Yes! You can use AI to fill out Form W-2G, Certain Gambling Winnings (Rev. January 2026)

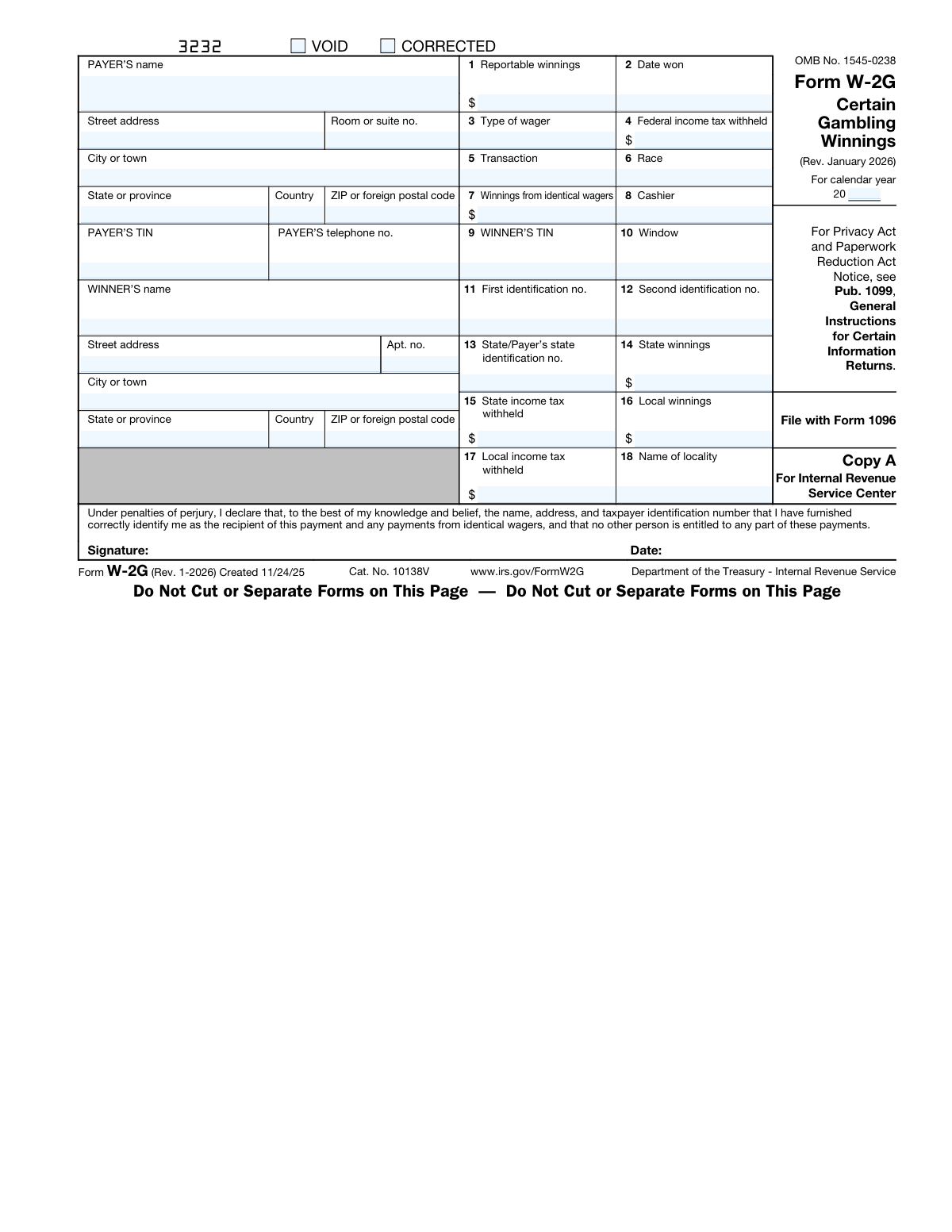

Form W-2G is an IRS information return used by casinos, racetracks, lotteries, and other payers to report reportable gambling winnings paid to a winner, along with any federal income tax withholding (and, where applicable, state and local withholding). It documents key details such as the date won, type of wager, transaction identifiers, and the winner’s taxpayer identification number, and it provides copies for the IRS, the winner, and state/local tax agencies. This form is important because it supports accurate income reporting on the winner’s tax return and substantiates withholding amounts that may be claimed as taxes paid. Today, this form can be filled out quickly and accurately using AI-powered services like Instafill.ai, which can also convert non-fillable PDF versions into interactive fillable forms.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out W-2G using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form W-2G, Certain Gambling Winnings (Rev. January 2026) |

| Number of pages: | 7 |

| Language: | English |

| Categories: | tax forms, IRS forms, gambling tax forms, income reporting forms, gambling forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out W-2G Online for Free in 2026

Are you looking to fill out a W-2G form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your W-2G form in just 37 seconds or less.

