Yes! You can use AI to fill out Form W-2G (Rev. January 2026), Certain Gambling Winnings

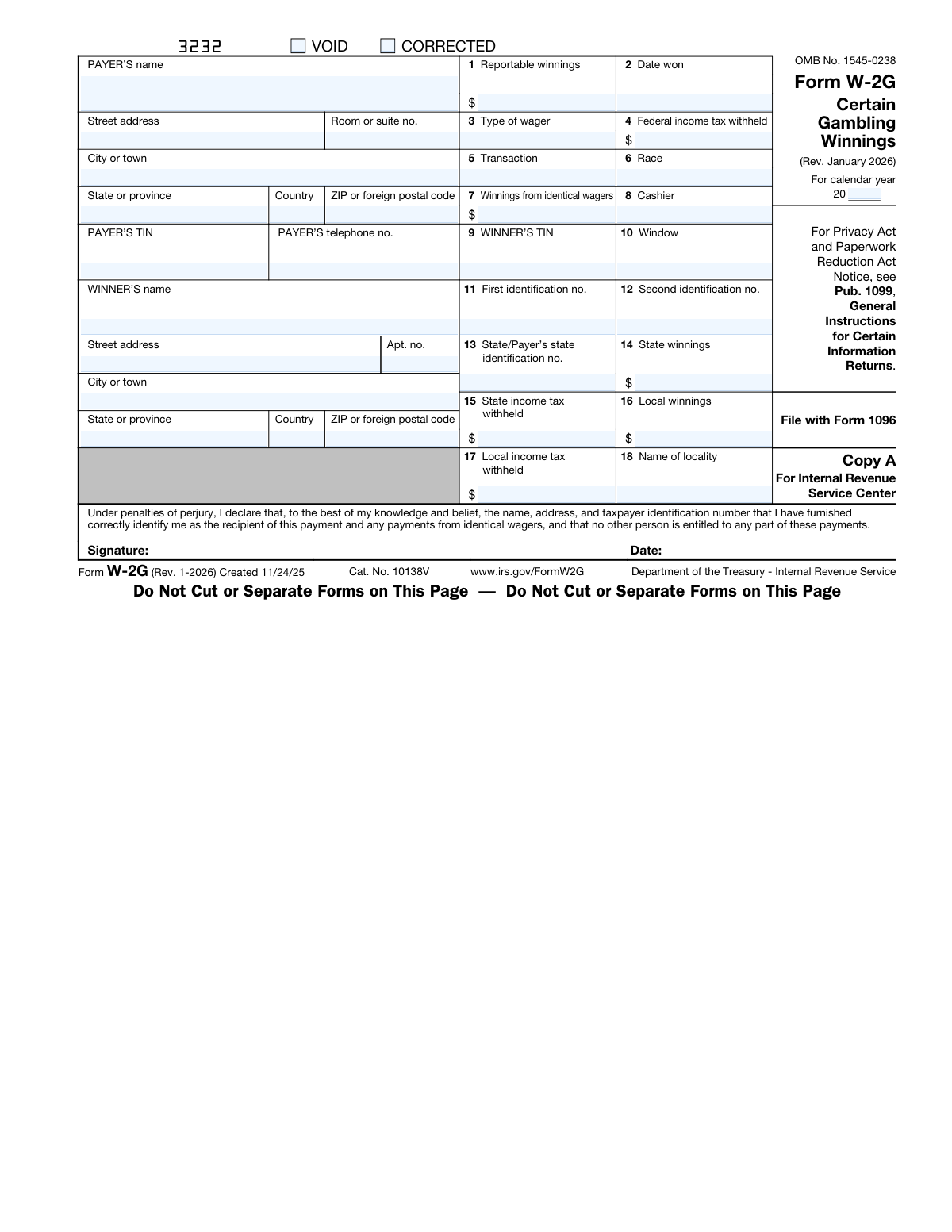

Form W-2G is an IRS information return used by casinos, racetracks, lotteries, and other payers to report qualifying gambling winnings paid to a winner, along with any federal income tax withholding (and, where applicable, state/local winnings and withholding). It includes payer and winner identifying information (names, addresses, TINs) and details about the wager and transaction so the IRS and tax agencies can match the income to the recipient’s tax return. Winners use their copies to report gambling income and claim any withholding on their tax returns, while payers file the appropriate copies with the IRS and may file with state/local agencies. Today, this form can be filled out quickly and accurately using AI-powered services like Instafill.ai, which can also convert non-fillable PDF versions into interactive fillable forms.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out W-2G using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form W-2G (Rev. January 2026), Certain Gambling Winnings |

| Number of pages: | 7 |

| Language: | English |

| Categories: | tax forms, IRS forms, gambling forms, income forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out W-2G Online for Free in 2026

Are you looking to fill out a W-2G form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your W-2G form in just 37 seconds or less.

Follow these steps to fill out your W-2G form online using Instafill.ai:

- 1 Go to Instafill.ai and upload the Form W-2G PDF (or select Form W-2G from the form library).

- 2 Let the AI detect and map the W-2G fields (payer info, winner info, winnings, withholding, and state/local boxes) and confirm the form year/revision is correct (Rev. January 2026).

- 3 Enter or import the payer’s details: legal name, address, payer TIN, and telephone number; indicate whether the form is VOID or CORRECTED if applicable.

- 4 Enter the winner’s details: name, address, and winner TIN, plus any identification numbers requested (first/second ID numbers).

- 5 Fill in the winnings and wager details: reportable winnings (Box 1), date won (Box 2), type of wager (Box 3), transaction/race/cashier/window fields, and winnings from identical wagers (Box 7) if applicable.

- 6 Complete tax withholding and jurisdictional amounts: federal income tax withheld (Box 4) and any state/local identification numbers, winnings, and tax withheld (Boxes 13–18) as applicable.

