Yes! You can use AI to fill out Form I-130A, Supplemental Info for Spouse Beneficiary

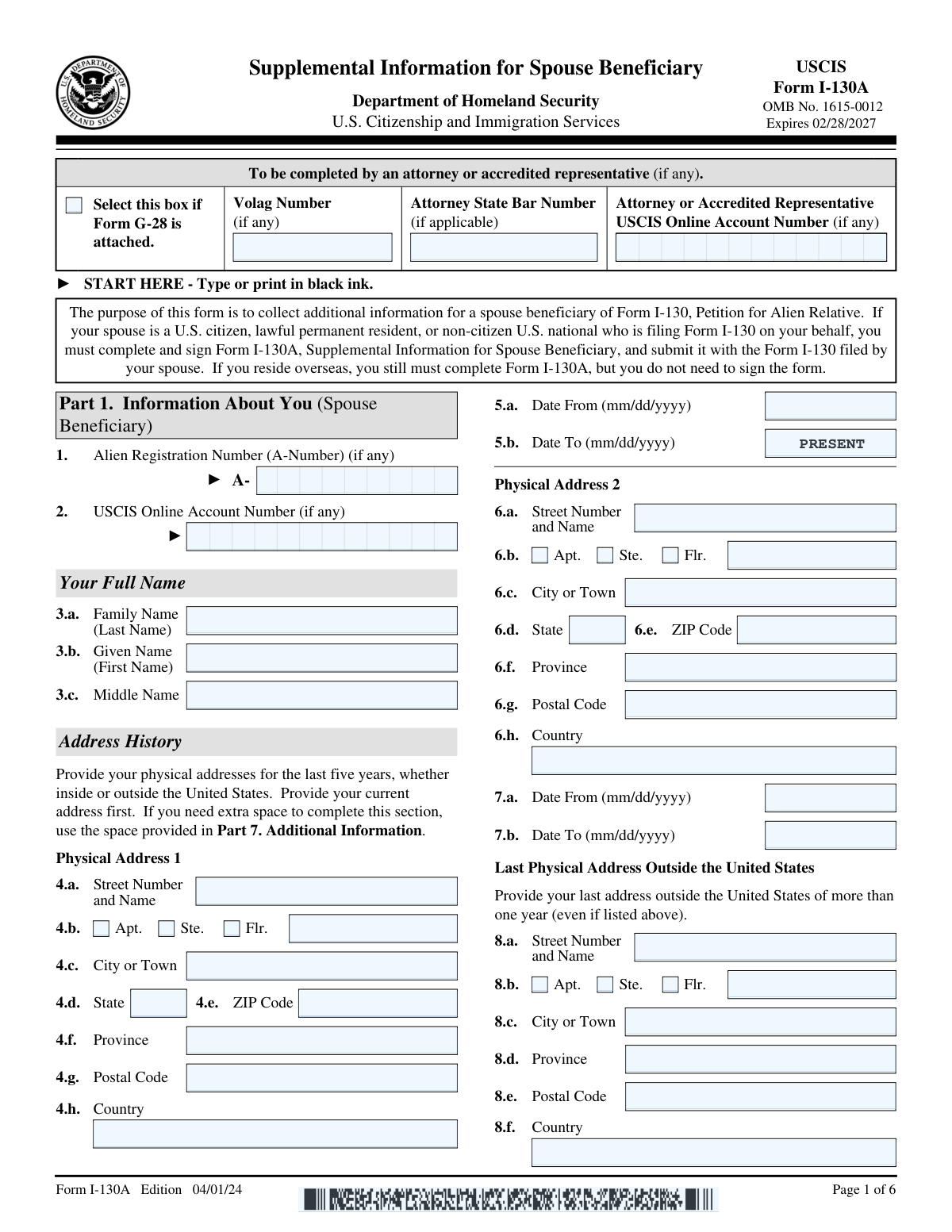

Form I-130A, officially known as the Supplemental Information for Spouse Beneficiary, is a document required by the U.S. Citizenship and Immigration Services (USCIS). It is used to provide additional details about a spouse who is being sponsored for a U.S. green card. This form is a necessary supplement to Form I-130, Petition for Alien Relative, and is important for the adjudication of the spousal immigration process.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form I-130A using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form I-130A, Supplemental Info for Spouse Beneficiary |

