Yes! You can use AI to fill out Nationwide Retirement Solutions Participant Distribution Request Form (PNF-0875M9, TRAC Version, 01/2025)

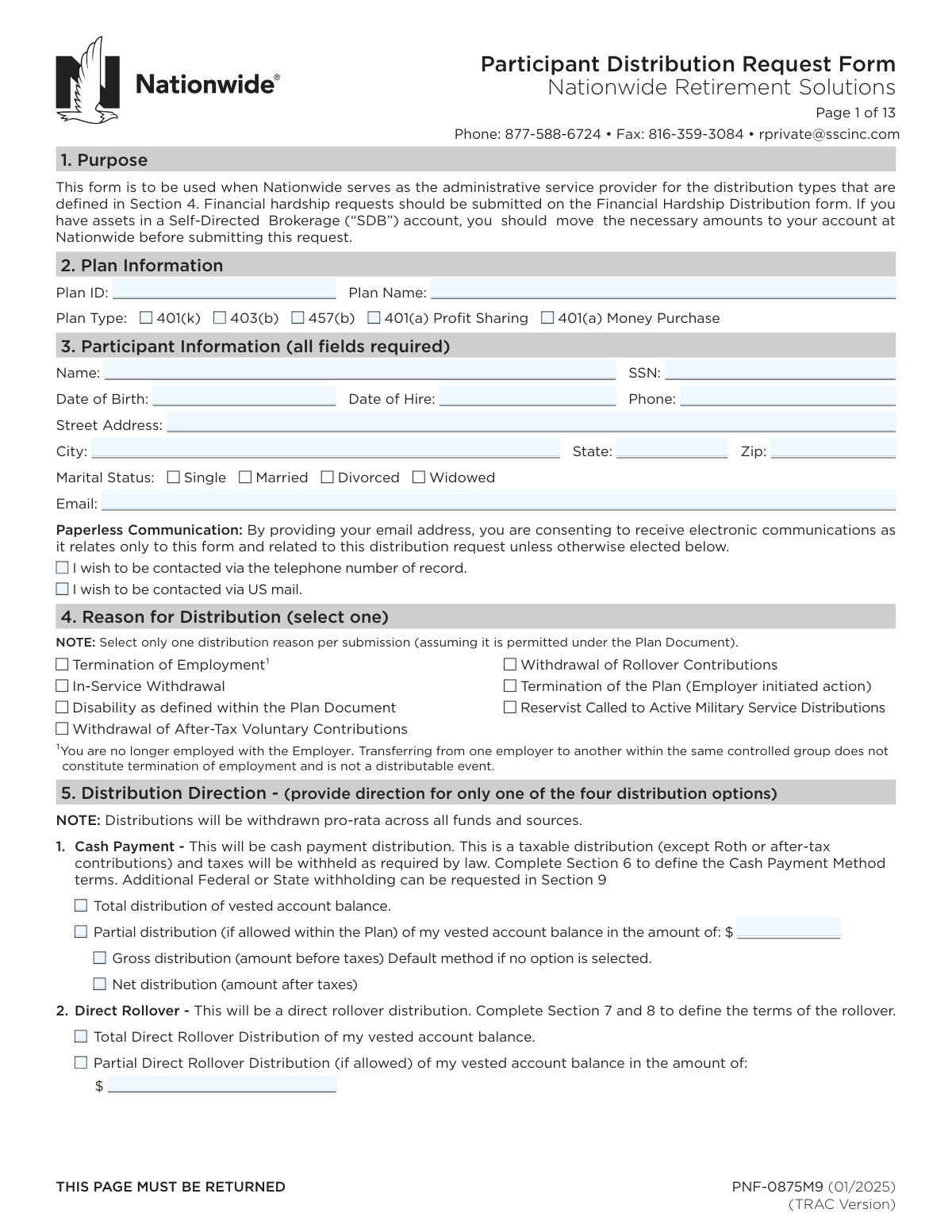

PNF-0875M9 is an official Nationwide Retirement Solutions form that a plan participant (and, when applicable, a spouse and plan sponsor/DPA) completes to request a permitted distribution from an employer-sponsored retirement plan (e.g., 401(k), 403(b), 457(b), or 401(a)). It captures the distribution reason, payment direction (cash vs. rollover), delivery method, rollover destination details, and tax withholding/certifications required to process the request and report it properly (e.g., via Form 1099-R). It is important because incorrect elections, missing signatures, or incomplete rollover/banking information can delay processing and may trigger unintended tax withholding or taxable events. Today, this form can be filled out quickly and accurately using AI-powered services like Instafill.ai, which can also convert non-fillable PDF versions into interactive fillable forms.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out PNF-0875M9 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Nationwide Retirement Solutions Participant Distribution Request Form (PNF-0875M9, TRAC Version, 01/2025) |

| Number of pages: | 5 |

| Language: | English |

| Categories: | financial forms, Nationwide forms, retirement forms, Nationwide retirement forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out PNF-0875M9 Online for Free in 2026

Are you looking to fill out a PNF-0875M9 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your PNF-0875M9 form in just 37 seconds or less.

