Yes! You can use AI to fill out Form 5884-C, Work Opportunity Credit

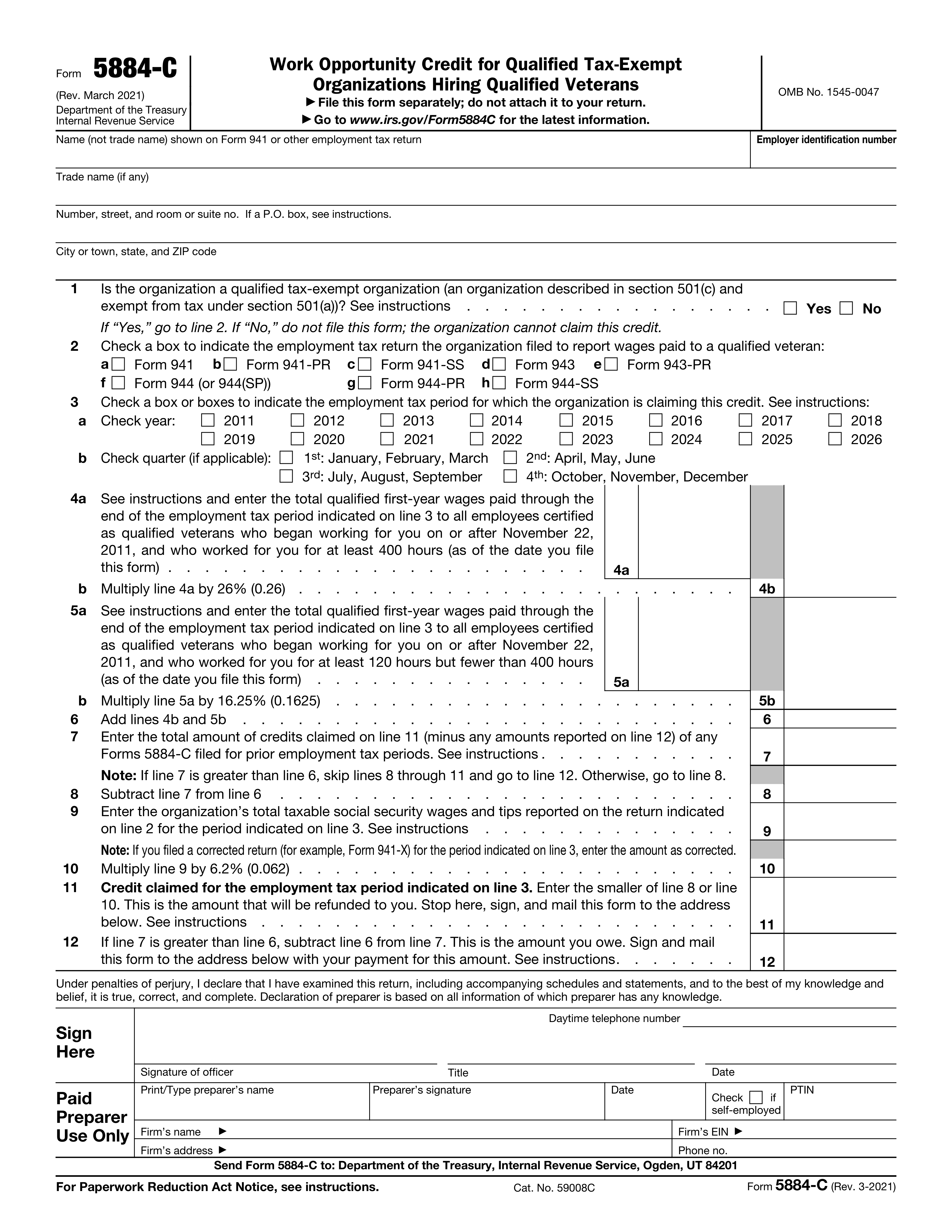

Form 5884-C, Work Opportunity Credit, is used by qualified tax-exempt organizations to claim a credit for qualified first-year wages paid to veterans. This form is important as it allows organizations to reduce their social security tax liability, encouraging the hiring of veterans.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 5884-C using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 5884-C, Work Opportunity Credit |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 55 |

| Number of pages: | 4 |

| Version: | 2021 |

| Language: | English |

| Categories: | veteran forms, veterans forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 5884-C Online for Free in 2026

Are you looking to fill out a FORM 5884-C form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 5884-C form in just 37 seconds or less.

Follow these steps to fill out your FORM 5884-C form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 5884-C.

