Fill out beneficiary forms

with AI.

Beneficiary forms are essential legal documents designed to manage the transfer of assets and benefits following an individual's passing. These forms serve as a direct instruction to financial institutions, insurance companies, and government agencies, often superseding a traditional will or trust. By clearly naming primary and contingent beneficiaries, you ensure that retirement savings, life insurance payouts, and investment accounts are distributed according to your specific wishes, helping your loved ones avoid the lengthy and often expensive probate process.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About beneficiary forms

This category covers a wide range of administrative needs, from designating heirs for a 401(k) or IRA to filing supplemental information for a spouse's green card application. You typically need these forms when starting a new job, opening a brokerage account with providers like Fidelity or Vanguard, or updating your estate plan after a major life event such as marriage or the birth of a child. Specialized documents, such as life insurance affidavits from The Hartford or retirement designations from TIAA, are also common requirements for maintaining clear financial records.

Navigating these legal requirements can be time-consuming, but tools like Instafill.ai use AI to fill these forms in under 30 seconds, ensuring your data is handled accurately and securely. Whether you are managing an inherited account or setting up your own legacy, having the right paperwork in order provides peace of mind and financial security for your family.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds

How to Choose the Right Form

Beneficiary forms are essential legal tools that ensure your assets—ranging from life insurance payouts to retirement savings—are distributed according to your wishes, often bypassing the lengthy probate process. Because these designations typically override instructions in a will, choosing the specific form for your account provider is critical.

Retirement and Investment Accounts

Most forms in this category are provider-specific. You should select the form that matches where your assets are currently held:

- Fidelity: Use the Fidelity Investments 403(b) Beneficiary Designation or the Fidelity Advisor IRA Beneficiary Designation to name heirs. If you have inherited an account, use the Fidelity Investments® Beneficiary Distribution Form to claim assets.

- Vanguard: Choose the Vanguard Retirement Plan Beneficiary Designation for standard accounts or the IRA Distribution to Charitable Beneficiary if you are an organization claiming a gift.

- Charles Schwab: Use the Designated Beneficiary Plan Agreement for Schwab One brokerage accounts or the Beneficiary Designation Form For IRA and 403(b)(7) Accounts for retirement funds.

- TIAA & Empower: Select the TIAA Beneficiary Designation Form or the Empower Beneficiary Recordkeeping Form to update your primary and contingent beneficiaries.

Life Insurance and Annuities

To ensure your loved ones receive policy proceeds, use the form provided by your insurer:

- Principal & Transamerica: Use the Principal Life Insurance Company Beneficiary Designation/Change Form or the Transamerica Beneficiary Change Form to update your policy.

- The Hartford: If you are a survivor identifying next of kin for a claim, use the Affidavit and Representations Regarding Next of Kin (Preference Beneficiary Affidavit).

- Minors: If naming a minor as a beneficiary, use the UTMA Beneficiary Designation (Uniform Transfers to Minor Act) to appoint a custodian.

Immigration and Government Benefits

Not all beneficiary forms are for estate planning. Some are required for legal status or government payouts:

