Yes! You can use AI to fill out Form SSA-3369-BK, Work History Report

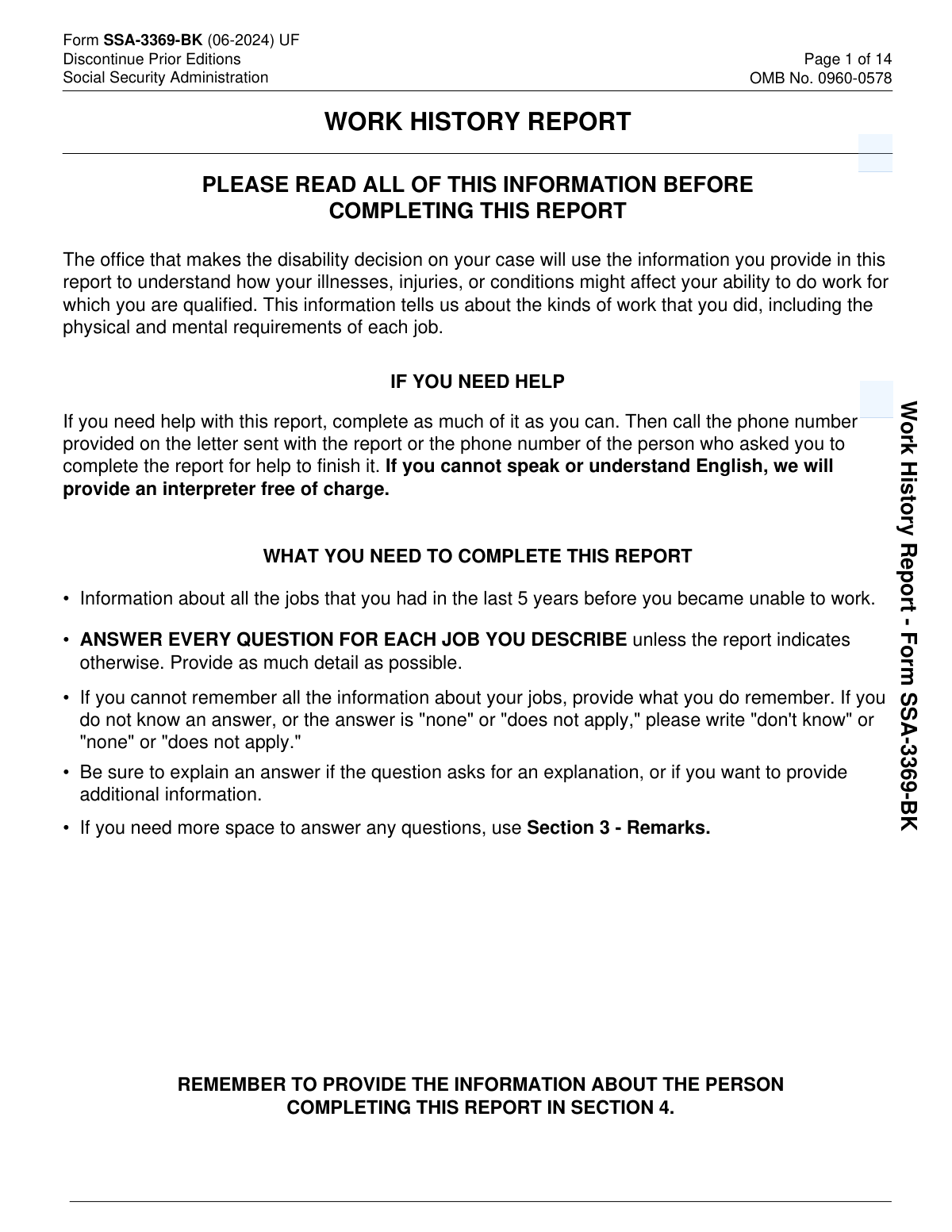

Form SSA-3369-BK is a Social Security Administration Work History Report completed as part of a disability claim (such as SSDI or SSI). It asks for a list of jobs performed in the 5 years before the applicant became unable to work and requires detailed descriptions of job duties, physical demands (standing, walking, lifting, reaching, etc.), tools/equipment used, and workplace exposures. Disability examiners use this information to compare the applicant’s past work requirements to their current functional limitations and determine whether they can perform past work or other work. Providing complete, accurate job details helps avoid delays and supports an accurate disability determination.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out SSA-3369-BK using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form SSA-3369-BK, Work History Report |

