Certificado de Reventa y Certificado de Exención para el Impuesto sobre Ventas y Uso de Texas (Form 01-339-S) Completed Form Examples and Samples

Explore detailed examples and samples of the Texas Resale and Exemption Certificate (Form 01-339-S). Our guide provides filled-out templates for the 'Certificado de Reventa y Certificado de Exención para el Impuesto sobre Ventas y Uso de Texas' to help you complete it correctly for resale or other tax exemptions.

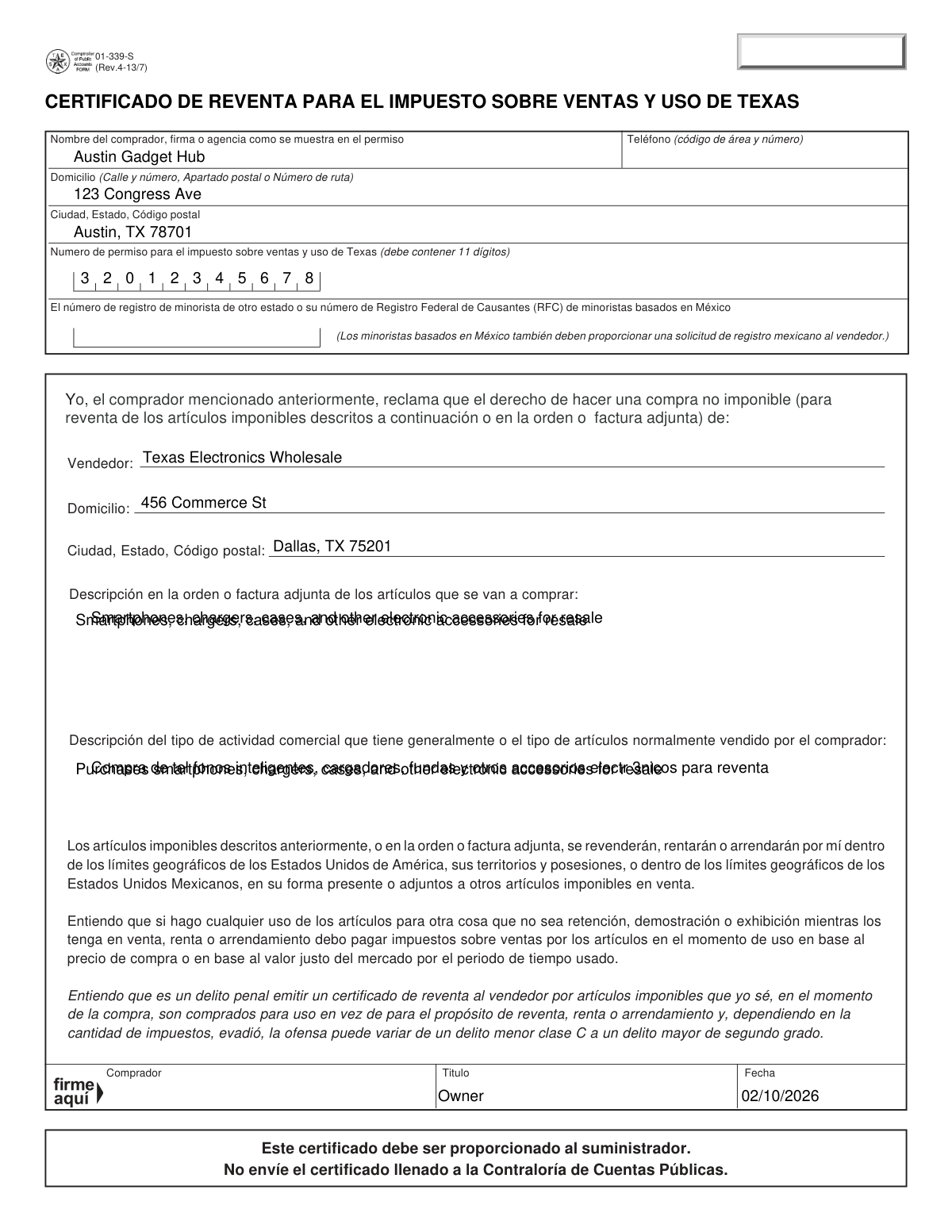

Texas Resale Certificate (Form 01-339-S) Example for Retailers

How this form was filled:

This example shows a retail store, 'Austin Gadget Hub', providing a completed resale certificate to its wholesale supplier. The form correctly identifies the purchaser and seller, provides the purchaser's Texas Taxpayer Number, and describes the items being purchased for resale. The 'Resale' box is checked, and the form is signed and dated by the owner.

Information used to fill out the document:

- Purchaser Name: Austin Gadget Hub

- Purchaser Address: 123 Congress Ave, Austin, TX 78701

- Purchaser Texas Taxpayer Number: 32012345678

- Seller Name: Texas Electronics Wholesale

- Seller Address: 456 Commerce St, Dallas, TX 75201

- Description of Items Purchased: Smartphones, chargers, cases, and other electronic accessories for resale

- Exemption Reason: Resale

- Signatory Name: Maria Garcia

- Signatory Title: Owner

- Date Signed: 2026-02-10

What this filled form sample shows:

- Correctly identifies the purchaser and seller information.

- Includes the mandatory Texas Taxpayer Number of the purchaser.

- Clearly states the items are for resale, the most common use for this form.

- Properly signed and dated by an authorized person.

Form specifications and details:

| Form Name: | Certificado de Reventa y Certificado de Exención para el Impuesto sobre Ventas y Uso de Texas (Form 01-339-S) |

| Use Case: | Retailer purchasing inventory from a wholesaler for resale. |

| Jurisdiction: | State of Texas |

Created: February 03, 2026 07:32 PM