Yes! You can use AI to fill out Form 5472 (Rev. December 2023), Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business

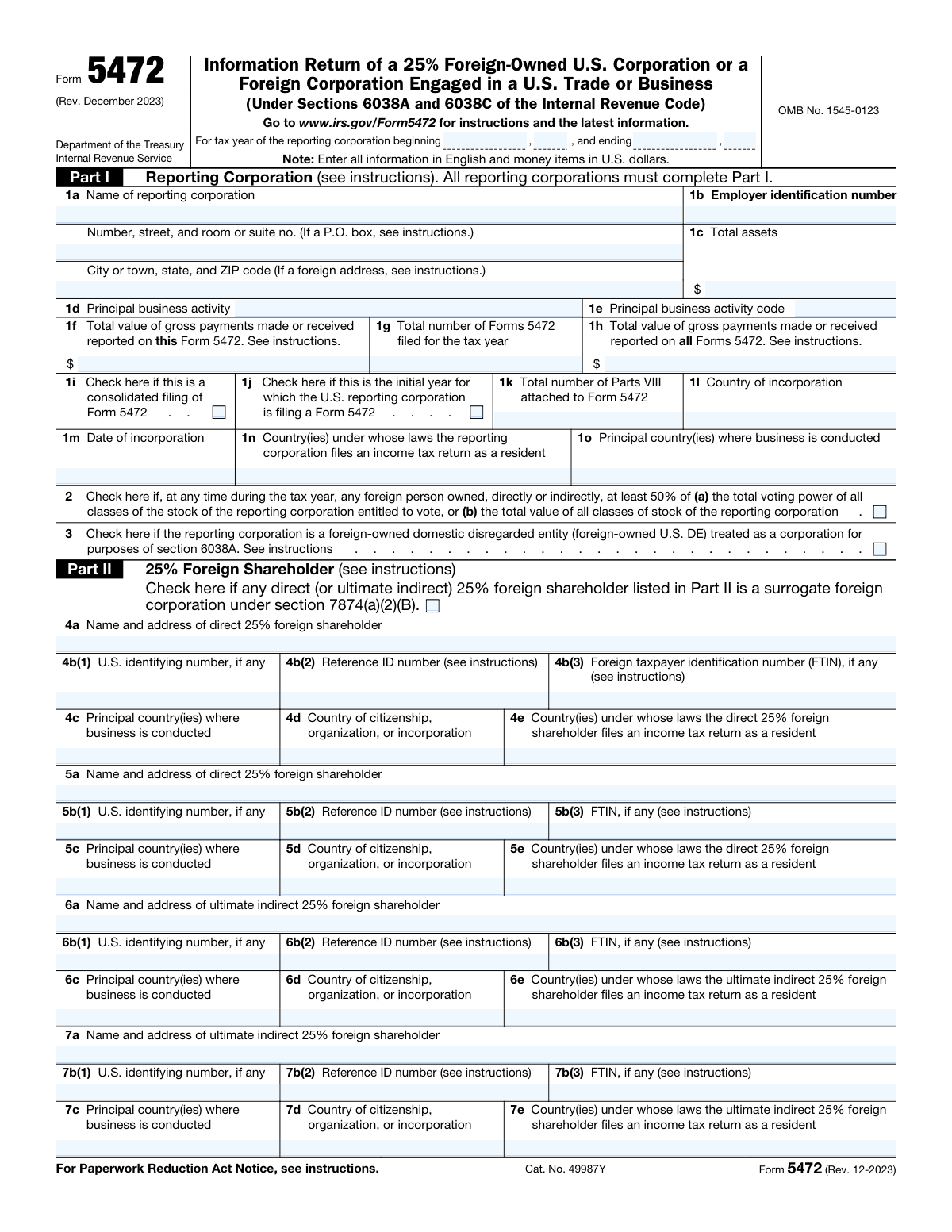

Form 5472 is an IRS information return required when a U.S. corporation is at least 25% foreign-owned, or when a foreign corporation is engaged in a U.S. trade or business, and there are reportable transactions with related parties. The form identifies the reporting corporation, its 25% foreign shareholder(s), and related party(ies), and summarizes monetary and certain nonmonetary transactions (such as sales, services, rents, royalties, loans, and cost sharing). It is important because it provides the IRS visibility into cross-border related-party dealings and transfer-pricing-related activity, and failure to file accurately and timely can trigger significant penalties.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 5472 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 5472 (Rev. December 2023), Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business |

| Number of pages: | 3 |

| Filled form examples: | Form Form 5472 Examples |

| Language: | English |

| Categories: | business forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 5472 Online for Free in 2026

Are you looking to fill out a FORM 5472 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 5472 form in just 37 seconds or less.

