Yes! You can use AI to fill out Form 8829, Expenses for Business Use of Your Home

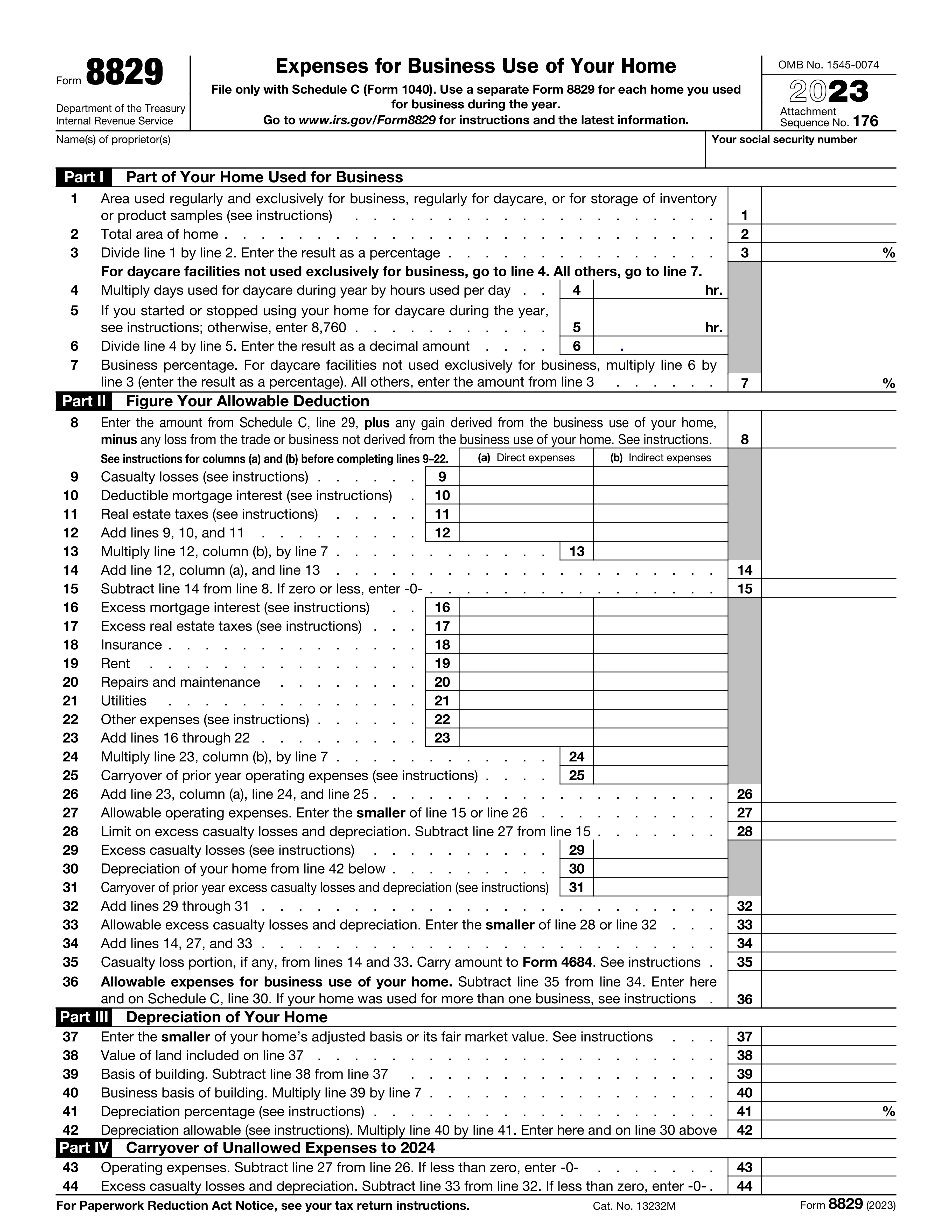

Form 8829, Expenses for Business Use of Your Home, is used to report and calculate the expenses related to the business use of your home. This form is essential for taxpayers who wish to claim deductions for home office expenses, ensuring they accurately report their allowable deductions.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 8829 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 8829, Expenses for Business Use of Your Home |

| Form issued by: | Department of the Treasury, Internal Revenue Service |

| Number of fields: | 58 |

| Number of pages: | 1 |

| Version: | 2023 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i8829.pdf |

| Filled form examples: | Form Form 8829 Examples |

| Language: | English |

| Categories: | business forms, business expense forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 8829 Online for Free in 2026

Are you looking to fill out a FORM 8829 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 8829 form in just 37 seconds or less.

Follow these steps to fill out your FORM 8829 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 8829.

- 2 Enter your name and social security number.

- 3 Fill in the area used for business.

