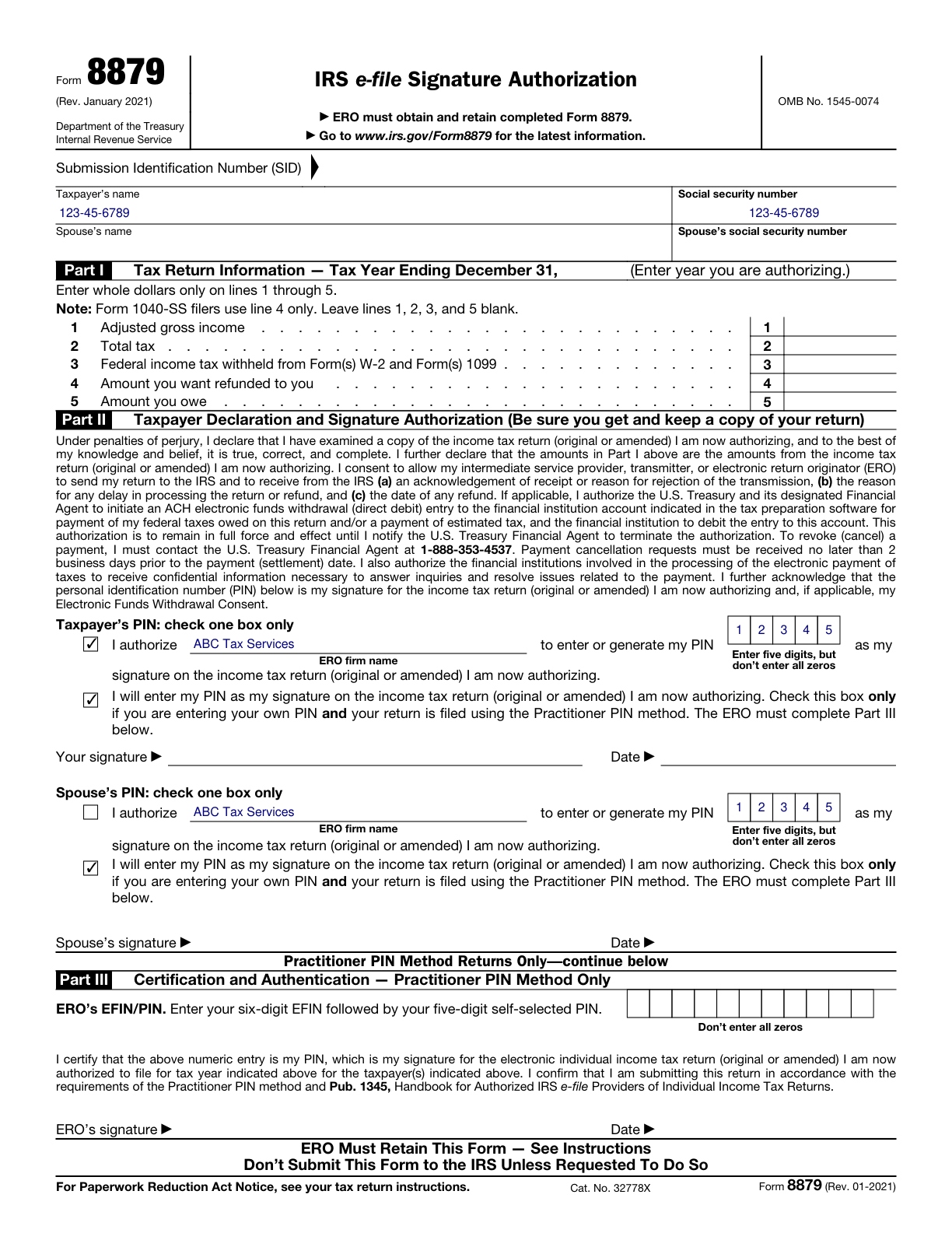

Form 8879, IRS e-file Signature Authorization Completed Form Examples and Samples

Explore our detailed example of a filled IRS Form 8879 for an individual taxpayer, providing step-by-step guidance on authorizing an ERO to file your tax return electronically. This sample includes crucial details like taxpayer's name, SSN, ERO consent, signature, and date.

Form 8879 Example – Individual Taxpayer

How this form was filled:

This example demonstrates how an individual taxpayer authorizes an ERO to enter their PIN for e-filing. The taxpayer's name and Social Security Number are clearly indicated, along with the ERO consents, and the form is properly signed and dated.

Information used to fill out the document:

- Taxpayer’s Name: Alice Smith

- Social Security Number (SSN): 123-45-6789

- Tax Year: 2024

- Electronic Return Originator (ERO) Firm’s Name: ABC Tax Services

- PIN: 12345

- Date: 02/25/2025

- Signature: Alice Smith

What this filled form sample shows:

- Correct indication of taxpayer's name and SSN

- Authorization for ERO with proper signature and PIN

- Accurate entry of the tax year

- Verification of ERO firm’s name and other relevant details

Form specifications and details:

| Use Case: | Individual taxpayer authorizing electronic filing |

| Form Purpose: | Authorize ERO to enter taxpayer's PIN for e-filing |