| Number of pages: | 14 |

| Filled form examples: | Form SSA-3369-BK Examples |

| Language: | English |

| Categories: | SSA forms |

Instafill Demo: How to fill out PDF forms in seconds with AI

How to Fill Out SSA-3369-BK Online for Free in 2026

Are you looking to fill out a SSA-3369-BK form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your SSA-3369-BK form in just 37 seconds or less.

Follow these steps to fill out your SSA-3369-BK form online using Instafill.ai:

- 1 Gather your work records for the 5 years before you became unable to work (job titles, employers/type of business, dates worked, pay rate, hours per day/week, and key duties).

- 2 Complete Section 1 with the applicant’s identifying information (name, Social Security number, and reliable daytime phone numbers).

- 3 In Section 2 (job list), enter each job held for 30 days or more during the relevant 5-year period, listing the most recent job first and including self-employment and foreign work.

- 4 For each job detail page (Job No. 1–5 and additional jobs if needed), describe a typical workday: main tasks, any reports written, any supervision performed, tools/machines used, and the amount/type of interaction with coworkers or the public.

- 5 For each job, complete the physical requirements and conditions: time spent standing/walking/sitting, postural activities (stooping, kneeling, crouching, crawling), hand use and reaching, lifting/carrying amounts and frequency, and any environmental exposures (noise, vibrations, hazardous substances, extreme temperatures, etc.).

- 6 Explain for each job how your medical conditions would affect your ability to perform that work today, using specific limitations (e.g., cannot lift over X lbs, cannot stand more than Y minutes, difficulty concentrating, etc.).

- 7 Use Section 3 (Remarks) for overflow details, clarifications, or additional jobs, then complete Section 4 to identify who filled out the report, provide contact information, sign/date as required by the requesting agency, and submit the completed form to the state agency that requested it.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable SSA-3369-BK Form?

Speed

Complete your SSA-3369-BK in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 SSA-3369-BK form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form SSA-3369-BK

The disability decision office uses this form to understand the work you did and the physical and mental demands of each job. This helps them evaluate how your medical conditions affect your ability to do work you are qualified for.

The person applying for disability benefits should complete it whenever possible. If someone else fills it out for the applicant, they must complete Section 4 with their name, relationship, and contact information.

List all jobs you had in the 5 years before you became unable to work because of your medical conditions. List your most recent job first.

Yes—include self-employment (such as rideshare driving or hair styling) and work performed in a foreign country. The goal is to capture all work during the relevant 5-year period.

Do not include jobs you held for less than 30 calendar days. If you are unsure whether a job meets that threshold, explain the dates and details in Section 3 (Remarks).

List all job titles even if they were for the same employer. Different titles can involve different duties and physical requirements, which can affect the disability evaluation.

You should gather job titles, type of business, dates worked (month/year), pay rate, hours per day, and days per week for each job. You’ll also need details about your duties, tools/equipment used, physical activities, lifting/carrying, and any workplace exposures.

Provide your best estimate and include as much detail as you can. If you truly don’t know an answer, write “don’t know,” and you can add clarifying details in Section 3 (Remarks).

Be specific about what you did in a typical workday (for example, stocking shelves, scheduling appointments, maintaining records). Include details about any report-writing, supervising others, and the machines/tools/equipment you used and what you used them for.

If you answer “Yes,” describe who you interacted with (coworkers, customers, clients), why (helping customers, coordinating work), how (in person, phone, computer), and how much time you spent doing it per day or week.

Enter the time spent on each activity in a typical workday using hours/minutes. The combined total for standing/walking and sitting should equal the “Hours per Day” you reported for that job.

Choose the best match for the heaviest weight you lifted and the weight you lifted frequently (about 1/3 to 2/3 of the workday). In the explanation box, describe what you lifted, how far you carried it, and how often.

