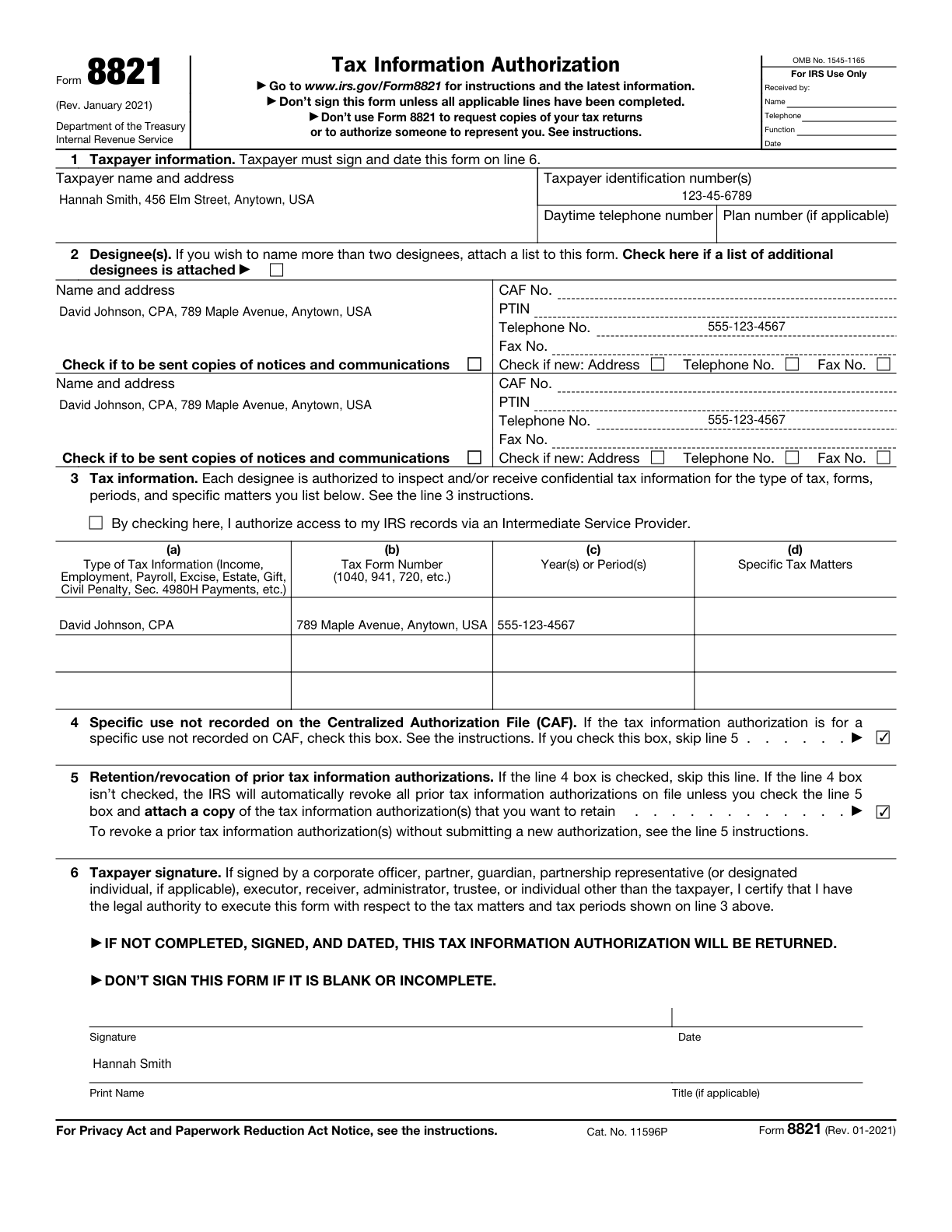

Form 8821, Tax Information Authorization Completed Form Examples and Samples

Explore a detailed example of Form 8821, showcasing how individuals can authorize a designee, such as a CPA, to receive their tax information. This sample highlights key sections including taxpayer details, designee information, and specified tax years for authorization.

Form 8821 Example – Individual Tax Information Authorization

How this form was filled:

This sample demonstrates how an individual authorizes a CPA to receive tax information. The individual’s details are filled out in Part I, the designee's information is provided in Part II, and the years covered are specified as 2024-2025.

Information used to fill out the document:

- Taxpayer Name: Hannah Smith

- Taxpayer Identification Number: 123-45-6789

- Taxpayer Address: 456 Elm Street, Anytown, USA

- Designee Name: David Johnson, CPA

- Designee Address: 789 Maple Avenue, Anytown, USA

- Designee Telephone: 555-123-4567

- Authorization Years: 2024-2025

- Signature: Hannah Smith

- Date: 03/20/2025

What this filled form sample shows:

- Accurate completion of taxpayer information in Part I

- Correct specification of designee details in Part II

- Clear indication of tax years covered: 2024-2025

- Properly formatted signature and date

Form specifications and details:

| Use Case: | Individual authorizing CPA to receive tax information |

| Relevant Tax Years: | 2024-2025 |

| Purpose: | To allow the CPA to access tax information |