Yes! You can use AI to fill out Meritain Health Claim Form (Health Claim Form)

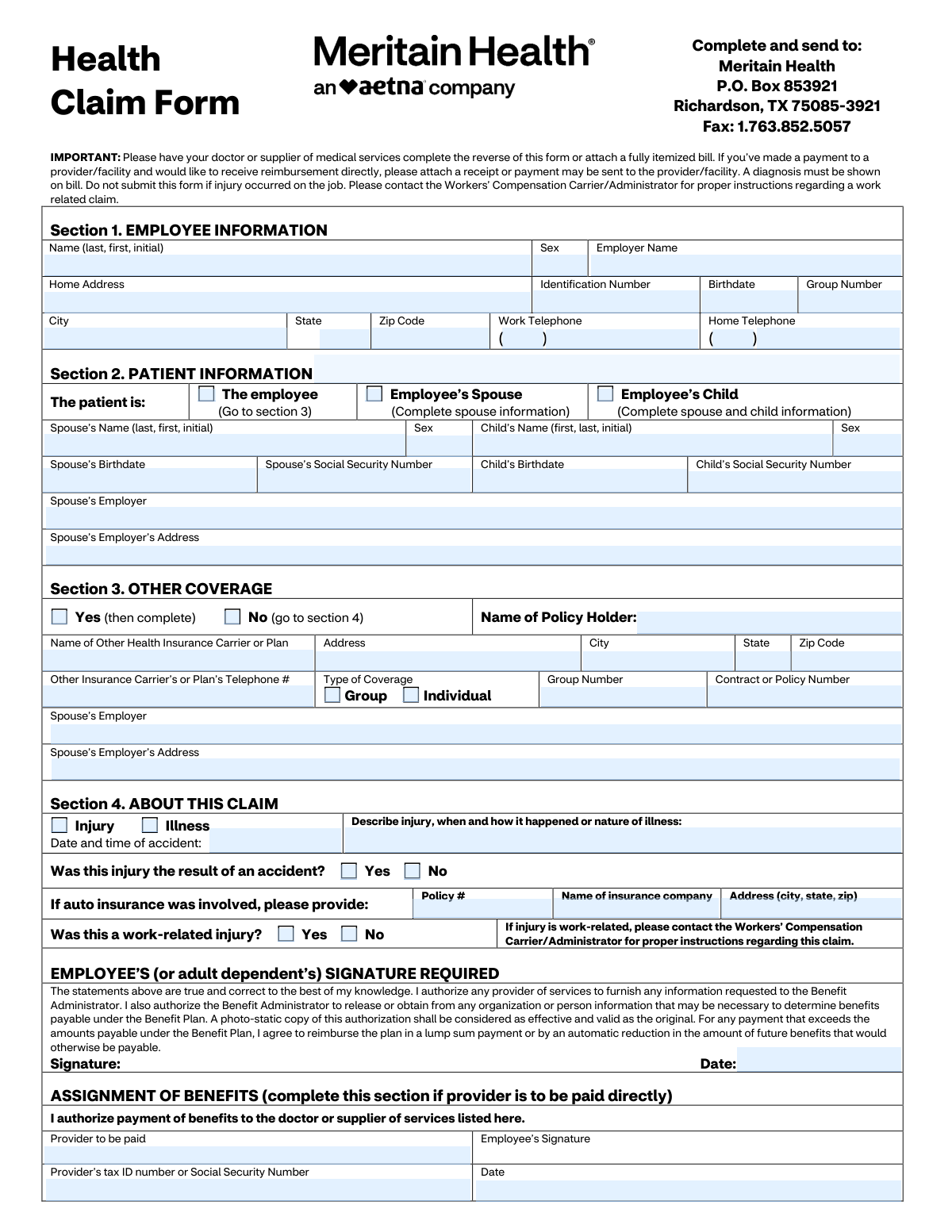

The Meritain Health Claim Form is an insurance claim document used by employees and dependents to request benefits for covered medical services, either for reimbursement to the member or for direct payment to a provider via an assignment of benefits. It collects employee/patient demographics, other insurance coverage (coordination of benefits), accident/illness details, and requires provider documentation such as diagnosis, dates of service, procedure codes, and charges. Submitting complete and accurate information helps prevent delays, supports proper benefit determination, and ensures the claim is routed correctly (including excluding work-related injuries that belong under workers’ compensation). Today, this form can be filled out quickly and accurately using AI-powered services like Instafill.ai, which can also convert non-fillable PDF versions into interactive fillable forms.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Meritain Health Claim Form using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Meritain Health Claim Form (Health Claim Form) |

| Number of pages: | 2 |

| Language: | English |

| Categories: | VA forms, Meritain Health forms, HR forms, VA claim forms, health forms |

