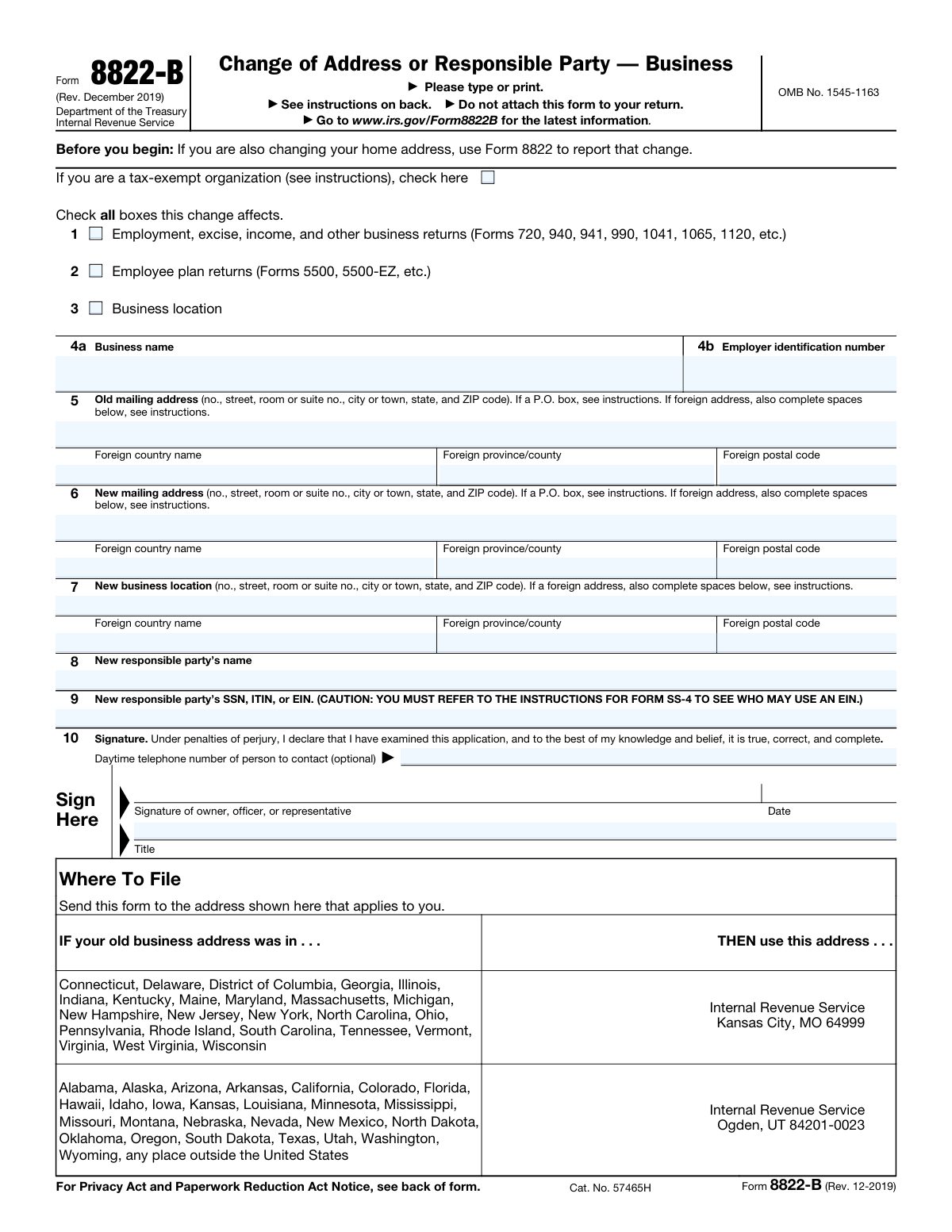

Yes! You can use AI to fill out Form 8822-B (Rev. December 2019), Change of Address or Responsible Party — Business