Follow these steps to fill out your PNF-0875M9 form online using Instafill.ai:

- 1 Go to Instafill.ai and upload the PNF-0875M9 Participant Distribution Request Form (or select it from the form library).

- 2 Enter plan details (Plan ID, Plan Name, and Plan Type) and confirm the form version/date to ensure you’re using the correct document.

- 3 Provide participant information (name, SSN, DOB, hire date, contact details, address, marital status, and communication preferences).

- 4 Select one distribution reason in Section 4 and choose one distribution direction option (cash payment, direct rollover, combination, or repetitive payments), including total vs. partial and gross vs. net where applicable.

- 5 If requesting a cash payment, complete the cash payment method (mail check or Direct Deposit ACH) and provide accurate bank routing/account details if using ACH.

- 6 If requesting a direct rollover (or a combination), complete rollover elections (pre-tax and Roth), provide the receiving trustee/custodian and account information, attach any required Letter of Acceptance, and choose where the rollover check should be mailed.

- 7 Review tax withholding instructions and certifications, then e-sign where permitted (or print to sign if required), obtain any required spousal consent/notary and plan sponsor/DPA authorization, and submit pages 1–7 via fax or through the plan sponsor per the submission instructions.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable PNF-0875M9 Form?

Speed

Complete your PNF-0875M9 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 PNF-0875M9 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form PNF-0875M9

This form is used to request a retirement plan distribution when Nationwide Retirement Solutions is serving as the plan’s administrative service provider. It covers common distribution reasons (like termination, in-service withdrawals, disability, etc.) and lets you choose cash payment, direct rollover, or a combination.

The participant (or beneficiary, if applicable) completes the participant sections and signs the authorization. The Plan Sponsor/Designated Plan Administrator (DPA) must also complete and sign the employer authorization section before submission.

No—financial hardship requests must be submitted on the separate Financial Hardship Distribution form. If you submit a hardship request on this form, it may be rejected or delayed.

You should move the needed amount from the SDB account to your Nationwide account before submitting this request. If the funds aren’t available at Nationwide, your distribution may be delayed.

Yes—Section 3 states all participant fields are required (name, SSN, date of birth, date of hire, phone, address, marital status, and email). Missing required information can delay processing.

You must select only one distribution reason per submission, as noted on the form. If you need multiple distribution reasons, you generally must submit separate requests (if permitted by the plan document).

It means the distribution is taken proportionally from the investments and money sources in your account rather than from a single fund you pick. If you need a different approach, you may need to review plan rules or contact the plan sponsor/Nationwide.

You can request (1) a cash payment, (2) a direct rollover, (3) a combination of cash payment and direct rollover, or (4) repetitive cash payments (if allowed by your plan). The form instructs you to provide direction for only one of these options per request.

A gross distribution is the amount before taxes are withheld, and it is the default if you don’t select an option. A net distribution is the amount you want to receive after taxes, which may require a larger gross withdrawal to cover withholding.

In Section 6, select Direct Deposit ACH and provide the financial institution name, 9-digit ABA routing number, account number, and account type (checking or savings). If the ACH info is incomplete/incorrect or required proof isn’t provided, the default is a mailed check to your address of record.

No—Section 8 states wires and Direct Deposit ACH are not available for rollover distributions. Rollover payments are made by check, and you must provide a Letter of Acceptance from the new provider.

You must complete the rollover direction (pre-tax and/or Roth options) and provide trustee/custodian details in the Rollover Account Information section, including payee name, address, and account number(s). If rolling over both Roth and pre-tax funds, separate account numbers must be provided.

Do not complete Section 9 if your only distribution is a direct rollover to an eligible plan or IRA. For cash payments, if you leave Section 9 blank, Nationwide will withhold mandatory federal and any required state taxes; additional federal withholding generally requires submitting IRS Form W-4R (and in some cases W-4P for certain systematic payments).

No—multiple sections state electronic or stamped signatures are not permitted. The participant signature (and spouse/plan sponsor/notary signatures, if required) must be handwritten and dated to avoid delays.

Follow Section 14: once completed, pages 1 through 7 can be faxed to 816-359-3084 or returned to the Plan Sponsor, who can submit via email to the Plan Contact at Nationwide. The form repeatedly notes “THIS PAGE MUST BE RETURNED,” so ensure all required pages and signatures are included.

Yes—AI form-filling services like Instafill.ai can help auto-fill fields accurately from your information and reduce errors. You can upload the PDF to Instafill.ai, map or confirm your details (plan info, participant info, payment/rollover choices), and then download a completed version for printing and handwritten signatures where required.

If the PDF isn’t fillable, Instafill.ai can convert a flat, non-fillable PDF into an interactive fillable form so you can type into the fields. After converting and completing it, you can export the finished document for signature and submission.

Compliance PNF-0875M9

Validation Checks by Instafill.ai

1

Plan Information Completeness and Plan Type Single-Select Validation

Validates that Plan ID and Plan Name are provided and that exactly one Plan Type checkbox (401(k), 403(b), 457(b), 401(a) Profit Sharing, 401(a) Money Purchase) is selected. This is important because distribution eligibility, tax rules, and processing workflows depend on the correct plan identification and plan type. If missing or multiple plan types are selected, the submission should be rejected or routed to manual review with a request for correction.

2

Participant Identity Required Fields and Basic Format Validation

Ensures all participant fields marked “all fields required” are present: Participant Name, SSN, Date of Birth, Date of Hire, Phone, Street Address, City, State, Zip, Marital Status, and Email. Also validates basic formatting (e.g., name not blank/initials-only, state is a valid 2-letter code, zip is 5 digits or ZIP+4). If any required field is missing or malformed, the form should fail validation because the record cannot be reliably matched and payments/notices may be misdirected.

3

SSN Format and Disallowed Values Check

Validates SSN is exactly 9 digits (allowing standard hyphen formatting) and rejects known invalid patterns (e.g., all zeros, 123-45-6789, 000-xx-xxxx). This reduces identity mismatch, fraud risk, and downstream IRS reporting errors (Form 1099-R). If the SSN fails validation, the submission should be blocked and the participant prompted to correct the SSN.

4

Date Fields Format and Chronological Consistency (DOB, Hire, Termination, Payroll Deduction, Signatures)

Checks that all dates are valid calendar dates in the expected format (mm/dd/yyyy where applicable) and that they are logically consistent: Date of Birth < Date of Hire; participant signature date is not before key elections are made; termination date (if provided) is on/after hire date; final payroll deduction date is on/after hire date and not after termination date (if termination is provided). This prevents impossible timelines that can invalidate distributable event determinations and payroll-based contribution reconciliation. If inconsistencies are found, the submission should be rejected or flagged for plan sponsor verification.

5

Participant Age Reasonableness and Eligibility Flagging

Calculates participant age from Date of Birth and flags implausible ages (e.g., under 14 or over 100) and potential early distribution scenarios (under 59½) for additional tax notice/withholding handling. While age alone may not block a distribution, it is critical for correct tax treatment and exception handling. If the age is implausible, the submission should fail; if merely under 59½, it should be flagged for tax/penalty disclosure and processing rules.

6

Marital Status Selection and Spousal Consent Conditional Requirement

Validates that exactly one marital status is selected and, if Married, enforces completion of Spousal Consent unless the participant explicitly selects “Not Applicable” and the plan does not require consent (as determined by plan rules/config). If spousal consent is required, the spouse’s printed name, signature, date, and witness (plan sponsor or notary) details must be present. If required spousal consent is missing or incomplete, the distribution must not be processed and should be returned for completion.

7

Reason for Distribution Single-Select and Supporting Plan Sponsor Data Alignment

Ensures exactly one “Reason for Distribution” checkbox is selected per submission (as stated on the form). Also checks alignment with plan sponsor-provided data when applicable (e.g., if “Termination of Employment” is selected, a termination date should be provided by the plan sponsor/DPA and should not be blank). If multiple reasons are selected or required sponsor data is missing, the request should be rejected to avoid processing under the wrong distributable event.

8

Distribution Direction Exclusive Option Validation (One of Four Options Only)

Validates that the participant provides direction for only one distribution option: (1) Cash Payment, (2) Direct Rollover, (3) Combination Cash + Rollover, or (4) Repetitive Cash Payments. This is essential because each option triggers different required sections (6 vs 7/8 vs both vs repetitive schedule) and different tax withholding rules. If more than one option is completed/selected, the submission should fail validation and require resubmission with a single clear direction.

9

Cash Payment Amount and Total/Partial Selection Consistency

If Cash Payment is selected, validates that either “Total distribution of vested account balance” OR “Partial distribution” is selected (not both), and if partial is selected, the partial amount is present, numeric, and greater than $0 with two-decimal currency precision. Also enforces that Gross vs Net selection is either one or defaults to Gross if none is selected, but never both. If the amount is missing/invalid or conflicting selections exist, the request should be rejected to prevent incorrect payout calculations.

10

Direct Rollover Amount and Total/Partial Selection Consistency

If Direct Rollover is selected, validates that either “Total Direct Rollover” OR “Partial Direct Rollover” is selected (not both), and if partial is selected, the rollover amount is present, numeric, and greater than $0. This prevents ambiguous instructions and ensures the rollover check is issued for the correct amount. If validation fails, the submission should be blocked and corrected instructions requested.

11

Combination Cash + Rollover Amount Logic

If the Combination option is selected, validates that the cash payment amount is provided, numeric, and greater than $0, and that the cash payment is designated as Gross or Net (or defaults to Gross if blank) but not both. Also enforces that rollover sections (7 and 8) are completed for the remaining balance and that cash payment method (Section 6) is completed for the cash portion. If any required component is missing, the submission should fail because the administrator cannot split the distribution correctly.

12

Repetitive Cash Payments Schedule and Amount Validation

If Repetitive Cash Payments are selected, validates that exactly one frequency is selected, the gross amount is provided and > $0, and the beginning date (if provided) is a valid mm/dd date; if omitted, system should default to processing date per form instructions. This is important to avoid unintended recurring payments or incorrect start timing. If frequency or amount is missing/invalid, the request should be rejected; if the date is invalid, it should be rejected or corrected before scheduling.

13

Direct Deposit ACH Banking Details Validation (Routing/Account/Type) and Check-by-Mail Fallback Rules

If Direct Deposit ACH is selected, validates that Financial Institution Name is present, ABA routing number is exactly 9 digits and passes the ABA checksum, and account number is present and within reasonable length/character constraints (digits only if required by system). Also validates account type selection (checking/savings) or applies the documented default to checking if blank. If banking details fail validation or are incomplete, the system should not attempt ACH and should either reject the submission (strict mode) or follow the form’s stated fallback to mail a check to the address of record (configurable), while flagging the record for potential delay.

14

Rollover Contribution Type Elections (Pre-Tax and Roth) Mutual Exclusivity and Completeness

If any direct rollover is requested, validates that for Pre-Tax contributions exactly one option is selected (N/A or one rollover destination) and for Roth contributions exactly one option is selected (N/A or one rollover destination). This prevents contradictory instructions such as selecting both “N/A” and a rollover destination, or multiple destinations for the same source type. If the selections are missing or conflicting, the submission should be rejected because the rollover cannot be allocated correctly.

15

Rollover Account Information Completeness and Separate Account Number Rule

When a rollover destination is selected, validates that the Trustee/Custodian payee name, address, city, state, and zip are complete and properly formatted, and that the relevant account number(s) are provided. Enforces the form rule that when both Roth and pre-tax funds are being rolled over, separate account numbers must be provided (i.e., both Pre-tax Account Number and Roth Account Number must be present and not identical if the receiving institution requires separation). If required rollover account details are missing, the request should fail because the rollover check cannot be issued correctly and may be rejected by the receiving custodian.

16

Tax Withholding Section Applicability and Required Attachment Checks (W-4R/W-4P/State Forms)

Validates that Section 9 is not completed when the only distribution is a direct rollover (no cash component), and that withholding elections requiring attachments are accompanied by the correct form: W-4R for additional federal withholding on direct/systematic payments <10 years, and W-4P or W-4R for systematic payments ≥10 years/RMD adjustments as described. Also flags state withholding adjustments as requiring an attached state form when the participant indicates an adjustment. If withholding is requested without required attachments, the submission should be rejected or defaulted to statutory withholding rules with a clear exception flag, per operational policy.

Common Mistakes in Completing PNF-0875M9

People often skip the Plan ID, abbreviate the Plan Name, or check the wrong Plan Type (401(k) vs 403(b) vs 457(b), etc.) because they assume Nationwide can “look it up.” This can cause the request to be routed incorrectly, rejected by the plan sponsor, or delayed while the administrator confirms the correct plan. Copy the Plan ID and official Plan Name exactly as shown on your statement or employer materials, and select only the plan type that matches the plan document. AI-powered form filling tools like Instafill.ai can help by pulling the correct plan identifiers from your records and validating that the plan type selection is consistent.

A very common issue is leaving “required” participant fields blank (SSN, DOB, address, phone) or entering information that doesn’t match plan records (nickname vs legal name, old address, transposed SSN digits). Mismatches can trigger identity verification issues and processing holds, especially for distributions and tax reporting (Form 1099-R). Use your legal name as on Social Security records, double-check SSN and dates, and ensure your address matches the “address of record” or update it before submitting. Instafill.ai can reduce errors by formatting SSNs/dates correctly and flagging missing required fields before submission.

