Fill out business forms

with AI.

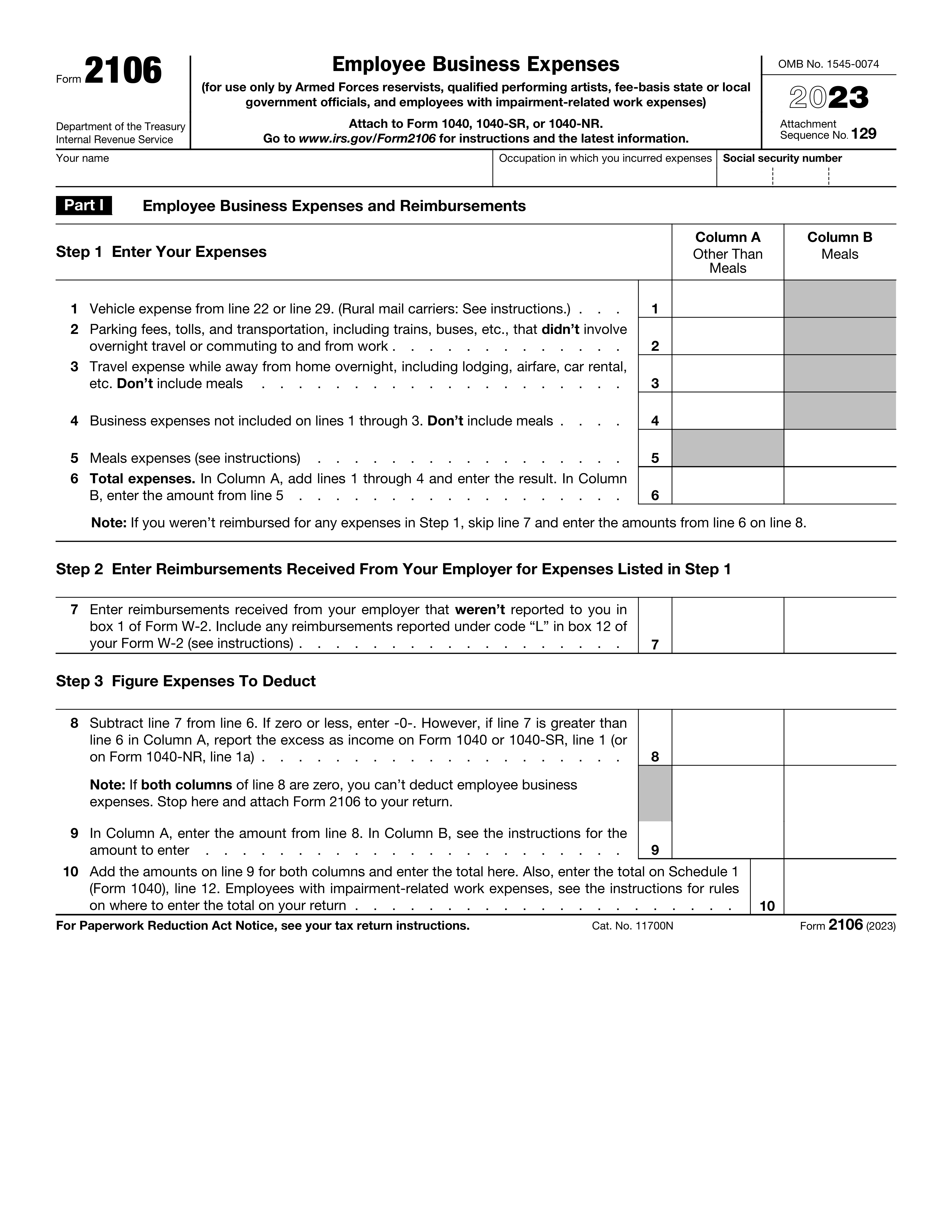

Business forms cover a broad range of official documents that companies, self-employed individuals, and organizations use to meet legal, regulatory, and tax obligations. This category includes IRS tax forms like Schedule C for sole proprietors reporting business income, Form 2553 for corporations electing S corporation status, and Form 8822-B for notifying the IRS of address or responsible party changes — along with licensing applications, information returns for foreign-owned corporations, and more. Whether you're a freelancer tracking deductible expenses or a tax-exempt organization reporting unrelated business income, having the right forms completed accurately is essential to staying compliant and avoiding penalties.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About business forms

These forms are used by a wide range of people: small business owners, accountants, contractors, corporate officers, nonprofit administrators, and even international businesses operating in the U.S. Many are time-sensitive — the IRS imposes strict deadlines and can assess significant penalties for late or inaccurate filings. Others, like state licensing applications or subcontracting reports, require careful documentation to avoid delays or disqualification.

Filling out business forms doesn't have to be a slow or error-prone process — tools like Instafill.ai use AI to complete these forms in under 30 seconds, handling the data accurately and securely so you can focus on running your business.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds