Yes! You can use AI to fill out Affidavit and Representations Regarding Next of Kin (Preference Beneficiary Affidavit) (The Hartford) – Form LC-7086-17

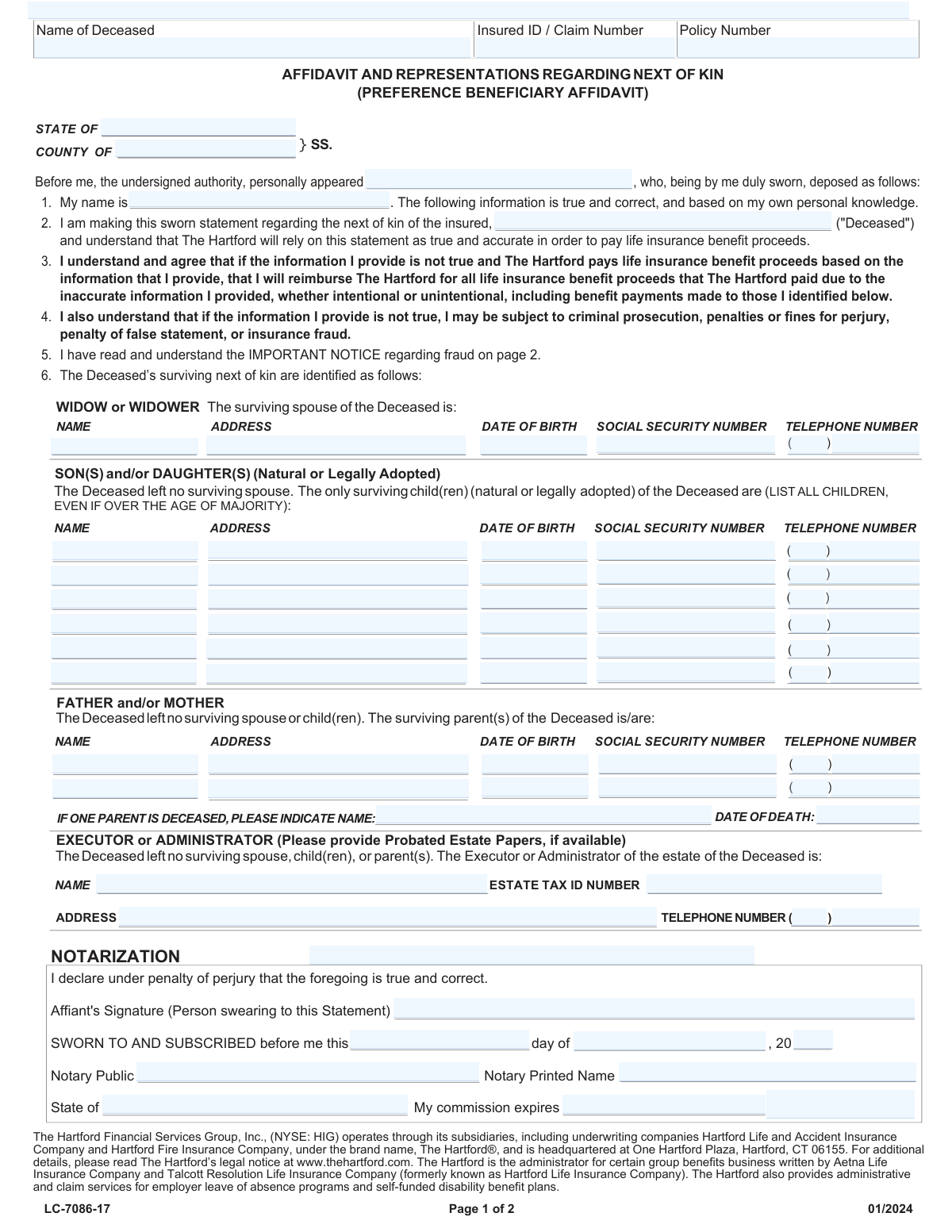

This form is a sworn affidavit used in a life insurance claim to identify the deceased insured’s surviving next of kin (spouse, children, parents, or estate representative) in order of preference. The affiant certifies the information under penalty of perjury and acknowledges Hartford will rely on it to determine who should receive benefit proceeds. It is important because incorrect or incomplete information can delay payment, require reimbursement of paid proceeds, and may expose the signer to civil or criminal penalties for fraud or perjury. The form also includes state-specific fraud warnings and requires notarization to validate the statement.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out LC-7086-17 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Affidavit and Representations Regarding Next of Kin (Preference Beneficiary Affidavit) (The Hartford) – Form LC-7086-17 |

| Number of pages: | 2 |

| Language: | English |

| Categories: | The Hartford forms, insurance forms, beneficiary forms, life insurance forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out LC-7086-17 Online for Free in 2026

Are you looking to fill out a LC-7086-17 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your LC-7086-17 form in just 37 seconds or less.