Follow these steps to fill out your FORM 5472 form online using Instafill.ai:

- 1 Enter the tax year covered and complete Part I with the reporting corporation’s legal name, address, EIN, total assets, business activity/code, incorporation details, and totals for gross payments and number of Forms 5472 filed.

- 2 Complete Part II by listing each direct and ultimate indirect 25% foreign shareholder, including names/addresses, U.S. identifying number or reference ID, FTIN (if any), and countries of incorporation/residency and where business is conducted.

- 3 Complete Part III by identifying the related party involved in the reportable transactions, indicating whether the related party is a foreign person or U.S. person, and providing identifying numbers, business activity/code, relationship checkboxes, and residency/business countries.

- 4 If the related party is foreign, complete Part IV by entering U.S.-dollar amounts for each category of monetary transactions (receipts and payments), including inventory/property sales and purchases, services, rents/royalties, intangibles, loans/interest, insurance, guarantees, and other amounts, then total the sections.

- 5 If applicable, complete Parts V and VI by attaching required statements describing other reportable transactions for a foreign-owned U.S. disregarded entity and any nonmonetary or less-than-full-consideration transactions, and check the corresponding boxes.

- 6 Answer Part VII additional information questions (imports, cost sharing participation, section 267A disallowed interest/royalty, FDII-related amounts, safe-haven interest rate loans, and covered debt instrument questions) and complete a separate Part VIII for each cost sharing arrangement if required.

- 7 If applicable, complete Part IX for base erosion payments and tax benefits under section 59A, then review for consistency, ensure all required attachments are included, and file Form 5472 with the reporting corporation’s income tax return (or as required for foreign-owned U.S. disregarded entities).

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 5472 Form?

Speed

Complete your Form 5472 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 5472 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 5472

Form 5472 is an IRS information return used to report certain transactions between a 25% foreign-owned U.S. corporation (or a foreign corporation engaged in a U.S. trade or business) and its related parties. It is filed under Internal Revenue Code sections 6038A and 6038C.

You generally must file if you are a U.S. corporation that is at least 25% foreign-owned at any time during the tax year, or a foreign corporation engaged in a U.S. trade or business with reportable related-party transactions. The form is also used by certain foreign-owned U.S. disregarded entities treated as corporations for section 6038A purposes.

It means a foreign person owns, directly or indirectly, at least 25% of the total voting power or total value of the corporation’s stock. The form also asks whether any foreign person owned at least 50% at any time during the year (Part I, line 2).

All reporting corporations must complete Part I, including the corporation’s name, address, EIN, total assets, principal business activity and code, and totals for gross payments reported. You also indicate items like initial-year filing, consolidated filing, and country/date of incorporation.

Yes. The form instructs you to enter all information in English and report all money items in U.S. dollars.

If the shareholder has no U.S. identifying number, you may need to use a Reference ID number as indicated on the form. If available, you can also provide a foreign taxpayer identification number (FTIN) in the FTIN field.

A direct 25% foreign shareholder owns the reporting corporation directly. An ultimate indirect 25% foreign shareholder owns through one or more entities in the ownership chain and is the top foreign owner meeting the 25% threshold.

Part III identifies the related party involved in the reportable transactions and whether that related party is a foreign person or a U.S. person. All reporting corporations must complete the Part III question and the rest of Part III.

Part IV must be completed if the related party in Part III is checked as a “foreign person.” You report monetary amounts for categories such as sales/purchases, rents, royalties, services, commissions, loans, and interest paid/received.

Yes, the form includes a checkbox to indicate that estimates were used. If you use estimates, you should be consistent and maintain support for how the amounts were determined.

Loans are reported in Part IV as “Amounts borrowed” (line 17) and “Amounts loaned” (line 31), including beginning and ending balances (or monthly average, as applicable). Interest paid or received is reported separately on lines 18 and 32.

