpayer's information with the eligibility requirements to confirm that the form is appropriate for their tax situation. If discrepancies are found, the AI flags the issue for review to prevent incorrect form submission.

2

Confirms that the full name and address are correctly printed

The AI confirms that the taxpayer's full name, including the middle initial and last name, along with the address, are accurately printed at the top of the form. It ensures that the printed information matches the taxpayer's legal documents and prior year tax returns to maintain consistency. The AI also checks for any typographical errors or omissions that could lead to processing delays or misdirected correspondence from the tax authorities.

3

Verifies that the Date of Birth (DOB) is entered correctly

The AI verifies that the Date of Birth (DOB) for each taxpayer is entered in the correct mm/dd/yyyy format. When filing jointly, it ensures that the DOB matches the order of names listed on the form to avoid confusion. The AI also checks for logical errors, such as future dates or improbable historical dates, to ensure the accuracy of the taxpayer's age-related information, which could affect tax calculations.

4

Checks if a prior name is provided

The AI checks if a prior name is provided for individuals who may have filed their previous year's tax return under a different last name, such as due to marriage or divorce. It ensures that the name change is noted on the form to maintain continuity with past tax records. The AI also assists in linking the current tax return with the taxpayer's historical data, which is crucial for accurate record-keeping and future references.

5

Validates the correct entry of SSN or ITIN

The AI validates the correct entry of the Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for each taxpayer. It ensures that the numbers are entered in the designated fields and correspond to the same order as the names on the form. The AI also checks for common input errors, such as transposed digits or incorrect number lengths, which are critical for the taxpayer's identity verification and tax processing.

6

Confirms the appropriate filing status box is checked

The AI ensures that the correct filing status is selected on the California Resident Income Tax Return form. It cross-references the taxpayer's federal filing status for consistency, while also accounting for any differences that may arise if the taxpayer is a Registered Domestic Partner (RDP). The AI checks for common errors such as selecting multiple statuses or leaving the status section blank, which could lead to incorrect tax calculations or processing delays.

7

Ensures all dependents' information is entered correctly

The AI meticulously verifies that each dependent's first name, last name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and their relationship to the taxpayer are accurately entered on the form. This validation is crucial as it affects personal exemptions and credits. The AI also checks for any discrepancies or missing information that could result in the rejection of the dependent's information or an incorrect tax liability.

8

Verifies the accurate reporting of income

The AI scrutinizes the reported amounts of wages, interest income, dividend income, pension income, and capital gain distributions to ensure accuracy. It cross-checks these figures against the taxpayer's supporting documents, such as W-2s, 1099s, and other financial statements. The AI also looks for common reporting errors, such as transposed numbers or misreported income, which could lead to an incorrect tax calculation or potential audits.

9

Calculates tax using the California 2EZ Table

The AI applies the California 2EZ Table to calculate the tax accurately for those eligible to use this simplified method. It also completes the Dependent Tax Worksheet when necessary, particularly if the taxpayer can be claimed as a dependent on someone else's return. The AI ensures that the correct tax rates and brackets are applied based on the taxpayer's income level and filing status, which is essential for determining the correct tax liability.

10

Confirms entry of applicable credits

The AI confirms that all applicable credits, such as the Senior Exemption, Nonrefundable Renter's Credit, and tax credits for children and dependents, are correctly entered on the California Resident Income Tax Return form. It checks for eligibility requirements and ensures that the correct credit amounts are applied. The AI also alerts the taxpayer to any missing credits they may be entitled to, which can reduce the overall tax liability and maximize the taxpayer's refund.

11

Checks the reporting of total tax withheld and any estimated tax payments

Ensures that the total amount of tax withheld, as reported on W-2s, 1099s, and other relevant documents, is accurately captured. Confirms that any estimated tax payments made throughout the tax year are correctly reported and applied to the taxpayer's account. Cross-references the taxpayer's records with the information provided to verify the accuracy of the reported amounts. Alerts the user to any discrepancies between the reported figures and the documentation provided to prevent errors in tax liability calculations.

12

Verifies the correct reporting of use tax owed using the Use Tax Worksheet or Estimated Use Tax Lookup Table

Validates that the taxpayer has correctly reported any use tax owed by utilizing the appropriate Use Tax Worksheet or Estimated Use Tax Lookup Table. Ensures that the calculations are based on the taxpayer's purchases and the applicable tax rates. Checks for common errors in the use tax reporting process, such as incorrect tax rate application or mathematical mistakes. Provides guidance to the taxpayer on how to accurately calculate and report use tax to comply with California tax regulations.

