Yes! You can use AI to fill out Form 1099-NEC (Rev. April 2025), Nonemployee Compensation

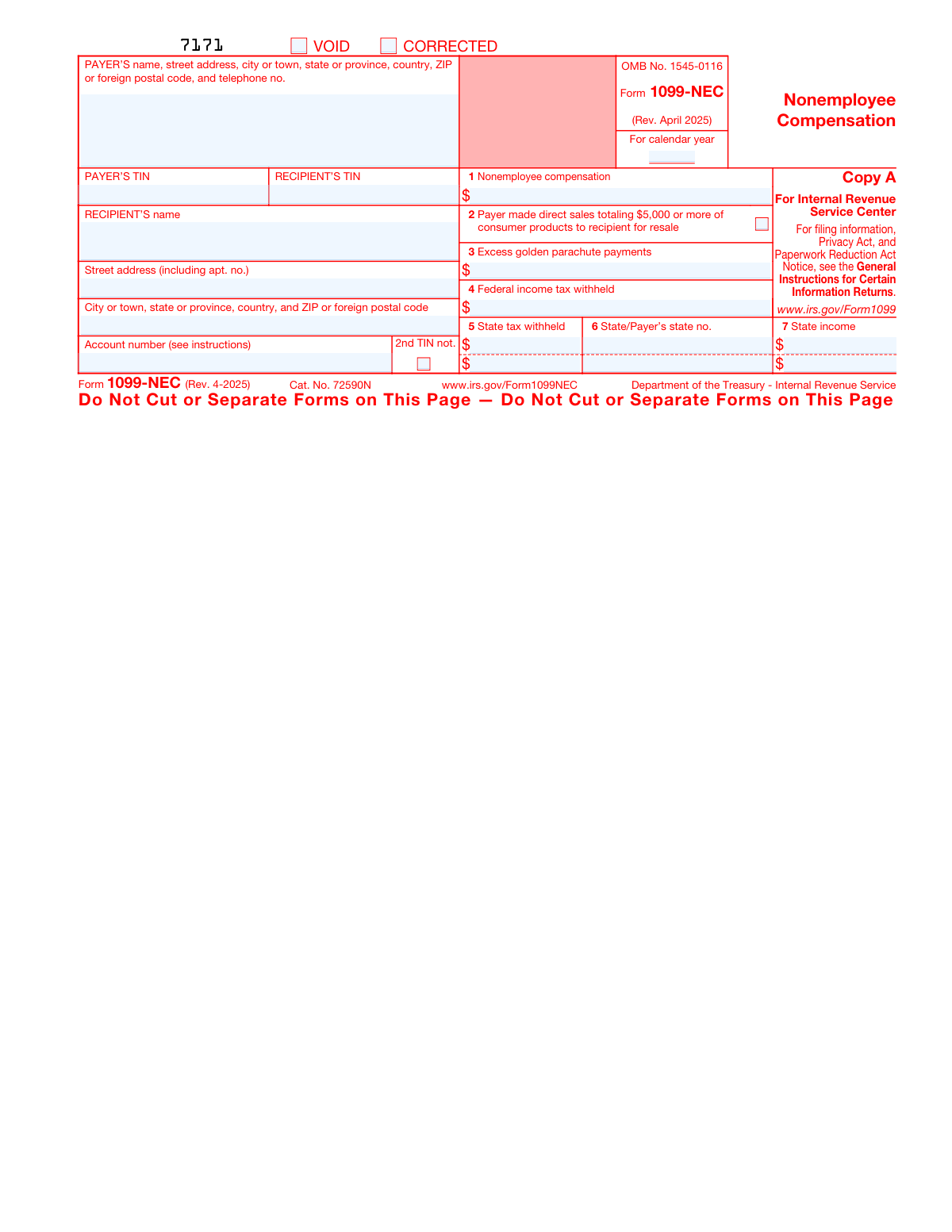

Form 1099-NEC is an IRS information return that reports payments made to nonemployees (such as independent contractors, freelancers, and vendors) that are treated as nonemployee compensation. It helps the IRS match income reported by recipients to amounts reported by payers, supporting accurate tax reporting and compliance. The form includes payer and recipient identifying information (including TINs) and the amount of nonemployee compensation, along with any backup withholding and certain state reporting details. Recipients use it to report income on their tax return (often as self-employment income) and to claim any federal or state tax withheld.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out 1099-NEC using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 1099-NEC (Rev. April 2025), Nonemployee Compensation |

| Number of pages: | 6 |

| Language: | English |

| Categories: | employee forms, 1099 forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out 1099-NEC Online for Free in 2026

Are you looking to fill out a 1099-NEC form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your 1099-NEC form in just 37 seconds or less.

