Form 5472 (Rev. December 2023), Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business Completed Form Examples and Samples

Explore clear, filled-out examples and samples of IRS Form 5472 (Rev. December 2023). Understand how to complete the Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business with our detailed guides for various scenarios.

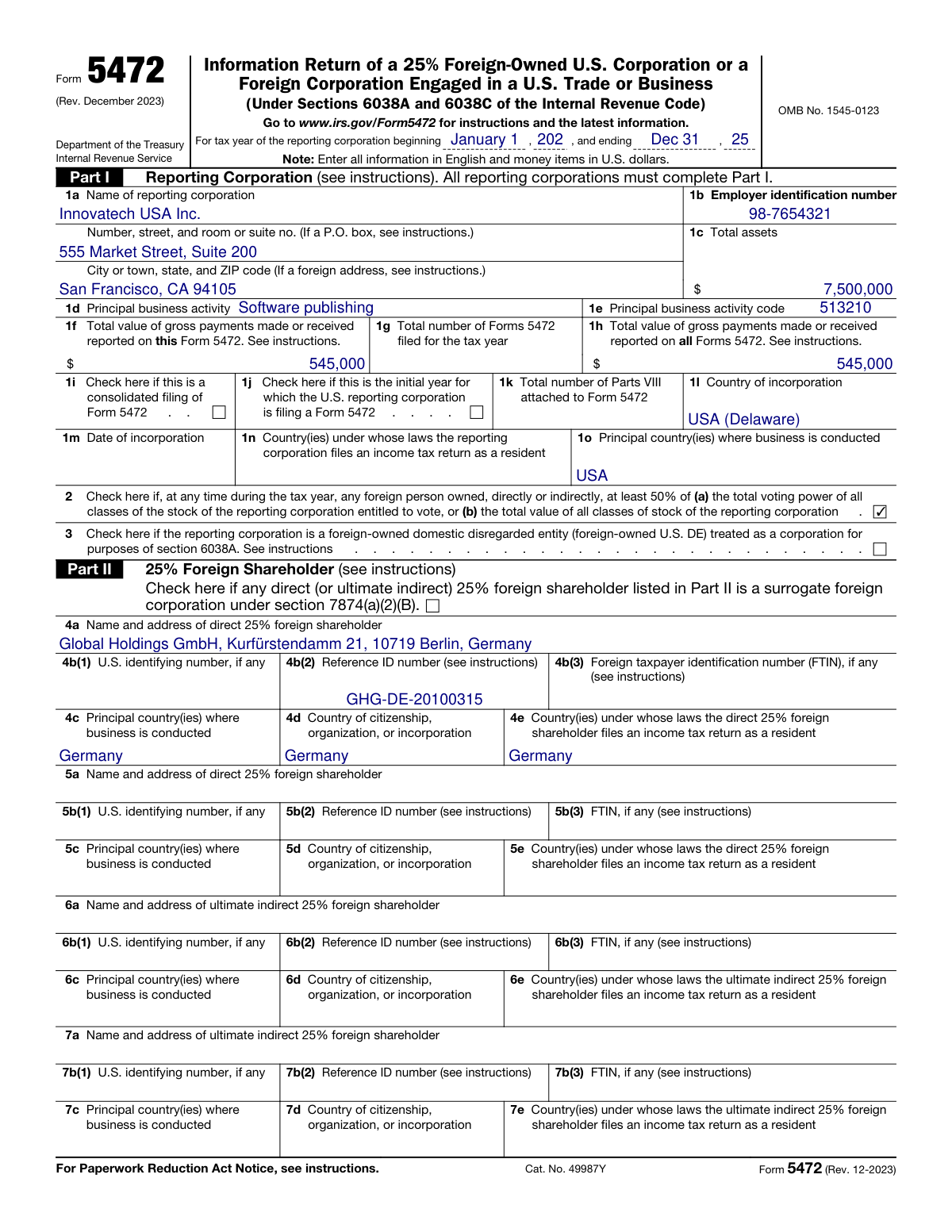

Form 5472 Example: U.S. Corporation Wholly Owned by a Foreign Individual

How this form was filled:

This example shows Form 5472 filed by a U.S. corporation, 'Innovatech USA Inc.', which is a 25% foreign-owned entity. The form identifies its sole foreign shareholder, 'Global Holdings GmbH' from Germany, and reports monetary transactions between them for the 2025 tax year, including sales of goods and interest payments on a shareholder loan.

Information used to fill out the document:

- Reporting Corporation Name: Innovatech USA Inc.

- Reporting Corporation EIN: 98-7654321

- Reporting Corporation Address: 555 Market Street, Suite 200, San Francisco, CA 94105

- Total Assets: $7,500,000

- Principal Business Activity Code: 513210 (Software Publishers)

- Country of Incorporation: USA (Delaware)

- Tax Year Beginning: January 1, 2025

- Tax Year Ending: December 31, 2025

- Related Party Name: Global Holdings GmbH

- Related Party Type: 25% foreign shareholder

- Related Party Country: Germany

- Related Party Address: Kurfürstendamm 21, 10719 Berlin, Germany

- Related Party Reference ID Number: GHG-DE-20100315

- Related Party Principal Business Activity: Holding company activities

- Direct Ownership Percentage: 100%

- Transaction 1 (Part IV): Sales of stock in trade (inventory) from Innovatech to Global Holdings: $500,000

- Transaction 2 (Part IV): Interest paid by Innovatech to Global Holdings on a loan: $45,000

- Base Erosion Payments (Part VII): Interest paid of $45,000 is also reported here.

What this filled form sample shows:

- Correctly identifies the U.S. corporation as the reporting corporation.

- Details a single 25% foreign shareholder (a German corporation) as the related party in Part II.

- Provides a Reference ID number for the foreign party as required when no U.S. TIN is available.

- Reports specific monetary transactions in Part IV, such as sales and interest payments.

- Confirms 100% direct ownership by the foreign shareholder in Part V.

- Includes relevant amounts in Part VII for base erosion and anti-abuse tax (BEAT) considerations.

Form specifications and details:

| Form Name: | Form 5472 (Rev. December 2023) |

| Form Title: | Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business |

| Use Case: | U.S. corporation wholly owned by a single foreign corporate shareholder, reporting intercompany transactions. |

Created: January 29, 2026 07:08 AM