13

Determines if the Individual Shared Responsibility Penalty applies using form FTB 3853

Assesses the taxpayer's requirement to pay the Individual Shared Responsibility Penalty by analyzing the information provided on form FTB 3853. Verifies that the taxpayer's health coverage status, exemptions, and any other relevant factors are accurately reflected in the form. Calculates the penalty amount, if applicable, based on the taxpayer's income and household size. Ensures that the penalty, if due, is correctly included in the overall tax calculation.

14

Calculates the amount of overpaid tax or tax due and ensures the correct figures are entered

Computes the final tax position of the taxpayer by considering all reported income, deductions, credits, and payments. Determines whether the taxpayer has overpaid and is due a refund or has underpaid and owes additional tax. Ensures that the correct figures for overpayment or tax due are entered on the tax return. Provides a clear summary of the tax calculation to facilitate understanding and review by the taxpayer.

15

Confirms the bank account information for direct deposit is provided and accurate

Verifies that the taxpayer has provided complete and accurate bank account information for the purpose of direct deposit of any tax refund. Checks the routing number, account number, and account type against the taxpayer's bank records to prevent errors in the refund process. Ensures that the bank account is eligible for direct deposits and that the taxpayer's name on the account matches the name on the tax return. Alerts the taxpayer to any issues with the bank account information to avoid delays or complications with the refund.

16

Ensures the tax return is signed and dated

The AI ensures that the California Resident Income Tax Return form is properly signed and dated by the taxpayer. If filing jointly, the AI confirms that both spouses or Registered Domestic Partners (RDPs) have provided their signatures. It also checks that the current date is included alongside the signature(s), verifying the document's completion date. Additionally, the AI validates that all necessary contact information is present and accurately filled out.

17

Validates the Paid Preparer's Information section

The AI validates that the Paid Preparer's Information section is fully completed if a paid preparer was utilized for the tax return. It verifies that all required fields, including the preparer's name, address, phone number, and Preparer Tax Identification Number (PTIN), are filled in. The AI also checks for the presence of the preparer's signature and the date signed, ensuring that the preparer's declaration is compliant with regulatory requirements.

18

Checks if the Third Party Designee section is completed correctly

The AI checks if the Third Party Designee section of the tax return is completed accurately in case the taxpayer wishes to authorize someone to discuss their tax return with the tax agency. It ensures that the designee's name, phone number, and personal identification number (PIN) are provided. The AI also confirms that the taxpayer has marked the 'Yes' box to authorize the designee, ensuring proper authorization protocols are followed.

19

Ensures federal Form(s) W-2 and all supporting forms and schedules are attached correctly

The AI ensures that federal Form(s) W-2, along with all necessary supporting forms and schedules, are attached correctly behind Side 5 of Form 540 2EZ. It verifies that the documents are organized in the proper order and securely attached to the tax return. The AI also checks for completeness and legibility of the forms to prevent any processing delays due to missing or unreadable information.

20

Verifies the tax return is mailed to the correct address

The AI verifies that the tax return is mailed to the correct address, which is determined based on whether the taxpayer is expecting a refund or has an amount due. It ensures that the address used matches the official addresses provided by the tax authority for the respective type of return. The AI also checks for any updates to the mailing addresses to prevent misdirection of the tax return.

Common Mistakes in Completing Form 540 2EZ

California Resident Income Tax Return forms require accurate and complete personal information, including name and address. Incorrect or incomplete information may lead to processing delays or even rejection of the form. To avoid this mistake, double-check all entered information against official documents, such as a driver's license or passport, and ensure that all required fields are filled out completely.

Determining the correct filing status is crucial when completing the California Resident Income Tax Return. Failing to check the appropriate filing status may result in incorrect calculations and potential penalties. To ensure accuracy, review the instructions carefully and consider all applicable factors, such as marital status, dependents, and income levels. Consult the instructions or a tax professional if uncertain.

Social Security Numbers (SSNs) and Individual Taxpayer Identification Numbers (ITINs) are essential pieces of information required on the California Resident Income Tax Return. Entering incorrect or incomplete numbers may lead to processing delays or even rejection of the form. To avoid this mistake, double-check all entered numbers against official documents and ensure that all required fields are filled out completely. If an ITIN is required and not already on file, apply for one well in advance of the tax filing deadline.