- 2 Enter organization name and EIN.

- 3 Indicate if the organization is tax-exempt.

- 4 Select the employment tax return filed.

- 5 Fill in qualified wages and credit amounts.

- 6 Sign and date the form electronically.

- 7 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 5884-C Form?

Speed

Complete your Form 5884-C in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 5884-C form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 5884-C

Form 5884-C, Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans, is a tax form used by qualified tax-exempt organizations to claim a work opportunity credit for wages paid to qualified veterans. The purpose of the form is to provide the IRS with information about the organization, the veteran employee, and the wages paid.

A qualified tax-exempt organization is any organization that is tax-exempt under section 501(c)(3) of the Internal Revenue Code and is also exempt from paying federal income tax on unrelated business taxable income. This includes religious, charitable, educational, and other types of organizations that meet the requirements of section 501(c)(3).

A qualified veteran is a veteran who was discharged or released from active duty in the U.S. Armed Forces after November 11, 1993, and prior to January 1, 2021. The veteran must also have been unemployed for at least 4 weeks or have received unemployment compensation for at least 6 weeks during the 1-year period ending on the hiring date. Employment of a qualified veteran is verified by submitting Form DD-214, Certificate of Release or Discharge from Active Duty, or other acceptable documentation to the employer. The employer must retain this documentation in their records.

Qualified first-year wages are wages paid to a qualified veteran during the first year of employment. The wages must be paid for services performed by the veteran in the United States and must be in the form of cash remuneration, including the cash value of tips, bonuses, and other forms of compensation. Wages paid for overtime work, holiday pay, and other forms of additional compensation are also included.

Form 5884-C must be filed with the IRS no later than January 31 of the year following the year in which the qualified veteran was hired. For example, if a qualified veteran was hired in 2022, Form 5884-C must be filed by January 31, 2023. However, if the organization is required to file an annual information return (Form 990, 990-EZ, or 990-PF) or an employment tax return (Form 941), the Form 5884-C may be filed with one of those returns instead of being filed separately.

To claim the Work Opportunity Credit (WOC) for qualified first-year wages paid to qualified veterans, follow these steps: 1. Obtain Form 5884-C, Election to Use Work Opportunity Credit for Snap and Qualified Veterans Hiring, and complete Part I. 2. Obtain Form 8850, Pre-screening Notice and Certification Request for the Veteran, and have the veteran complete it. 3. Obtain a certification from the appropriate state workforce agency or the Department of Labor Veterans' Employment and Training Service that the veteran is a qualified veteran. 4. Attach Form 8850 and the certification to Form 5884-C and file it with your quarterly employment tax return, Form 941, on or before the due date (including extensions). 5. Report the wages and credits on Form 5884-C, line 1a and 1b, respectively.

Form 5884-C should be filed with your quarterly employment tax return, Form 941. It is important to note that the due date for filing Form 941, including Form 5884-C, can be extended by filing Form 7004, Application for Automatic Extension of Time To File Certain Employer Returns, up to 30 days. However, the deposit requirements for employment taxes still apply.

To be considered a qualified veteran for the Work Opportunity Credit, the veteran must be certified by the appropriate state workforce agency or the Department of Labor Veterans' Employment and Training Service. The certification confirms that the veteran is entitled to the credit based on their disability status or discharge status. To obtain the certification, the veteran must provide proof of their military service or disability status, and the employer must complete and submit Form 8850, Pre-screening Notice and Certification Request for the Veteran, to the state workforce agency or the Department of Labor.

To report and claim the Work Opportunity Credit for qualified first-year wages paid to qualified veterans, follow these steps: 1. Obtain Form 5884-C, Election to Use Work Opportunity Credit for Snap and Qualified Veterans Hiring, and complete Part I. 2. Obtain Form 8850, Pre-screening Notice and Certification Request for the Veteran, and have the veteran complete it. 3. Obtain a certification from the appropriate state workforce agency or the Department of Labor Veterans' Employment and Training Service that the veteran is a qualified veteran. 4. Attach Form 8850 and the certification to Form 5884-C and file it with your quarterly employment tax return, Form 941, on or before the due date (including extensions). 5. Report the wages and credits on Form 5884-C, line 1a and 1b, respectively.

Line 4a on Form 5884-C represents the total amount of qualified first-year wages paid to all qualified veterans during the tax year. Line 5a represents the total amount of the Work Opportunity Credit that can be claimed for those wages. The difference between the two lines is the amount of the credit, which is calculated based on the percentage of the qualified first-year wages paid to each qualified veteran, as specified in the Work Opportunity Credit percentage table.

