Form 8829, Expenses for Business Use of Your Home Completed Form Examples and Samples

Explore detailed examples of Form 8829, Expenses for Business Use of Home, tailored for freelance graphic designers and online marketing consultants. Learn how to accurately complete the form to optimize deductions, covering home space utilization and relevant expenses.

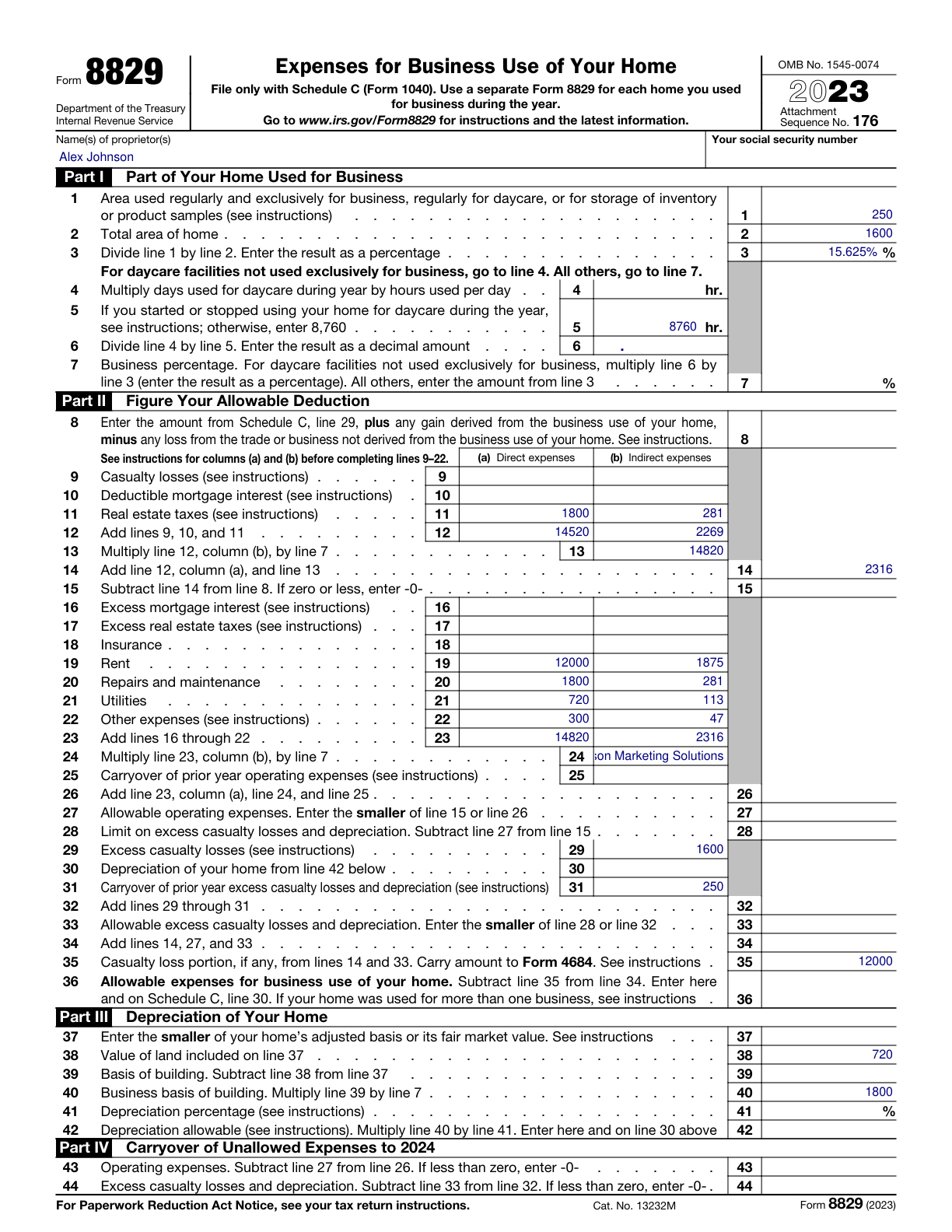

Form 8829 Example – Freelance Graphic Designer

How this form was filled:

This example demonstrates how a freelance graphic designer can fill out Form 8829 to calculate deductions for business use of a home office. It covers details like total home space, business use percentage, and all relevant expenses.