Exposures include things like outdoors, extreme heat/cold (non-weather related), wetness, humidity, hazardous substances, moving mechanical parts, high places, heavy vibration, and loud noises. Check all that apply and explain what you were exposed to and how often.

Each job section includes a prompt asking you to explain how your medical conditions would affect your ability to do that job. Describe specific limitations (for example, pain with lifting, difficulty standing, trouble concentrating) as they relate to the job’s tasks.

Use Section 3 (Remarks) for extra space and reference the job title number and the question you are continuing. If you add more jobs beyond the five detailed job sections, attach separate sheets and provide the same type of information requested for Jobs 1–5.

Send or bring the completed form to the State agency that requested it (not to the Baltimore address, which is only for comments about the time estimate). SSA estimates it takes about 40 minutes to read the instructions, gather facts, and answer the questions.

Compliance SSA-3369-BK

Validation Checks by Instafill.ai

1

Validates claimant name fields are present and properly structured (Section 1.A)

Checks that the claimant’s First Name and Last Name are provided, and that Middle Initial and Suffix (if provided) contain only expected characters (letters for middle initial; known suffix patterns like Jr., Sr., II, III). This is important for identity matching and to prevent downstream record-linking errors. If validation fails, the submission should be flagged as incomplete and routed for correction before adjudication.

2

Validates Social Security Number format and disallows invalid SSNs (Section 1.B)

Ensures the SSN is exactly 9 digits (allowing optional hyphens) and rejects clearly invalid values (e.g., all zeros, 123456789, 000-00-0000). Accurate SSN capture is critical for associating the work history with the correct claimant record. If validation fails, the form should be rejected or placed in a hold state requiring corrected SSN entry.

3

Validates claimant daytime phone number format and minimum contactability (Section 1.C)

Checks that at least one phone number (primary or secondary) is provided and that each provided number matches acceptable formats (e.g., NANP 10 digits for US/Canada, or includes IDD/country code for international). This matters because the agency may need to contact the claimant for clarification, and unreachable claimants delay decisions. If validation fails, prompt for a corrected number or require an alternate contact method per business rules.

4

Ensures at least one job is listed or an explicit 'none/don’t know' statement is provided (Section 2 job list)

Validates that the work history section contains at least one job entry within the 10-row list, or that the claimant explicitly indicates no qualifying jobs in the relevant period (e.g., via remarks). This is essential because the disability determination relies on past relevant work analysis. If validation fails, the submission should be flagged for missing core work history information.

5

Validates each listed job has required core fields: Job Title, Type of Business, and Dates Worked

For every job row that has any data, checks that Job Title, Type of Business, and both From and To dates are present (or a permitted placeholder like 'don’t know' if allowed by intake rules). These fields are required to classify the job and determine whether it falls within the relevant timeframe. If validation fails, the system should identify the specific job row and missing fields for correction.

6

Validates job dates are in MM/YYYY format and represent real calendar months

Ensures From and To values match MM/YYYY, with month between 01 and 12 and year within a reasonable range (e.g., not in the far future). Correct date formatting prevents misinterpretation and calculation errors in duration and recency. If validation fails, the job entry should be blocked from submission until corrected.

7

Checks logical consistency of job date ranges (From date must be on/before To date)

Verifies that for each job, the From month/year is not later than the To month/year. This is important for computing job duration and determining whether the job is within the 5-year lookback period. If validation fails, the system should prompt the user to correct the date order or confirm if dates were reversed.

8

Flags jobs that appear to be shorter than 30 calendar days (exclusion rule)

Uses the From/To month-year values to estimate whether a job could have lasted less than 30 days and flags it for review (e.g., same month with no additional detail). The form instructs not to include jobs held less than 30 calendar days, and including them can clutter analysis and misstate past relevant work. If validation fails, the system should request confirmation of duration or removal/clarification in remarks.