Line 7 of Form 5884-C reports the total wages, tips, and other compensation paid to qualified veterans during the tax year. Line 11 reports the total wages, tips, and other compensation paid to all other employees who are not qualified veterans. The difference between these two lines is the amount of wages paid specifically to qualified veterans.

The preferred method of payment for the amount owed on line 12 of Form 5884-C is by check or money order made payable to the 'United States Treasury.' Payments can also be made electronically through the Electronic Federal Tax Payment System (EFTPS).

A paid preparer is an individual who is compensated for preparing and filing a tax return, including Form 5884-C, on behalf of a taxpayer. The paid preparer must sign the form and provide their Preparer Tax Identification Number (PTIN) on line 13. They are responsible for ensuring the accuracy of the information reported on the form.

The Paperwork Reduction Act (PRA) is a federal law that requires federal agencies to obtain approval from the Office of Management and Budget (OMB) before collecting certain information from the public. Form 5884-C, like all IRS forms, includes a PRA notice. This notice explains the types of information being collected, the purpose of the collection, and the reporting requirements. Completing and filing Form 5884-C constitutes consent to the collection of this information.

Failing to file Form 5884-C on time or accurately can result in penalties and interest charges. The IRS may assess a penalty of up to $500 for each late or incorrect filing, with a maximum penalty of $50,000 for large organizations. In addition, failure to file may delay the processing of the Work Opportunity Credit for the tax year in question. It is important to file Form 5884-C accurately and on time to avoid these potential consequences.

Form 5884-C, Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans, can be filed by organizations with multiple locations or trusts. Each location or trust that intends to claim the work opportunity credit must file a separate Form 5884-C. The employer identification number (EIN) of the tax-exempt organization must be reported on each form. If the organization or trust has multiple worksites, each worksite may be considered a separate location for the purpose of determining the work opportunity credit. It is important to note that each location or trust must maintain separate records of the wages paid and hours worked by each qualified veteran. The instructions for Form 5884-C provide further details on reporting multiple locations or trusts. For more information, refer to the instructions for Form 5884-C and IRS Publication 970, Tax Benefits for Businesses and Farmers.

The IRS provides several resources to help organizations understand and file Form 5884-C, Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans. These resources include:

* Instructions for Form 5884-C: This document provides detailed information on how to complete and file the form, including information on eligibility, calculation of the credit, and recordkeeping requirements.

* IRS Publication 970, Tax Benefits for Businesses and Farmers: This publication provides an overview of various tax credits and incentives available to businesses and farmers, including the work opportunity credit for qualified tax-exempt organizations.

* IRS Website: The IRS website offers a variety of resources related to Form 5884-C, including forms, instructions, and frequently asked questions.

* IRS Customer Service: The IRS offers customer service assistance by phone and mail. Taxpayers can contact the Business and Specialty Tax Line at 1-800-829-4933 for assistance with Form 5884-C.

* Tax Professionals: Tax professionals, such as certified public accountants (CPAs) and enrolled agents, can provide guidance and assistance with the filing of Form 5884-C. It is important to choose a qualified tax professional with experience in tax-exempt organizations and the work opportunity credit.

Compliance Form 5884-C

Validation Checks by Instafill.ai

1

Name Matching with Form 941

Ensures that the name provided on the Work Opportunity Credit form for Qualified Tax-Exempt Organizations matches the name on Form 941 or any other related employment tax return. This is crucial for maintaining consistency across tax documents and for the IRS to accurately associate the forms with the correct entity.

2

EIN Validation

Confirms that the Employer Identification Number (EIN) is present on the form and is a valid number. This involves checking the format and cross-referencing with IRS records to ensure that the EIN corresponds to the named organization. The EIN is essential for the IRS to identify the organization's tax account.

3

Trade Name Inclusion

Verifies that if a trade name is applicable to the organization, it is properly included on the form. This helps distinguish the organization from others, especially if the legal name is common or similar to other entities. Including the trade name can also facilitate easier processing of the form by the IRS.

4

Complete Address Verification

Checks that the address provided on the form is complete and accurate, including the number, street, room or suite number, city or town, state, and ZIP code. A complete address is necessary for any correspondence related to the form and to ensure that the organization can be located for any official matters.

5

Qualified Tax-Exempt Organization Confirmation

Validates that the organization has checked 'Yes' on line 1 of the form to confirm that it is a qualified tax-exempt organization. This is a mandatory step for the organization to be eligible for the Work Opportunity Credit, and it must be clearly indicated on the form.

6

Confirms the correct type of employment tax return filed is indicated on line 2.

The AI ensures that the type of employment tax return specified on line 2 matches the organization's filing requirements. It cross-references the provided information with the known types of employment tax returns to confirm accuracy. The AI also checks for common errors, such as selecting an incorrect form type or providing inconsistent information that does not align with the organization's tax status. This validation is crucial to ensure that the credit is applied to the proper tax return.

7

Verifies the employment tax period for which the credit is claimed is correctly indicated on line 3.

The AI verifies that the employment tax period stated on line 3 is accurately represented and falls within the appropriate tax year for the credit claim. It checks the format of the date or period to ensure it adheres to the required standards and confirms that the period is eligible for the Work Opportunity Credit. The AI also prevents the input of future dates or periods outside the tax year in question, thereby avoiding potential errors in the credit claim process.

8

Calculates and validates the total qualified first-year wages on line 4a for employees who worked at least 400 hours.

The AI calculates the total qualified first-year wages for employees who have completed at least 400 hours of service. It ensures that the wages entered on line 4a are for eligible employees and that the total is accurately computed. The AI also checks for any discrepancies in the wage amounts and flags any values that fall outside of expected ranges, based on historical data and wage trends. This validation is essential for determining the correct credit amount.

9

Ensures the correct multiplication of the amount on line 4a by 26% to determine the value on line 4b.

The AI ensures that the amount entered on line 4a is correctly multiplied by 26% to arrive at the figure on line 4b. It performs the multiplication operation and cross-verifies the result with the entered value. If there is a mismatch, the AI highlights the discrepancy for correction. This step is vital to accurately calculate the credit portion based on the qualified first-year wages of employees who worked at least 400 hours.

10

Calculates and validates the total qualified first-year wages on line 5a for employees who worked at least 120 hours but fewer than 400 hours.

The AI calculates the total qualified first-year wages for employees who have worked at least 120 hours but fewer than 400 hours. It validates that the wages reported on line 5a correspond to the correct employee category and that the sum is accurately tallied. The AI also scrutinizes the data for any anomalies or figures that deviate from expected patterns, ensuring that only eligible wages are included in the calculation for the credit.

11

Ensures the correct multiplication of the amount on line 5a by 16.25% to determine the value on line 5b.

The AI ensures that the amount entered on line 5a is accurately multiplied by 16.25%. This calculation is critical as it determines the value that will be reported on line 5b, which contributes to the computation of the Work Opportunity Credit. The AI verifies that the multiplication is performed correctly and that the resulting figure is accurately reflected on line 5b, preventing any discrepancies that could arise from manual calculation errors.

12

Confirms the correct addition of amounts from lines 4b and 5b to determine the total on line 6.

The AI confirms that the amounts on lines 4b and 5b are correctly added together. This step is essential for determining the total Work Opportunity Credit amount on line 6. The AI checks for any addition errors and ensures that the sum of these two lines matches the total reported on line 6, thus ensuring the accuracy of the cumulative credit amount.

13

Verifies the correct entry of the total amount of credits claimed on prior Forms 5884-C on line 7.

The AI verifies that the total amount of credits previously claimed on any prior Forms 5884-C is correctly entered on line 7. This validation is crucial to avoid overstating the credit amount for the current period. The AI cross-references past submissions to ensure that the figure on line 7 is accurate and that it reflects all previously claimed credits.

14

Calculates the correct subtraction of line 7 from line 6 to determine the amount on line 8.

The AI calculates the correct subtraction of the amount on line 7 from the total on line 6 to determine the net credit amount on line 8. This step is vital to ascertain the current credit amount available to the organization. The AI ensures that the subtraction is accurate, resulting in the correct net credit being reported on line 8.

15

Ensures the organization’s total taxable social security wages and tips are accurately reported on line 9.

The AI ensures that the organization's total taxable social security wages and tips are accurately reported on line 9. This figure is important for determining the limitation on the credit that can be claimed. The AI checks that the amount on line 9 is correct and that it corresponds with the organization's payroll records, ensuring compliance with tax regulations.

16

Confirms the correct multiplication of line 9 by 6.2% to determine the value on line 10

The AI ensures that the value on line 9 is accurately multiplied by 6.2% to calculate the amount for line 10. This step is crucial as it determines the credit amount that can be claimed. The AI cross-verifies the mathematical accuracy of the multiplication and alerts if there is any discrepancy. It also re-calculates the value to prevent any manual input errors and confirms the correct figure is entered on line 10.