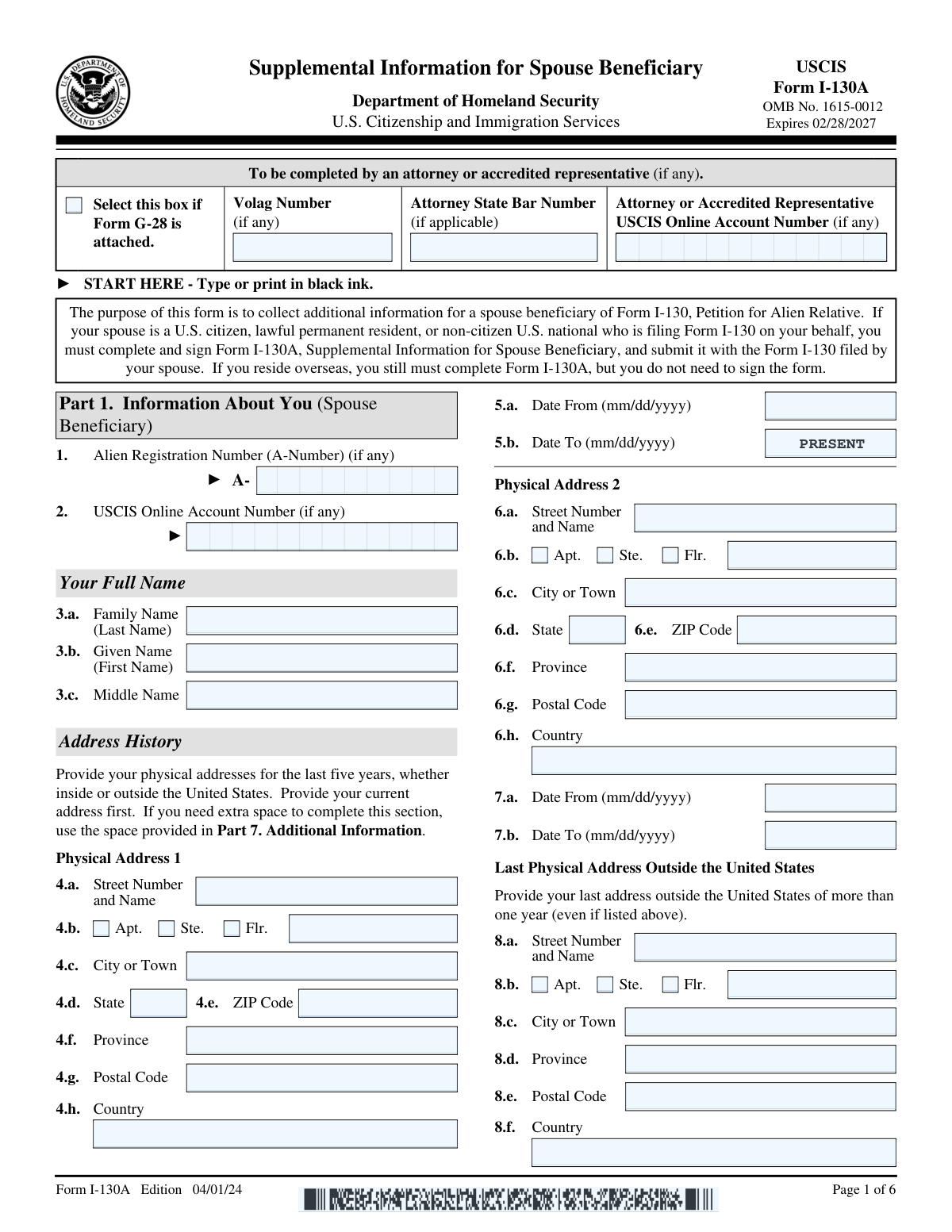

- Immigration: Form I-130A, Supplemental Info for Spouse Beneficiary is required by USCIS when sponsoring a spouse for a green card.

- Veterans Affairs: Use VA Form 21-0788, Information Regarding Apportionment of Beneficiary's Award to request that a portion of a veteran's benefits be paid to a dependent.

- Taxes: If you are receiving income from a trust or estate in California, you will need the California Schedule K-1 (541) for your tax filings.

Form Comparison

| Form | Purpose | Who Files It | Relevant Agency |

|---|---|---|---|

| Form CMS-1696, Appointment of Representative | Designates a representative to manage Medicare claims and appeals. | Medicare beneficiaries or their appointed representatives. | Centers for Medicare & Medicaid Services (CMS) |

| Form I-130A, Supplemental Info for Spouse Beneficiary | Provides supplemental personal details for a spouse's green card application. | The spouse beneficiary of a U.S. citizen or resident. | U.S. Citizenship and Immigration Services (USCIS) |

| Form I-361, Affidavit of Financial Support | Demonstrates financial ability to support an Amerasian immigrant beneficiary. | U.S. sponsors of Amerasian immigration applicants. | U.S. Citizenship and Immigration Services (USCIS) |

| Affidavit and Representations Regarding Next of Kin (Preference Beneficiary Affidavit) (The Hartford) – Form LC-7086-17 | Identifies surviving next of kin to determine life insurance distribution. | Surviving spouse, children, or parents of the deceased. | The Hartford Life Insurance |

| Lifestyle Protector – Risk New Business for Multiple Lives Assured (LPMLA 04/2024) | Application for new risk policies covering multiple lives assured. | Insurance applicants or their financial advisers. | Liberty (Insurance Provider) |

| Form I-130, Petition for Alien Relative | Proves a qualifying family relationship for immigration sponsorship. | U.S. citizens or lawful permanent residents. | U.S. Citizenship and Immigration Services (USCIS) |

| National Integrity Life Insurance Company Ownership Change Request Form (NI-77-0039-2505) | Updates ownership or beneficiary designations for annuity contracts. | Current annuity contract owners. | National Integrity Life Insurance Company |

| Carer Payment and Carer Allowance – Medical Report (SA431) for a child under 16 years | Clinical report documenting a child's disability for carer benefits. | Treating health professionals for a child's carer. | Services Australia (Centrelink) |

| Form 3520 (Rev. December 2023), Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts | Reports transactions with foreign trusts and receipt of foreign gifts. | U.S. persons with foreign trust or gift interests. | Internal Revenue Service (IRS) |

| VA Form 21-4138, Statement in Support of Claim | Provides a narrative statement to support a VA benefit claim. | Veterans, survivors, or their designated beneficiaries. | Department of Veterans Affairs (VA) |

| Form SSA-454-BK, Continuing Disability Review Report | Updates medical and work info for continuing disability reviews. | Individuals currently receiving Social Security disability benefits. | Social Security Administration (SSA) |

| VA Form 21-0788, Information Regarding Apportionment of Beneficiary's Award | Requests the division of benefit awards among dependents. | Veterans, surviving spouses, or dependent claimants. | Department of Veterans Affairs (VA) |

Tips for beneficiary forms

Avoid using vague terms like 'my children' or 'my estate' when naming beneficiaries. To prevent legal disputes and ensure the provider can uniquely identify your heirs, always include full legal names, Social Security numbers, and current contact information.

For many employer-sponsored retirement plans, such as 401(k) or 403(b) accounts, federal law often requires your spouse to sign a notarized waiver if they are not named as the primary beneficiary. Failure to include this required signature can render your designation invalid.

Naming a backup or 'contingent' beneficiary is a critical safety net. If your primary beneficiary passes away before you, having a contingent listed ensures your assets transfer directly to your secondary choice rather than being tied up in a lengthy probate court process.

Beneficiary designations typically supersede instructions left in a will or trust. It is vital to review and update these forms immediately following life changes such as marriage, divorce, or the birth of a child to ensure your assets are distributed according to your current wishes.

Completing multiple forms for different accounts can be tedious and prone to error. AI-powered tools like Instafill.ai can complete these forms in under 30 seconds with high accuracy, ensuring your data stays secure while saving you significant time during the estate planning process.

When naming multiple primary beneficiaries, ensure the total percentage of assets allocated equals exactly 100%. Mathematical errors are a common reason for form rejection, which can lead to significant delays in processing your request.

Many institutions, including The Hartford and TIAA, require signatures to be witnessed by a notary public or a plan representative. Always check the 'Instructions' section of the specific form to see if notarization is required before you sign and submit the document.

Frequently Asked Questions

A beneficiary designation form is a legal document used to specify who will receive assets from an account or insurance policy upon the owner's death. These forms are standard for life insurance, retirement accounts like 401(k)s and IRAs, and certain brokerage accounts to ensure assets are transferred according to the owner's wishes.

In most jurisdictions, a beneficiary designation form takes legal precedence over a will or trust for that specific account. Because these forms create a direct transfer of ownership, the financial institution is generally required to pay the named beneficiary regardless of what is written in a general will.

A primary beneficiary is the first person or entity designated to receive the assets. A contingent beneficiary serves as a backup and only receives the distribution if all primary beneficiaries have passed away or are legally unable to accept the funds at the time of the account holder's death.

It is recommended to review and update your forms after significant life events such as marriage, divorce, the birth of a child, or the passing of a previously named beneficiary. Keeping these forms current ensures that your assets do not accidentally go to an ex-spouse or an estate, which could trigger a lengthy probate process.

While you can name a minor, they usually cannot manage the assets directly until they reach the age of majority. Many people use a Uniform Transfers to Minors Act (UTMA) designation or name a trust as the beneficiary to ensure a guardian or trustee manages the funds for the child's benefit.

Under federal laws like ERISA, a spouse often has a legal right to be the primary beneficiary of a retirement plan. If an account holder wishes to name someone else, the spouse must typically sign a waiver or consent section, which often requires notarization to be valid.

Yes, AI tools like Instafill.ai can be used to fill out these forms in under 30 seconds. The AI accurately extracts data from your source documents and places it into the correct fields on the PDF, reducing the risk of manual entry errors that could delay the processing of your designation.

While manual entry can take 10 to 15 minutes depending on the complexity of the form, using an AI-powered service like Instafill.ai allows you to complete the process in less than 30 seconds. This technology ensures that sensitive information like Social Security numbers and account details are placed precisely where they belong.

Completed forms should be submitted directly to the organization managing the account, such as the insurance company (The Hartford, Transamerica) or the investment firm (Fidelity, Vanguard, TIAA). Most companies offer an online portal for uploads, though some may still require the original document to be sent via mail.

If no beneficiary is named, the assets are typically paid to your estate. This often forces the funds to go through probate court, which can be a time-consuming and expensive process that delays your heirs' access to the money.

Yes, most forms allow you to designate a legal entity such as a 501(c)(3) non-profit, a church, or a living trust as a beneficiary. You will generally need to provide the entity's full legal name, their tax identification number (EIN), and their current mailing address.

Glossary

- Primary Beneficiary

- The individual or entity first in line to receive the proceeds or assets from an insurance policy or retirement account upon the owner's death.

- Contingent Beneficiary

- Also known as a secondary beneficiary, this is the person or entity who inherits the assets only if all primary beneficiaries are deceased or unable to accept the distribution.

- Spousal Consent

- A legal requirement for many retirement plans where a spouse must provide a notarized signature to waive their right to the assets if they are not named as the sole primary beneficiary.

- Per Stirpes

- A legal term used in distribution which ensures that if a named beneficiary dies before the account owner, their share of the inheritance passes down to their own children or heirs.

- Probate

- The court-supervised legal process of validating a will and distributing a deceased person's estate; properly completed beneficiary forms allow assets to bypass this process entirely.

- UTMA (Uniform Transfers to Minors Act)

- A set of laws that allows a minor to receive assets, such as life insurance proceeds, which are managed by a designated custodian until the minor reaches the age of majority.

- TOD / POD (Transfer on Death / Payable on Death)

- Arrangements for brokerage or bank accounts that allow the assets to transfer directly to a named beneficiary upon the owner's death without the need for a will.

- QPSA (Qualified Preretirement Survivor Annuity)

- A mandatory death benefit provided by certain retirement plans to the surviving spouse of a participant who dies before they begin receiving their retirement benefits.

- Affiant

- The person who signs an affidavit and swears to the truth of the information provided, commonly required when identifying next of kin for insurance claims.