- 4 Complete the allowable deduction calculations.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 8829 Form?

Speed

Complete your Form 8829 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 8829 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 8829

Form 8829, Expenses for Business Use of Home, is used to calculate the allowable deduction for expenses related to the business use of a home.

Individuals who have used their home for business purposes during the tax year should file Form 8829.

Part I of Form 8829 requires the following information:

1. Proprietor's name and social security number

2. Area of the home used for business

3. Total area of the home

The business percentage is calculated by dividing the area used for business by the total area of the home.

Direct expenses are expenses that can be easily identified with the business use of the home and include:

1. Casualty losses

2. Mortgage interest

3. Real estate taxes

Indirect expenses are expenses that cannot be easily identified with the business use of the home and include:

1. Rent

2. Utilities

3. Insurance

4. Repairs and maintenance

These expenses are allocated based on the business percentage calculated in Part I.

Expenses are reported in Part II of Form 8829. Direct expenses are listed separately, while indirect expenses are calculated based on the total expenses and the business percentage.

Form 8829 should be filed along with the individual's tax return for the tax year in which the business use of the home occurred.

Part III of Form 8829 is used to calculate the depreciation of the home office based on the business percentage. This calculation is important as it helps determine the amount of depreciation that can be claimed as a deduction for the business use of your home.

Operating expenses are the expenses that can be deducted in the current tax year. These expenses are directly related to the business use of your home office and include items such as utilities, repairs, and insurance. Excess casualty losses and depreciation, on the other hand, are carried over to the next tax year. Excess casualty losses refer to any losses that exceed the $100 threshold per event, while depreciation is the decrease in value of the home office over time. These expenses can be deducted in future years, subject to certain limits.

The Carryover of Prior Year Operating Expenses line is used to carry over any unused operating expenses from the previous tax year. If you had operating expenses in the previous year that were not fully deducted, you can carry them over to the current year and deduct them against the current year's operating expenses.

The Allowable Operating Expenses line is used to determine the total amount of operating expenses that can be deducted in the current tax year. This calculation is important as it helps determine the total amount of expenses that can be claimed as a deduction for the business use of your home office.

The Limit on Excess Casualty Losses and Depreciation line is used to determine the amount of excess casualty losses and depreciation that can be deducted in the current tax year. The IRS imposes certain limits on the amount of excess casualty losses and depreciation that can be deducted in a given year. This line helps you calculate and keep track of these limits to ensure that you are not claiming more than what is allowed by the IRS.

The Allowable Excess Casualty Losses and Depreciation line in Part IV of Form 8829 is used to determine the total amount of excess casualty losses and depreciation that can be carried over to the next tax year. Excess casualty losses are the losses that exceed the insurance reimbursement, while depreciation is the decrease in value of the home office over time. These expenses can be deducted in the current tax year up to the limit set by the IRS, and any amounts above that limit can be carried over to the next year.

The Allowable Expenses for Business Use of Your Home line in Part III of Form 8829 is used to determine the total amount of expenses that can be deducted for the business use of the home. This includes expenses such as mortgage interest, real estate taxes, utilities, repairs, and insurance. The total amount of expenses is limited by the IRS based on the percentage of the home that is used for business purposes. Any expenses above the limit can be carried over to the next tax year.

The Depreciation Allowable line in Part III of Form 8829 is used to determine the amount of depreciation that can be deducted for the business use of the home. Depreciation is the decrease in value of the home office over time. The IRS allows a specific rate of depreciation based on the type of property and the method of depreciation chosen by the taxpayer. The total amount of depreciation is limited by the IRS based on the percentage of the home that is used for business purposes.

The Carryover of Unallowed Expenses to 2024 lines in Part IV of Form 8829 are used to carry over any unused operating expenses, excess casualty losses and depreciation to the next tax year. Operating expenses are the expenses that are not subject to the limits set by the IRS, such as utilities and repairs. Excess expenses, casualty losses, and depreciation above the limits can be carried over to the next year and deducted in that year, up to the limits set by the IRS.

Compliance Form 8829

Validation Checks by Instafill.ai

1

Ensures that the form used is the correct year's version of Form 8829

The software ensures that the version of Form 8829 being filled out corresponds to the correct tax year. It checks the form's date against the current tax year and alerts the user if there is a mismatch. This is crucial as tax laws and form requirements can change annually, and using an outdated form could lead to incorrect filings. The system prevents submission of the form if the year does not align with the current tax period.

2

Confirms that the taxpayer meets the specific requirements to deduct expenses for the business use of their home

The software confirms that the taxpayer satisfies the criteria for deducting home office expenses. It reviews the information provided against the IRS guidelines to ensure eligibility, such as the exclusive and regular use of a portion of the home for business purposes, and that the home is the principal place of business. The system prompts the user for additional information if the eligibility criteria appear not to be met, ensuring compliance with tax regulations.