Follow these steps to fill out your 1099-NEC form online using Instafill.ai:

- 1 Select the tax year and indicate whether the form is VOID or CORRECTED, if applicable.

- 2 Enter the payer’s information: legal name, address, phone number, and payer’s TIN (EIN/SSN as applicable).

- 3 Enter the recipient’s information: legal name, address, recipient’s TIN (and 2nd TIN notice if applicable), and an account number if you use one to identify the payee.

- 4 Complete the payment boxes: Box 1 nonemployee compensation amount; check Box 2 if direct sales of $5,000+ of consumer products for resale apply; enter Box 3 excess golden parachute payments if applicable.

- 5 Enter any withholding: Box 4 federal income tax withheld (backup withholding) and Boxes 5–7 for state tax withheld, state/payer state number, and state income.

- 6 Review for accuracy (names/TINs/amounts), generate the correct copies (Copy A for IRS filing, Copy B for recipient, and state copies as required), and submit via e-file or prepare official scannable Copy A for paper filing.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable 1099-NEC Form?

Speed

Complete your 1099-NEC in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 1099-NEC form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form 1099-NEC

Form 1099-NEC reports nonemployee compensation—payments made to someone who is not treated as an employee (for example, an independent contractor). The payer provides copies to the recipient and files Copy A with the IRS.

The payer (business or person making the payment) completes the form and files it with the IRS, and provides Copy B to the recipient. Recipients generally do not file the form itself with the IRS, but use it to prepare their tax return.

No. The online/website-printed Copy A is not scannable, and the IRS may impose penalties for filing non-scannable information returns. If filing on paper, order the official scannable forms from IRS.gov/EmployerForms.

Copy B and the other black copies may be downloaded, printed, and provided to the recipient (and used for state filing where applicable). Copy A (red) is for IRS processing and must be the official scannable version if you paper-file.

If you have 10 or more information returns to file, you may be required to file electronically. The form text directs filers to IRS.gov/InfoReturn for e-file options.

Yes. The IRS strongly encourages e-filing even if you have fewer than 10 information returns, though you may be able to paper-file using official scannable forms.

You’ll need the payer’s name, address, telephone number, and TIN, plus the recipient’s name, address, and TIN. The form also includes an optional account number field to distinguish the recipient’s account.

For identity protection, the recipient copy may display only the last four digits of the recipient’s TIN. The issuer still reports the full TIN to the IRS.

Box 1 shows the amount of nonemployee compensation paid to the recipient. Recipients generally report it as self-employment income (for example, on Schedule C or F) unless it is not self-employment income (such as a sporadic activity or hobby), in which case it may be reported as “Other income” on Schedule 1 (Form 1040).

If Box 2 is checked, it indicates the payer made direct sales totaling $5,000 or more of consumer products to the recipient for resale. The recipient generally reports income from selling those products on Schedule C (Form 1040).

Box 3 reports total compensation of excess golden parachute payments that may be subject to a 20% excise tax. The recipient should follow their tax return instructions for where to report this amount.

Box 4 shows backup withholding—federal tax withheld when the payer is required to withhold (often because the recipient didn’t provide a TIN). Recipients generally include this amount on their tax return as tax withheld.

Boxes 5–7 are for state reporting: state tax withheld, the state/payer’s state number, and state income. These boxes help recipients and state tax agencies match withholding and income for state tax returns.

If you believe you are an employee and the payer won’t correct it, the recipient instructions say to report the Box 1 amount as wages on Form 1040/1040-SR/1040-NR and complete Form 8919. Pub. 1779 provides more guidance on worker classification.

Possibly. The recipient instructions note that if you receive payments with no income, Social Security, or Medicare taxes withheld, you may need to make estimated tax payments using Form 1040-ES (or 1040-ES (NR)).

Compliance 1099-NEC

Validation Checks by Instafill.ai

1

Calendar Year Presence and Validity

Validates that the “For calendar year” field is present and contains a 4-digit year (YYYY). The year must be reasonable (for example, not in the far past/future) and should align with the form revision context (Rev. April 2025 typically used for 2024+ reporting). If the year is missing or malformed, the submission should be rejected because the IRS/state cannot apply the amounts to the correct tax year.

2

Mutual Exclusivity of VOID and CORRECTED Indicators

Checks that the form is not marked as both VOID and CORRECTED at the same time. VOID indicates the form should be disregarded, while CORRECTED indicates it replaces a previously filed form. If both are selected, the system should flag the record for correction because downstream filing logic and recipient reporting become ambiguous.

3

Payer Name and Mailing Address Completeness

Ensures the payer’s name and full mailing address are provided, including street, city, state/province, and ZIP/foreign postal code (and country when non-US). This information is required for identification, correspondence, and matching by tax agencies. If incomplete, the form should fail validation because it may be considered an invalid information return.