Follow these steps to fill out your W-2G form online using Instafill.ai:

- 1 Go to Instafill.ai and upload the Form W-2G PDF (or select Form W-2G from the form library).

- 2 Choose the correct tax year and form status (e.g., mark VOID or CORRECTED only if applicable).

- 3 Enter the payer’s information: name, address, payer TIN, and telephone number.

- 4 Enter the winner’s identification and address details, including the winner’s name and winner’s TIN.

- 5 Fill in the winnings and transaction details (boxes 1–12), such as reportable winnings, date won, type of wager, transaction/race, and any winnings from identical wagers.

- 6 Enter withholding and jurisdictional amounts (boxes 4 and 13–18), including federal income tax withheld and any state/local winnings and tax withheld, plus locality name if applicable.

- 7 Use Instafill.ai to validate fields for completeness/formatting, then generate and download/print the required copies (IRS/State/Winner/Payer) and sign/date where required.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable W-2G Form?

Speed

Complete your W-2G in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 W-2G form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form W-2G

Form W-2G reports certain gambling winnings and any federal, state, or local tax withheld. The payer (casino, racetrack, lottery, etc.) files it with the IRS and provides copies to the winner.

The payer completes and issues Form W-2G. The winner typically provides accurate name, address, and TIN, and may need to sign the form in certain withholding situations.

You generally receive a W-2G when your winnings meet IRS reporting thresholds or when winnings are subject to federal income tax withholding. The form itself points you to Pub. 1099 for the thresholds by wager type.

You’ll usually need your legal name, current mailing address, and taxpayer identification number (SSN/ITIN/EIN as applicable). The payer may also record ID numbers (for example, driver’s license or passport) in the identification fields.

VOID is checked when a form was issued in error and should be treated as invalid. CORRECTED is checked when the payer is fixing information that was reported on a previously filed W-2G.

Enter the last two digits of the calendar year after the printed “20” (for example, enter “26” for 2026). This should match the year the winnings were paid/recorded for reporting.

Box 1 shows the total reportable winnings for the transaction. Box 7 is used when the payout includes winnings from identical wagers that are included in the payment.

Federal income tax withheld is shown in Box 4. If Box 4 has an amount, include it on your Form 1040/1040-SR as federal income tax withheld, and follow the form’s instruction to attach Copy B to your return when required.

You must sign Form W-2G if you are the only person entitled to the winnings and the winnings are subject to regular gambling withholding. You return the signed form to the payer, who then gives you your copies.

If another person is entitled to any part of the winnings, prepare Form 5754 and give it to the payer. The payer uses Form 5754 to issue separate W-2Gs to each person listed as a winner.

Copy C is for the winner’s records, and Copy B is used to report the income on your federal return (and may need to be attached if federal tax was withheld). Copy 2 is for state/local returns if required, while Copy A is filed with the IRS by the payer (with Form 1096) and Copy D is for the payer.

Yes—if you don’t provide a TIN, certain winnings that aren’t subject to regular gambling withholding may be subject to backup withholding. Box 4 will show any federal income tax withheld.

The form instructions state that gambling winnings are generally reported on the “Other income” line of Schedule 1 (Form 1040). You should keep records of winnings and losses, and losses are deductible only up to the amount of winnings (see the IRS publications referenced on the form for details).

Yes—AI form-filling tools can help reduce errors and save time by extracting details (names, addresses, TINs, amounts, dates) and placing them into the correct boxes. Services like Instafill.ai use AI to auto-fill form fields accurately and speed up completion.

With Instafill.ai, you can upload the W-2G PDF, provide or import the payer/winner and winnings details, and let the AI map the data into the correct fields for review before exporting. If the PDF is flat/non-fillable, Instafill.ai can convert it into an interactive fillable form so you can complete and sign it digitally where applicable.

Compliance W-2G

Validation Checks by Instafill.ai

1

Calendar Year (YY) is present and valid for the printed '20__' format

Validate that the calendar year field contains exactly two digits (00–99) that complete the printed '20' prefix (e.g., '26' for 2026). The value must represent a plausible filing year (typically within an allowed range such as current year ± a configured tolerance) to prevent misreporting to the wrong tax year. If the value is missing, non-numeric, or outside the allowed range, the submission should be rejected or routed for manual review.

2

Mutual exclusivity of VOID and CORRECTED status checkboxes

Ensure that the form is not marked both VOID and CORRECTED at the same time, since these statuses are logically incompatible (voided forms should not be treated as corrections). Also validate that at least one status is selected only when required by the workflow (e.g., normal filing may have neither checked). If both are checked, block submission and require the filer to choose the correct status.

