Fill out gambling forms

with AI.

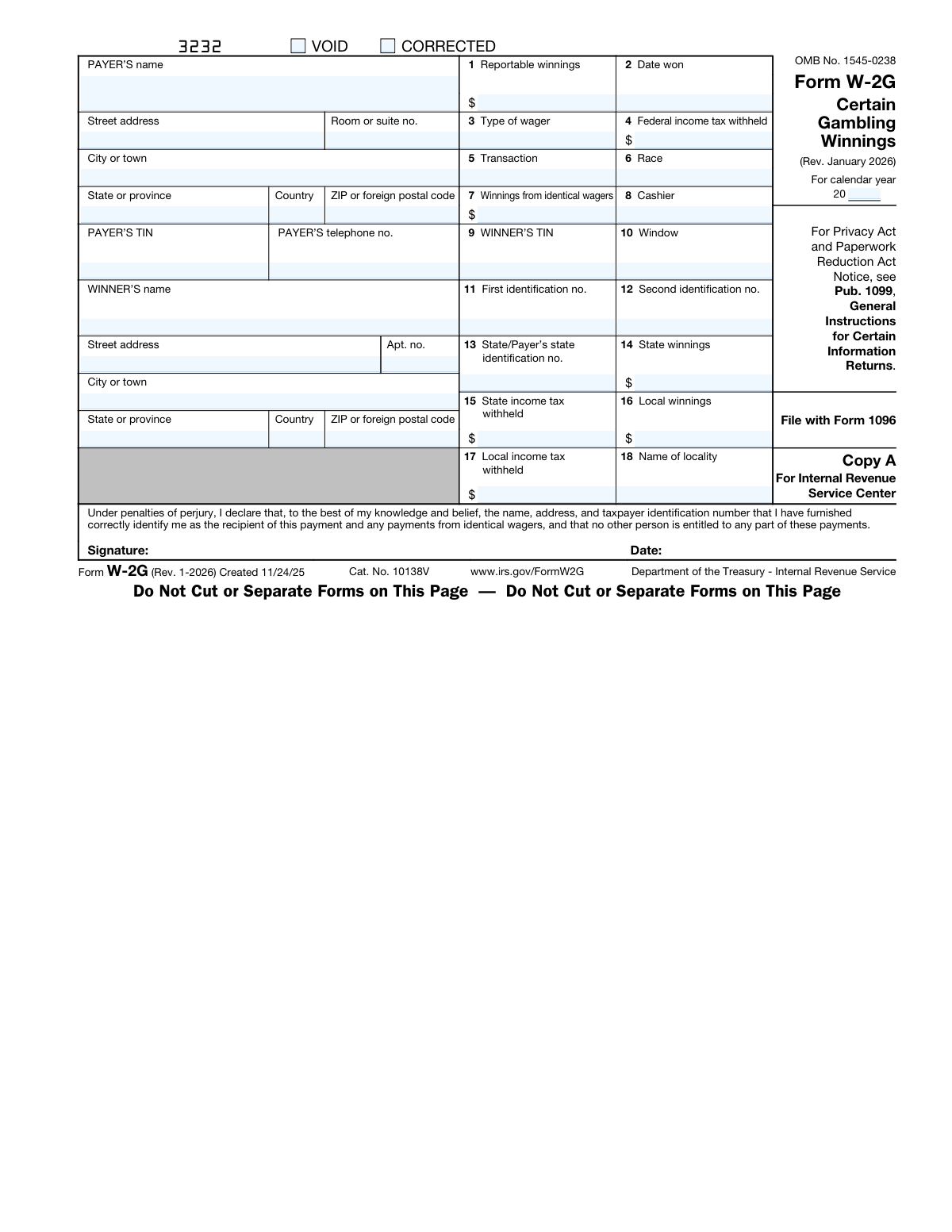

Gambling forms are a specific category of IRS tax documents used to report gambling winnings and any associated federal, state, or local tax withholding. These forms serve an important role in the U.S. tax system by ensuring that income earned through casinos, lotteries, racetracks, and other wagering activities is properly documented and reported to the IRS. The most prominent form in this category is Form W-2G, Certain Gambling Winnings, which payers are required to issue when a winner's winnings meet certain reporting thresholds.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About gambling forms

These forms are relevant to two main groups of people: payers — such as casinos, lottery organizations, and racetracks — who must file and distribute the forms when reportable winnings are paid out, and winners themselves, who need their copies to accurately report gambling income and claim any withheld taxes on their federal and state tax returns. Whether you hit a jackpot on a slot machine, won big at a horse race, or received a substantial lottery prize, understanding and correctly completing these forms is essential to staying compliant with IRS requirements.

Because gambling tax forms involve precise details like taxpayer identification numbers, withholding amounts, and wager descriptions, accuracy is critical. Tools like Instafill.ai use AI to fill these forms in under 30 seconds, handling the data accurately and securely — a practical time-saver for both individual winners and tax professionals managing multiple filings.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds