Form 568, LLC Income Return Completed Form Examples and Samples

Explore a detailed example of Form 568 for a multi-member LLC filing in California. Understand key components such as income, expenses, member shares, and tax calculations to ensure accurate filing and compliance.

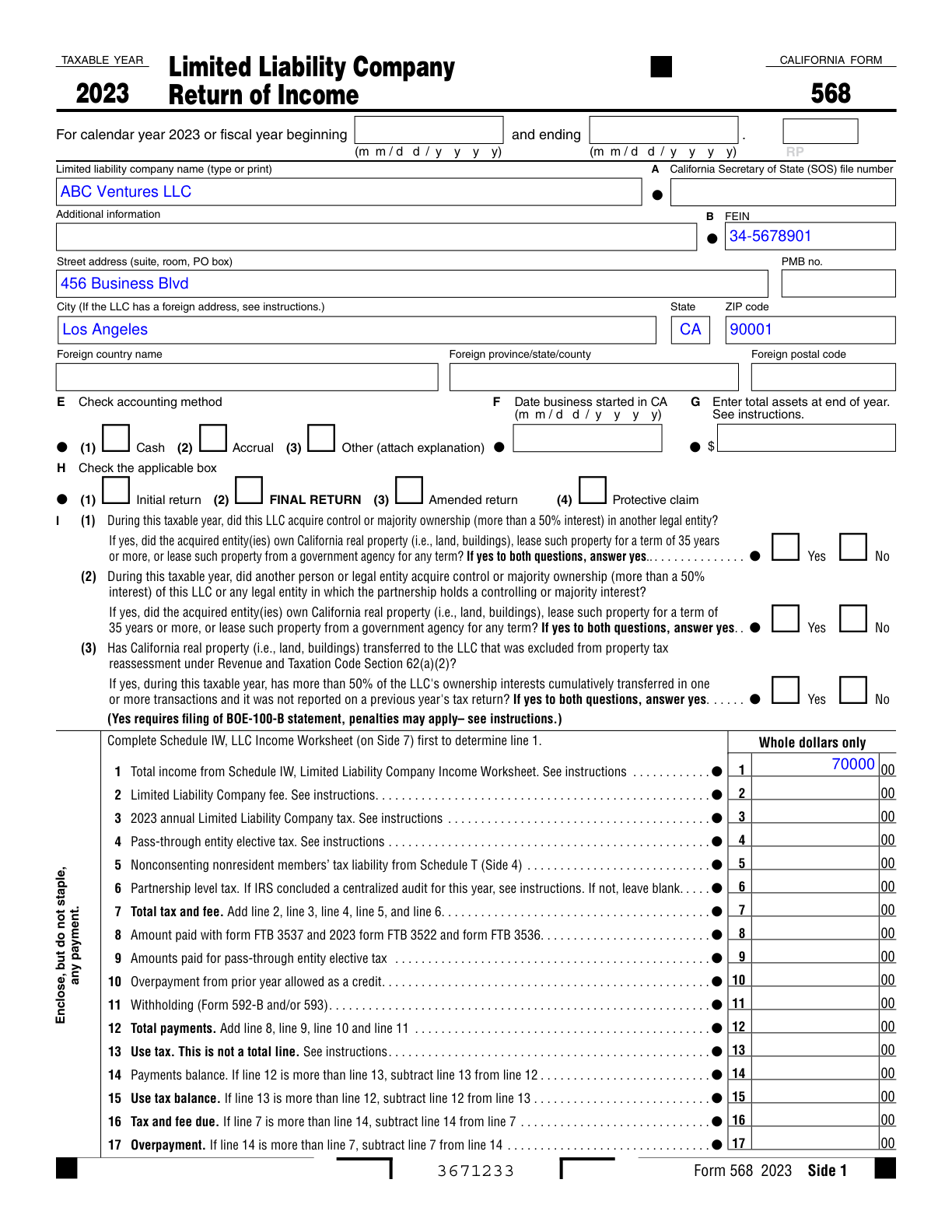

Form 568 Example – Multi-Member LLC

How this form was filled:

This example demonstrates the completion of Form 568 for a multi-member LLC filing in California. Key details include the reporting of income, expenses, and member information comprising two partners with equal shares. The form includes the primary LLC details, financial data, member information, and tax calculations.

Information used to fill out the document:

- LLC Name: ABC Ventures LLC

- EIN: 34-5678901

- Address: 456 Business Blvd, Los Angeles, CA 90001

- Taxable Year: 2024

- Gross Income: 150000

- Total Expenses: 80000

- Net Income: 70000

- Member 1 Name: Alice Smith

- Member 1 Ownership Percentage: 50%

- Member 2 Name: Bob Johnson

- Member 2 Ownership Percentage: 50%

- Signature: Alice Smith

- Date: 03/01/2025

What this filled form sample shows:

- Completing the LLC details including name and EIN

- Reporting comprehensive financial data such as income and expenses

- Accurately listing member information with ownership percentages

- Properly calculated net income and tax obligations

- Correct signature and date placement for authenticity

Form specifications and details:

| Use Case: | Multi-member LLC filing in California |

| Filing Requirement: | Annual LLC tax returns in California |