Instafill Demo: How to fill out PDF forms in seconds with AI

How to Fill Out Meritain Health Claim Form Online for Free in 2026

Are you looking to fill out a MERITAIN HEALTH CLAIM FORM form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your MERITAIN HEALTH CLAIM FORM form in just 37 seconds or less.

Follow these steps to fill out your MERITAIN HEALTH CLAIM FORM form online using Instafill.ai:

- 1 Go to Instafill.ai and upload the Meritain Health Claim Form (or select it from the form library) and add any supporting documents such as itemized bills and receipts.

- 2 Enter employee information (name, sex, employer, ID number, birthdate, group number, address, and phone numbers).

- 3 Complete patient information by selecting whether the patient is the employee, spouse, or child, and provide spouse/child details if applicable (names, birthdates, SSNs, employer information).

- 4 Fill out other coverage details (if any), including other insurer name, policyholder, plan type (group/individual), group/policy numbers, and contact information.

- 5 Provide claim details (injury vs. illness, accident date/time, description, auto insurance information if applicable, and confirm whether the injury is work-related).

- 6 Review and e-sign the employee/adult dependent authorization and complete the Assignment of Benefits section if you want the provider paid directly (provider name, tax ID/SSN, dates).

- 7 Have the doctor/supplier complete the provider section (diagnosis, treatment dates, procedure codes, charges, signature) or attach a fully itemized bill, then submit to Meritain Health via mail or fax as listed on the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Meritain Health Claim Form Form?

Speed

Complete your Meritain Health Claim Form in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Meritain Health Claim Form form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Meritain Health Claim Form

This form is used to request payment or reimbursement for covered medical services through Meritain Health. It helps Meritain process your claim by collecting employee, patient, other insurance, and service details.

You (the employee or adult dependent) complete the front sections (Employee, Patient, Other Coverage, and Claim details) and sign the authorization. Your doctor or medical supplier must complete the reverse side, or you can attach a fully itemized bill that includes the required details.

Mail it to Meritain Health, P.O. Box 853921, Richardson, TX 75085-3921, or fax it to 1.763.852.5057. Keep copies of everything you submit for your records.

Attach the completed provider section (reverse side) or a fully itemized bill from the provider. If you already paid and want reimbursement to you, attach a receipt or proof of payment; otherwise payment may be sent to the provider/facility.

Yes—Meritain requires that a diagnosis be shown on the bill. If the diagnosis is missing, the claim may be delayed or denied until the provider supplies it.

No. The form states not to submit it if the injury occurred on the job; instead, contact your Workers’ Compensation Carrier/Administrator for instructions on filing a work-related claim.

Check the box for “Employee’s Spouse” or “Employee’s Child” and fill in the spouse and/or child details requested (name, sex, birthdate, and Social Security number). If the patient is the employee, check “The employee” and proceed to Section 3.

Check “Yes” and provide the other plan’s policyholder name, carrier/plan name, address, phone number, coverage type (group or individual), and group/contract or policy numbers. If there is no other coverage, check “No” and go to Section 4.

Indicate whether the claim is for an injury or illness, provide the accident date/time (if applicable), and describe what happened or the nature of the illness. If auto insurance was involved, include the auto policy number, insurer name, and insurer address.

Complete Assignment of Benefits if you want Meritain to pay the provider directly instead of reimbursing you. You’ll list the provider to be paid, include the provider’s Tax ID/SSN, and sign/date the authorization.

The provider supplies diagnosis information (ICD-10 or description), dates of service, place of service codes, procedure codes (CPT or description), charges, and their signature and Tax ID/SSN. They may also need to answer questions about employment-related injury, pregnancy, lab work, and hospitalization dates.