Follow these steps to fill out your LC-7086-17 form online using Instafill.ai:

- 1 Enter the deceased insured’s identifying information (name, insured ID/claim number, and policy number) and the state/county where the affidavit is executed.

- 2 Provide the affiant’s name and confirm the statements acknowledging the affidavit is based on personal knowledge and will be relied upon for payment of benefits.

- 3 Complete the next-of-kin section in order: list the surviving spouse (if any) with full contact details, date of birth, Social Security number, and phone number.

- 4 If there is no surviving spouse, list all surviving children (including adults) with their addresses, dates of birth, Social Security numbers, and phone numbers; if none, list surviving parent(s) and include deceased parent name/date of death if applicable.

- 5 If there is no spouse, child, or parent, provide the executor/administrator information and include estate tax ID number; attach probated estate papers if available.

- 6 Review the Important Notice/fraud statement applicable to the affiant’s state of residence, then sign and date the form where indicated.

- 7 Complete notarization: sign in the presence of a notary, have the notary complete the venue/date, notary name, commission information, and apply the notary seal as required.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable LC-7086-17 Form?

Speed

Complete your LC-7086-17 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 LC-7086-17 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form LC-7086-17

This form is used to identify the deceased insured’s surviving next of kin so The Hartford can determine who should receive life insurance benefit proceeds when needed. The Hartford relies on the information in this sworn statement to process payment.

The person with personal knowledge of the deceased’s family situation (the “Affiant”) should complete and sign it. The Affiant must be willing to swear under penalty of perjury that the information provided is true and correct.

Yes. The form includes a notarization section that must be completed by a Notary Public, including the date, state, notary signature/printed name, and commission expiration.

You should provide the Name of Deceased, Insured ID/Claim Number, and Policy Number. If you don’t have one of these numbers, provide what you have and contact The Hartford for help locating the missing information.

By signing, the Affiant declares under penalty of perjury that the statements are true and correct. The Affiant also agrees to reimburse The Hartford if benefits are paid based on inaccurate information, even if the error was unintentional.

The form asks you to list next of kin in order: surviving spouse (widow/widower), then children (natural or legally adopted), then parents, and if none of those exist, the executor/administrator of the estate. You should complete the section that matches the deceased’s situation.

Yes. The form specifically instructs you to list all children, even if they are over the age of majority, as long as they are natural or legally adopted children of the deceased.

For each person, the form requests name, address, date of birth, Social Security number, and telephone number. Provide as much complete and accurate information as possible to avoid delays.

If there is no surviving spouse or children, you should complete the “Father and/or Mother” section and list the surviving parent(s). If one parent is deceased, you must indicate that parent’s name and date of death.

Complete that section only if the deceased left no surviving spouse, children, or parents. The form asks you to provide probated estate papers if available, along with the executor/administrator’s name, estate tax ID number, address, and phone number.

Provide the information you do know and try to obtain the missing details before submission, since incomplete information can slow processing. If you cannot obtain it, note that it is unknown and contact The Hartford for guidance on acceptable alternatives.

The “Important Notice” explains state-specific fraud warnings and penalties for providing false or misleading information. You must sign and date at the bottom of that page to confirm the statements are true and complete to the best of your knowledge and belief.

Use the statement that matches your state of residence as listed on the form (some states have specific wording, while others fall under the “all states except” category). If you are unsure, use your current legal residence state and ask The Hartford if clarification is needed.

The form itself does not list a specific processing time, and timing can vary based on completeness and any required follow-up. Submitting a fully completed, signed, and notarized form (and estate papers if applicable) helps reduce delays.

Submission instructions are not shown on the provided pages. You should follow the claim packet directions or contact The Hartford claims team to confirm the correct mailing address, fax number, or online upload option for your claim.

Compliance LC-7086-17

Validation Checks by Instafill.ai

1

Deceased Identification Fields Present (Name + Insured ID/Claim Number or Policy Number)

Validates that the form includes the Deceased’s name and at least one unique identifier (Insured ID/Claim Number and/or Policy Number). This is required to correctly match the affidavit to the correct claim and policy record and prevent misapplied payments. If missing or incomplete, the submission should be rejected or routed to manual review for claimant outreach before any processing continues.

2

Affiant Full Name Provided and Not Blank

Checks that the affiant’s name in statement item 1 is completed with a non-empty, non-placeholder value (e.g., not just initials, “N/A,” or whitespace). The affidavit is a sworn statement and must clearly identify who is making the representations. If validation fails, the form should be considered incomplete and returned for correction because the statement cannot be relied upon without an identified affiant.