Information used to fill out the document:

- Name: Sarah Smith

- Business Name: Sarah's Design Studio

- Total Area of Home: 1400 square feet

- Area Used Regularly and Exclusively for Business: 300 square feet

- Indirect Expenses: Mortgage Interest, Utilities, Insurance

- Mortgage Interest: $6000 annually

- Utilities: $2400 annually

- Insurance: $1200 annually

- Repairs and Maintenance: $500 annually

- Date: 03/20/2025

What this filled form sample shows:

- Detailed completion of home size and business-use percentage

- Inclusion of indirect expenses like mortgage interest and utilities

- Breakdown of deductible expenses based on business use percentage

- Proper calculation of deductions for a home office

Form specifications and details:

| Use Case: | Freelance graphic designer using a dedicated home office |

| Filing Year: | 2025 |

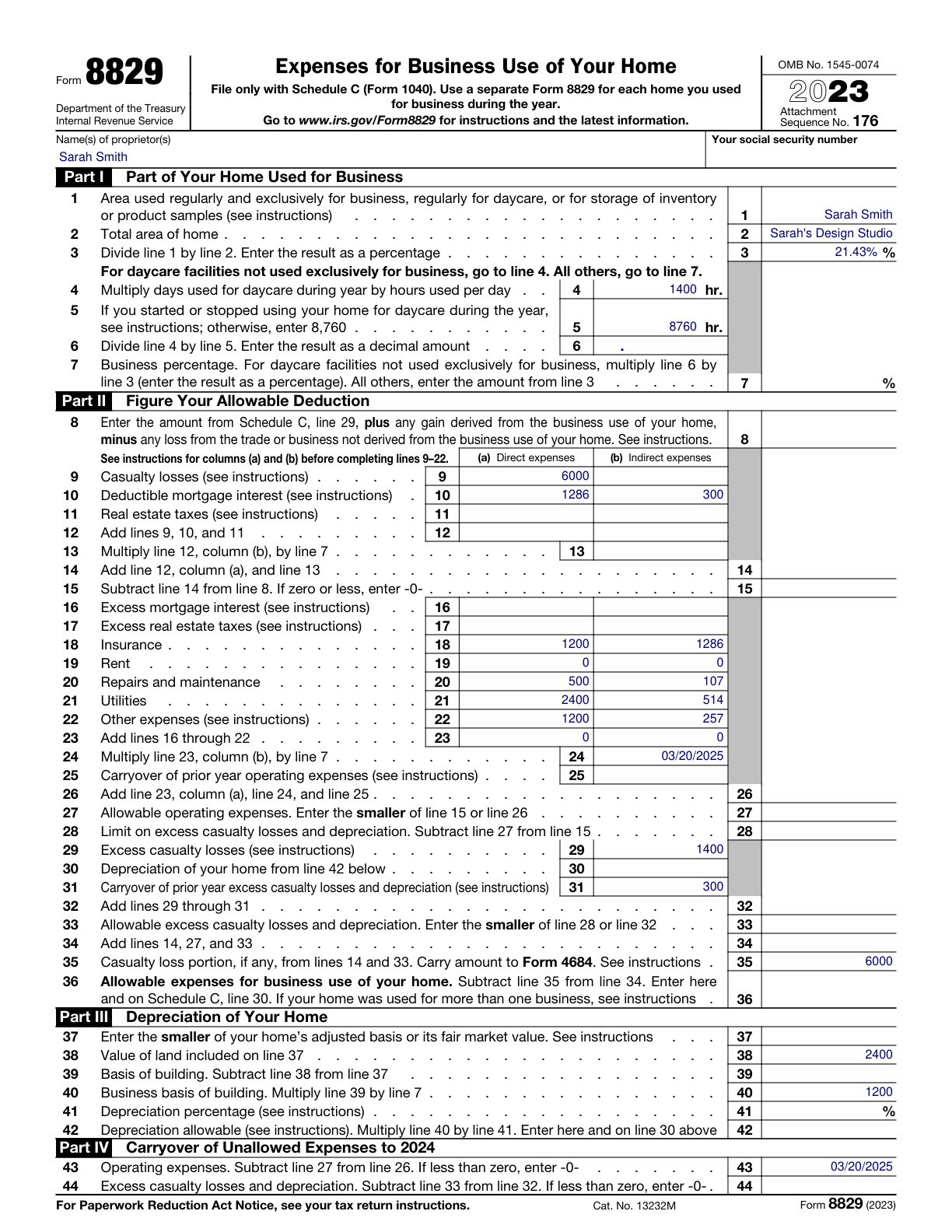

Form 8829 Example – Online Marketing Consultant

How this form was filled:

This example shows how an online marketing consultant can complete Form 8829 to determine deductions for business use of a home office, including calculations for home space and expenses like rent and internet.

Information used to fill out the document:

- Name: Alex Johnson

- Business Name: Johnson Marketing Solutions

- Total Area of Home: 1600 square feet

- Area Used Regularly and Exclusively for Business: 250 square feet

- Indirect Expenses: Rent, Internet, Property Taxes

- Rent: $12000 annually

- Internet: $720 annually

- Property Taxes: $1800 annually

- Repairs and Maintenance: $300 annually

- Date: 04/15/2025

What this filled form sample shows:

- Comprehensive inclusion of home space metrics and business usage percentage

- Explicit detail on indirect expenses like rent and internet

- Detailed breakdown of applicable deductions based on business use area

- Accurate computation of home office deductions for tax filing

Form specifications and details:

| Use Case: | Online marketing consultant using a dedicated home office |

| Filing Year: | 2025 |