They are standard codes indicating where care was provided (for example, 11 = physician’s office, 21 = inpatient hospital, 23 = emergency room, 81 = independent laboratory). Your provider typically knows which code to use for each service line.

The form does not list a specific processing time, and timing can vary based on completeness and whether additional information is needed. Submitting an itemized bill with diagnosis and complete provider details helps avoid delays.

Yes—AI form-filling tools (such as Instafill.ai) can help auto-fill fields accurately from your information and supporting documents, reducing manual typing and errors. Always review the completed form for accuracy before signing and submitting.

Upload the PDF to Instafill.ai, provide your details (and optionally upload an itemized bill/receipt), and the AI will map your information into the correct fields for review and download. If the PDF is flat/non-fillable, Instafill.ai can convert it into an interactive fillable form so you can complete and sign it more easily.

Compliance Meritain Health Claim Form

Validation Checks by Instafill.ai

1

Employee identity fields completeness (Section 1 required set)

Validates that the core employee fields are present: Employee Name, Sex, Employer Name, Identification Number, Birthdate, Group Number, and full home address (street/city/state/zip). These fields are required to match the claim to the correct member and plan and to route correspondence. If any are missing, the submission should be rejected or pended as “incomplete member information” and the user prompted to supply the missing fields.

2

Employee birthdate format and plausibility

Checks that Employee Birthdate is a valid date in an accepted format (e.g., MM/DD/YYYY) and is not in the future. Also validates plausibility (e.g., age between 0 and 120) to catch transposed digits and data-entry errors. If validation fails, the claim should be pended because eligibility and dependent rules often rely on accurate DOB.

3

US address validation for employee and patient/physician addresses

Ensures address blocks (Employee Home Address, Patient Address, Spouse Employer Address, Other Insurance Address, Physician Address) contain minimally required components: street, city, state, and ZIP where applicable. State must be a 2-letter US abbreviation and ZIP must be 5 digits (optionally ZIP+4). If invalid, the system should flag the record for correction because payments, EOBs, and coordination-of-benefits letters may be undeliverable.

4

Phone number formatting and completeness (area code + 7-digit)

Validates that phone numbers are provided in the expected structure where split fields exist (area code and main number) and that each part is numeric with correct lengths (3-digit area code, 7-digit main). This applies to Employee Work/Home phones, Other Insurance phone, and Physician phone. If invalid, the submission should be accepted with a warning or pended depending on business rules, since missing/invalid contact info can delay claim resolution.

5

Patient identity selection is mutually exclusive and drives required dependent fields

Checks that exactly one patient identity checkbox is selected: employee, spouse, or child. Based on the selection, enforces conditional requirements: if spouse is patient, spouse fields (name/sex/DOB/SSN) must be completed; if child is patient, both spouse fields (as indicated by the form) and child fields (name/sex/DOB/SSN) must be completed. If the selection is missing, multiple selected, or dependent fields are incomplete, the claim should be rejected/pended because the patient cannot be unambiguously identified.

6

Social Security Number (SSN) format validation for spouse/child/provider when provided

Validates that SSNs (Spouse SSN, Child SSN, and any field allowing SSN as provider identifier) are 9 digits and not obviously invalid patterns (e.g., all zeros, 123456789). This reduces downstream eligibility mismatches and prevents storing malformed identifiers. If invalid, the system should block submission or require correction because SSN is used for identification and coordination of benefits in some workflows.

7

Other coverage Yes/No selection is mutually exclusive and conditionally requires policy details

Ensures exactly one checkbox is selected for Other Coverage (Yes or No). If Yes is selected, requires completion of key other insurance fields: policy holder name, carrier/plan name, address (city/state/zip), phone, and contract/policy number (and group number if coverage type is group). If the Yes/No is inconsistent or required details are missing, the claim should be pended because coordination of benefits cannot be performed.

8

Other coverage type selection (Group vs Individual) and related field logic

Validates that at most one coverage type is selected (Group or Individual) when other coverage is Yes. If Group is selected, Group Number should be required; if Individual is selected, Group Number should be blank or optional per configuration, but Contract/Policy Number remains required. If the type is missing or contradictory, the system should flag for correction to avoid incorrect COB processing.