California Resident Income Tax Return forms require reporting of all sources of income, including wages, tips, and income from investments. Failing to report all income may result in underpayment of taxes and potential penalties. To ensure accuracy, review all income statements and tax documents carefully and report all income, even if it was not reported to the employer or other payer. Consult the instructions or a tax professional if uncertain.

Calculating taxes correctly is essential when completing the California Resident Income Tax Return. Failing to use the correct tax table or making calculation errors may result in underpayment or overpayment of taxes. To avoid this mistake, review the instructions carefully and use the correct tax table for your filing status and income level. Double-check all calculations and consult a tax professional if uncertain.

California Resident Income Tax Return form (FTB 540 or 541) offers various credits to taxpayers. Neglecting to claim these credits can result in missed opportunities to reduce your tax liability. Ensure you review the instructions carefully and gather all necessary documentation to support your eligibility for each credit. Failure to claim applicable credits may lead to an inaccurate tax calculation and potential overpayment or underpayment of taxes.

California state tax law requires taxpayers to report their total tax withheld and estimated tax payments. Neglecting to report these amounts can lead to underreported income and potential penalties. Ensure you gather all necessary documentation, including W-2s, 1099s, and records of estimated tax payments. Double-check your calculations to ensure accuracy.

California residents are required to report and pay use tax on purchases made from out-of-state sellers that do not collect sales tax. Neglecting to report and pay this tax can lead to penalties and interest. Ensure you maintain records of these purchases and calculate the use tax owed. Failure to report and pay use tax can result in an inaccurate tax calculation and potential underpayment of taxes.

California Resident Income Tax Return forms must be signed and dated by the taxpayer or their authorized representative. Neglecting to sign and date the form can delay the processing of your tax return and potentially result in penalties. Ensure you sign and date the form before submitting it.

California Resident Income Tax Return forms may require the attachment of additional forms and schedules. Neglecting to attach these documents can delay the processing of your tax return and potentially result in penalties. Ensure you carefully review the instructions and gather all necessary documentation.

California Franchise Tax Board processes tax returns at specific addresses based on the taxpayer's residence. Incorrect mailing addresses can result in significant delays in processing and potential loss of important correspondence. To avoid this mistake, double-check the mailing address provided on the tax form or consult the FTB website for the correct address based on your tax residence.

Providing incomplete or incorrect information for dependents can lead to processing delays, potential underpayment or overpayment of taxes, and even penalties. Ensure that all required information, such as names, Social Security numbers, and relationship status, is accurately reported for each dependent. Additionally, be sure to include dependents who meet the eligibility requirements, even if they do not have a Social Security number.

Providing incorrect or incomplete date of birth information for taxpayers or dependents can result in processing delays and potential underpayment or overpayment of taxes. Ensure that all date of birth information is entered accurately and completely, using the format required by the tax form. Double-check this information against official documents, such as birth certificates or Social Security cards, to minimize errors.

If a taxpayer has changed their last name due to marriage, divorce, or other reasons, they must report their prior name on the tax return. Failure to do so can result in processing delays and potential underpayment or overpayment of taxes. To avoid this mistake, ensure that all required name information is accurately reported, including any prior names that may be relevant.

Direct deposit of tax refunds is a convenient and secure way to receive refunds, but taxpayers must provide accurate bank account information to receive the funds. Failure to provide this information can result in processing delays and potential loss of the refund. To avoid this mistake, ensure that all required bank account information is accurately reported, including routing number and account number, and that the account is in the taxpayer's name.

California Resident Income Tax Return form (TR-2050) requires taxpayers to indicate whether they had minimum essential coverage for the tax year. Failing to check the appropriate box or providing incorrect information regarding this coverage can lead to penalties or incorrect calculations of tax liability. To avoid this mistake, taxpayers should carefully review their health insurance coverage and ensure they accurately report their status on the form. It is recommended to gather all necessary documentation, such as insurance policy information, before completing the form.

If a taxpayer has used the services of a paid tax preparer to complete their California Resident Income Tax Return, they are required to provide the preparer's name, PTIN (Preparer Tax Identification Number), and signature on the form. Neglecting to provide this information can result in processing delays or potential penalties. To ensure compliance, taxpayers should gather the necessary information from their preparer before submitting the form.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 540 2EZ with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 540-2ez-2023 forms, ensuring each field is accurate.