3

Required payer identity fields completeness (name, address, TIN, phone)

Confirm that the payer’s name, street address, city, state/province, ZIP/postal code, payer TIN, and payer telephone number are present when the form is not VOID. These fields are essential for IRS/state matching and for contacting the payer regarding discrepancies. If any required payer field is missing, the form should fail validation and prompt for completion.

4

Payer TIN format and checksum/structure validation (EIN/SSN/ITIN rules)

Validate that the payer TIN contains 9 digits (allowing optional hyphen formatting) and is not an obviously invalid value (e.g., all zeros, 123456789). Where possible, apply structural checks (e.g., EIN commonly formatted as XX-XXXXXXX) and disallow non-numeric characters other than hyphen. If the TIN fails format/structure checks, reject the submission to avoid IRS rejection and downstream matching failures.

5

Payer telephone number format validation

Ensure the payer telephone number is a valid callable number: for U.S. numbers, 10 digits with optional punctuation; for international, allow leading '+' and country code with a configured length range. This reduces failed contact attempts and improves exception handling. If the phone number is malformed or too short/long, require correction before acceptance.

6

Winner identity and address required fields completeness

Verify that the winner’s name, street address, city, state/province, and ZIP/postal code are provided when the form is not VOID. These fields are required for recipient identification and for mailing/recordkeeping, and they support IRS/state matching. If any required winner field is missing, the form should be rejected or flagged for remediation.

7

Winner TIN format validation and disallowance of placeholder values

Validate that the winner’s TIN is 9 digits (SSN/ITIN/EIN as applicable), allowing standard hyphen formatting, and reject known placeholders (e.g., 000000000, 999999999). A valid TIN is critical because missing/invalid TINs can trigger backup withholding and cause IRS filing errors. If invalid, block submission and require a corrected TIN or an approved exception workflow.

8

Date won is a valid date and consistent with the calendar year

Check that 'Date won' is a real calendar date (MM/DD/YYYY or an accepted system format) and not in the future relative to submission date (unless explicitly allowed). Also ensure the year portion aligns with the form’s calendar year (e.g., a 2026 W-2G should not show a 2025 or 2027 win date unless a documented exception is allowed). If the date is invalid or inconsistent, fail validation to prevent reporting in the wrong tax period.

9

Monetary fields are numeric, non-negative, and limited to two decimal places

Validate that all dollar fields (Boxes 1, 4, 7, 14–17) contain valid numeric amounts with at most two decimal places and are not negative. This prevents calculation errors, IRS schema rejections, and incorrect withholding reporting. If any amount is non-numeric, negative, or has excessive precision, the form should be rejected and the user prompted to correct the value.

10

Federal withholding (Box 4) does not exceed reportable winnings (Box 1)

Ensure Box 4 (federal income tax withheld) is less than or equal to Box 1 (reportable winnings), since withholding cannot logically exceed the reported payout amount. This check catches data entry swaps and decimal/scale errors that would create implausible tax reporting. If Box 4 > Box 1, block submission and require correction or documented override with review.

11

Winnings from identical wagers (Box 7) is not greater than reportable winnings (Box 1)

Validate that Box 7 is less than or equal to Box 1 because identical-wager winnings included in the payment should be a subset of total reportable winnings. This helps detect mis-keyed amounts and ensures consistent reporting across related fields. If Box 7 exceeds Box 1, fail validation and request corrected amounts.

12

State tax section dependency checks (Boxes 13–15)

If state winnings (Box 14) or state income tax withheld (Box 15) is provided, require the state/payer state identification number (Box 13) and a valid state/province value in the address section. Also ensure Box 15 is not greater than Box 14 and that both are non-negative currency values. If dependencies or logical limits fail, reject or flag for correction to prevent state filing errors.

13

Local tax section dependency checks (Boxes 16–18)

If local winnings (Box 16) or local income tax withheld (Box 17) is provided, require the name of locality (Box 18). Also ensure Box 17 is not greater than Box 16 and that both are valid non-negative currency values. If locality is missing or amounts are inconsistent, fail validation to avoid incomplete local tax reporting.

14

Transaction identification completeness when winnings are reported

When Box 1 (reportable winnings) is populated, require a transaction identifier/description (Box 5) and at least one operational identifier such as cashier (Box 8) or window (Box 10) based on business rules. These fields support auditability and traceability of the payout event. If winnings are reported without sufficient transaction identifiers, route the submission for correction or manual review.

15

Signature and signature date required when federal withholding is present

If Box 4 (federal income tax withheld) is greater than zero, require the winner’s signature and a signature date, consistent with the form’s instruction that the winner must sign when subject to regular gambling withholding. This ensures legal attestation and reduces disputes about recipient identity and entitlement. If withholding is present but signature/date are missing or the date is invalid, block submission or require an attestation workflow.