IRS Form 8822-B is an official Internal Revenue Service form that entities use to notify the IRS when their business mailing address, business location, or “responsible party” (the individual who controls, manages, or directs the entity) changes. Keeping this information current helps ensure the IRS can send notices and correspondence to the correct address and maintain accurate EIN-related records; entities with an EIN generally must report responsible party changes within 60 days. The form is signed under penalties of perjury by an authorized individual (such as an officer, owner, partner, fiduciary, or authorized representative), and representatives may need to attach a power of attorney. Today, this form can be filled out quickly and accurately using AI-powered services like Instafill.ai, which can also convert non-fillable PDF versions into interactive fillable forms.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out 8822-B using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 8822-B (Rev. December 2019), Change of Address or Responsible Party — Business |

| Number of pages: | 1 |

| Language: | English |

| Categories: | business tax forms, tax forms, IRS forms, IRS business forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out 8822-B Online for Free in 2026

Are you looking to fill out a 8822-B form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your 8822-B form in just 37 seconds or less.

Follow these steps to fill out your 8822-B form online using Instafill.ai:

- 1 Go to Instafill.ai and upload Form 8822-B (or select it from the form library).

- 2 Let the AI detect and map the form fields, then confirm the form version and your entity type (including whether you are a tax-exempt organization).

- 3 Select which changes apply by checking the relevant boxes (affected returns and/or business location).

- 4 Enter the business identification details, including the legal business name and EIN.

- 5 Provide the old mailing address and the new mailing address (including foreign address details if applicable).

- 6 If applicable, enter the new business location address and the new responsible party’s name and SSN/ITIN/EIN, then add an optional daytime phone number.

- 7 Review for completeness, e-sign or prepare for wet signature as required, download the finalized form, and mail it to the correct IRS address listed on the form (do not attach it to a tax return).

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable 8822-B Form?

Speed

Complete your 8822-B in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 8822-B form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form 8822-B

Form 8822-B is used to notify the IRS of a change to a business’s mailing address, business location, or the identity of the business’s responsible party. It updates IRS records so notices and correspondence go to the right place and person.

Any entity with an EIN should file Form 8822-B when its business mailing address, business location, or responsible party changes. Entities must also file even if they are not currently engaged in a trade or business.

No—Form 8822-B is for business changes. If you are also changing your home address, use IRS Form 8822 for the personal address change.

If your entity has an EIN, you are required to report a responsible party change on lines 8 and 9 within 60 days of the change. The IRS references Form SS-4 instructions for who qualifies as a responsible party and which ID number to use.

Check the boxes for the areas impacted: (1) business tax returns like 941/1120/1065, (2) employee plan returns like 5500, and/or (3) business location. Checking the right boxes helps the IRS apply the update to the correct records.

You’ll need the business legal name, EIN, old mailing address, new mailing address, and/or new business location address (if changing). If changing the responsible party, you’ll also need the new responsible party’s name and SSN/ITIN/EIN.

Yes, but generally you should only use a P.O. Box instead of a street address if your post office does not deliver mail to your street address. The form instructions provide additional guidance for P.O. Boxes.

Enter the address following the foreign country’s postal practices and complete the foreign country name, province/county, and postal code fields. Do not abbreviate the country name.

The new mailing address is where the IRS should send correspondence, while the new business location is the physical location of the business. If both changed, complete both sections and check the “Business location” box.

An owner, officer, general partner, LLC member manager, plan administrator, fiduciary, or authorized representative may sign. If a representative signs, they must attach a copy of their power of attorney (for example, Form 2848).

No. The form specifically says not to attach Form 8822-B to your return; it should be sent separately to the appropriate IRS address listed under “Where To File.”

Mail it to the IRS address based on the state (or country) of your OLD business address. Old addresses in many eastern and midwestern states go to IRS Kansas City, MO 64999; old addresses in the listed western states and any place outside the U.S. go to IRS Ogden, UT 84201-0023.

Processing typically takes about 4 to 6 weeks for the IRS to update your address or responsible party information. Times can vary depending on IRS workload.

