Form 8862, Information To Claim Certain Credits Completed Form Examples and Samples

Explore detailed examples of completed Form 8862 for reclaiming tax credits like the Earned Income Tax Credit and American Opportunity Credit. Each sample includes taxpayer information, disallowance reasons, and steps for regaining eligibility, providing an essential guide for accurate form completion and documentation.

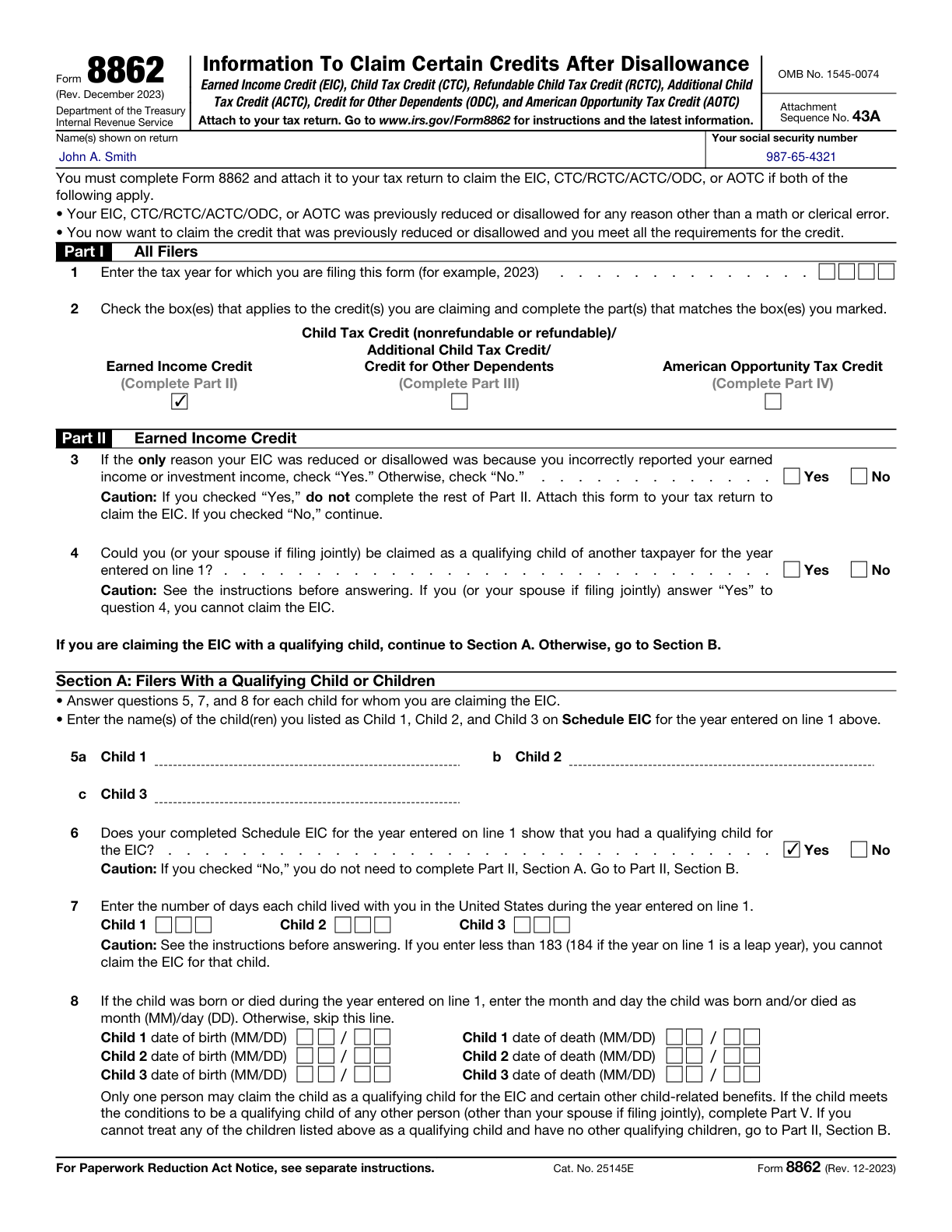

Form 8862 Example – Recovery of Earned Income Tax Credit

How this form was filled:

This example demonstrates the completion of Form 8862 to recover the Earned Income Tax Credit. It includes a taxpayer's personal information, previous disallowance reasons, and requalification details for the credit. Proper documentation and explanation for regaining eligibility are provided.