Common Mistakes in Completing W-2G

People often type the full year (e.g., 2026) or the wrong two digits because the form shows a printed “20” followed by a blank. Using the wrong year can cause mismatches with IRS/state records and may require a corrected filing. To avoid this, enter only the last two digits (e.g., “26” for 2026) and confirm it matches the date won and the tax year being reported; AI tools like Instafill.ai can enforce the two-digit format automatically.

A common error is checking CORRECTED when the form should be VOID (or vice versa), or leaving both unchecked when a replacement is intended. This can lead to duplicate reporting, IRS notices, or the original incorrect record remaining on file. Only check VOID if the form was issued in error and should be null, and check CORRECTED only when amending a previously filed W-2G for the same transaction; Instafill.ai can prompt the correct status based on the user’s intent and prevent contradictory selections.

Because payer and winner sections look similar, filers sometimes place the casino/track/lottery details in the winner fields or put the winner’s SSN in the payer TIN box. This can trigger TIN/name mismatch notices, backup withholding issues, and rejected or questioned information returns. Double-check that the payer is the entity paying the winnings and the winner is the recipient, and validate TIN ownership before submission; Instafill.ai can map data to the correct section and flag mismatches.

Winners may enter an ITIN/SSN incorrectly (missing digits, transposed numbers) or provide an EIN when the winner is an individual, and payers may enter an invalid EIN/TIN format. Incorrect TINs can cause backup withholding, IRS correspondence, and delays in crediting withheld taxes to the winner. Always enter the exact TIN as issued (9 digits), match it to the legal name on tax records, and avoid placeholders like “applied for”; Instafill.ai can validate length/format and reduce transposition errors.

People frequently omit apartment/unit numbers, use a P.O. Box incorrectly, or leave out ZIP/foreign postal codes and country for non-U.S. addresses. This can prevent the winner from receiving copies, complicate state/local reporting, and create record-matching problems. Use a complete deliverable address (including apt/unit and correct ZIP/postal code) and include the country when outside the U.S.; Instafill.ai can standardize address formatting and prompt for missing components.

Filers sometimes put the payout after subtracting the wager (or after fees) into Box 1, or confuse Box 1 (reportable winnings) with Box 7 (winnings from identical wagers). Misreporting amounts can lead to incorrect withholding calculations, incorrect income reporting by the winner, and potential penalties for inaccurate information returns. Follow the W-2G instructions for what is “reportable” for the wager type and use Box 7 only for identical wagers included in the payment; Instafill.ai can apply rules and consistency checks between boxes.

A frequent mistake is using an ambiguous date format (e.g., 01/02/26), entering the payout date instead of the date won, or leaving the date blank. Incorrect dates can cause audit trail issues and mismatches with transaction records, especially when multiple payouts occur. Use a clear, consistent date format (MM/DD/YYYY if required by the system) and ensure it matches the underlying ticket/transaction documentation; Instafill.ai can normalize date formats and flag impossible or inconsistent dates.

Because Box 5 (Transaction) and related fields (Cashier, Window) can seem internal, they’re often skipped or filled with vague text that doesn’t match the payer’s records. Missing or inconsistent identifiers make it harder to substantiate the W-2G, resolve disputes, or support corrections. Enter the exact ticket/transaction number and the correct window/cashier identifiers as shown in the payer’s system; Instafill.ai can capture and format these consistently and reduce typos.

People may enter withholding as a percentage instead of a dollar amount, leave Box 4 blank when withholding occurred, or enter state/local withholding without corresponding state/local winnings (Boxes 14–18). This can prevent the winner from properly claiming withholding on their return and can create reconciliation issues for the payer. Enter withholding as dollars and cents, and ensure state/local withheld amounts correspond to the correct taxable winnings and locality; Instafill.ai can enforce numeric currency formatting and cross-check that related boxes are filled consistently.

Winners often miss the signature line, not realizing the form must be signed when the winner is the only person entitled to the winnings and the winnings are subject to regular gambling withholding. An unsigned form can delay processing, cause the payer to withhold or report differently, and may require re-issuance. Review the “Instructions to Winner” and sign/date only when required; Instafill.ai can prompt for signature requirements based on the withholding scenario and ensure the date is present.

In group wins, one person may be listed as the sole winner on the W-2G even though others are entitled to a share, because filers don’t realize Form 5754 is needed. This can misallocate income to the wrong taxpayer and create disputes and IRS matching problems for everyone involved. If any other person is entitled to part of the winnings, complete Form 5754 so the payer can issue separate W-2Gs; Instafill.ai can guide users through the multi-winner workflow and reduce misreporting.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out W-2G with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-w-2g-certain-gambling-winnings-rev-january-2026 forms, ensuring each field is accurate.