Form 8809 (Rev. December 2025), Application for Extension of Time To File Information Returns Completed Form Examples and Samples

View filled-out examples and samples of IRS Form 8809 (Rev. December 2025), Application for Extension of Time To File Information Returns. Learn how to correctly request a 30-day extension for filing forms like W-2, 1099-NEC, 1099-MISC, and more. Our detailed guides help you complete your application accurately.

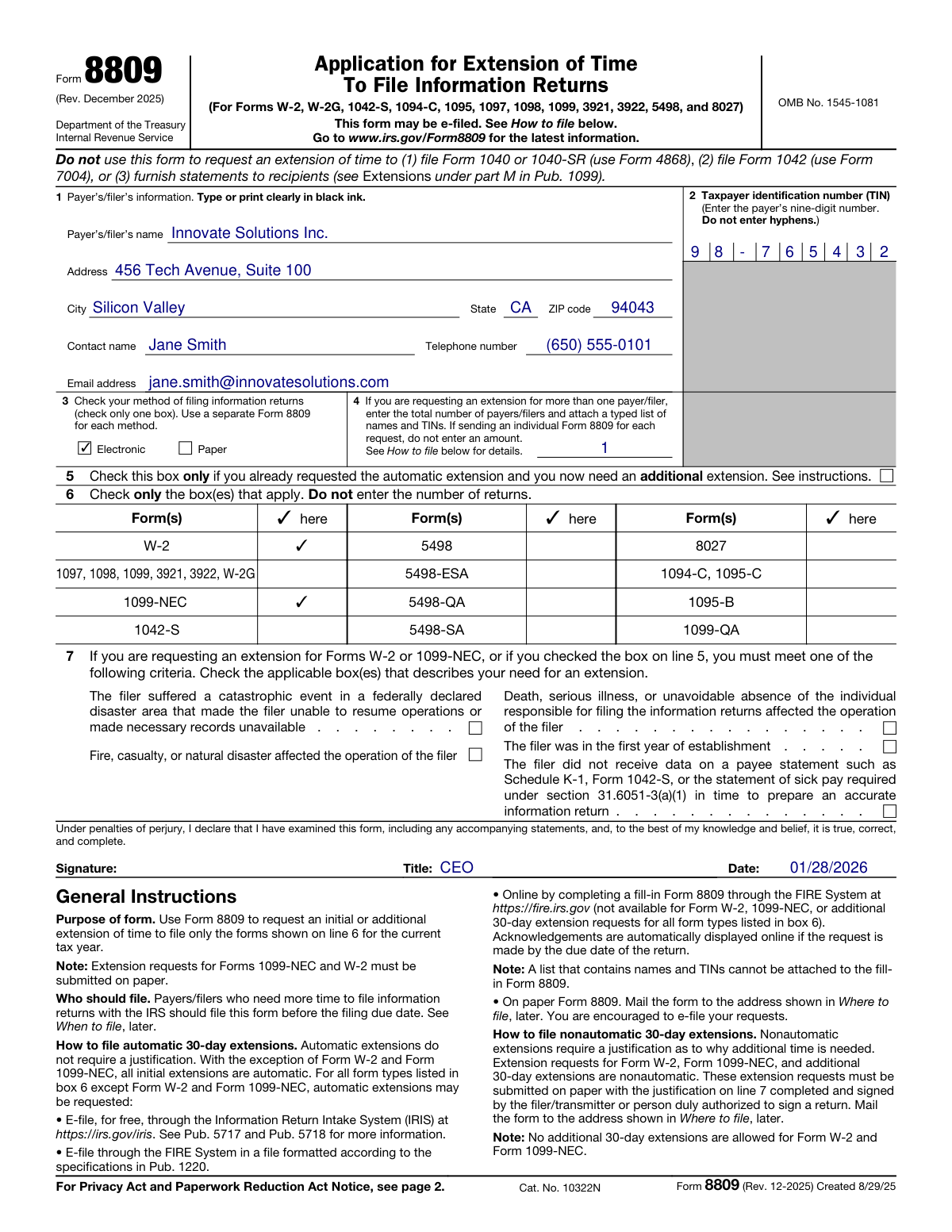

Form 8809 Example – Small Business Requesting Extension for W-2s and 1099s

How this form was filled:

This is a sample Form 8809 filled out by a small corporation requesting an initial 30-day extension to file Forms W-2 and 1099-NEC for the 2025 tax year. The form specifies the types and quantities of returns, indicates an electronic filing method, and provides a detailed, valid explanation for the filing delay.

Information used to fill out the document:

- Filer's Name: Innovate Solutions Inc.

- Filer's EIN: 98-7654321

- Address: 456 Tech Avenue, Suite 100

- City, State, ZIP: Silicon Valley, CA 94043

- Person to Contact: Jane Smith

- Contact Telephone: (650) 555-0101

- Contact Email: [email protected]

- Tax Year: 2025

- Request Type: Original Request

- Forms for Extension (Line 6): W-2, 1099-NEC

- Number of W-2 Returns: 50

- Number of 1099-NEC Returns: 15

- Filing Method: Electronically

- Reason for Delay: Our primary bookkeeper, responsible for finalizing all payroll and contractor payment data, experienced a sudden and severe medical emergency in early January 2026. This unforeseen event has caused a significant delay in our ability to accurately prepare and file our information returns by the original deadline. We require a 30-day extension to allow our accounting team to complete the necessary data verification and processing.

- Signature: John Davis, CEO

- Date: 01/28/2026

What this filled form sample shows:

- Correctly identifies the filer information and tax year for the extension.

- Specifies the exact information returns (W-2, 1099-NEC) for which the extension is requested.

- Includes a clear and reasonable explanation for the delay, a critical requirement for approval.

- Accurately lists the total number of returns for each form type.

- Shows the form properly signed and dated before the original filing deadline of January 31st.

Form specifications and details:

| Use Case: | Small business requesting a 30-day extension for Forms W-2 and 1099-NEC. |

| Form Version: | Form 8809 (Rev. December 2025) |

| Tax Year: | 2025 |

| Filing Date: | January 28, 2026 |

Created: February 03, 2026 07:23 PM