4

Payer Telephone Number Format Validation

Validates that the payer telephone number is present (if required by the workflow) and conforms to an acceptable format (e.g., 10-digit US number with optional punctuation, or E.164 for international). A valid phone number supports recipient inquiries and compliance follow-up. If the phone number is malformed, the system should prompt correction or require confirmation before submission.

5

Payer TIN (EIN/SSN) Format and Check Rules

Validates that the payer’s TIN is present and formatted as a valid EIN (9 digits, often written as XX-XXXXXXX) or SSN (XXX-XX-XXXX) depending on payer type. The check should reject obvious invalid values (all zeros, repeated digits, wrong length, non-numeric characters beyond separators). If invalid, the submission should be blocked because IRS matching and penalty risk increase significantly.

6

Recipient Name and Mailing Address Completeness

Ensures the recipient’s name and full mailing address are provided, including street (apt/unit if applicable), city, state/province, and ZIP/foreign postal code (and country when applicable). Recipient identity and address are required for furnishing the statement and for IRS matching. If missing or partial, the form should be rejected or routed to an exception queue for remediation.

7

Recipient TIN Format and Presence (with Masking Rules for Recipient Copy)

Validates that the recipient TIN is present and structurally valid (SSN/ITIN/ATIN/EIN: 9 digits with allowable separators). If the system generates recipient-facing copies, it should allow masking to last four digits on Copy B while ensuring the full TIN is stored and transmitted to the IRS. If the TIN is missing/invalid, the form should fail validation due to backup withholding and matching implications.

8

Second TIN Notice Field Consistency

Checks that the “2nd TIN not.” indicator is only used when the recipient has been notified by the IRS that the TIN is incorrect (per instructions) and that it is not populated with arbitrary text. This prevents misuse of the field and supports correct backup withholding workflows. If inconsistent (e.g., indicator set without a recipient TIN present), the submission should be flagged for review.

9

Account Number Optionality and Format Constraints

Validates that the account number is either blank or conforms to allowed character/length constraints (commonly alphanumeric and limited length), and is consistent across corrected filings for the same recipient when used. Account numbers help uniquely identify recipient accounts when multiple forms exist. If the account number contains invalid characters or is excessively long, the system should reject or normalize it to prevent IRS/state ingestion issues.

10

Box 1 Nonemployee Compensation Amount Format and Range

Validates that Box 1 is a non-negative currency amount with at most two decimal places and within reasonable upper bounds (to catch data entry errors like extra zeros). Box 1 is the primary reportable amount and must be numeric for filing and recipient reporting. If invalid (negative, non-numeric, too many decimals), the submission should be blocked.

11

Box 4 Federal Income Tax Withheld Logical Constraint

Ensures Box 4 is a non-negative currency amount with two decimals max and is not greater than Box 1 in typical scenarios (or, if greater, requires an override reason/exception). Backup withholding is generally a percentage of payments and should not exceed the reported compensation without explanation. If the constraint fails, the system should flag the record for correction to avoid filing an implausible withholding amount.

12

Direct Sales Checkbox (Box 2) Boolean Validation and Dependency

Validates that Box 2 is strictly a boolean (checked/unchecked) and not accompanied by an amount entry (since Box 2 is an indicator, not a dollar field). This checkbox has specific meaning (direct sales of $5,000+ for resale) and should not be inferred from Box 1. If the field contains non-boolean data or conflicting annotations, the submission should be rejected or corrected.

13

Box 3 Excess Golden Parachute Payments Amount Validation

Validates that Box 3, if provided, is a non-negative currency amount with at most two decimals. This field is specialized and should not contain text or negative adjustments. If invalid, the system should block submission because it affects excise tax reporting and recipient compliance.

14

State Reporting Fields Completeness When Any State Amount Is Present (Boxes 5–7)

If any of Boxes 5 (state tax withheld) or 7 (state income) contains an amount, validates that Box 6 (state abbreviation and/or payer’s state ID number) is present and properly formatted. State agencies require the state identifier to apply withholding and income to the correct jurisdiction and payer account. If amounts exist without state identifiers, the system should fail validation or require completion of Box 6.

15

State Amounts Numeric and Cross-Field Consistency (Boxes 5 and 7)

Validates that state tax withheld (Box 5) and state income (Box 7) are non-negative currency amounts with at most two decimals, and that withheld is not unreasonably high relative to state income (e.g., withheld > income without an override). This catches common keying errors and prevents state filing rejections. If inconsistent, the record should be flagged for correction before generating Copy 1/Copy 2 outputs.

16

Copy/Output Type Rules: Copy A Scannability and Printing Restrictions

When the workflow includes generating a “Copy A” output, validates that the system is using an IRS-approved scannable template (not a web-printed facsimile) and that Copy A is not offered for non-scannable printing. The IRS can penalize filers for submitting non-scannable Copy A forms. If the system cannot guarantee scannability, it should block Copy A printing and direct the user to order official forms or e-file.