| Form issued by: | Department of Homeland Security, U.S. Citizenship and Immigration Services |

| Number of fields: | 194 |

| Number of pages: | 6 |

| Version: | 04/01/24 |

| Filled form examples: | Form Form I-130A Examples |

| Language: | English |

| Categories: | immigration forms, beneficiary forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form I-130A Online for Free in 2026

Are you looking to fill out a FORM I-130A form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM I-130A form in just 37 seconds or less.

Follow these steps to fill out your FORM I-130A form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form I-130A

- 2 Enter information about spouse beneficiary

- 3 Provide address and employment history

- 4 Include parent information if applicable

- 5 Add interpreter and preparer details

- 6 Sign and date the form electronically

- 7 Check for accuracy and submit form

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form I-130A Form?

Speed

Complete your Form I-130A in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form I-130A form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form I-130A

Form I-130A, Supplemental Information for Spouse Beneficiary, is a form used by U.S. Citizenship and Immigration Services (USCIS) to collect additional background information on a spouse beneficiary when a U.S. citizen or lawful permanent resident files Form I-130, Petition for Alien Relative, on behalf of their non-U.S. citizen spouse. It is designed to gather personal details about the spouse that are necessary for the adjudication of the immigrant visa petition.

Form I-130A must be completed by the spouse beneficiary when a U.S. citizen or lawful permanent resident is filing Form I-130, Petition for Alien Relative, on their behalf. The spouse beneficiary is the non-U.S. citizen who is married to the petitioner and seeking to immigrate to the United States.

In Part 1 of Form I-130A, the spouse beneficiary is required to provide personal information such as their full name, address, date of birth, place of birth, nationality, Alien Registration Number (if applicable), Social Security Number (if any), and information about their parents. This part also asks for details about the beneficiary's current marital status and any previous marriages.

The spouse beneficiary must provide their address history for the past five years on Form I-130A. This includes all the places where the beneficiary has lived during that time period, without leaving any gaps.

An attorney or accredited representative is not required to complete Form I-130A. However, beneficiaries may choose to seek the assistance of an attorney or accredited representative to ensure the form is completed accurately and to provide guidance throughout the immigration process. If an attorney or accredited representative is used, their information must be provided in the appropriate section of the form.

On Form I-130A, the spouse beneficiary is required to provide the following information about their parents: full legal name of each parent (including mother’s maiden name), date of birth, country of birth, and current address if living. If either parent is deceased, that should be indicated on the form.

Form I-130A requires the spouse beneficiary to include their employment history for the last five years, whether inside or outside the United States. The information should include the names of the employers, addresses, job titles, and the dates of employment for each position held.

Yes, the spouse beneficiary is required to provide employment information from outside the United States as part of their employment history on Form I-130A. This includes all employment within the last five years, regardless of the country in which it took place.

If the spouse beneficiary has never worked outside the United States, they should indicate this on Form I-130A by stating 'None' or 'Not Applicable' in the relevant sections of the employment history. It is important to provide accurate information and not leave any sections blank unless instructed to do so.

Part 4 of Form I-130A is designed to collect additional information about the spouse beneficiary's employment and addresses. This part of the form requires detailed employment history for the last five years and the addresses where the spouse beneficiary has lived during that time. The purpose is to provide U.S. Citizenship and Immigration Services (USCIS) with a comprehensive background of the spouse beneficiary's work and residence history for eligibility and security purposes.

On Form I-130A, the spouse beneficiary must certify that all the information provided is complete, true, and correct. They must also certify that they authorize the release of any information from their records that U.S. Citizenship and Immigration Services (USCIS) needs to determine eligibility for the immigration benefit they are seeking. Additionally, they must acknowledge that they understand the information in the form, and that they have had the opportunity to review and correct it before signing.