- 7 Review the AI validation checks for missing/invalid TINs, dates, and dollar amounts; add signature/date if required for regular gambling withholding, then download/print the correct copies for filing and recipient records.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable W-2G Form?

Speed

Complete your W-2G in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 W-2G form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form W-2G

Form W-2G reports certain gambling winnings and any federal, state, or local income tax withheld. The payer (casino, racetrack, lottery, etc.) uses it to report the winnings to the IRS and provide copies to the winner.

The payer completes Form W-2G and furnishes copies to the winner. The winner may need to provide accurate name, address, and TIN, and may need to sign the form in certain withholding situations.

You generally receive a W-2G when your gambling winnings meet IRS reporting thresholds or when winnings are subject to federal income tax withholding. The form notes that thresholds vary by type of gambling; see IRS Pub. 1099 for details.

You typically must provide your full legal name, current address, and taxpayer identification number (SSN/ITIN/EIN as applicable). You may also be asked for identification numbers shown in boxes 11 and 12 (for example, driver’s license or other ID).

Box 1 shows the amount of gambling winnings being reported to the IRS. This is the key amount you generally report as gambling income on your tax return.

Box 2 is the date the winnings were won. It helps document the timing of the income for the calendar year being reported.

Box 3 describes the kind of gambling activity (for example, lottery, slot machine, horse race wager, etc.). The payer should enter a description that matches the wager that produced the winnings.

Box 4 shows any federal income tax withheld from your winnings. The form instructions say to include this amount on your Form 1040/1040-SR as federal income tax withheld, and attach Copy B to your return if box 4 shows withholding.

You must sign Form W-2G if you are the only person entitled to the winnings and the winnings are subject to regular gambling withholding. You return the signed form to the payer, who then provides your copies.

If another person is entitled to any part of the winnings, the instructions say to prepare Form 5754. Give Form 5754 to the payer so they can issue separate W-2Gs to each winner.

Box 7 reports winnings from identical wagers, which can apply when multiple similar bets are treated together for reporting. The winner’s declaration on the form references these payments, so accuracy matters.