3

Verifies that a separate Form 8829 is used for each home used for business during the tax year

The software verifies that if the taxpayer used more than one home for business purposes during the tax year, a separate Form 8829 is completed for each property. It checks the number of forms filled out against the number of homes reported for business use. The system ensures that each home's expenses are accurately reported and that no property is overlooked, which is essential for proper tax calculation and compliance.

4

Checks that Form 8829 is not used if the taxpayer is claiming expenses for business use of their home as a partner

The software checks the taxpayer's filing status to ensure that Form 8829 is not utilized if the taxpayer is claiming home office expenses as a partner. It identifies the appropriate forms for partners to use instead of Form 8829, such as Schedule E. This validation is important to prevent incorrect form submissions, which could result in processing delays or the rejection of the tax return.

5

Ensures that the taxpayer does not use Form 8829 if all expenses are allocable to inventory costs

The software ensures that the taxpayer does not use Form 8829 if all the expenses for the business use of their home are allocable to inventory costs. It assesses the nature of the expenses reported and guides the taxpayer to the correct form or line item on their tax return if inventory costs are the sole expenses. This helps maintain accurate tax reporting and adherence to IRS rules regarding home office deductions.

6

Confirms that the taxpayer has not elected to use the simplified method for the home for the tax year 2023.

The AI ensures that the taxpayer has not opted for the simplified method when claiming expenses for business use of their home for the tax year 2023. It checks for any indications or selections on the form that might suggest the simplified method was chosen. If the simplified method is detected, the AI flags this as an error, as the form in question requires the use of the regular method. The AI also cross-references previous years' filings to ensure consistency in the method applied.

7

Verifies that if the simplified method was used in 2022 but not in 2023, any unallowed expenses from a prior year Form 8829 are correctly carried over.

The AI verifies the correct carryover of any unallowed expenses from the prior year's Form 8829 if the taxpayer used the simplified method in 2022 but has switched to the regular method for 2023. It checks the current form for proper documentation and calculations of these expenses. The AI also reviews the previous year's form to confirm the accuracy of the carryover and ensures that the transition from the simplified to the regular method is handled correctly.

8

Checks that Part I of the form is completed to calculate the percentage of the home used for business.

The AI checks that Part I of the form is fully completed, which is essential for calculating the percentage of the home used for business purposes. It ensures that all required fields are filled in with accurate measurements and that the calculations are performed correctly. The AI also confirms that the area used exclusively for business is clearly defined and that the percentage is calculated based on the correct figures.

9

Ensures that Part II is filled out to report gross income from the business use of the home and to deduct expenses directly related to business use of the home.

The AI ensures that Part II of the form is properly filled out to report the gross income attributable to the business use of the home. It verifies that all relevant expenses directly related to the business use of the home are accurately reported and deducted. The AI checks for completeness and accuracy in this section, ensuring that the taxpayer is claiming the correct amounts and that the deductions are substantiated.

10

Verifies that Part III is completed for calculating depreciation of the home used for business.

The AI verifies that Part III of the form is completed, which is necessary for calculating the depreciation of the home used for business purposes. It ensures that the correct depreciation method is selected, the basis of the property is accurately reported, and the calculation of depreciation is done in accordance with current tax laws and regulations. The AI also checks for consistency with previous years' depreciation claims, if applicable.

11

Confirms that Part IV is used to figure any allowable carryover of expenses that exceed the limit.

The AI ensures that Part IV of the form is properly utilized to calculate any permissible carryover of expenses that surpass the allowable limit. It checks that the calculations align with the current tax regulations and that any carryover is accurately reflected in the subsequent tax year's calculations. The AI also confirms that the carryover does not exceed the deduction limit for the upcoming year and that the entries are consistent with the taxpayer's financial records.

12

Checks for the attachment of any required statements or forms, such as Form 4562 for depreciation, if necessary.

The AI verifies that all necessary statements and forms are attached to the main form, including Form 4562 for depreciation when applicable. It checks that these attachments are complete and correctly filled out, ensuring that they comply with the IRS requirements. The AI also prompts the user to attach any additional documentation that may be required based on the expenses claimed on the form.

13

Ensures that if expenses exceed the current year's limit, the excess is correctly carried over to the next year, subject to the deduction limit for that year.

The AI ensures that if the expenses claimed for business use of the home exceed the current year's limit, the excess amount is accurately carried over to the next year. It calculates the carryover in accordance with the IRS guidelines, taking into account the deduction limit for the subsequent year. The AI also maintains a record of the carryover to facilitate accurate reporting in future tax filings.

14

Verifies the accuracy of all entries on the form before submission.