The form explicitly states to select only one distribution reason per submission, but people often check multiple boxes (e.g., Termination + In-Service) to “cover all bases.” This creates ambiguity about eligibility and can cause the request to be rejected or require resubmission. Choose the single reason that matches the plan’s distributable event and submit separate requests if needed (and permitted). Instafill.ai can enforce single-choice logic and prevent incompatible selections.

Applicants frequently mark Termination of Employment even when they transferred within the same controlled group or are still employed, because they interpret a job change as termination. The form warns that controlled-group transfers do not constitute termination, and selecting this incorrectly can lead to denial or a request for employer verification. Confirm your employment status with HR/plan sponsor and use the correct reason (or the correct form, such as hardship, if applicable). Instafill.ai can prompt clarifying questions and help route you to the correct distribution reason based on your situation.

Section 5 requires you to provide direction for only one of the four distribution options, but people often complete Cash Payment and Direct Rollover sections simultaneously without choosing the “Combination” option. This can result in conflicting instructions (e.g., total cash distribution checked while also requesting a rollover), forcing manual follow-up and delays. Decide whether you want (1) cash, (2) direct rollover, (3) combination, or (4) repetitive payments, and complete only the sections tied to that choice. Instafill.ai can detect conflicting checkboxes and ensure only the relevant sections are completed.

Many people request a partial distribution amount but don’t understand whether the amount is gross (before taxes) or net (after taxes), leading to receiving less (or more) than expected. This is especially problematic when mandatory withholding applies, because a “net” request may require a larger gross withdrawal to cover taxes. If you care about the exact amount you receive, confirm whether you should select gross or net and consider consulting a tax advisor; otherwise, accept the default gross method. Instafill.ai can help by highlighting the tax/withholding implications and validating that the requested amount aligns with the gross/net selection.

ACH setups commonly fail due to transposed digits, using a deposit slip number instead of the 9-digit ABA routing number, omitting account type (checking/savings), or attempting to deposit to a prepaid debit card (not allowed). Errors can cause returned payments and default the distribution to a mailed check to the address of record, delaying receipt. Use a voided check/bank letter when possible, enter the 9-digit routing number carefully, and explicitly select checking or savings. Instafill.ai can validate routing number length/format and reduce data-entry mistakes before you submit.

Rollover requests are often delayed because the “Check payable to Trustee/Custodian,” custodian address, and/or the receiving account number is missing, or because the required Letter of Acceptance from the new provider isn’t attached. Another frequent mistake is providing only one account number when both pre-tax and Roth funds are being rolled over, even though the form notes separate account numbers are required. Confirm with the receiving institution exactly how the check should be titled and obtain the Letter of Acceptance, then provide separate pre-tax and Roth account numbers if applicable. Instafill.ai can prompt for required rollover attachments and ensure all rollover payee/address fields are completed consistently.

People sometimes ask for a wire or ACH for a rollover, but the form states wires and ACH are not available for rollover distributions. Others fail to select where the rollover check should be mailed (to trustee/custodian vs to participant), which can create delivery issues and delays. Follow the form’s allowed methods: rollover is by check only, and you must choose the mailing destination. Instafill.ai can restrict disallowed payment methods and require a clear selection for check delivery.

A common error is filling out Section 9 even when the distribution is only a direct rollover (the form says not to), or assuming additional withholding will be applied without attaching the required IRS Form W-4R (or W-4P for certain systematic payments). This can lead to default withholding rules being applied, unexpected tax withholding, or processing delays while forms are requested. Only complete Section 9 when you have a taxable cash component, and attach the correct IRS withholding form if you want to change defaults. Instafill.ai can guide you to the correct tax section based on your distribution type and remind you to attach the required IRS forms.

Submissions are frequently rejected because the participant signature is missing/undated, an electronic or stamped signature is used (explicitly not permitted), or spousal consent is required but not properly completed and witnessed by a plan sponsor or notary. These issues are common because applicants overlook the plan-specific spousal consent requirement or assume e-signatures are acceptable. Sign in ink, date all signature lines, and if married and the plan requires consent, complete the spouse section with proper witnessing/notarization. Instafill.ai can flag missing signature/date fields and highlight when spousal consent steps are likely required based on marital status and plan rules.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out PNF-0875M9 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills nationwide-retirement-solutions-participant-distribution-request-form-pnf-0875m9-trac-version-012025-1 forms, ensuring each field is accurate.