17

Verifies the smaller amount between line 8 and line 10 is entered on line 11 for the refundable amount

The AI verifies that the smaller of the two amounts from line 8 and line 10 is correctly identified and entered on line 11, which represents the refundable credit amount. It performs a comparison check to ensure that the correct figure is used. The AI's logic is designed to automatically select the lesser value, as required by the form's instructions, and to validate that the entry on line 11 is accurate.

18

Calculates if line 7 is greater than line 6 and correctly enters the owed amount on line 12

The AI calculates whether the amount on line 7 is greater than the amount on line 6 and, if so, correctly enters the resulting owed amount on line 12. This validation is essential for determining if the organization owes additional tax. The AI checks for accuracy in the comparison and ensures that the correct figures are carried over to line 12, providing an additional layer of verification for the accuracy of the form.

19

Checks that the form is signed by an authorized officer of the organization and includes their title and the date

The AI checks to ensure that the form has been signed by an authorized officer of the organization. It looks for a signature, the officer's title, and the date to confirm that the form is properly executed. While the AI cannot physically verify signatures, it can check for the presence of signature indicators and remind the user if these fields appear to be incomplete or missing, thus maintaining the form's validity.

20

If a paid preparer completed the form, ensures that they have signed and provided their information in the designated section

In cases where a paid preparer is responsible for completing the form, the AI ensures that the preparer's signature and relevant information are present in the designated section. The AI checks for the completeness of the preparer's details, including their name, address, and identification numbers. It alerts the user if any required information is missing or incomplete, ensuring that the form complies with all necessary requirements.

Common Mistakes in Completing Form 5884-C

The Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans form requires the taxpayer to indicate the type of employment tax return filed on line 2. Failure to provide the correct information can lead to processing delays and potential rejections of the form. To avoid this mistake, taxpayers should double-check their employment tax return filings and ensure they select the appropriate option on the form. It is recommended to consult the instructions provided with the form or contact the IRS for clarification if necessary.

The Employer Identification Number (EIN) is a unique identifier assigned to businesses and other organizations for tax purposes. Entering an incorrect EIN on line 2 of the form can result in processing delays and potential rejections. To prevent this mistake, taxpayers should verify the accuracy of their EIN before submitting the form. They can check their records or contact the IRS for assistance if needed.

Providing incomplete or inaccurate name and address information on the form can lead to processing delays and potential rejections. It is essential to ensure that all required fields are filled out completely and accurately. Taxpayers should double-check their entries for typos, missing information, and formatting issues. It is recommended to use the official mailing address of the organization as listed on the tax-exempt bond or other official documentation.

Lines 4a, 4b, 5a, and 5b of the form require specific information related to the veteran employee's wages, hours worked, and the corresponding credit amounts. Incomplete or inaccurate information can result in processing delays and potential rejections. To avoid this mistake, taxpayers should ensure they have all necessary payroll records and documentation for the veteran employees before completing the form. They should double-check their calculations and verify that all required fields are filled out completely and accurately.

Calculating the correct amounts on lines 4b, 5b, and 6 is crucial for accurately determining the credit amount. Failure to do so can result in incorrect credit calculations and potential rejections of the form. Taxpayers should carefully review the instructions provided with the form and consult their payroll records to ensure they have calculated the correct amounts. It is recommended to double-check calculations and consult with a tax professional if needed.

Tax-exempt organizations completing the Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans form must accurately report the total taxable social security wages and tips paid to qualified veterans. Failure to do so may result in incorrect calculations of the credit. To avoid this mistake, carefully review the wages and tips reported on the form and ensure they match the actual amounts paid. Double-check calculations and consult the instructions provided with the form if necessary.

The Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans form must be signed by an officer of the organization and include the officer's title and the date of signing. Failure to do so may result in the form being rejected by the IRS. To avoid this mistake, ensure that the person signing the form has the necessary authority and understands the importance of completing all required fields. It is also recommended to maintain a copy of the signed form for organizational records.

Once the Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans form is completed and signed, it must be sent to the specified address for processing by the IRS. Failure to do so may result in the organization not receiving the credit. To avoid this mistake, carefully review the instructions provided with the form and ensure that it is sent to the correct address. It is also recommended to send the form as soon as possible after hiring a qualified veteran to ensure timely processing.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 5884-C with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 5884-c forms, ensuring each field is accurate.