Form 8949 (2025), Sales and Other Dispositions of Capital Assets Completed Form Examples and Samples

Explore comprehensive examples and samples of a filled IRS Form 8949 for the 2025 tax year. Understand how to correctly report Sales and Other Dispositions of Capital Assets, including short-term and long-term stock sales, from your Form 1099-B. Our detailed guides help you accurately calculate capital gains and losses for your Schedule D.

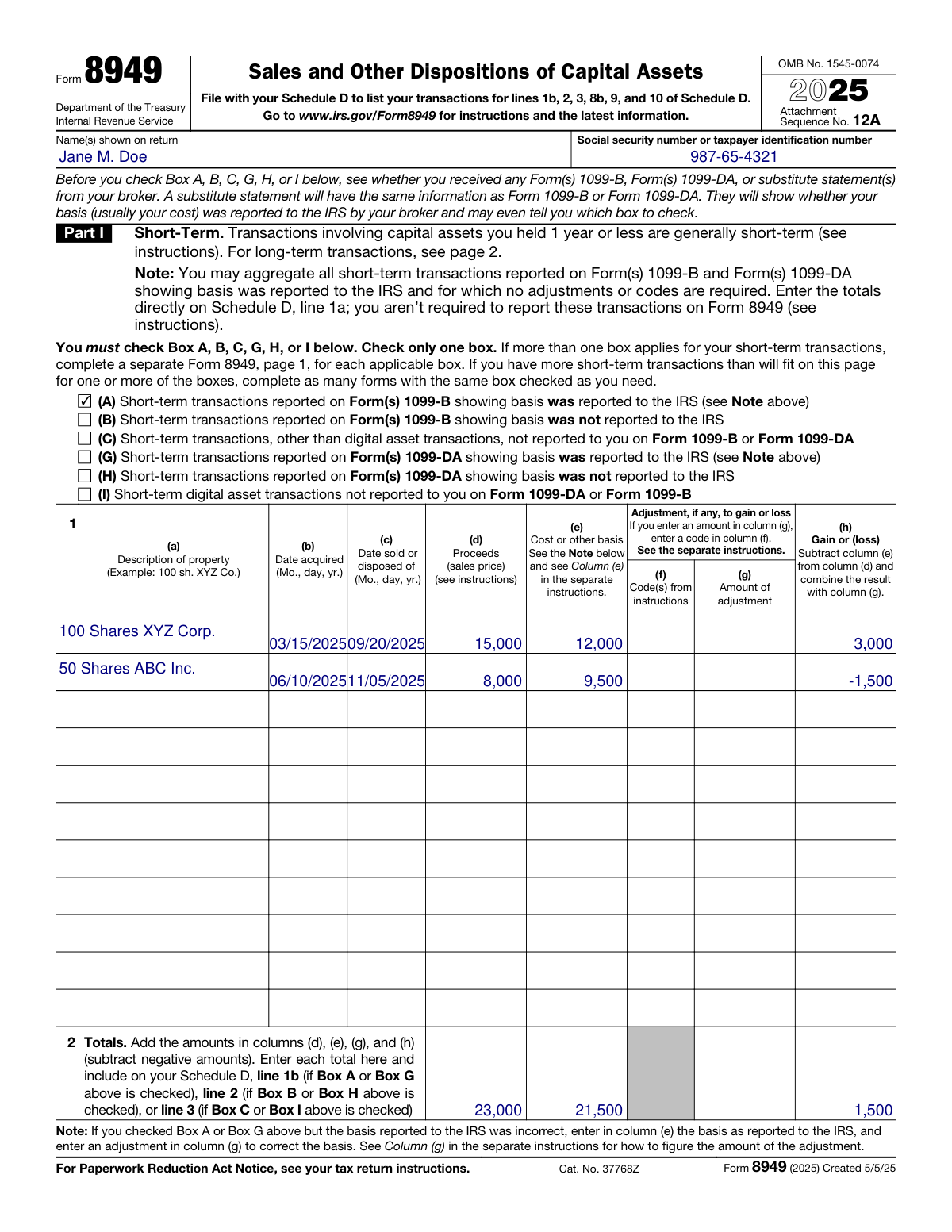

Form 8949 (2025) Example: Reporting Short-Term Stock Sales

How this form was filled:

This sample of Form 8949 for the 2025 tax year illustrates how a taxpayer reports short-term capital gains and losses from stock sales. The transactions shown were reported on Form 1099-B with the cost basis provided to the IRS, so Part I with Box A checked is used. The example includes one sale resulting in a gain and another resulting in a loss, with the totals calculated at the bottom for transfer to Schedule D.

Information used to fill out the document:

- Taxpayer Name: Jane M. Doe

- Taxpayer SSN: 987-65-4321

- Transaction Type: Short-Term Transactions with basis reported to IRS (Part I, Box A)

- Asset 1 Description: 100 Shares XYZ Corp.

- Date Acquired (Asset 1): 03/15/2025

- Date Sold (Asset 1): 09/20/2025

- Proceeds (Asset 1): 15000.00

- Cost Basis (Asset 1): 12000.00

- Gain or (Loss) (Asset 1): 3000.00

- Asset 2 Description: 50 Shares ABC Inc.

- Date Acquired (Asset 2): 06/10/2025

- Date Sold (Asset 2): 11/05/2025

- Proceeds (Asset 2): 8000.00

- Cost Basis (Asset 2): 9500.00

- Gain or (Loss) (Asset 2): -1500.00

- Total Proceeds: 23000.00

- Total Cost Basis: 21500.00

- Total Gain or (Loss): 1500.00

What this filled form sample shows:

- Illustrates reporting of short-term transactions where cost basis was reported to the IRS (Box A).

- Includes both a capital gain and a capital loss to demonstrate proper recording of each.

- Shows correct formatting for dates, proceeds, and cost basis as received from a Form 1099-B.

- Demonstrates the calculation of totals to be carried over to Schedule D (Form 1040).

Form specifications and details:

| Form: | Form 8949, Sales and Other Dispositions of Capital Assets |

| Version: | 2025 |

| Use Case: | Reporting Short-Term Stock Sales from Form 1099-B |

| Filing Year: | 2026 (for Tax Year 2025) |

Created: January 29, 2026 07:45 AM