3

Jurisdiction Completeness (State and County for Affidavit Notary Block)

Ensures the 'STATE OF' and 'COUNTY OF' fields in the affidavit notarization section are completed. This establishes the legal jurisdiction where the oath was administered and is essential for enforceability and compliance. If either field is missing, the notarization is potentially defective and the submission should be flagged for correction or re-notarization.

4

Notarization Date Format and Completeness

Validates that the notarization date line ('this day of, 20') is fully completed with a valid day, month, and 4-digit year, and that the date is a real calendar date. Notarization without a complete date can invalidate the affidavit and create legal and audit issues. If invalid or incomplete, the form should be rejected and the claimant instructed to obtain a corrected notarization.

5

Notary Identification Completed (Notary Signature and Printed Name)

Checks that both the notary public signature and the notary printed name fields are present and not blank. These elements are required to identify the notary who administered the oath and to support verification if needed. If missing, the notarization cannot be authenticated and the submission should be returned for completion.

6

Notary Commission Expiration Date Validity

Validates that the 'My commission expires' field contains a valid date and that the commission expiration is not earlier than the notarization date. A notary must have an active commission at the time of notarization for the affidavit to be valid. If the commission is expired or the date is missing/invalid, the form should be flagged as invalid notarization and require re-notarization.

7

Affiant Signature and Signature Date Present (Important Notice Page)

Ensures the affiant signed and dated the acknowledgment at the bottom of the Important Notice page. This confirms the affiant attests the statements are true and complete and acknowledges the fraud notice applicable to their state. If either signature or date is missing, the affidavit should be treated as incomplete and not actionable until corrected.

8

Next-of-Kin Section Exclusivity and Hierarchy Consistency

Validates that the form’s next-of-kin listings follow the stated hierarchy: spouse section used if a surviving spouse exists; children section used only if no spouse; parents section used only if no spouse and no children; executor/administrator used only if no spouse, children, or parents. This prevents contradictory declarations (e.g., listing a spouse and also asserting 'left no surviving spouse'). If inconsistencies are detected, the submission should be routed to manual review and payment should be blocked pending clarification.

9

Spouse Section Completeness When Spouse Listed

If a spouse is listed, checks that spouse name, address, date of birth, Social Security number, and telephone number are all provided. These fields are needed to identify the beneficiary candidate, perform identity verification, and support payment issuance. If any required spouse field is missing, the form should be marked incomplete and returned for completion or supplemented documentation.

10

Children Entries Completeness and 'List All Children' Enforcement

If the children section is used, validates that at least one child is listed and that each listed child has name, address, date of birth, Social Security number, and telephone number completed. It also checks that the affiant did not leave blank rows between filled rows (to reduce risk of later alteration) and that the section is not used while also listing a spouse. If incomplete or contradictory, the submission should be rejected or escalated for manual follow-up to ensure all eligible children are captured.

11

Parents Section Completeness and Deceased Parent Details

If the parents section is used, validates that the surviving parent(s) are listed with required identifying details (name, address, DOB, SSN, phone). If the form indicates one parent is deceased, it requires the deceased parent’s name and date of death to be present and the date of death to be a valid date. If missing or invalid, the submission should be flagged because next-of-kin determination may be incorrect without complete parental status.

12

Executor/Administrator Section Requires Estate Tax ID and Contact Details

If the executor/administrator section is used, checks that the executor/administrator name, estate tax ID number, address, and telephone number are provided. This information is necessary to validate authority and to process estate-related payments and reporting. If any required field is missing, the form should be held and the submitter requested to provide the missing estate details (and probated papers if available).

13

SSN Format Validation for All Listed Individuals

Validates that each Social Security number provided (spouse/children/parents) matches an acceptable SSN format (e.g., 9 digits, optionally with dashes) and is not an obvious placeholder (e.g., 000-00-0000, 123-45-6789). Correct SSNs are critical for identity verification, tax reporting, and fraud prevention. If an SSN fails validation, the record should be flagged for correction and may require additional identity documentation.

14

Date of Birth and Date of Death Format and Plausibility Checks

Ensures all dates of birth and any date of death are valid calendar dates and fall within plausible ranges (e.g., DOB not in the future; parent DOB implies reasonable age relative to deceased if deceased DOB is available in the claim system). Date plausibility helps detect data entry errors and potential fraud. If a date is invalid or implausible, the submission should be routed for manual review and corrected documentation requested.

15

Telephone Number Format Validation (Including Area Code)

Checks that each telephone number field contains a valid phone format (e.g., 10 digits for US numbers) and is not left as only parentheses or punctuation. Reliable contact information is necessary for follow-up questions, identity verification, and payment issue resolution. If invalid or missing where required, the form should be marked incomplete and the submitter contacted to provide a correct number.