If you don’t update the IRS, you may not receive important notices (like a notice of deficiency or demand for tax), even though penalties and interest can still accrue. For EIN entities, reporting a responsible party change is mandatory.

Yes—AI tools like Instafill.ai can help auto-fill form fields accurately using the information you provide, saving time and reducing errors. Typically, you upload the Form 8822-B PDF to Instafill.ai, answer a guided set of questions (business name, EIN, old/new addresses, responsible party details), and the system populates the correct fields for you to review before downloading for signature and mailing.

If the PDF is not fillable, Instafill.ai can convert a flat, non-fillable PDF into an interactive fillable form so you can type directly into the fields. After conversion, you can auto-fill and review the entries before printing and signing.

Compliance 8822-B

Validation Checks by Instafill.ai

1

Requires at least one 'Affected Returns' checkbox selection

Validates that the filer checked at least one of the change categories (Affected Returns 1, 2, and/or 3). This is important because the IRS needs to know what records the change applies to (returns, plans, and/or business location). If none are selected, the submission should be rejected or flagged as incomplete because the requested change scope is ambiguous.

2

Business name presence and legal-name quality check

Ensures the Business Name field is present, non-empty, and appears to be a full legal name rather than a placeholder (e.g., 'N/A', 'same', or only punctuation). This matters because the IRS uses the legal entity name to match the EIN and update the correct account. If the name is missing or clearly invalid, the form should fail validation and require correction before processing.

3

EIN format and disallowed patterns validation

Validates that the Employer Identification Number is exactly 9 digits (optionally formatted as NN-NNNNNNN) and contains only digits after normalization. It should also reject obvious invalid values such as all zeros, repeated digits, or fewer/more than 9 digits. If the EIN fails validation, the submission should be rejected because the IRS cannot reliably associate the change with the correct entity.

4

Old mailing address completeness (domestic vs. foreign) validation

Checks that the Old Mailing Address is complete and internally consistent: for a U.S. address, it must include street (or valid P.O. Box), city, state, and ZIP; for a foreign address, the foreign country name must be provided and U.S.-specific state/ZIP requirements should not be enforced. This is important because the 'old address' is used to locate the existing IRS record and route the update. If required components are missing for the chosen address type, the submission should be flagged for correction.

5

New mailing address required when address change is indicated

If the filer indicates the change affects business returns (Affected Returns 1) and/or employee plan returns (Affected Returns 2), validate that a New Mailing Address is provided and complete. This matters because those selections imply the IRS should update the mailing address used for notices and correspondence. If the new mailing address is missing or incomplete, the form should fail validation because the requested change cannot be applied.

6

New business location required when 'Business Location' is selected

When Affected Returns 3 (Business Location) is checked, validates that the New Business Location Address is present and complete (domestic or foreign rules applied appropriately). This is important because selecting business location indicates a physical location update, which is distinct from mailing address. If the location is not provided, the submission should be rejected or routed to an exception queue for follow-up.

7

Domestic address state and ZIP format validation

For any U.S. address entered (old mailing, new mailing, or new business location), validates that the state is a valid U.S. state/territory abbreviation and the ZIP code is 5 digits or ZIP+4 (##### or #####-####). This prevents undeliverable mail and reduces IRS processing delays caused by malformed addresses. If state/ZIP formatting fails, the system should prompt for correction and block submission until fixed.

8

Foreign address fields consistency and country-name rule

If a foreign address is indicated (by presence of a foreign country name or non-U.S. formatting), validates that the foreign country name is present and not abbreviated (e.g., reject 'UK' in favor of 'United Kingdom' per instructions), and that foreign province/county and foreign postal code are provided when applicable. This is important for international deliverability and compliance with IRS instructions. If foreign fields are incomplete or the country is clearly abbreviated, the submission should be flagged and require correction.

9

P.O. Box usage validation for mailing addresses

If the address line indicates a P.O. Box, validates that it includes a box number and is used only for mailing addresses (old/new mailing), not as a business location unless explicitly allowed by business rules. This matters because the IRS distinguishes between mailing address and physical business location, and missing box numbers make the address unusable. If the P.O. Box is malformed or used in an invalid context, the submission should be blocked for correction.

10

Change detection: new address/location must differ from old mailing address

Validates that at least one of the provided 'new' values (new mailing address, new business location, or responsible party info) differs materially from the old mailing address or prior values captured in the submission context. This prevents no-op submissions that waste processing time and can create confusion in audit trails. If no meaningful change is detected, the system should warn the user and require confirmation or prevent submission depending on policy.

11

Responsible party fields required when responsible party change is provided

If either New Responsible Party’s Name or New Responsible Party’s SSN/ITIN/EIN is entered, validates that both are present (name and identification number). This is important because the IRS requires both elements to identify the responsible party and update records accurately. If one is missing, the submission should fail validation and request the missing field.

12

Responsible party identification number type and format validation (SSN/ITIN/EIN)

Validates that the New Responsible Party’s SSN/ITIN/EIN is 9 digits after normalization and matches acceptable formatting (SSN often ###-##-####, EIN often ##-#######, ITIN often ###-##-####) while rejecting clearly invalid patterns (all zeros, non-digits, wrong length). This matters because an incorrect identifier can misassociate the responsible party and cause compliance issues. If the ID fails validation, the submission should be rejected and the user prompted to correct the number.

13

Daytime telephone number format validation (optional field)

If a Daytime Telephone Number is provided, validates it contains a valid phone structure (e.g., 10 digits for U.S. numbers, allowing common punctuation, and optionally an extension) and is not obviously invalid (e.g., too short, all same digit). This is important because IRS processing may require follow-up, and an invalid phone number prevents timely resolution. If invalid, the system should either block submission (if policy requires) or flag the field and request correction while allowing submission if truly optional.

14

Signature date presence and valid date format check

Validates that the Date field is present and is a real calendar date in an accepted format (e.g., MM/DD/YYYY), not a future date beyond a reasonable tolerance. This matters because the declaration under penalties of perjury must be dated to establish when the statement was made. If the date is missing or invalid, the submission should be rejected as unsigned/undated.

15

Signatory title required and role plausibility validation

Ensures the Signatory’s Title is present and plausibly matches an authorized signer category described in the instructions (e.g., owner, officer, general partner, LLC member manager, plan administrator, fiduciary, authorized representative). This is important because unauthorized signatures can cause the IRS to refuse the change. If the title is missing or clearly inconsistent (e.g., 'friend', 'assistant' without authorization), the submission should be flagged for additional documentation or rejected.

16

Power of attorney attachment requirement when signer is a representative

If the signatory title or signer type indicates 'representative' (or similar), validate that a power of attorney document is attached (e.g., Form 2848 or equivalent) as required by the form instructions. This prevents unauthorized third-party address/responsible party changes, which the IRS states it will not process. If POA is not present when required, the submission should be rejected or routed to an exception workflow requesting the attachment.

Common Mistakes in Completing 8822-B

People often submit Form 8822-B when they moved personally, but the IRS requires Form 8822 for home address changes. This can delay updates and cause IRS notices to keep going to the old address. Avoid this by confirming the change is for a business mailing address, business location, or responsible party; use Form 8822 for personal moves. AI-powered tools like Instafill.ai can prompt you to choose the correct form based on the type of address change.

Filers frequently skip the checkboxes for which returns the change affects (employment/excise/income, employee plan, and/or business location) because they assume the IRS will apply the change everywhere automatically. If the wrong boxes are checked, the IRS may not update the address for the accounts you intended, leading to misdirected notices and processing delays. Avoid this by reviewing which tax filings the EIN is associated with (e.g., 941 payroll, 1120/1065 income, 990 exempt org, 5500 plans) and checking all that apply. Instafill.ai can reduce this error by validating selections against your entity type and typical filing profile.

A common mistake is listing a “doing business as” name rather than the exact legal name tied to the EIN on IRS records. Mismatches can cause the IRS to have trouble matching the request to the correct entity, slowing or preventing the update. Avoid this by using the legal name as shown on the EIN assignment letter (CP 575) or the most recent IRS correspondence/return. Instafill.ai can help by standardizing the business name and flagging likely mismatches before submission.