Part V applies to a reporting corporation that is a foreign-owned U.S. disregarded entity and requires describing certain additional reportable transactions (such as formation, dissolution, contributions, and distributions) on an attached sheet. Part VI requires an attached description for nonmonetary or less-than-full consideration transactions with a foreign related party.

Part VII asks about items such as importing goods from a foreign related party, cost sharing arrangements, disallowed interest/royalty deductions under section 267A, FDII-related amounts, safe-haven interest rate loans, and certain related-party debt instrument transactions. These questions help the IRS understand transfer pricing, documentation, and other cross-border tax issues.

You complete Part VIII only if the reporting corporation was a participant in a cost sharing arrangement (CSA) during the tax year (Part VII, line 39). A separate Part VIII is required for each CSA, and you must report the requested CSA details and amounts in U.S. dollars.

Part IX is used to report amounts related to base erosion payments and base erosion tax benefits under section 59A, as well as qualified derivative payments. This section is relevant for corporations that may be subject to the base erosion and anti-abuse tax (BEAT) rules.

Compliance Form 5472

Validation Checks by Instafill.ai

1

Tax Year Begin/End Dates Present and Valid

Validate that the tax year beginning and ending dates are both provided and are valid calendar dates in an accepted format (e.g., MM/DD/YYYY). Confirm the ending date is after the beginning date and that the period length is reasonable for the filer (typically 12 months unless a short year is indicated). If this validation fails, the submission should be rejected or routed for correction because the tax period determines which transactions and thresholds apply.

2

Reporting Corporation Name and U.S. Address Completeness

Ensure the reporting corporation’s legal name and full address fields (street, city, state/province, and ZIP/postal code) are completed and in English as required by the form. For U.S. addresses, validate state is a valid USPS abbreviation and ZIP is 5 digits (or ZIP+4). If incomplete or improperly formatted, the filing may be unprocessable and should be flagged for correction.

3

Employer Identification Number (EIN) Format Validation

Check that the EIN is present and matches the required 9-digit format (NN-NNNNNNN or NNNNNNNNN), disallowing SSN-like patterns where applicable. Also validate that the EIN is not all zeros and does not contain non-numeric characters beyond an optional hyphen. If invalid, the form should fail validation because EIN is a primary identifier used for matching and compliance.

4

Total Assets (Line 1c) Currency and Non-Negative Check

Validate that total assets is provided as a U.S. dollar amount, numeric, and non-negative, with at most two decimal places. Reject values containing currency symbols beyond optional formatting, commas in wrong positions, or negative amounts unless explicitly allowed by business rules (generally not for assets). If this fails, downstream computations and reasonableness checks cannot be performed reliably.

5

Principal Business Activity and Activity Code Consistency

Ensure both the principal business activity description (Line 1d) and the principal business activity code (Line 1e) are provided and that the code is in the expected numeric format (typically 6 digits). Validate that the code is a valid IRS business activity code and is consistent with the text description (e.g., not a manufacturing code with a services description). If inconsistent or missing, the submission should be flagged because classification affects reporting and analytics.

6

Gross Payments Totals: Line 1f/1h and Form Count (Line 1g) Logical Consistency

Validate that Line 1g (total number of Forms 5472 filed) is a positive integer when any gross payments are reported, and that Lines 1f and 1h are valid U.S. dollar amounts. Enforce that Line 1h (all Forms) is greater than or equal to Line 1f (this Form) and that Line 1h is not populated with Line 1g equal to zero. If this fails, the filing should be rejected or flagged because totals across forms must reconcile for compliance.

7

Consolidated Filing Indicator Requires Multiple Forms and Consistent Totals

If the consolidated filing checkbox (Line 1i) is checked, validate that Line 1g indicates more than one Form 5472 and that Line 1h reflects aggregation across all included forms. Also ensure the submission includes the expected number of related Form 5472 records in the filing package. If the indicator is inconsistent with counts/totals, the filing should be flagged because consolidated reporting has specific aggregation requirements.

8

Incorporation Country and Date Validity (Lines 1l and 1m)

Validate that the country of incorporation is provided using an accepted country value (e.g., ISO-recognized name) and that the date of incorporation is a valid date not in the future. Optionally check that the incorporation date is not after the tax year end date. If invalid, the submission should be flagged because entity status and jurisdictional rules depend on these fields.