16

Address Completeness for Each Listed Next-of-Kin

Validates that each listed person’s address is sufficiently complete (at minimum street line and either city/state/ZIP or an equivalent complete mailing address) and not a placeholder like 'same as above' unless the system supports explicit address copying. Accurate addresses are needed for correspondence, potential check mailing, and compliance notices. If address data is incomplete, the submission should be held for correction to avoid misdelivery and processing delays.

Common Mistakes in Completing LC-7086-17

People often skip these fields because they don’t have the paperwork handy or assume the insurer can “look it up” by name alone. Missing or incorrect identifiers can delay processing, cause the affidavit to be associated with the wrong claim, or trigger follow-up requests. Avoid this by copying the Insured ID/Claim Number and Policy Number exactly as shown on the claim correspondence or policy documents, and double-checking for transposed digits.

A frequent error is filling out the affidavit but leaving the STATE/COUNTY (venue), the “day of ___, 20__” line, or the notary’s printed name/commission expiration incomplete. If the notarization block is incomplete or signed outside the notary’s presence, the affidavit may be rejected as invalid and must be redone. To avoid this, do not sign until you are in front of the notary, and confirm the notary completes every notary field (including state, commission expiration, and stamp/seal if required).

This form has multiple signature contexts (affiant signature for the sworn statement and a signature/date on the Important Notice page). People sometimes sign only one page, sign on the notary line, or use a signature that doesn’t match their ID used for notarization. This can lead to notarization refusal, re-execution requests, or delays in benefit payment. Avoid it by signing only where the form instructs, ensuring the affiant signs as the person making the statement, and using the same legal signature as on the identification presented to the notary.

Applicants commonly misunderstand the hierarchy and fill in multiple sections even when a higher-priority category exists (e.g., listing parents or an executor even though there is a surviving spouse or child). This creates conflicts and can require additional documentation or legal review before proceeds are paid. Avoid this by following the form’s logic: complete the spouse section if a spouse survives; only complete the children section if there is no surviving spouse; only complete parents if no spouse or children; only list an executor/administrator if no spouse, children, or parents.

The form explicitly requires listing ALL children “even if over the age of majority,” but people often omit adult children, children from prior relationships, or legally adopted children due to oversight or family dynamics. Omissions can be treated as a material inaccuracy, potentially exposing the affiant to repayment obligations and delaying payment while the insurer investigates. Avoid this by making a complete list of all natural and legally adopted children, regardless of age, relationship status, or dependency.

Many submissions include names but leave addresses or telephone numbers blank, especially when the affiant doesn’t have current contact information. Missing contact details can prevent the insurer from verifying beneficiaries or issuing payments, resulting in follow-up requests and delays. Avoid this by providing the most current mailing address and phone number available, and if unknown, attach an explanation and any partial information (city/state, last known address) rather than leaving fields empty.

Dates are often entered in inconsistent formats (e.g., 1/2/24 vs. 02-01-2024) or with transposed month/day, especially when multiple family members are listed. Incorrect dates can cause identity verification failures, mismatches with records, and additional documentation requests. Avoid this by using a consistent format (MM/DD/YYYY unless otherwise instructed) and verifying each date against official documents (birth certificate, death certificate, or government ID).

People sometimes leave SSNs blank, enter partial numbers, swap digits, or provide a Tax ID where an SSN is requested (or vice versa). Incorrect SSNs can delay identity verification and may require resubmission, while unnecessary inclusion can raise privacy concerns if the form is sent insecurely. Avoid this by entering the correct SSN for each person where requested, double-checking digits, and using the Estate Tax ID only in the executor/administrator section where it is specifically requested.

When listing surviving parents, people often forget to complete the “IF ONE PARENT IS DECEASED, PLEASE INDICATE NAME” and “DATE OF DEATH” lines. This omission can create ambiguity about whether one or both parents survive, which affects next-of-kin determination and can trigger additional proof requests. Avoid this by clearly stating the deceased parent’s full name and date of death, and ensuring the surviving parent’s details are fully completed.

Applicants frequently list an executor/administrator without attaching probated estate papers (when available) or they provide a personal SSN instead of the estate’s Tax ID number. This can lead to payment holds because the insurer may need proof of legal authority and correct tax reporting information. Avoid this by attaching letters testamentary/letters of administration or other probate documents if available, and confirming whether the number requested is the estate EIN/Tax ID (not the executor’s SSN).

Because the fraud notice is lengthy and state-specific, people often overlook the instruction to read the applicable statement and sign/date at the bottom of page 2. Missing this signature/date can result in an incomplete submission and a request to re-sign, delaying claim processing. Avoid this by signing and dating page 2 where indicated, and ensuring the signature matches the affiant’s signature used for the affidavit.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out LC-7086-17 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills affidavit-and-representations-regarding-next-of-kin forms, ensuring each field is accurate.