9

Claim reason selection (Injury vs Illness) is mutually exclusive and drives date requirements

Checks that exactly one claim reason is selected: Injury or Illness. If Injury is selected, accident date/time and injury description should be required; if Illness is selected, illness narrative is required and the provider-side “date of first treatment” should be present. If invalid, the claim should be pended because the adjudication path and required documentation differ for injuries vs illnesses.

10

Accident confirmation consistency with claim reason and accident details

Validates that the Accident Confirmation (Yes/No) is mutually exclusive and logically consistent with the claim reason. If claim reason is Injury, Accident Confirmation should generally be Yes (or, if No, the system should require an explanation in the incident description); if claim reason is Illness, Accident Confirmation should be No. If inconsistent, the system should flag the claim for manual review because it may indicate misclassification affecting benefits and liability.

11

Auto insurance fields required when auto involvement is indicated by narrative/policy entry

If any auto insurance field is populated (policy number, insurer name, insurer address), validates that all required auto insurance fields are completed and properly formatted (policy number non-empty, insurer name present, address includes city/state/zip). This prevents partial third-party liability information that cannot be used. If incomplete, the claim should be pended for additional information to support subrogation/coordination.

12

Work-related injury gating (must not be submitted as health claim if work-related)

Ensures Work-Related Injury Confirmation is answered (Yes/No) and is consistent with the provider-side employment injury status. If either indicates “Yes,” the system should stop standard health claim submission and route the user to Workers’ Compensation instructions (or mark as ineligible for this form). If inconsistent between employee and provider sections, the claim should be flagged for manual review because work-related claims are typically excluded from health plan processing.

13

Signature and signature date presence and chronology (employee/adult dependent)

Validates that the employee (or adult dependent) signature is present and that the signature date is a valid date not in the future. Also checks that the signature date is on or after the earliest date of service/accident date where applicable (or at least not unreasonably earlier), to reduce authorization disputes. If missing/invalid, the claim should be pended because authorization to release information and reimbursement terms may be unenforceable.

14

Assignment of Benefits (AOB) conditional requirements

If any AOB field is completed (e.g., Provider to be Paid), validates that the full AOB set is present: provider name, employee signature, provider tax ID/SSN, and AOB date. Also validates the AOB date format and not in the future. If incomplete, the system should either ignore AOB and default payment to member (with warning) or pend for completion, depending on payment policy.

15

Provider identifier (Tax ID/SSN) format and exclusivity

Validates that the provider identifier is either a 9-digit EIN/Tax ID or a 9-digit SSN, numeric only, and not blank when provider payment or physician section is completed. This is critical for payment reporting and provider matching. If invalid, the claim should be pended because payments may fail or be misapplied without a valid provider identifier.

16

Clinical/service line integrity: dates, codes, and charges consistency

For each populated service line, validates that Date From and Date To (if present) are valid dates and Date To is not earlier than Date From; Place of Service is one of the allowed codes (e.g., 11, 12, 21, 22, 23, 81); Procedure Code is present; Diagnosis Code is present; and Charges are numeric and greater than 0 with at most two decimals. Also checks that at least one service line is provided when the claim is submitted with provider details. If any check fails, the claim should be rejected/pended because adjudication cannot proceed without valid service line data.

Common Mistakes in Completing Meritain Health Claim Form

People often mail the form alone or attach a summary statement that doesn’t list CPT/HCPCS codes, dates of service, charges, and the diagnosis. This commonly leads to delays, requests for more information, or denial because the plan can’t verify what was done and why. Always attach a fully itemized bill (or have the provider complete the reverse side) and ensure a diagnosis (ICD-10 or written diagnosis) is shown. AI-powered tools like Instafill.ai can help by prompting for missing required attachments and validating that key billing elements are present before submission.

A frequent error is checking the wrong patient box or checking multiple boxes, then leaving the required dependent fields blank (e.g., spouse/child name, birthdate, SSN). This causes eligibility mismatches and can result in the claim being pended until the correct patient information is provided. Check exactly one patient category and complete all dependent fields required by that selection (spouse info for spouse/child; child info for child). Instafill.ai can reduce this by using conditional logic to show only the fields that apply and flagging inconsistent selections.