9

Residency and Principal Business Countries Are Provided and Valid

For Lines 1n and 1o, validate that at least one country is provided where required and that each country entry is valid (standardized country list) and in English. If multiple countries are allowed, enforce a consistent delimiter and prevent duplicates. If this fails, the filing should be flagged because residency and operating jurisdictions affect treaty and reporting interpretations.

10

Foreign Ownership Status (Lines 2 and 3) Must Be Answered and Not Contradictory

Ensure the filer addresses the ownership status by completing the relevant checkbox(es) and that the combination is logically consistent (e.g., a foreign-owned U.S. disregarded entity treated as a corporation for 6038A purposes should align with foreign ownership context). If neither is selected when required by filing context, or if selections conflict with entity type rules, the submission should be rejected or routed for review because it determines whether Form 5472 is required and which parts apply.

11

25% Foreign Shareholder Entries: Required Identification and Address Rules

For each completed shareholder block (Lines 4–7), validate that name and address are present and formatted, and that at least one identifying number is provided when required by instructions (U.S. identifying number, Reference ID, and/or FTIN as applicable). Enforce that Reference ID is present when U.S. identifying number is missing, and that FTIN format is non-empty and plausible when provided (alphanumeric, reasonable length). If this fails, the filing should be flagged because shareholder identification is central to 6038A/6038C compliance.

12

Related Party (Part III) Person Type Selection and Dependency Enforcement

Validate that exactly one box is selected for whether the related party is a foreign person or U.S. person, and that Part III fields (name/address, activity, relationship) are completed. If the foreign person box is checked, enforce completion of Part IV monetary transactions (or explicit zeros where allowed). If this fails, the submission should be rejected/flagged because Part IV is mandatory for foreign related parties.

13

Part IV Monetary Transaction Amounts: Numeric, Non-Negative, and Totals Reconcile

Validate that each populated line in Part IV (Lines 9–21 and 23–35) is a U.S. dollar amount with at most two decimals and is non-negative. Recalculate Line 22 as the sum of Lines 9–21 and Line 36 as the sum of Lines 23–35, and require exact match (or defined rounding tolerance). If totals do not reconcile, the submission should fail validation because the form’s internal arithmetic must be correct.

14

Loan Balances (Lines 17 and 31) Require Beginning/Ending Values and Consistency

If any borrowing (Line 17) or lending (Line 31) is reported, require both beginning balance and ending balance/monthly average fields to be present and numeric. Validate that balances are non-negative and that interest received/paid (Lines 18 and 32) is not reported without a corresponding loan balance unless an explanation/other category is provided. If this fails, the filing should be flagged because loan reporting must be internally consistent for transfer pricing and related-party scrutiny.

15

Attachment Checkbox Dependencies (Parts V and VI, and Part VII 38b)

If Part V or Part VI checkboxes are selected, require an attached statement/schedule describing the transactions as instructed; similarly, if Part VII 38a is 'Yes', require the explanatory statement for 38b. Validate that the attachment is present, properly labeled, and non-empty. If missing, the submission should be rejected or marked incomplete because the checkbox indicates required supplemental disclosure.

16

Yes/No Question Logic in Part VII and Required Amount Fields

Enforce that each Yes/No question in Part VII is answered, and apply dependencies: if 40a is 'Yes' then 40b must be a valid dollar amount; if 41a is 'Yes' then 41b–41d must be present and valid dollar amounts; if 43a is 'Yes' then 43b(1) and 43b(2) must be present. If dependencies are not met, the filing should fail validation because required follow-up disclosures are missing.

17

Cost Sharing Arrangement (Part VIII) Completion Triggered by Part VII Q39

If Part VII question 39 indicates the foreign parent participated in a CSA ('Yes'), validate that at least one Part VIII is included and that required fields (description, participation status, pre-2009 status, benefits share percent, and cost amounts) are completed. Validate that the benefits share (Line 47) is a percentage between 0 and 100, and that Line 49b is consistent with Line 49a and the benefits share within defined tolerance. If this fails, the submission should be flagged because CSA reporting is mandatory and mathematically constrained.

Common Mistakes in Completing Form 5472

Filers often overlook the header line for the reporting corporation’s tax year or enter dates that don’t match the corporation’s Form 1120/1120-F (or the entity’s actual accounting period). This creates processing mismatches and can trigger IRS correspondence or rejection of the filing package. Use the exact tax year start and end dates used on the income tax return (or pro forma return for foreign-owned U.S. disregarded entities) and keep them consistent across all attached Forms 5472.

Because the form requires all information in English and money items in U.S. dollars, people commonly paste foreign-language legal names/addresses or report amounts in local currency. This can lead to unclear identification of parties and incorrect totals, which increases audit risk and follow-up requests. Translate names/addresses into English where appropriate and convert all monetary amounts to USD using a consistent method (and retain the exchange-rate support in your records).

A frequent error is entering an SSN/ITIN instead of the corporation’s EIN, transposing digits, or leaving the EIN blank (especially for newly formed entities or foreign-owned U.S. disregarded entities). An incorrect EIN can prevent proper matching to the tax return and may result in penalties or notices. Confirm the EIN from the IRS assignment letter (CP 575) or prior filings and ensure it matches the name on line 1a.

Filers often enter total assets from the wrong financial statement, omit year-end adjustments, or report in thousands while the form expects full dollars. This can make the filing internally inconsistent and raise questions about the corporation’s size and reporting completeness. Use the same basis and year-end date as the tax return balance sheet (Schedule L, if applicable) and report the full USD amount without scaling unless explicitly instructed.

People commonly enter a narrative activity that doesn’t align with the IRS activity code list, use an outdated code, or copy a code from another entity that has a different primary revenue source. Incorrect codes can cause classification issues and may prompt questions about whether the right transactions were reported. Select the code that best matches the entity’s primary activity for the year and ensure the description and code agree.

Checkboxes in Part I (for consolidated filing and initial year) and lines 2–3 are frequently missed or checked incorrectly because filers misunderstand the ownership thresholds or disregarded-entity rules. Wrong selections can lead to incomplete reporting, missing required attachments, or incorrect expectations about how many Forms 5472 should be filed. Review ownership during the entire tax year, confirm whether the filer is a foreign-owned U.S. disregarded entity treated as a corporation for 6038A purposes, and only check consolidated filing if you meet the specific IRS conditions.

A common mistake is listing only the immediate owner when an ultimate indirect 25% foreign shareholder must also be disclosed, or mixing up “direct” and “ultimate indirect” entries. This can make the ownership chain unclear and may be treated as an incomplete Form 5472. Map the ownership structure for the entire year, list each required direct and ultimate indirect 25% foreign shareholder in the correct lines, and ensure names/addresses and country fields are complete.

Filers often don’t have a U.S. identifying number or FTIN for a foreign party and then leave all identifier fields empty, not realizing a Reference ID number is expected when other IDs are unavailable. Missing identifiers can delay processing and increase the chance of IRS follow-up because the related party cannot be reliably matched. If no U.S. TIN or FTIN exists, create and consistently use a unique Reference ID number for that party across all filings and years, following the instructions.

People frequently forget to indicate whether the related party is a foreign person or U.S. person, or they check the wrong relationship boxes in line 8e. This matters because it determines whether Part IV is required and how transactions should be interpreted. Confirm the related party’s status and relationship to the reporting corporation and the 25% foreign shareholder, and ensure the Part III heading selection aligns with the transactions you report.

A very common error is netting payments (e.g., reporting only the net of purchases and returns), combining different transaction types into “Other,” or omitting required beginning/ending balances for amounts borrowed/loaned. Misclassification can understate reportable amounts and create inconsistencies with transfer pricing documentation or financial records. Report gross payments by category on the correct lines, avoid netting unless instructions explicitly allow it, and complete both balance fields for loans (including whether you used ending balance or monthly average).

Filers often check the box indicating additional reportable transactions (Part V) or nonmonetary/less-than-full consideration transactions (Part VI) but fail to attach the separate sheet description, or they answer “Yes” to Part VII import valuation questions and forget the required explanation statement. Missing attachments can make the filing incomplete and may trigger IRS notices or penalties. When a part requires an attached description, include a clearly labeled statement with enough detail to identify the transaction, parties, dates, and amounts (or valuation method).

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 5472 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-5472-rev-december-2023-information-return-of forms, ensuring each field is accurate.