If the spouse beneficiary cannot fully understand English, they must have an interpreter assist them in understanding the content of Form I-130A. The interpreter must read the form to the beneficiary in a language they understand, and the beneficiary must certify that they understand the interpreted information. The interpreter must also provide their information and sign the form, certifying that they have accurately translated the information for the spouse beneficiary.

Yes, the spouse beneficiary can authorize the release of information to USCIS. On Form I-130A, there is a section where the spouse beneficiary consents to the release of information from their records to USCIS. This authorization is necessary for USCIS to obtain the information required to adjudicate the immigration benefit application.

In Part 5 of Form I-130A, the interpreter must provide their full name, address, and phone number. They must also provide their business or organization name if applicable. The interpreter must sign and date the form, certifying that they have read the form to the spouse beneficiary in a language that the beneficiary understands and that they have interpreted everything accurately. The interpreter must also certify that they are competent to translate from English to the language spoken by the beneficiary and that they are not an attorney or accredited representative unless they are the spouse beneficiary's legal representative.

If someone other than the spouse beneficiary is preparing Form I-130A, that person is considered the preparer and must complete the 'Preparer's Information' section of the form. The preparer must provide their full name, address, and contact information. They must also state their relationship to the spouse beneficiary and provide their own declaration certifying that they completed the form at the request of the beneficiary and that the form is based on information provided by the beneficiary. The preparer must sign and date the form, indicating that they have prepared the form according to the information given to them by the spouse beneficiary.

If additional space is needed to provide information on Form I-130A, you should attach a separate sheet of paper with the additional information. Make sure to include your name and Alien Registration Number (A-Number) if you have one, at the top of each sheet. Also, indicate the page number, part number, and item number to which the answer refers. Sign and date each sheet.

No, the spouse beneficiary does not need to sign Form I-130A if they reside overseas. However, the petitioner must complete and sign Form I-130A on behalf of the spouse beneficiary. The form will still need to be submitted with all the required information.

Not completely filling out Form I-130A or failing to submit required documents can result in delays in processing, requests for evidence (RFE), or even the denial of the underlying Form I-130 petition. It is crucial to provide all requested information and documentation to ensure the application is processed efficiently and to avoid potential setbacks.

The OMB No. (Office of Management and Budget Control Number) and expiration date for Form I-130A are typically found in the top right corner of the form. These details are specific to the version of the form being used and are updated periodically. Applicants should ensure they are using the most current form by checking the USCIS website or the form instructions.

Additional information can be provided on a separate sheet of paper if the space on Form I-130A is insufficient. You must include your full name, Alien Registration Number (A-Number) if applicable, and clearly indicate the part and item number your answer refers to. Each additional sheet must be signed and dated.

Compliance Form I-130A

Validation Checks by Instafill.ai

1

Form Edition and Expiration Date Check

Ensures that the form edition is accurately identified as 04/01/24 and verifies that the expiration date is 02/28/2027. This check confirms that the Form I-130A being used is current and valid for submission. It prevents the use of outdated forms that may lead to processing delays or rejections. The check is crucial for maintaining compliance with USCIS regulations.

2

Ink Color Compliance Check

Confirms that all information provided on the Form I-130A is typed or printed in black ink. This validation is essential to adhere to the submission standards set by USCIS. It ensures that the form is legible and machine-readable, which facilitates efficient processing. The check helps avoid potential issues that may arise from using non-standard ink colors.

3

Alien Registration Number Verification

Verifies that the Alien Registration Number (A-Number), if applicable, is correctly entered in Part 1, Item 1 of the Form I-130A. This check is vital for accurately associating the form with the correct individual's immigration records. It reduces the risk of misidentification and ensures the proper handling of the beneficiary's case.

4

USCIS Online Account Number Accuracy Check

Checks that the USCIS Online Account Number, if applicable, is accurately provided in Part 1, Item 2 of the Form I-130A. This validation ensures that the beneficiary's electronic records are correctly linked to the paper submission. It facilitates communication and status tracking through the USCIS online system.

5

Full Legal Name Validation

Validates that the full legal name of the spouse beneficiary is provided in Part 1, Items 3.a. to 3.c., including Family Name, Given Name, and Middle Name. This check is critical for the accurate identification of the beneficiary. It ensures consistency across all legal documents and immigration forms, which is essential for the adjudication process.

6

Confirms the current Physical Address 1 is completely filled out in Part 1, Items 4.a. to 4.h.

This validation check ensures that the current Physical Address 1 fields, from 4.a. to 4.h., in Part 1 of Form I-130A are fully completed. It confirms that no part of the address, including street number, street name, city, state, and zip code, is left blank. The check also verifies the accuracy of the address format according to USPS standards. Additionally, it cross-references the provided address with public records for consistency and validity.

7

Verifies the dates of residence at the current address are correctly entered in Part 1, Items 5.a. and 5.b.

This validation check verifies that the dates of residence at the current address, specified in Part 1, Items 5.a. and 5.b., are correctly entered on Form I-130A. It ensures that the dates are in the proper format (MM/DD/YYYY) and that the 'From' date precedes the 'To' date. The check also confirms that the 'To' date is either the current date or a date in the past, and not a future date. If the beneficiary is still residing at the address, it validates that the 'To' date field is appropriately marked as 'Present'.

8

Checks for the complete previous Physical Address 2 and corresponding dates of residence in Part 1, Items 6.a. to 7.b.

This validation check ensures that the previous Physical Address 2, along with the corresponding dates of residence, are fully provided in Part 1, Items 6.a. to 7.b., of Form I-130A. It checks for completeness of all address components, including street, city, state, and zip code. The check also confirms that the dates of residence are in the correct format and logically sequenced, ensuring that the 'From' date is earlier than the 'To' date and that there are no overlaps or gaps with the current address dates.

9

Ensures the last address outside the United States of more than one year is provided in Part 1, Items 8.a. to 8.f.

This validation check ensures that the last address outside the United States where the beneficiary resided for more than one year is fully provided in Part 1, Items 8.a. to 8.f., of Form I-130A. It confirms that all fields related to the foreign address, including street, city, province, postal code, and country, are filled out. The check also verifies that the address is consistent with the country's addressing format and that the dates of residence reflect a period of more than one year.

10

Validates employment information, including Employer Name, Address, Occupation, and Employment Dates for all employers listed in Part 2.

This validation check validates the employment information provided in Part 2 of Form I-130A. It ensures that the Employer Name, Address, Occupation, and Employment Dates for all listed employers are complete and accurate. The check verifies that the employment dates are in the correct format and that the periods of employment do not overlap. It also confirms that the employer's address is valid and that the occupation title is consistent with standard occupational classifications.

11

Confirms the 'Unemployed' status is indicated if applicable in Part 2, Item 1.

The validation ensures that if the spouse beneficiary is not currently employed, the 'Unemployed' status is clearly indicated in Part 2, Item 1 of Form I-130A. It checks for the presence of an indication that accurately reflects the employment status of the spouse beneficiary. If the status is not properly marked, the validation prompts for a correction to ensure that the form accurately represents the individual's current employment situation. This is crucial as it affects the credibility of the information provided on the form.

12

Verifies information about employment outside the United States is complete in Part 3 if applicable.

This validation verifies that all necessary details regarding any employment outside the United States are fully completed in Part 3 of Form I-130A, if applicable. It checks for completeness and accuracy of the employment information, including dates of employment, names and addresses of employers, and the nature of the work performed. The validation aims to ensure that the spouse beneficiary's employment history is thoroughly documented, which is essential for the adjudication of the form.

13

Checks that the Spouse Beneficiary's Statement in Part 4 is completed, with the appropriate box selected, contact information provided, and the form signed and dated.

This check ensures that the Spouse Beneficiary's Statement in Part 4 of Form I-130A is fully completed. It confirms that the spouse beneficiary has selected the appropriate box to indicate whether they can read and understand English and that their contact information is provided. Additionally, it verifies that the form has been signed and dated by the spouse beneficiary. This validation is critical to establish the authenticity of the form and the willingness of the spouse beneficiary to provide truthful information.

14

Ensures the Interpreter's Contact Information, Certification, and Signature are complete in Part 5 if an interpreter was used.

The validation ensures that if an interpreter was used in the completion of Form I-130A, all the required fields in Part 5 are properly filled out. This includes the interpreter's contact information, certification that they have accurately translated the information for the spouse beneficiary, and their signature. The validation confirms the interpreter's role and accountability in the process, which is important for maintaining the integrity of the information provided.

15

Validates the Contact Information, Declaration, and Signature of the Person Preparing the Form in Part 6 if someone other than the spouse beneficiary prepared the form.

This validation confirms that if Form I-130A was prepared by someone other than the spouse beneficiary, the preparer's contact information, declaration, and signature are all present and complete in Part 6. It checks for the preparer's full name, address, and other contact details, along with a declaration that the form was prepared at the request of the spouse beneficiary, and ensures that the preparer has signed and dated the form. This step is essential to identify the preparer and to certify that the information was prepared according to the spouse beneficiary's instructions.

Common Mistakes in Completing Form I-130A

Submissions of Form I-130A that are not completed in black ink or typed text can lead to processing delays or even rejections. To ensure clarity and legibility, it is crucial to use only black ink if filling out the form by hand or to type the information electronically before printing. This helps in preventing any misunderstandings or errors in reading the information provided. Applicants should double-check the form instructions for any specific requirements regarding the method of completion.

A signature and date are mandatory for the validation of Form I-130A. Neglecting to sign or date the form in the designated areas can result in the form being returned or denied, as it is considered incomplete without these elements. Applicants should carefully review each section of the form to identify where signatures and dates are required. It is advisable to go over the completed form before submission to ensure that all necessary signatures and dates have been provided.

If the spouse beneficiary has been issued an Alien Registration Number (A-Number), it must be included on Form I-130A. Failing to provide this number can cause delays in the processing of the application. The A-Number is a crucial identifier for individuals who have previously interacted with U.S. immigration services. Beneficiaries should ensure they have their A-Number available when filling out the form and should double-check to make sure it is entered correctly in the appropriate field.

The USCIS Online Account Number is an important piece of information that should be included on Form I-130A if the spouse beneficiary has one. This number helps in tracking the application and correspondence with USCIS. Not including this number when it is available can lead to missed communications or updates regarding the application status. Beneficiaries with an online account should locate their USCIS Online Account Number and ensure it is accurately entered on the form.

It is essential to provide the full legal name of the spouse beneficiary in the order specified on Form I-130A. Incorrectly formatted names or missing parts of the name can lead to confusion and potential issues with the application. The full legal name includes the first name, middle name, and last name, and each should be placed in the correct section of the form. Applicants should review their legal documents to confirm the correct spelling and order of their names before completing the form.

Applicants often incorrectly format the Physical Address fields by not following the standard address format, which includes street number, street name, city, state, and ZIP code. To avoid this mistake, double-check that the address is complete and formatted as it would appear on mail. Use a separate line for the apartment or suite number if applicable. Refer to a recent piece of mail or official document to confirm the correct format of your address.

Failing to enter the dates of residence accurately can lead to processing delays. Ensure that all dates are entered in a month/day/year format and that they accurately reflect the period of residence at each address listed. Cross-reference with personal records, such as lease agreements or utility bills, to confirm the exact dates. Avoid approximations unless you cannot determine the precise dates, in which case provide a best estimate and indicate it as such.

Omitting previous addresses is a common oversight that can result in incomplete background checks or processing delays. It is important to list all addresses where you have resided during the period specified in the form instructions. Review your personal records, including rental agreements and correspondence, to ensure no address is overlooked. If you have moved frequently, consider creating a timeline of your residences to assist in accurately completing this section.