Many submissions include an SSN in place of the plan identification number, omit the group number, or transpose digits. When the member can’t be matched to the correct plan/group, the claim may be delayed, misrouted, or denied for “unable to identify member.” Copy the identification number and group number exactly as shown on the ID card and double-check digit order. Instafill.ai can auto-format and validate these identifiers to catch common length/character issues.

This form separates area code and the 7-digit number, and people often put the full phone number in one field, omit the area code, or include punctuation that doesn’t fit the boxes. Incomplete contact details can slow down follow-ups for missing documentation or coordination of benefits questions. Enter area code in the area-code field and the remaining 7 digits in the main field; provide a complete mailing address with city, 2-letter state abbreviation, and ZIP. Instafill.ai can standardize phone/address formatting and prevent field-overflow issues.

Claimants frequently check “No” even when other insurance exists, or check “Yes” but leave carrier name, policy/group numbers, or policyholder details blank. Incorrect coordination of benefits can trigger denials, overpayment recovery, or repeated requests for other insurance information. If any other health plan covers the patient (including a spouse’s plan), check “Yes” and complete all fields, including policyholder name and policy/group/contract numbers. Instafill.ai can prompt for the required COB fields when “Yes” is selected and validate that the section is complete.

People sometimes mark “No” to work-related injury to try to get the claim processed, or they submit the form even though the injury occurred on the job. This can lead to denial, recoupment, or significant delays while the administrator redirects the claim to Workers’ Compensation. If the condition arose from employment, do not submit this health claim form—contact the Workers’ Compensation Carrier/Administrator as instructed. Instafill.ai can flag conflicting answers (e.g., injury description suggests workplace incident but “No” is checked) to prevent misfiling.

When “Injury” is selected, people often forget to answer whether it was an accident, omit the accident date/time, or fail to provide auto insurance policy/company details when applicable. Missing accident information can cause the claim to pend for third-party liability review or be denied until details are provided. Provide the accident date and time, clearly describe how it happened, and include auto insurer information if a vehicle was involved. Instafill.ai can enforce consistency between “Injury,” “Accident: Yes/No,” and the required accident/auto fields.

A very common issue is forgetting the employee/adult dependent signature and date, or having a minor sign, or leaving the assignment-of-benefits signature/date incomplete when requesting direct payment to a provider. Unsigned forms are typically returned or pended because authorization language requires a valid signature to release information and process payment. Ensure the employee (or adult dependent) signs and dates the main authorization, and complete the Assignment of Benefits section only if the provider should be paid directly. Instafill.ai can highlight signature/date requirements and prevent submission with missing authorization fields.

People often fill in the provider-to-be-paid name but omit the provider Tax ID/SSN, or they complete this section even when they want reimbursement to themselves (and forget to attach a receipt). This can result in payment being delayed, sent to the wrong party, or requiring re-issuance. Only complete Assignment of Benefits if you want the provider paid directly, and include the provider’s correct Tax ID/SSN and the signed/date fields; if you paid out-of-pocket and want reimbursement, attach proof of payment. Instafill.ai can guide the pay-to choice and ensure the correct supporting documentation is included.

The reverse side requires clinical and billing details (diagnosis, dates of service, place of service codes, procedure codes, charges, physician signature), but claimants often leave it blank or fill it themselves inaccurately. Without provider-completed information or an equivalent itemized bill, the administrator may be unable to adjudicate the claim. Have the doctor/supplier complete the provider section and sign it, or attach a complete itemized bill that includes the same elements. If the form is only available as a flat non-fillable PDF, Instafill.ai can convert it into a fillable version and help ensure the provider fields are completed in the correct format.

Common mistakes include using non-ICD-10 diagnosis codes, leaving diagnosis codes blank, mixing up “From” and “To” dates, using narrative text where a code is expected, or entering an invalid place-of-service code (e.g., not using 11/21/22/23/81/12 as indicated). These errors can cause claim rejections, manual review, or incorrect benefit calculation. Copy codes directly from the provider’s itemized bill, ensure each service line has matching dates, place of service, procedure code, diagnosis code, and charges, and verify date formats are consistent. Instafill.ai can validate code/date formats and reduce line-item inconsistencies before submission.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Meritain Health Claim Form with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills meritain-health-claim-form-health-claim-form-1 forms, ensuring each field is accurate.