9

Validates Job Detail sections are completed for each of Jobs 1–5 that are listed

If a job is listed in Section 2 as Job No. 1–5, checks that the corresponding detailed section includes key responses (rate of pay, pay period selection, hours per day, days per week, and task description). These details are needed to assess exertional and skill demands of the work. If validation fails, the submission should be marked incomplete and the missing job detail section(s) identified.

10

Validates rate of pay is numeric, non-negative, and paired with exactly one pay period (Jobs 1–5)

Ensures the pay amount is a valid number (allowing decimals), is not negative, and that exactly one pay period checkbox (Hour/Day/Week/Month/Year) is selected when pay is provided. This prevents ambiguous wage interpretation and supports consistency checks against hours worked. If validation fails, require correction or selection of a single pay period before acceptance.

11

Validates hours per day and days per week are within plausible bounds (Jobs 1–5)

Checks that Hours per Day is greater than 0 and not unreasonably high (e.g., > 24), and Days per Week is between 1 and 7 when provided. These values are used to interpret physical activity totals and work schedule demands. If validation fails, the system should prompt for corrected values or an explanation in remarks if unusual schedules are claimed.

12

Ensures standing/walking + sitting equals Hours per Day (time-allocation consistency)

Validates that the combined time entered for 'Standing and walking (combined)' plus 'Sitting' equals the stated Hours per Day for that job, allowing a small tolerance if minutes are used (e.g., ±5 minutes). The form explicitly requires this equality, and inconsistencies undermine the reliability of exertional assessment. If validation fails, the system should highlight the mismatch and require adjustment.

13

Validates physical activity durations are in valid Hours/Minutes format and do not exceed the workday

Checks that each activity duration is expressed as valid hours/minutes (minutes 0–59) and that no single activity exceeds Hours per Day. This prevents impossible entries (e.g., 90 minutes in the minutes field or 10 hours of stooping in an 8-hour day). If validation fails, the system should require corrected time entries before submission.

14

Validates bilateral/unilateral selections are made when time is entered for hand/finger/reaching activities

If the user enters a duration for finger use, grasping, or reaching, ensures they also select the applicable option (One Hand vs Both Hands; One Arm vs Both Arms). This distinction affects functional capacity interpretation and job demand classification. If validation fails, prompt the user to select the appropriate limb usage option or remove the duration.

15

Validates lifting/carrying selections are complete and logically consistent (heaviest vs frequently lifted)

Ensures a selection is made for both 'heaviest weight lifted' and 'weight frequently lifted' when the lifting/carrying section is addressed, and flags cases where 'frequently lifted' exceeds 'heaviest lifted' (unless 'Other' with explanation). These values are central to exertional level determination and must be internally consistent. If validation fails, require correction or an explanatory note when 'Other' is selected.

16

Requires exposure frequency/details when any environmental exposure checkbox is selected

If any exposure (e.g., hazardous substances, loud noises, extreme heat) is checked, validates that the narrative field describing the exposure and how often it occurred is not blank. Without frequency/context, the exposure data cannot be used reliably in vocational and medical analysis. If validation fails, prompt for the missing exposure description or uncheck exposures that do not apply.

17

Validates interaction question branching: YES requires interaction details; NO must not include contradictory details

If 'Did this job require you to interact…' is marked YES, ensures the follow-up description includes who was interacted with and at least one modality/purpose/time estimate. If marked NO, flags substantial interaction narratives as contradictory and requests confirmation. If validation fails, require the user to reconcile the YES/NO selection with the narrative.

18

Validates Section 4 completion, including conditional requirements when 'Someone else' completes the report

Checks that Date Report Completed is present and in MM/DD/YYYY format, and that one option is selected for who completed the report. If 'Someone else' is selected, requires the preparer’s name, relationship, mailing address (city/state/ZIP and country if not USA), and daytime phone number in valid formats. If validation fails, the submission should be blocked because the report lacks required attestation/contact information for the preparer.

Common Mistakes in Completing SSA-3369-BK

Many people list their “last 5 years of work” from today, or they include older jobs that feel important, instead of focusing on the 5 years before they became unable to work due to medical conditions. This can cause the disability examiner to evaluate the wrong work history and may lead to delays or incorrect conclusions about what work you can still do. To avoid this, identify your alleged onset date (when you became unable to work) and list only jobs performed in the 5-year window immediately before that date.

Applicants often include very short-term jobs, training stints, or “trial” employment because they want to be thorough. The form specifically says not to include jobs you held less than 30 calendar days, and including them can clutter the record and create follow-up questions. To avoid this, screen your list and omit any job that lasted under 30 calendar days; if it feels relevant, briefly explain it in Section 3 (Remarks) rather than listing it as a job entry.

People commonly list one employer and one title even when they had multiple roles (e.g., “Warehouse worker” but they were also a “Forklift operator” or “Lead”). This matters because SSA evaluates the physical/mental demands of each job, and different titles can have very different requirements. To avoid this, list every job title separately—even if it was for the same employer—and use the job numbers consistently when providing details later.

Entries like “Worker,” “Manager,” or “Office” don’t tell SSA what the job actually was, and “Company” without the type of business doesn’t clarify the work setting. Vague titles can lead to misclassification of your past work and additional development requests. Use a specific title (e.g., “Retail cashier,” “Home health aide,” “Accounts payable clerk”) and a clear business type (e.g., “Big-box retail store,” “Residential construction,” “Medical clinic”).

A frequent error is writing full dates (MM/DD/YYYY), only a year, or using words like “Spring 2021,” which doesn’t match the form’s MM/YYYY requirement for Dates Worked. Inconsistent or unclear dates can create gaps/overlaps that trigger follow-up and slow the decision. To avoid this, enter month and year for both “From” and “To” for every job, and if you truly can’t recall, write “don’t know” and estimate as closely as possible.

People often enter a dollar amount but forget to check whether it’s per hour/week/month, or they provide hours/day and days/week that don’t align with the pay type (e.g., annual salary but only listing 2 days/week). These inconsistencies can raise questions about whether the work was full-time, part-time, or substantial, and may require clarification. To avoid this, pick the correct pay unit, then ensure hours/day and days/week reflect your typical schedule for that job (estimate if needed).

Many applicants write a one-line summary like “customer service” or “did paperwork,” which doesn’t describe the actual duties and demands of a typical day. SSA needs detail to understand skill level, complexity, pace, and physical/mental requirements; vague answers can lead to an inaccurate job classification. To avoid this, describe a typical workday with concrete tasks, frequency, and context (e.g., “answered 40–60 calls/day, entered orders in software, handled cash drawer, stocked shelves for 1–2 hours”).

Applicants often overlook the conditional prompts about writing/completing reports and supervising others, especially if they think it was “minor.” Missing these details can understate the cognitive demands, responsibility level, and transferable skills of the job, which can affect the disability analysis. To avoid this, if you wrote anything (logs, incident reports, chart notes, inventory counts) or supervised anyone (training, scheduling, evaluations), describe what it was and how much time you spent on it.

A very common mistake is listing standing, walking, and sitting times that exceed or fall short of the “Hours per Day,” or leaving one blank. This creates internal inconsistencies and can lead to follow-up requests or assumptions that don’t reflect your actual job demands. To avoid this, start with your total hours/day, then allocate standing/walking (combined) and sitting so they sum exactly to that total; use hours and minutes rather than rough phrases like “most of the day.”

People often check an activity but forget to indicate whether it was done with one hand/arm or both, or they mark both without thinking through the job. SSA uses these details to evaluate upper-extremity demands and how certain medical conditions may limit work. To avoid this, choose the accurate option (one vs. both) and estimate time spent; if tasks varied, describe the typical pattern in the space provided or in Remarks.

Applicants frequently check a weight box but don’t explain what was lifted, how far it was carried, or how often—yet the form explicitly asks for those details. Without specifics, SSA may misjudge exertional level (sedentary/light/medium/heavy) and request clarification. To avoid this, pair the weight selection with examples (e.g., “lifted 30-lb boxes of paper, carried 20–30 feet, 10–15 times/day”) and distinguish “heaviest” from “frequently lifted.”

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out SSA-3369-BK with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-ssa-3369-bk-work-history-report forms, ensuring each field is accurate.