Boxes 14–18 report state and local winnings and any state/local tax withheld, plus the locality name. Copy 2 is intended to be attached to your state, city, or local income tax return if required.

VOID is checked when a form should be treated as canceled and not processed. CORRECTED is checked when the payer is issuing an updated version to fix information from a previously filed W-2G.

The payer instructions state that gambling winnings paid to nonresident aliens and foreign corporations are generally reported on Form 1042-S instead of Form W-2G. If you’re unsure, ask the payer which form applies to your status.

Yes—AI tools like Instafill.ai can help auto-fill form fields accurately and save time by extracting details (payer info, winner info, amounts, dates) from your documents. To use it, upload the W-2G PDF to Instafill.ai, review the suggested entries for each box, and then export/download the completed form.

If the PDF isn’t fillable, Instafill.ai can convert flat non-fillable PDFs into interactive fillable forms so you can type directly into the fields. After conversion, you can auto-fill and then manually review before saving.

Compliance W-2G

Validation Checks by Instafill.ai

1

Calendar Year is exactly two digits and within an acceptable range

Validate that the Calendar Year field contains exactly two numeric digits (00–99) and maps to a reasonable filing year (e.g., not far in the past/future relative to the system’s current year and the form revision). This is important because the IRS uses the tax year to match withholding and income to the correct period. If validation fails, reject submission or require correction before generating/filing copies.

2

VOID and CORRECTED checkboxes are mutually exclusive

Ensure the form is not marked both VOID and CORRECTED at the same time. These statuses have different processing meanings: VOID indicates the form should not be processed, while CORRECTED indicates it replaces a previously filed form. If both are selected, flag as an error and block submission until one status is chosen.

3

Required payer identity fields are present and non-placeholder

Check that Payer’s Name and Payer’s TIN are provided and are not blank, all zeros, or obvious placeholders (e.g., 'N/A', 'UNKNOWN'). This is critical for IRS matching and for identifying the withholding agent/payer. If missing or invalid, fail validation and require completion before acceptance.

4

Payer TIN format validation (EIN/SSN/ITIN rules)

Validate that Payer’s TIN is 9 digits and passes basic TIN formatting rules (digits only after normalization; allow hyphenated input but store normalized). Optionally apply EIN prefix rules (first two digits not '00') and disallow '000000000'. Incorrect TINs cause IRS rejection/mismatch notices; if invalid, prevent filing output and prompt for correction.

5

Winner TIN format validation (SSN/ITIN/EIN) and presence when required

Validate Winner’s TIN is 9 digits (after stripping hyphens/spaces) and not an invalid placeholder (e.g., 000-00-0000). Because backup withholding and IRS matching depend on the winner’s TIN, the system should require it for reportable winnings records unless a documented exception workflow exists. If invalid or missing, flag as error or route to an exception/backup-withholding handling path per business rules.

6

Payer and Winner address completeness and country-aware postal validation

Ensure required address components are present: street address, city/town, state/province (when applicable), and ZIP/postal code. Apply country-aware rules: if Country is 'US' or blank (default US), require a valid 5-digit ZIP or ZIP+4; if foreign, allow alphanumeric postal codes and require Country to be populated. If validation fails, block submission because incomplete addresses can invalidate information return delivery and jurisdictional reporting.

7

State/Province code validation for US addresses

When Country is US (or omitted and treated as US), validate that State/Province is a valid USPS two-letter state/territory code. This matters for state reporting (boxes 13–15) and for address standardization. If invalid, return an error and require a corrected state code.

8

Payer telephone number format validation

Validate Payer’s telephone number contains a valid phone pattern (e.g., 10 digits for US numbers, optionally with country code; allow common separators but normalize). This is important for downstream contact and error resolution with the payer. If invalid, warn or error based on policy; at minimum, prevent non-numeric garbage and enforce a minimum digit count.

9

Reportable Winnings (Box 1) is a valid non-negative currency amount

Validate Box 1 is present (for a non-VOID form), numeric, and non-negative, with at most two decimal places. This is the primary reported income amount and must be machine-readable and arithmetically valid. If invalid, reject submission because it affects IRS reporting and withholding calculations.