Information used to fill out the document:

- Taxpayer’s Name: John A. Smith

- Social Security Number: 987-65-4321

- Address: 456 Elm Street, Anytown, USA

- Disallowance Year: 2023

- Disallowance Reason: Incorrect filing status

- Current Filing Status: Head of Household

- Explanation for Eligibility: Corrected filing status with required documentation

- Date: 03/10

What this filled form sample shows:

- Accurate taxpayer identification and disallowance details

- Detailed explanation of corrections made to regain eligibility

- Proper documentation for head of household status

- Clear date and signature from taxpayer

Form specifications and details:

| Use Case: | Regaining eligibility for Earned Income Tax Credit after disallowance |

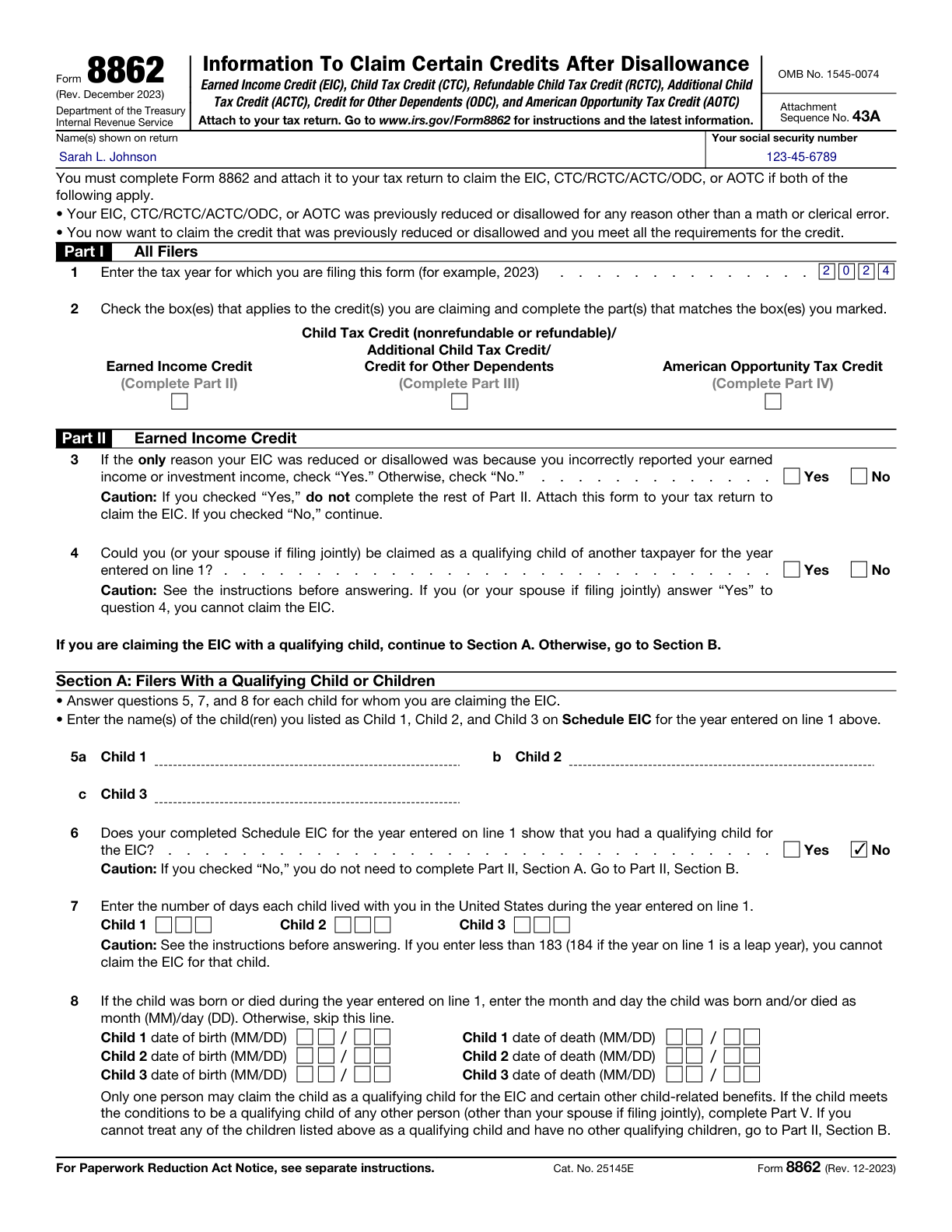

Form 8862 Example – Recovery of American Opportunity Credit

How this form was filled:

This example illustrates the completion of Form 8862 to recover the American Opportunity Tax Credit. It includes a taxpayer's details, reasons for previous disallowance, and comprehensive explanation with supporting documentation to qualify again.

Information used to fill out the document:

- Taxpayer’s Name: Sarah L. Johnson

- Social Security Number: 123-45-6789

- Address: 789 Oak Avenue, Metropolis, USA

- Disallowance Year: 2024

- Disallowance Reason: Incomplete educational details

- Current Filing Status: Single

- Explanation for Eligibility: Provided complete enrollment and expense documents

- Date: 05/12

What this filled form sample shows:

- Complete taxpayer personal details and disallowance history

- Comprehensive documentation of educational qualification

- Clear narrative on correction measures undertaken

- Accurate date and attestation

Form specifications and details:

| Use Case: | Reestablishing eligibility for the American Opportunity Tax Credit after disallowance |