Common Mistakes in Completing 1099-NEC

People often print the red “Copy A” from a website PDF and mail it to the IRS, not realizing the IRS requires the official scannable Copy A. The IRS may assess penalties or reject the filing because the printed version isn’t scannable. To avoid this, e-file whenever possible or order official paper forms from IRS.gov/EmployerForms that include the scannable Copy A.

Filers sometimes send Copy B (recipient copy) to the IRS or forget to provide the recipient copy, because the multiple copies look similar. This can lead to IRS processing issues and recipient complaints (and potential penalties for failing to furnish statements). Match each copy to its purpose: Copy A to IRS (official scannable or e-file), Copy B to the recipient, and Copy 1/Copy 2 for state filing/recipient state return when applicable.

When a form has an error, people often reissue a new form but forget to mark it as “CORRECTED,” or they mark “VOID” incorrectly. This can create duplicate reporting at the IRS and mismatches for the recipient, triggering notices. Only check “VOID” to cancel a form that should not be processed, and check “CORRECTED” when replacing a previously filed/furnished 1099-NEC; follow IRS correction procedures.

A very common error is transposing digits, using the wrong entity’s TIN, or leaving the TIN empty because it wasn’t collected on Form W-9. Incorrect or missing TINs can trigger IRS B-notices, backup withholding requirements, and penalties for incorrect information returns. Always collect a completed W-9 before payment, validate the TIN/name combination when possible, and double-check digit counts (SSN/ITIN 9 digits; EIN 9 digits).

Filers frequently put a business/DBA name on the “RECIPIENT’S name” line while using an individual’s SSN, or they use an EIN while listing a person’s name. This mismatch can cause IRS matching failures and penalty notices, and it can complicate the recipient’s tax reporting. Use the legal name associated with the TIN from the W-9 (often the individual’s name for SSN/ITIN, with the business name/DBA in the appropriate W-9 field) and ensure the TIN corresponds to that legal name.

People often report net payments after fees, subtract refunds/chargebacks incorrectly, include nonreportable reimbursements without an accountable plan, or report payments in the wrong calendar year. This leads to incorrect income reporting for the recipient and potential amended/corrected filings. Box 1 should generally reflect total reportable nonemployee compensation paid during the calendar year (cash basis), and you should reconcile to payment records before issuing the form.

A frequent misunderstanding is putting rents, prizes/awards, legal settlements, or other non-NEC items on 1099-NEC because it’s the “contractor form.” Misclassification can cause IRS matching issues and incorrect recipient reporting. Use 1099-NEC primarily for nonemployee compensation (services), and use 1099-MISC or other appropriate forms/boxes for other payment types per IRS instructions.

Filers often overlook Box 2 because it’s a checkbox rather than a dollar amount, or they assume it’s only for MLM situations without confirming. Missing this check can make the information return incomplete and may affect the recipient’s understanding of reporting obligations. If you made direct sales totaling $5,000 or more of consumer products to the recipient for resale (buy-sell, deposit-commission, etc.), ensure Box 2 is checked even if Box 1 is also used.

Some payers withhold backup withholding but forget to report it in Box 4, or they mistakenly put regular withholding amounts there without meeting backup withholding rules. This can prevent the recipient from properly claiming withholding as a credit and can create IRS discrepancies. Only report actual federal income tax withheld under backup withholding rules in Box 4, and ensure your withholding rate and triggers align with IRS guidance (often due to missing/incorrect TIN).

Addresses are often missing apartment/suite numbers, have incorrect ZIP codes, or omit country/province for foreign addresses; payer phone numbers are also frequently left out. Bad address data can cause undeliverable recipient copies and delays in resolving IRS notices. Use standardized USPS formatting when possible, include all required address components (including foreign postal codes/country), and verify the recipient’s mailing address before issuing Copy B.

Filers sometimes enter state withholding in Box 5 without a valid state ID in Box 6, use the wrong state abbreviation/number, or report state income that doesn’t match state filings. This can create problems with state tax departments and cause recipient confusion when filing state returns. Only complete Boxes 5–7 when you actually withheld state tax or have state reporting obligations, and ensure the state payer number and amounts match your state withholding returns.

Some filers continue paper filing even when they meet the threshold requiring e-filing, or they don’t realize the IRS strongly encourages e-filing even below the threshold. Filing the wrong way can lead to noncompliance and potential penalties, plus slower processing and higher error rates. Confirm your total number of information returns for the year and use IRS e-file options when required (and preferably even when not required).

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out 1099-NEC with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-1099-nec-rev-april-2025-nonemployee-compensat forms, ensuring each field is accurate.