Applicants sometimes forget to list their last address outside the U.S., which is required information for those who have resided abroad. This address is crucial for a complete immigration history. If you have lived outside the U.S., review your international travel documents, such as passports or visas, to find the address and include it in the form. Ensure that this address is as complete and accurate as possible, including the country and any applicable postal codes.

When not currently employed, applicants often leave the employment section blank instead of specifying 'Unemployed.' It is important to clearly indicate employment status to avoid any confusion regarding your current situation. If you are not working, write 'Unemployed' in the relevant section and provide the date when your last employment ended, if applicable. This clarity helps to present a complete and accurate account of your employment history.

Applicants often neglect to provide details of employment outside the United States. It is crucial to include all employment history for the last five years, regardless of the country in which the work took place. To avoid this mistake, carefully review the employment history section and ensure that each job held outside the U.S. is listed with accurate dates, job titles, and employer information. This information is important for establishing a complete work history and can impact the adjudication of the form.

Many applicants forget to specify whether an interpreter was used during the completion of Form I-130A. It is important to indicate this information by checking the appropriate box in the designated section of the form. If an interpreter was used, their information must be provided. To prevent this oversight, double-check the form to ensure that the use of an interpreter is clearly stated and that all related fields are filled out correctly.

Applicants sometimes provide incomplete contact information and certification for the interpreter. It is essential that the interpreter's full name, address, and phone number are provided, along with their certification that they are competent to translate and that the translation is accurate. To avoid this error, verify that the interpreter has completed all required fields and that they have signed and dated the certification section of the form.

In cases where someone other than the spouse beneficiary completes the form, it is a common mistake for the preparer to not declare their role. The preparer must provide their full name, address, and contact information, and sign and date the form. To ensure compliance, if you are the preparer, fill out the 'Preparer's Statement' section completely and provide all the necessary information to identify yourself and your role in the preparation of the form.

When Form I-130A is prepared by an attorney or accredited representative, applicants often forget to attach Form G-28, Notice of Entry of Appearance as Attorney or Accredited Representative. This form is required to authorize the representative to act on behalf of the applicant. To avoid this mistake, ensure that Form G-28 is completed accurately and attached to Form I-130A before submission. This will confirm the representative's authority and enable them to communicate with USCIS regarding the case.

Applicants sometimes submit an outdated edition of Form I-130A, which can lead to processing delays or even rejection of the application. It is crucial to check the U.S. Citizenship and Immigration Services (USCIS) website for the most current edition of the form before submission. The edition date is typically located at the bottom of the form's pages. Always download the form directly from the USCIS website to ensure you are using the correct version.

Failure to properly attach additional sheets with the applicant's name, Alien Registration Number (A-Number), and page and part number references can result in confusion and processing errors. When additional information is necessary, use a separate sheet of paper and include the required identifying information at the top of each sheet. Securely attach the additional sheets to the form to prevent separation during handling.

Omitting required documents when submitting Form I-130A can lead to significant delays or a denial of the application. Carefully review the instructions for Form I-130A to understand which documents are mandatory for your specific situation. Gather and organize all necessary documents before filing the form, and double-check your package to ensure completeness before sending it to USCIS.

Leaving fields blank on Form I-130A can cause confusion and may lead to the assumption that the applicant overlooked the question. To avoid this, fill in every field on the form. If a question does not apply to your situation, write 'N/A' (not applicable) or 'None' to indicate that the question has been considered and answered appropriately. This practice demonstrates attention to detail and ensures that all parts of the form have been addressed.

Applicants sometimes neglect to use Part 7 of Form I-130A for providing additional information when the space provided in other parts of the form is insufficient. Always review your answers and use Part 7 to provide complete information if you run out of space in any section. Clearly indicate the page, part, and item number to which each additional piece of information pertains. This ensures that your information is accurately associated with the correct part of the form.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form I-130A with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills i-130a forms, ensuring each field is accurate.