10

Date Won (Box 2) is a valid date and consistent with Calendar Year

Validate that Date Won is a real calendar date (MM/DD/YYYY or accepted system format) and not in the future relative to submission date (unless explicitly allowed). Also ensure the year of Date Won matches the Calendar Year indicated on the form (interpreting the two-digit year correctly). If inconsistent, flag as error because the record may be reported in the wrong tax year.

11

Federal income tax withheld (Box 4) is valid and not greater than winnings

Validate Box 4 is numeric, non-negative, and has at most two decimals, and enforce a logical cap such as Box 4 ≤ Box 1 (or ≤ taxable winnings per internal rules if wager amount is tracked elsewhere). This prevents impossible withholding amounts and reduces IRS mismatch risk. If the withheld amount exceeds winnings or is otherwise invalid, block submission and require correction.

12

Type of wager (Box 3) is present and conforms to allowed values/length

Ensure Type of Wager is provided for non-VOID forms and is not empty, and enforce a maximum length and character set (e.g., no control characters). If the system uses a controlled vocabulary (lottery, sweepstakes, horse racing, keno, bingo, etc.), validate against that list. If invalid, fail validation because wager type drives reporting thresholds and withholding logic.

13

Transaction/Race/Window/Cashier fields are format-consistent and non-conflicting

Validate that Transaction (Box 5), Race (Box 6), Window (Box 10), and Cashier (Box 8) meet expected formats (e.g., alphanumeric, max length) and do not contain prohibited characters. If one of these operational identifiers is required by the payer’s workflow, enforce presence when winnings are reported. If validation fails, flag for correction because these fields support audit trails and reconciliation.

14

Identical wagers winnings (Box 7) is valid and logically consistent with Box 1

Validate Box 7 is numeric, non-negative, and has at most two decimals. Enforce a consistency rule such as Box 7 ≤ Box 1 (or require an explanation/override if business rules allow otherwise), since identical-wager winnings are typically a subset/related component of reportable winnings. If inconsistent, raise an error or require review to prevent misreporting.

15

State and local tax sections are internally consistent (Boxes 13–18)

If any state fields are populated (state ID, state winnings, or state tax withheld), require the associated state identifier and state winnings, and validate state tax withheld is non-negative and not greater than state winnings. Similarly, if any local fields are populated (local winnings or local tax withheld), require Name of Locality and validate local tax withheld ≤ local winnings. If these relationships fail, block submission because partial or inconsistent jurisdictional data can cause state/local filing errors.

16

Signature and signature date required when federal withholding is present

When Box 4 (federal income tax withheld) is greater than zero, require the winner’s signature and signature date, as the form text indicates the winner must sign when winnings are subject to regular gambling withholding. Validate the signature date is a valid date and not earlier than Date Won (or not unreasonably earlier). If missing/invalid, fail validation or route to an exception workflow because the payer may not be able to substantiate withholding without the signed certification.

Common Mistakes in Completing W-2G

People often enter the full year (e.g., 2026) when the form header expects only the last two digits, or they use the year they’re filing taxes instead of the year the winnings were paid. This can cause mismatches with IRS/state records and trigger correction requests or rejected filings. Always use the calendar year the winnings were paid and follow the form’s digit requirement exactly. AI-powered tools like Instafill.ai can enforce the correct year format and prevent accidental year mismatches.

Filers sometimes check VOID when they really mean CORRECTED, forget to check CORRECTED when reissuing a form, or mistakenly check both boxes. This can result in the IRS treating the form as invalid, duplicating income reporting, or failing to replace the original record. Only check VOID to cancel a form entirely, and check CORRECTED only when replacing a previously filed W-2G. Instafill.ai can prompt for the reason (void vs. corrected) and reduce status-box errors.