The AI meticulously verifies the accuracy of all entries on the form before submission. It cross-references the data with the taxpayer's financial documents to ensure that all amounts and calculations are correct. The AI also checks for common errors, such as mathematical discrepancies or incomplete fields, and alerts the user to any inconsistencies that need to be addressed prior to filing.

15

Checks for the most current information and any future developments related to Form 8829 on the IRS website.

The AI checks for the most up-to-date information and any future developments regarding Form 8829 on the IRS website. It ensures that the form being used is the latest version and that any new guidelines or changes in tax law are taken into account when filling out the form. The AI also informs the user of any updates or new requirements that may affect the filing of expenses for business use of the home.

Common Mistakes in Completing Form 8829

Failure to accurately calculate the percentage of the home used for business can result in an over or under estimation of the allowable deduction. To avoid this mistake, carefully review the instructions for calculating the percentage of business use and ensure all eligible square footage is accounted for. Additionally, keep detailed records of the time spent working from home and the percentage of expenses related to the business use of the home.

Neglecting to report gross income from business use of the home can result in underreported income and potential penalties. To avoid this mistake, carefully review the instructions for reporting gross income and ensure all income related to the business use of the home is reported. This includes income from renting out a portion of the home or income earned as an employee working from home.

Failure to deduct expenses directly related to the business use of the home can result in missed deductions and potential overpayment of taxes. To avoid this mistake, carefully review the instructions for reporting expenses and ensure all eligible expenses are reported. This includes expenses for utilities, repairs, and insurance related to the business use of the home.

Miscalculation of depreciation can result in incorrect deductions and potential penalties. To avoid this mistake, carefully review the instructions for calculating depreciation and ensure all eligible expenses are accounted for. It is also important to use the correct method and rate for depreciation based on the type of property and the year it was placed in service.

Failure to attach Form 4562 for depreciation can result in missed deductions and potential penalties. To avoid this mistake, carefully review the instructions for reporting depreciation and ensure Form 4562 is attached if required. This form is necessary to report the details of the property being depreciated and the method and rate of depreciation.

The Business Use of Home Expenses form allows taxpayers to deduct certain expenses related to the business use of their home. However, there is a limit to the amount of expenses that can be deducted each year. If expenses exceed this limit, the excess amount must be carried over to the next year in Part IV of the form. Failure to properly carry over excess expenses can result in an underreported income or an incorrect deduction. To avoid this mistake, carefully review Part IV of the form and ensure that all excess expenses from previous years are accounted for and carried over correctly.

The Business Use of Home Expenses form requires taxpayers to provide detailed information about their home business expenses. It is essential to carefully review all entries for accuracy before submitting the form to the IRS. Errors or omissions can result in an incorrect deduction or an underreported income. To avoid this mistake, take the time to double-check all entries, including the calculation of expenses and the allocation of square footage for business use. It is also recommended to consult with a tax professional or the IRS if there is any uncertainty regarding the proper reporting of expenses.

The Business Use of Home Expenses form has undergone several revisions over the years, and it is essential to use the correct version for the tax year in question. Additionally, there are specific circumstances that may require the use of additional forms or schedules. Failure to use the correct form or to include all required forms and schedules can result in an incorrect deduction or an underreported income. To avoid this mistake, carefully review the instructions for the form and consult with a tax professional or the IRS if there is any uncertainty regarding the proper form or forms to use.

The Business Use of Home Expenses form has specific requirements for deducting expenses related to the business use of a home. Failure to understand these requirements can result in incorrectly claimed expenses or an underreported income. For example, expenses related to the maintenance, repair, or improvement of the home may be deductible only if they are directly related to the business use of the home. To avoid this mistake, carefully review the instructions for the form and consult with a tax professional or the IRS if there is any uncertainty regarding the proper reporting of expenses.

The Business Use of Home Expenses form requires taxpayers to report all income related to the business use of their home. This includes income from renting out part of the home, as well as income from the sale of goods or services provided from the home. Failure to report all income can result in an underreported income and potential penalties. To avoid this mistake, carefully review all income related to the business use of the home and ensure that it is reported accurately on the form.

One of the most common mistakes made when completing the Expenses for Business Use of Home form is failing to maintain proper records and documentation to support the expenses claimed. This can lead to inaccurate or incomplete reporting, which may result in disallowed expenses or even penalties. To avoid this mistake, it is essential to keep detailed records of all expenses related to the business use of your home. This includes maintaining records of the date, amount, and business purpose of each expense. Additionally, it is recommended to keep receipts, invoices, and other documentation as proof of the expense. Proper record keeping not only ensures the accuracy of your tax reporting but also provides evidence to support your expenses if you are ever audited by the IRS.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 8829 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 8829 forms, ensuring each field is accurate.