People often mistype the EIN, omit a digit, or use the owner’s SSN instead, especially when copying from payroll systems or prior filings. An incorrect EIN can result in the change being applied to the wrong account or rejected, which can lead to missed IRS notices and continued penalties/interest if mail is not received. Avoid this by verifying the EIN from official IRS documentation and entering it in the standard 9-digit format (often shown as XX-XXXXXXX). Instafill.ai can validate EIN length/format and catch common digit-entry errors.

Filers frequently leave out suite numbers, room numbers, or ZIP+4, or they split address components incorrectly because the form asks for a full mailing address line. Incomplete addresses can cause USPS delivery failures and IRS correspondence being returned, which can create serious downstream issues (e.g., not receiving a notice of deficiency). Avoid this by entering the full deliverable address exactly as used by USPS, including unit designators (Ste, Apt, Rm) and the correct ZIP code. Instafill.ai can auto-format addresses and validate them for completeness.

Many people use a P.O. Box even when their post office delivers to their street address, or they enter both a street address and a P.O. Box in a way that confuses delivery. The instructions limit P.O. Box use to situations where street delivery is not available, and incorrect formatting can delay mail or cause processing questions. Avoid this by following the IRS instruction: use the P.O. Box number instead of the street address only when street delivery is not available, and format it clearly (e.g., “P.O. Box 123”). Instafill.ai can guide correct P.O. Box usage and formatting.

For foreign addresses, filers often abbreviate the country name, put the postal code in the U.S. ZIP field, or skip the province/county line. This can lead to undeliverable mail and delays because the IRS requests country-specific formatting and a non-abbreviated country name. Avoid this by following the destination country’s postal conventions, writing the full country name, and completing the foreign province/county and foreign postal code fields when applicable. Instafill.ai can format foreign addresses correctly and ensure required foreign fields aren’t missed.

People often enter the same address in both sections without thinking, or they put the physical location in the mailing address field (or vice versa). This matters because the IRS uses the mailing address for correspondence, while the business location is the physical site; mixing them can cause notices to go to the wrong place or create inconsistencies across IRS records. Avoid this by deciding: where should IRS mail be delivered (mailing address) and where is the business physically located (business location), then complete only the relevant sections accurately. Instafill.ai can prompt you to distinguish mailing vs. physical addresses and prevent accidental duplication.

Entities often forget that a responsible party change must be reported within 60 days, or they enter an ID number that doesn’t match the responsible party (e.g., using the business EIN when an SSN/ITIN is required, or entering an EIN for someone not eligible to use one). This can lead to IRS records not reflecting the correct controlling individual, which can complicate account access and correspondence. Avoid this by confirming who qualifies as the responsible party per Form SS-4 instructions and entering the correct SSN/ITIN/EIN for that person/entity. Instafill.ai can help by validating ID formats and reminding you of timing/eligibility rules.

A frequent rejection point is an unsigned form, missing date/title, or a signature from someone not authorized (e.g., an employee or outside preparer without authority). The IRS requires an owner, officer, general partner, LLC member-manager, fiduciary, plan administrator, or authorized representative to sign; otherwise the change may not be processed. Avoid this by ensuring the signer’s role matches IRS requirements and completing the signature, date, and title fields every time. Instafill.ai can flag missing signature blocks and ensure the title field is completed consistently.

When an accountant or attorney signs on behalf of the business, they often forget to include a copy of the power of attorney, as required by the instructions. Without POA documentation, the IRS may treat the submission as coming from an unauthorized third party and refuse to process the change. Avoid this by attaching Form 2848 (or other valid POA) whenever a representative signs, and confirming it covers the relevant tax matters. Instafill.ai can remind you to include required attachments and help package the submission correctly.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out 8822-B with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-8822-b-rev-december-2019-change-of-address-or-responsible-party-business forms, ensuring each field is accurate.