A very common error is entering the casino/track/lottery operator details in the winner fields (or vice versa), especially when copying from receipts or account profiles. This leads to TIN/name mismatches and can cause IRS notices or backup withholding issues. Double-check that the payer section contains the business issuing the W-2G and the winner section contains the individual/entity receiving the winnings. Instafill.ai can map data to the correct section and validate that payer and winner identities aren’t swapped.

People frequently omit the winner’s TIN, transpose digits, or enter an EIN when an SSN/ITIN is required (or the reverse for entity winners). Incorrect TINs can trigger backup withholding, IRS mismatch notices, and delays in crediting withheld taxes to the right taxpayer. Verify the TIN against official documents and enter it without extra characters unless the form instructions specify formatting. Instafill.ai can validate TIN length/patterns and flag likely mismatches before submission.

Winners often enter nicknames, shortened names, or a spouse’s name even though the TIN belongs to someone else. The IRS matches name/TIN combinations, and mismatches can lead to correspondence, withholding complications, or problems claiming the withholding on the tax return. Use the exact legal name associated with the SSN/ITIN/EIN (as shown on the Social Security card, IRS letter, or EIN assignment). Instafill.ai can standardize names and help ensure the name aligns with the provided TIN.

Addresses are often incomplete (missing apartment/unit), use the wrong ZIP+4, or place foreign postal codes in the wrong field, especially when the winner recently moved. Bad addresses can prevent the winner from receiving copies and can create state/local reporting errors. Enter the full deliverable address, including apt/unit/room where applicable, and use the correct state/province and ZIP/postal code format for the country. Instafill.ai can auto-format addresses and validate ZIP/postal codes to reduce undeliverable mail and reporting issues.

Filers sometimes put the withheld tax in the winnings box, report net winnings instead of reportable winnings, or inconsistently include cents (or add commas/extra symbols that break processing). These errors can cause incorrect income reporting and incorrect tax credit amounts on the winner’s return, potentially leading to underpayment notices. Enter amounts in the correct boxes, use standard currency formatting (numbers only), and follow the payer’s records for “reportable” vs. “withheld.” Instafill.ai can apply numeric validation and ensure amounts land in the correct boxes.

People often enter the date the prize was paid out rather than the date won, use an ambiguous format (e.g., 01/02/26), or leave the field blank when rushing. Incorrect dates can complicate audits, state reporting, and reconciliation with transaction logs. Use the exact date the winnings were won and enter it in a clear, consistent format (typically MM/DD/YYYY unless the form system specifies otherwise). Instafill.ai can enforce date formats and flag impossible or inconsistent dates.

Boxes like Transaction, Race, Window, Cashier, and identification numbers are frequently skipped because filers assume they’re optional or don’t know which number to use. Missing or incorrect identifiers make it harder to substantiate the payment, reconcile to internal logs, or respond to IRS/state inquiries. Use the payer’s system-generated identifiers (from the wagering ticket, cage receipt, or terminal record) and keep them consistent across copies. Instafill.ai can help by pulling structured identifiers from source data and placing them into the correct fields.

When winnings are shared (group tickets, pooled bets), people often list only one person as the winner and ignore the requirement to allocate winnings using Form 5754. This can cause the wrong person to be taxed on the full amount and can create disputes or IRS questions if others claim a share. If another person is entitled to any part of the winnings, prepare Form 5754 and provide it to the payer so separate W-2Gs can be issued. Instafill.ai can guide users through winner allocation workflows and reduce missed multi-winner documentation.

Winners sometimes forget to sign and date the form when the instructions require a signature (generally when the winner is the only person entitled to the winnings and regular gambling withholding applies). An unsigned form can delay processing, delay issuance of copies, or create withholding/reporting complications for the payer. Review the signature requirement for the specific situation and ensure the signature and date are completed before returning the form to the payer. If the form is only available as a flat non-fillable PDF, Instafill.ai can convert it into a fillable version and help ensure signature/date fields aren’t overlooked.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out W-2G with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-w-2g-rev-january-2026-certain-gambling-winnings forms, ensuring each field is accurate.