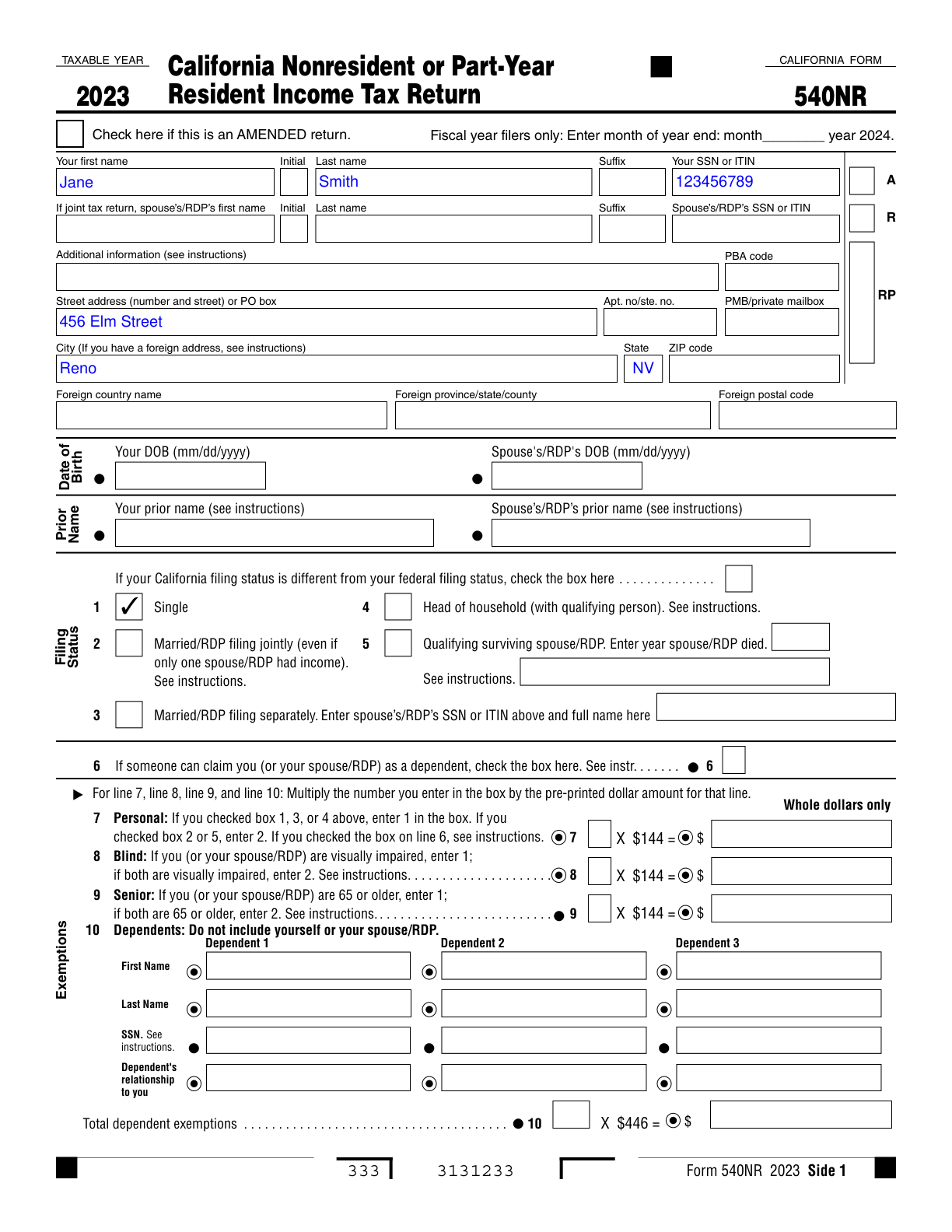

Form 540NR, California Nonresident Tax Return Completed Form Examples and Samples

Explore our comprehensive Form 540NR example, showcasing a completed California Nonresident Tax Return. This sample provides insights into filing as a nonresident, covering scenarios like working in California with detailed instructions on filling out personal info, filing status, and California source income.

Form 540NR Example – Nonresident Tax Return

How this form was filled:

This example of Form 540NR details a nonresident filing scenario where the filer works in California. It includes personal information, filing status as single, and details regarding California source income. The form is signed and dated.

Information used to fill out the document:

- Filer’s Name: Jane Smith

- Filing Status: Single

- Address: 456 Elm Street, Reno, NV

- Social Security Number: 123-45-6789

- California Source Income: $30,000

- Total Income: $50,000

- Tax Withheld: $2,500

- Signature: Jane Smith

- Date: 04/10/2025

What this filled form sample shows:

- Correct filing status marked as Single

- Accurate California source income declaration

- Properly calculated tax withheld amount

- Signed and dated form

Form specifications and details:

| Use Case: | Nonresident with California source income |